by Calculated Risk on 11/07/2011 04:40:00 PM

Monday, November 07, 2011

Visible Existing Home Inventory declines 16% year-over-year in early November

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

• In a few months, the NAR is expect to release revisions for their existing home sales and inventory numbers for the last few years. The sales revisions will be down (the NAR has pre-announced this), and the inventory is expected to be revised down too.

• Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be back to late 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through September (left axis) and the HousingTracker data for the 54 metro areas through October. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates in a few months).

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the November listings - for the 54 metro areas - declined 16.8% from the same week last year. The graph shows monthly inventory change (this is preliminary for November).

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too.

Fed: Banks Tighten Lending Standards to Banks and Firms with European Exposures

by Calculated Risk on 11/07/2011 02:17:00 PM

The Federal Reserve released the quarterly October 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices today. The survey had a special question on lending to European banks and firms. With regards to banks, the tightening was "considerable", however to European firms the tightening was "moderage":

About one-half of the domestic bank respondents, mostly large banks, indicated that they make loans or extend credit lines to European banks or their affiliates or subsidiaries, and about two-thirds of the foreign respondents indicated the same. Among those domestic and foreign respondents, a large share--about two-thirds--reported having tightened standards on loans to European banks over the third quarter. Many domestic banks indicated that the tightening was considerable.On the U.S. Commercial and Industrial (C&I):

About three-fifths of the domestic respondents, mostly large banks, and all foreign respondents indicated that they make loans or extend credit lines to nonfinancial firms that have operations in the United States and significant exposures to European economies. Among those domestic and foreign respondents, a moderate fraction indicated that they had tightened standards on C&I loans to such firms.

A small net fraction of domestic banks reported having eased standards on C&I loans during the third quarter, in contrast to more widespread reports of such easing in previous quarters. This moderate net reduction in easing was concentrated in loans to large and middle-market firms rather than in loans to smaller firms. ... Reports of weaker demand for C&I loans outnumbered reports of stronger demand in a reversal from recent quarters, particularly with respect to demand from large and middle-market firms.For Commercial Real Estate:

Domestic banks continued to report little change in their standards on CRE loans, which were widely described in a special question in the previous survey as being at or near their tightest levels since 2005. In contrast, a large fraction of foreign respondents reported having tightened standards on CRE loans, in a substantial shift from the net easing reported by those institutions in the prior two surveys.And on consumer lending:

Modest fractions of banks reported having eased standards on consumer credit card loans and on other non-auto loans. As in the previous survey, somewhat larger fractions of banks reported having eased standards on auto loans.There are several charts here.

So far the European financial crisis hasn't led to tighter lending standards in the U.S., but standards are already pretty tight.

Italy: 10 Year bond yields continue to increase

by Calculated Risk on 11/07/2011 01:16:00 PM

In October 2010, the Irish 10 year yield moved above 6.6%, and by the end of November the yield hit 9% and Ireland asked for help.

Now the Italian 10 year yield is at 6.65% and there is a sense of deja vu.

From the NY Times: Italy Bonds Push Higher

Interest rates on Italian bonds rose to new euro-era records on Monday, close to the level that earlier forced Greece, Ireland and Portugal to seek financial rescues.And from the WSJ: Reasons to Be Fearful as Italian Yields Spike

Greek, Irish, and Portuguese 10-year bond yields spent an average of 43 trading days above 5.50% before they climbed above 6.00%, notes Gary Jenkins, head of fixed income at Evolution Securities.Italy's deficit to GDP is only around 4% - that is much lower than the other countries in trouble. But Italy already has a high debt to GDP ratio (around 118%), and slow (or no) growth ... not a good combination.

The move to 6.50% took 24 days, while the move to 7.00% was even quicker, taking just 15 days, he said. An Italian treasury bill sale on Thursday will be a good test.

CoreLogic: House Price Index declined 1.1% in September

by Calculated Risk on 11/07/2011 10:30:00 AM

Notes: This CoreLogic Home Price Index report is for September. The Case-Shiller index released two weeks ago was for August. Case-Shiller is currently the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of July, August and September (September weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® September Home Price Index Shows Second Consecutive Month-Over-Month and Year-Over-Year Decline

CoreLogic ... today released its September Home Price Index (HPI®) which shows that home prices in the U.S. decreased 1.1 percent on a month-over-month basis, the second consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 4.1 percent in September 2011 compared to September 2010.

...

“Even with low interest rates, demand for houses remains muted. Home sales are down in September and the inventory of homes for sale remains elevated. Home prices are adjusting to correct for the supply-demand imbalance and we expect declines to continue through the winter. Distressed sales remain a significant share of homes that do sell and are driving home prices overall,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.1% in September, and is down 4.1% over the last year, and off 31.2% from the peak - and up 3.6% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index late this year or early in 2012.

