by Calculated Risk on 10/25/2011 03:55:00 PM

Tuesday, October 25, 2011

ATA Trucking Index increased 1.6% in September

From ATA: ATA Truck Tonnage Index Increased 1.6% in September

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 1.6% in September after falling a revised 0.5% in August 2011. August’s decrease was more than the 0.2% drop ATA reported on September 27, 2011. The latest gain put the SA index at 115.8 (2000=100) in September, up from the August level of 114.

...

Compared with September 2010, SA tonnage was up a solid 5.9%. In August, the tonnage index was 4.9% above a year earlier.

“I continue to believe the economy will skirt another recession because truck tonnage isn’t showing signs that we are in a recession,” ATA Chief Economist Bob Costello said. “Tonnage is suggesting that we are in a weak growth period for the economy, but not a recession.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Sluggish growth after stalling earlier this year ...

Earlier:

• Case Shiller: Home Prices increased Seasonally in August

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 10/25/2011 02:05:00 PM

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through August) and CoreLogic House Price Indexes (through August) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to July 2000, and the CoreLogic index back to June 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to August 2000 levels, and the CoreLogic index is back to July 2000.

In real terms - and as a price-to-rent ratio - prices are mostly back to 2000 levels (nationally) and will probably be back to 1999 levels in the next few months.

Earlier:

• Case Shiller: Home Prices increased Seasonally in August

Philly Fed State Coincident Indexes increase in September

by Calculated Risk on 10/25/2011 11:59:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2011. In the past month, the indexes increased in 30 states, decreased in 13, and remained unchanged in seven for a one-month diffusion index of 34. Over the past three months, the indexes increased in 30 states, decreased in 16, and remained unchanged in four (Kentucky, Maryland, Mississippi, and New Mexico) for a three-month diffusion index of 28.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 35 states had increasing activity, up from 28 in August. It is important to remember that August was an especially weak month due to the debt ceiling debate, and some rebound in September was expected.

Here is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago - but this is an improvement from August.

Here is a map of the three month change in the Philly Fed state coincident indicators. Several states have turned red again. This map was all red during the worst of the recession, and all green not long ago - but this is an improvement from August.Earlier:

• Case Shiller: Home Prices increased Seasonally in August

Misc: Richmond Fed, FHFA House Prices decline, Consumer Confidence down

by Calculated Risk on 10/25/2011 10:17:00 AM

• Richmond Fed: Manufacturing Contraction Persists in October; Employment Turns Negative

In October, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — was unchanged from September's reading of −6. Among the index's components, shipments lost four points to −6, while new orders gained twelve points to finish at −5 and the jobs index turned negative, moving down fourteen points to −7.• From the Conference Board Consumer Confidence Index® Declines

...

Labor market conditions weakened at District plants in October. The manufacturing employment index moved down 14 points to −7 — the first negative reading for employment since September 2010. The average workweek index, however, gained six points to −1, while wage growth was virtually unchanged, easing one point to finish at 5.

The Conference Board Consumer Confidence Index®, which had slightly improved in September, declined in October. The Index now stands at 39.8 (1985=100), down from 46.4 in September.This is the lowest reading since 26.9 in March 2009.

• From the FHFA: FHFA House Price Index Falls 0.1 Percent in August, First Monthly Decline Since March

U.S. house prices fell 0.1 percent on a seasonally adjusted basis from July to August, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.8 percent increase in July was revised to reflect no change. For the 12 months ending in August, U.S. prices fell 4.0 percent.• Via Bloomberg, EU Finance minister meeting cancelled:

While 27 EU leaders convene before the 17 chiefs of the 17 euro nations tomorrow, a meeting of the 27 EU finance ministers scheduled to precede them was cancelled with no explanation.Earlier:

• Case Shiller: Home Prices increased Seasonally in August

Case Shiller: Home Prices increased Seasonally in August

by Calculated Risk on 10/25/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August (actually a 3 month average of June, July and August).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 0.2% in August (from July) Not Seasonally Adjusted (NSA), but declined Seasonally Adjusted (SA).

From S&P: Annual Rates of Change Continue to Improve According to the S&P/Case-Shiller Home Price Indices

Data through August 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed increases of +0.2% for the 10- and 20-City Composites in August versus July. Ten of the 20 cities covered by the indices also saw home prices increase over the month.d.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.2% from the peak, and down 0.2% in August (SA). The Composite 10 is 1.0% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 32.0% from the peak, and down 0.1% in August (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.6% compared to August 2010.

