by Calculated Risk on 11/01/2011 11:45:00 AM

Tuesday, November 01, 2011

Construction Spending increased slightly in September

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2011 was estimated at a seasonally adjusted annual rate of $787.2 billion, 0.2 percent (±1.8%)* above the revised August estimate of $786.0 billion. The September figure is 1.3 percent (±1.9%)* below the September 2010 estimate of $797.3 billion.Private construction spending increased in September:

Spending on private construction was at a seasonally adjusted annual rate of $501.8 billion, 0.6 percent (±1.1%)* above the revised August estimate of $499.0 billion. Residential construction was at a seasonally adjusted annual rate of $228.3 billion in September, 0.9 percent (±1.3%)* above the revised August estimate of $226.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 66% below the peak in early 2006, and non-residential spending is 34% below the peak in January 2008.

Public construction spending is now 12% below the peak in March 2009.

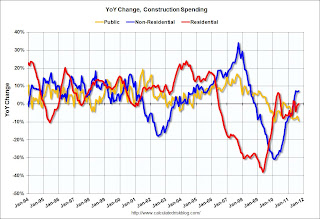

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index indicates slower expansion in October

ISM Manufacturing index indicates slower expansion in October

by Calculated Risk on 11/01/2011 10:00:00 AM

PMI was at 50.8% in October, down from 51.6% in September. The employment index was at 53.5%, down from 53.8%, and new orders index was at 52.4%, up from 49.6%.

From the Institute for Supply Management: October 2011 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in October for the 27th consecutive month, and the overall economy grew for the 29th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 50.8 percent, a decrease of 0.8 percentage point from September's reading of 51.6 percent, indicating expansion in the manufacturing sector for the 27th consecutive month. The New Orders Index increased 2.8 percentage points from September to 52.4 percent, indicating a return to growth after three months of contraction. The Prices Index, at 41 percent, dropped 15 percentage points, and is below the 50 percent mark for the first time since May 2009 when it registered 43.5 percent. Inventories decreased to 46.7 percent, which is 5.3 percentage points below the September reading of 52 percent. Comments from respondents are mixed, indicating positive relief from raw materials pricing and continuing strength in a few industries, but there is also more concern and caution about growth in this uncertain economy."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.0%, and suggests manufacturing expanded at a slightly slower rate in October than in September. It appears manufacturing employment expanded in October with the employment index at 53.5%. New orders were up, and prices fell sharply.

Greece Update

by Calculated Risk on 11/01/2011 08:38:00 AM

Some European bond yields are rising sharply ...

From the Financial Times: Referendum call sparks fears over Greek bail-out

The premier also raised the stakes by announcing a parliamentary vote of confidence ... The debate ... will start on Wednesday with a vote set for midnight on Friday.From the WSJ: Greek Vote Threatens Bailout

excerpt with permission

A "yes" vote in the referendum could deflate the massive street protests and strikes that threaten to paralyze Greece as it tries to enact a brutal austerity program to earn rescue loans from the euro zone and the International Monetary Fund.The Greek 2 year yield is up to 84.2% (up from 77.7% yesterday) The Greek 1 year yield is up to 194% (from 158%).

A "no" vote, however, could bring down the government and cut off international funding for Greece, leaving the country facing a financial meltdown. The government expects to hold the referendum in January.

The Portuguese 2 year yield is up to 19.6% (from 18.3% yesterday) and the Irish 2 year yield is up to 9.3% (from 8.8%).

The Spanish 10 year yield is at 5.6% and the Italian 10 year yield is up to 6.3% (from 6.1%).

The Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.0%.

Monday, October 31, 2011

Gasoline Price Update

by Calculated Risk on 10/31/2011 10:27:00 PM

The graph below shows gasoline prices have been slowly moving down since peaking in early May.

Unfortunately, according to Bloomberg, Brent Crude is up to $109.12 per barrel, and WTI is up to $92.83.

According to the EIA, WTI is up from $79 per barrel at the end of September, and Brent is up from $105. It appears the gap between WTI and Brent is closing.

Note: This graph show oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Europe: Greece to Hold Referendum on Debt Deal in December or January

by Calculated Risk on 10/31/2011 06:14:00 PM

This was announced earlier today, but this story has the timing. From the NY Times: Greece to Hold Referendum on New Debt Deal

Prime Minister George Papandreou announced Monday night that his Socialist government would hold a rare national referendum on a new debt agreement for Greece ... Mr. Papandreou said that the decision on whether to adopt the deal, which includes fresh financial assistance for the country but also imposes unpopular austerity measures, belonged to the Greek people. “Let us allow the people to have the last word, let them decide on the country’s fate,” he said ... Government sources said that the confidence vote was expected by the end of the week, with the referendum much later, in December or even January.So there will be a vote of confidence by the end of this week, and then a general referendum later.