Sluggish Growth and Payroll Employment

by Calculated Risk on 11/07/2011 09:18:00 AM

If we continue to see sluggish growth with 125,000 payroll jobs added per month (the pace this year), it will take an additional 52 months just to get back to the pre-recession level of payroll employment.

If job growth picks up a little - say to 200,000 payroll jobs per month - it will take an additional 33 months to get back to the pre-recession level.

The following two graphs show these projections.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month.

Click on graph for larger image.

Click on graph for larger image.

If we follow the red line path, payroll jobs will return to the pre-recession level in February 2016. The dashed blue line returns to the pre-recession level in July 2014.

And this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

The second graph shows the same data but aligned at peak job losses.

The second graph shows the same data but aligned at peak job losses.

This really illustrates both the depth of the 2007 employment recession and the very sluggish recovery.

The recent debate has been between another recession and sluggish growth (I thought sluggish growth was more likely), but we have to remember even sluggish growth is a disaster for payroll employment.

Sunday, November 06, 2011

Sunday Night Futures

by Calculated Risk on 11/06/2011 10:55:00 PM

Greece is trying to form a coalition government, and the current Greek Prime Minister George Papandreou is expected to resign on Monday. Meanwhile in Italy ...

From Bloomberg: Berlusconi’s Majority Unravels as Defections Mount Before Key Budget Vote

Prime Minister Silvio Berlusconi’s majority is unraveling before a key parliamentary vote tomorrow, with allies pressuring him to step aside after contagion from the region’s sovereign debt crisis pushed Italy’s borrowing costs to euro-era records.From the NY Times: For Markets in Europe, the Focus of Fear Moves to Italy

Among fresh warning signs, Italy’s cost of borrowing has jumped to the highest rate since the country adopted the euro. Others signs include pressures building in the plumbing of Europe’s banking system. While those pressures are not yet at the levels experienced during the 2008 financial crisis ... they are high enough to cause worry, analysts say.The Greek 2 year yield is down to 98%, and the Greek 1 year yield is up to 236%.

The Portuguese 2 year yield is at 20.1% and the Irish 2 year yield is up to 9.2%.

The Spanish 10 year yield is at 5.58% and the Italian 10 year yield is at 6.37%.

The Asian markets are mixed tonight. The Nikkei is down about 0.5%, the Hang Seng is down slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 and Dow futures are down slightly.

Oil: WTI futures are up to $94.79 and Brent is up to $113.13 per barrel.

Yesterday:

• Schedule for Week of Nov 6th

• Summary for Week Ending Nov 4th

MERS Update: Multidistrict litigation decision

by Calculated Risk on 11/06/2011 07:00:00 PM

CR Note: This is a guest post from albrt.

Howdy folks, this is albrt. I'm trying to get back in the habit of writing for CR once in a while, so this is an update on MERS and its role in the ongoing housing finance mess. Background posts on MERS from a couple of years ago are here and here.

The item that inspired me to start posting again was the October 3 decision by Federal District Court Judge James Teilborg of Arizona, dismissing the 72 cases in the MERS multidistrict litigation.

Background

A federal "multidistrict litigation" case (commonly called an "MDL") is set up to resolve a question that has come up in a large number of courts. The first thing that happens in an MDL case is that someone requests a panel of federal judges to look at the cases, and they decide whether it would make sense to centralize the cases with one judge to address the common issues.

All of these cases were brought by borrowers to defeat or reverse a foreclosure, which means the borrower is the plaintiff and one or more entities on the lender side are the defendants. Generally a borrower brings a case like this because the house is located in a state where foreclosures can be done without going to court, often based on a document called a deed of trust rather than a true mortgage.

The lender defendants in six cases, including MERS, requested centralization in Arizona. The MDL panel decided to send cases involving allegations that "various participants in MERS formed a conspiracy to commit fraud and/or that security instruments are unenforceable or foreclosures are inappropriate due to MERS's presence as a party." The panel did not send claims involving other allegedly unlawful loan origination or collection practices.

When an MDL is opened up, other federal judges can send cases that appear to qualify, so the MDL eventually grew from 6 to 72 cases.

By the way, Judge Teilborg is the same judge who dismissed a similar case by a plaintiff named Cervantes, and his decision was recently upheld by the 9th Circuit. The MDL panel specifically chose to send the cases to Judge Teilborg "because he presided over Cervantes." The 9th Circuit's decision in September may have had a lot to do with the timing of this decision in October.