The Composite 20 SA is down 3.9% compared to August 2010. This is slightly smaller year-over-year decline than in July.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in August seasonally adjusted. Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in August seasonally adjusted. Prices in Las Vegas are off 59.8% from the peak, and prices in Dallas only off 9.0% from the peak.As S&P noted, prices increased in 10 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 6 cities.

The small increase reported by S&P was seasonal.

Monday, October 24, 2011

Report: Negotiators ask Greek debt holders to take 60% cut in face value of bonds

by Calculated Risk on 10/24/2011 11:12:00 PM

From the Financial Times: Hard line adopted on Greek debt loss

European negotiators have asked Greek debt holders to accept a 60 per cent cut in the face value of their bonds ...The previous agreement was for a 21% cut in the net present value, not the face value. This is a 60% cut in the face value, and according to the Financial Times, this is about a 75% to 80% reduction in NPV.

excerpt with permission

The Greek 2 year yield is up to 78%. The Greek 1 year yield is at 183%.

The Portuguese 2 year yield is up to 18% and the Irish 2 year yield is up to 8.7%.

The Spanish 10 year yield is at 5.55% and the Italian 10 year yield is at 5.95%.

The Belgian 10 year yield is at 4.45% and the French 10 year yield is up to 3.3%.

More on HARP and Housing

by Calculated Risk on 10/24/2011 07:38:00 PM

Many of the reviews of the HARP changes are pretty negative. As an example, Felix Salmon wrote: Obama’s pathetic refinancing initiative. But I think Felix was expecting too much.

This program only applies to Fannie and Freddie loans because the U.S. taxpayer already has the credit risk for these loans. Felix seemed to expect more when he wrote: "If you’re a homeowner whose mortgage isn’t owned or guaranteed by Frannie, you’re out of luck."

What this program does do is remove many of the stumbling blocks to refinancing Fannie and Freddie loans (eliminate reps and warrants, reduce or eliminate fees, automatic 2nd subordination, minimal qualifying). These were all deal killers for HARP, and hopefully these changes will smooth the refinance road.

As far as non-GSE loans, Jon Prior at HousingWire mentioned some of the comments from the press conference today about the pending mortgage settlement:

As part of the negotiations, the AGs are working to force servicers to refinance current borrowers into lower-rate mortgages.This sounds like a HARP type refinance program for non-GSE loans (the "accelerating the reduction of principal" is one of the goals of HARP by refinancing into shorter term mortgages).

"The settlement negotiation is also going to be focused on significantly accelerating the reduction of principal," Department of Housing and Urban Development Secretary Shaun Donovan said Monday.

And there is more to come. I expect an announcement in the next month or two of some sort of program for Fannie/Freddie/FHA REO disposition. This would probably involve selling REOs in bulk to investors and include some sort of plan to rent them to the current occupants.

Put those three programs together: HARP refinance for GSE loans, a HARP like refinance program as part of the mortgage settlement for many non-GSE loans, and and an REO dispositions program that keeps many occupants in place as renters and I think that will help.

This doesn't solve all of the housing problems. But the refinance programs provide a stimulus to a number of borrowers and lowers the probability of default. I'm probably in the minority, but I think this is helpful.

A few comments on the HARP Refinance Program changes

by Calculated Risk on 10/24/2011 04:38:00 PM

Here is the press release from the FHFA: FHFA, Fannie Mae and Freddie Mac Announce HARP Changes to Reach More Borrowers

• One of the key elements is the elimination of seller and servicer reps and warrants on these loans. Several readers have asked if that is a "gift" for the originators?

It is definitely a plus, but these are seasoned loans (the loans had to be originated before May 2009), so the borrower has been making payments for several years. From the FHFA:

Nearly all HARP-eligible borrowers have been paying their mortgages for more than three years, and most of those for four or more years. These are seasoned loans made to borrowers who have demonstrated a capacity and commitment to make good on their mortgage obligation through a period of severe economic stress and house price declines.This will hit some MBS owners since these borrowers will now be able to refinance and the previous loan will be paid off (and these borrowers were paying high interest rates).