The Greek 2 year yield is down to 77.7%. The Greek 1 year yield is down to 158%.

The Portuguese 2 year yield is up to 18.3% and the Irish 2 year yield is up to 8.8%.

The Spanish 10 year yield is at 5.54% and the Italian 10 year yield is up to 6.1%.

The Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.1%.

Fannie Mae and Freddie Mac Serious Delinquency Rates mixed in September

by Calculated Risk on 10/31/2011 04:14:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 4.00% in September. This is down from 4.03% in August, and down from 4.56% in September of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.51% in September, up from 3.49% in August. This is down from 3.80% in September 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Tracking this on a monthly basis this is kind of like watching paint dry, but the serious delinquency rates are generally falling - but only falling slowly. The key is the normal serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a number of years.

Restaurant Performance Index increased in September

by Calculated Risk on 10/31/2011 12:45:00 PM

From the National Restaurant Association: Restaurant Performance Index Rose Above 100 in September, as Sales and Traffic Levels Improved

Buoyed by stronger same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) topped the 100 mark in September for the first time in three months. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.1 in September, up 0.7 percent from August and its highest level since June. In addition, September represented the first time in three months that the RPI stood above 100, the level above which signifies expansion in the index of key industry indicators.

“The September increase in the Restaurant Performance Index was fueled by improvements in the same-store sales and customer traffic indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Among the forward-looking indicators, restaurant operators are more optimistic about sales growth in the months ahead, while their outlook for the overall economy remains cloudy.”

...

Restaurant operators reported stronger same-store sales in September. ... Restaurant operators also bounced back from a sluggish August performance to report net positive customer traffic levels in September.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.1 in September (abpve 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

Last month I wrote: "August was an especially weak economic month following the debt ceiling debate, and it will be interesting to see if these indicators show some rebound in September and October." This is a small rebound, but this suggests the recent dip might have been partially due to the default threat.

Dallas Fed Manufacturing Survey shows sluggish expansion

by Calculated Risk on 10/31/2011 10:30:00 AM

This is the last of the regional Fed surveys for October. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed and still weak in October, but improved from August and September.

Dallas Fed: Texas Manufacturing Activity Expands

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but edged down from 5.9 to 4.1, suggesting growth slowed slightly.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated growth in October, and the pace of new orders increased. The shipments index fell from 9.4 to 2.7, suggesting shipment volumes continued to increase but at a slower pace. The capacity utilization index moved back into positive territory after being negative for two months. The new orders index suggested a pickup in demand, moving from 3.6 to 8.3. ...

Perceptions of general business conditions improved in October. The general business activity index jumped up from -14.4 to 2.3, its first positive reading in six months. The company outlook index also rose markedly, bouncing back to a reading of 7.2 after coming in near zero in September.

Labor market indicators reflected higher labor demand growth. The employment index came in at 15.1, up slightly from 13.4 in September.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM index for October will be released Tuesday, Nov 1st and this suggests another fairly weak reading in October. The consensus is for a slight increase to 52.0 from 51.6 in September.

Chicago PMI at 58.4, down from 60.4 in September

by Calculated Risk on 10/31/2011 09:45:00 AM

From the Chicago ISM Chicago Business Barometer™ Stabilized:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER stabilized in October. The Business Barometer marked a 25th month of expansion, yet the 3 month moving average for the barometer fell for the 7th consecutive month. Monthly changes in the individual Business Activity components were generally modest with all but one component converging towards their 3 month moving averages.The overall index decreased to 58.4 from 60.4 in September. This was close to consensus expectations of 58.0.

Note: any number above 50 shows expansion.

The employment index increased to 62.3 from 60.6. "EMPLOYMENT highest in 6-months"

The new orders index decreased to 61.3 from 65.3. "NEW ORDERS erased half of September's gain"

Weekend:

• Summary for Week ending Oct 28th

• Schedule for Week of Oct 30th

• FOMC Meeting Preview

Mario Draghi takes over at ECB tomorrow, FT Cartoon

by Calculated Risk on 10/31/2011 08:51:00 AM

A cartoon from the FT Alphaville: E*C*B

[This] appears on page 8 of the FT’s UK print edition. It’s like one of them Renaissance allegory paintings ... Interpretations welcome.

I'm not sure about the meaning, but I liked the play on M*A*S*H.

Maybe this has something to do with Mario Draghi taking over at the ECB tomorrow. Although the ECB will obviously cut rates soon (they were caught going the wrong direction), it seems that Draghi's hands are mostly tied as far as QE.