Judge Teilborg's Decision

Judge Teilborg considered motions to dismiss 20 of the MDL cases, and dismissed each of them. Judge Teilborg then dismissed the remaining 52 complaints, but ordered the plaintiffs to take their best collective shot at submitting a "consolidated amended complaint" that avoided the shortcomings identified in the previous 20 complaints. The October 3rd order dismissed the consolidated complaint, and dismissed each of the 72 MDL claims with prejudice. At least some of the cases are apparently still alive in other courts based on claims that were not covered by the MDL decision.

The Fraud Issues

The fraud issues were essentially disposed of by earlier rulings, including Cervantes, and did not figure prominently in the October 3 MDL decision. Federal court rules require fraud allegations to be specific. Fraud is a hard claim to prove - to simplify it a little, the plaintiff needs to identify false statements, and explain how the plaintiff was harmed by relying on the statements.

The 9th Circuit said:

Although the plaintiffs allege that aspects of the MERS system are fraudulent, they cannot establish that they were misinformed about the MERS system, relied on any misinformation in entering into their home loans, or were injured as a result of the misinformation. If anything, the allegations suggest that the plaintiffs were informed of the exact aspects of the MERS system that they now complain about.The 9th Circuit apparently based the latter observation on the deed of trust itself, which said MERS would be the beneficiary and the note could be transferred without notice, which was basically what happened.

The Invalidation Issue

Judge Teilborg summarized the issue like this:

Fundamentally, all of Plaintiffs' claims turn on their contention that naming MERS as a beneficiary on the deeds of trust, and the subsequent operation of the MERS system, splits the MERS deeds of trust from their promissory notes and renders these notes unsecured and unenforceable. . . . The documents alleged to be false would only be false if there is legal merit to these arguments; the wrongful foreclosures would only be wrongful if one of these theories holds.Judge Teilborg decided that naming MERS as a beneficiary on a deed of trust does not permanently destroy the security interest and completely bar foreclosure. That eliminated the second major MDL claim, although Judge Teilborg recognized that some of the plaintiffs might be able to get some relief based on narrower allegations about what happened in their specific cases.

Miscellaneous Points

The plaintiffs argued that the deeds of trust in some of these cases could qualify as "false documents" for the purpose of an Arizona Statute prohibiting the recording of false documents. In addition to ruling that the documents could not be considered "false" based on general MERS invalidity, Judge Teilborg said "robosigning" was an issue between the parties to the assignment, and was not something the borrowers could sue over. I'm not sure this is right. Although courts in non-judicial foreclosure situations have generally have not upheld a broad "show me the note" doctrine, in at least some situations borrowers may have a right to know that the person foreclosing can prove title to the loan and the deed of trust.

Judge Teilborg also decided that the foreclosures could not be wrongful unless the plaintiffs had not defaulted. The plaintiffs argued that a foreclosure can be wrongful in other ways. The law is unclear on this point, and a decision from a state court while the MDL decision is up on appeal could change the outcome.

My Conclusions

I would be the last person to argue that banks did nothing wrong in the last ten years. I am very critical of the banks, and of the way the Bush-Obama administration has dealt with the banks. However, I am in about 90% agreement with Judge Teilborg that the plaintiffs in the MDL litigation were wrong about their two central arguments.

I haven't seen any evidence that the banks were intentionally trying to fool borrowers when they developed MERS. The banks were trying to avoid recording fees, and they were trying to develop a system for offloading inherently bad loans onto the buyers of mortgage backed securities and derivatives. I don't think the banks cared at all about borrowers.

Judge Teilborg also seems to me to be correct about automatically invalidating MERS mortgages. It is clear that there are many foreclosure cases where the wrong party has done the wrong thing, sometimes spectacularly wrong. Many of those foreclosures should be halted until things are sorted out. But even in the worst case scenario a judge can probably figure out who owns what, and eventually allow somebody to foreclose if the borrower isn't paying. That will be costly, but there is no reason why the mortgage should be permanently invalidated.

With 72 cases in this MDL, it is certainly possible that one or more plaintiffs will succeed in persuading the 9th Circuit that Judge Teilborg overlooked something. But there isn't any broad legal doctrine of "Bank error in your favor! Collect 1 free house." Screwed up paperwork makes things more difficult for borrowers in some respects, but it can also work in the borrower's favor in negotiations for a modification, or especially in bankruptcy. It rarely ends up completely and permanently invalidating the bank's security interest.

In fact, some folks may remember the case of Olga, whose mortgage was invalidated in bankruptcy. The lender appealed, and from what I can tell by looking at later court documents the parties reached a settlement including a mortgage modification. Even Olga does not appear to have gotten a free house.