Reps and warrants protect the Enterprises from losses on defective loans; typically, such defects show up in the first few years of a mortgage and so the value of the reps and warrants decline over time. By refinancing into a lower interest rate and/or shorter term mortgage, these borrowers are recommitting to their mortgage and strengthening their household balance sheet, thereby reducing the credit risk they already pose to the Enterprises. Therefore, FHFA has concluded that eliminating the reps and warrants that may have discouraged industry participants from taking greater advantage of HARP to-date will be good for borrowers, housing markets, and the Enterprises and taxpayers.

• Some readers have pointed out this doesn't help with negative equity. However there is an attempt in this program to get borrowers to refinance in to shorter term loans - and by paying down the loan amount - the borrowers will reach positive equity sooner. But this doesn't reduce the loan balance.

• I suspect this will encourage some short term delinquent borrowers to bring their mortgage loans current. From the FHFA: "The borrower must be current on the mortgage at the time of the refinance, with no late payment in the past six months and no more than one late payment in the past 12 months." So some 30 day delinquent borrowers could refinance in 6 months - and many in a year if they can bring their loan current. Mortgage rates will probably still be pretty low in a year!

• The FHFA estimates this will help close to 1 million borrowers, but according to a Dow Jones report, analysts at Barclays Capital have estimated that between 1.9 million and 3.1 million homeowners will be eligible.

• All of the major lenders have agreed to automatically subordinate their second liens behind the new HARP loans. This makes sense - a lower payment on the first helps the 2nd lien - but under the old program this had to approved on a loan by loan basis.

This program will probably be more successful than the original HARP. Of course this doesn't help delinquent borrowers - or borrowers with loans not guaranteed by Fannie or Freddie. Frequently loans are sold to Fannie or Freddie and the borrower keeps paying the servicer and isn't aware that the loan has been sold. Anyone with a loan originated before May 2009 should probably check:

Homeowners can determine if they have a Fannie Mae or Freddie Mac loan by going to:

http://www.FannieMae.com/loanlookup/ or calling 800-7FANNIE (8 am to 8 pm ET)

https://ww3.FreddieMac.com/corporate/ or 800-FREDDIE (8 am to 8 pm ET)

DOT: Vehicle Miles Driven decreased 1.7% in August compared to August 2010

by Calculated Risk on 10/24/2011 02:22:00 PM

The Department of Transportation (DOT) reported today:

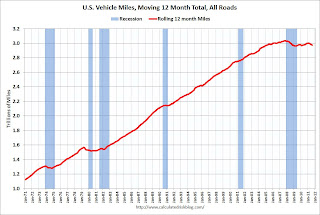

•Travel on all roads and streets changed by -1.7% (-4.6 billion vehicle miles) for August 2011 as compared with August 2010.The following graph shows the rolling 12 month total vehicle miles driven.

•Travel for the month is estimated to be 263.0 billion vehicle miles.

•Cumulative Travel for 2011 changed by -1.3% (-26.0 billion vehicle miles).

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 45 months - so this is a new record for longest period below the previous peak - and still counting! Talk about moving sideways ...

The second graph shows the year-over-year change from the same month in the previous year.

The current decline is not as a severe as in 2008, but this is significant.

The current decline is not as a severe as in 2008, but this is significant.It appears the slowdown at the end of July and in August impacted miles driven, and perhaps miles driven will increase in September.

Moody's: Commercial Real Estate Prices increased 2.4% in August

by Calculated Risk on 10/24/2011 11:22:00 AM

From Bloomberg: Moody’s U.S. Commercial Property Index Rose 2.4% in August

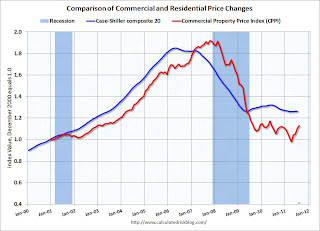

The Moody’s/REAL Commercial Property Price Index advanced 2.4 percent from July. It’s up 7.2 percent from a year earlier ... Moody’s doesn’t see “significant” price gains in the near term as loan originations based on commercial-mortgage backed securities slow and demand for vacant space continues to “languish,” the company said. ... The share of distressed deals was 21.7 percent, the lowest since January 2010.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 7.2% from a year ago, and down about 41% from the peak in 2007. This index is very volatile because there are relatively few transactions - and some of the recent increase was due to fewer distressed sales - and some of the increase was probably seasonal.