Some lenders have apparently learned at least part of the lesson, and have stopped filing foreclosures in the name of MERS. If MERS assigns the deed of trust to the correct entity, that should resolve a lot of the complications by reuniting the mortgage and the note.

If folks have questions, I can try to address them in a follow-up post.

Report: Greek Government Agrees to Coalition Deal

by Calculated Risk on 11/06/2011 03:29:00 PM

From Athens News: Coalition government deal reached

According to sources, Greek prime minister George Papandreou and opposition leader Antonis Samaras agreed on the form of a coalition governments at talks hosted by the president Karolos Papoulias on Sunday.UPDATE:

According to an announcement [from] the Presidency George Papandreou will not lead the new government. The new government will ratify the EU deal of Oct. 26th and afterwards will lead the country to elections.

From the NY Times: Leaders in Greece Agree to Form a New Government

After crisis talks on Sunday night, Prime Minister George Papandreou and his main rival agreed to create a new unity government in Greece that will not be led by Mr. Papandreou, according to a statement released Sunday night by the Greek president, who mediated the talks.

Mr. Papandreou and the opposition leader Antonis Samaras agreed to meet again on Monday to hammer out the details. The name of the new prime minister is not expected until then.

Retail: Seasonal Hiring vs. Retail Sales

by Calculated Risk on 11/06/2011 01:50:00 PM

On Friday I noted that retailers hired seasonal workers at close to the pre-crisis pace in October. Reader Hd asked about the correlation between seasonal hiring and retail sales. Below is a scatter graph of historical October retail hiring vs. the real increase in retail sales.

First, here is the NRF forecast for this year: NRF Forecasts Holiday Sales Increase of 2.8 Percent to $465.6 Billion

The 2011 holiday season can be summed up in one word: average. On the heels of a holiday season that outperformed most analysts’ expectations, holiday retail sales for 2011 are expected to increase 2.8 percent to $465.6 billion, according to the National Retail Federation. While that growth is far lower than the 5.2 percent increase retailers experienced last year, it is slightly higher than the ten-year average holiday sales increase of 2.6 percent.Here is a repeat of the graph of retail hiring based on the BLS employment report:

...

NRF used its holiday forecasting model to create a projection for seasonal hiring in retail. According to NRF, retailers are expected to hire between 480,000 and 500,000 seasonal workers this holiday season, which is comparable to the 495,000 seasonal employees they hired last year.

...

Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Click on graph for larger image.

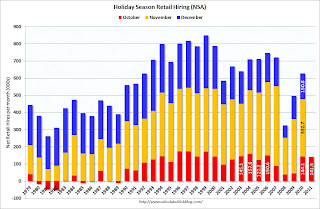

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired 141.5 thousand workers (NSA) net in October. This is about the same level as in 2003 through 2006 and the same as in 2010. Note: this is NSA (Not Seasonally Adjusted).

The scatter graph is for the years 1993 through 2010 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

The scatter graph is for the years 1993 through 2010 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.69 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants.

This suggests a real gain of around 2.5% in Q4 (plus inflation), well above the NRF forecast of 2.8% nominal (including inflation).

However November is the key month for seasonal retail hiring, and if retailers hire 330,000+ seasonal workers in November like last year, this retail season will probably be solid.

Greece Update

by Calculated Risk on 11/06/2011 08:43:00 AM

It seems likely the Greek Prime Minister George Papandreou will resign today after an agreement is reached on a coalition government and an interim Prime Minister.

There is a cabinet meeting starting at 9 AM ET.

From Athens News: Negotiations over coalition underway

The government spokesman announced on Sunday morning, speaking on a current affairs TV programme, that an agreement over a coalition or unity government could be worked out the same day, while adding that the name of a new prime minister could also be announced.From the WSJ: Greek Leader May Step Down

Spokesman Ilias Mossialos underlined that negotiations are underway, clarifying that the name of the new premier must be announced by tomorrow. However, he cautioned that current Prime Minister George Papandreou would resign only when the two issues are finalised.

... main opposition New Democracy party cadres have been quoted as saying the party will agree to such a prospect as long as a transitional government lasts no longer than six weeks, time enough to ratify and implement a series of landmark recent agreements Athens has signed with its creditors.

Greek Prime Minister George Papandreou may announce his resignation after a cabinet meeting Sunday that will pave the way for a coalition government ... Earlier in the day, Antonis Samaras, the head of Greece's main opposition New Democracy party, called for Mr. Papandreou's immediate resignation, indicating that he was open to talks with the ruling socialists over forming a coalition government.