by Calculated Risk on 10/19/2011 09:40:00 AM

Wednesday, October 19, 2011

2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

I'll have more on prices later ...

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.4 percent over the last 12 months to an index level of 223.688 (1982-84=100)."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation:

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

• In 2008, the Q3 average of CPI-W was 215.495. In the previous year, 2007, the average in Q3 of CPI-W was 203.596. That gave an increase of 5.8% for COLA for 2009.

• In 2009, the Q3 average of CPI-W was 211.013. That was a decline of 2.1% from 2008, however, by law, the adjustment is never negative so the benefits remained the same in 2010.

• In 2010, the Q3 average of CPI-W was 214.136. That was an increase of 1.5% from 2009, however the average was still below the Q3 average in 2008, so the adjustment was zero.

• In 2011, the Q3 average of CPI-W was 223.233. This is above the Q3 2008 average, and COLA will increase around 3.6% for next year (the current 223.233 divided by the Q3 2008 level of 215.495).

Of course medicare premiums will increase too.

Contribution and Benefit Base

Since COLA increased, the contribution base will be adjusted using the National Average Wage Index.

This is based on a one year lag. Since there was no increase in COLA for the last two years, the contribution base has remained at $106,800 for three years. Since COLA will be positive this year, the adjustment this year will use the 2010 National Average Wage Index compared to the 2007 Wage Index. The National Average Wage Index for 2010 was $41,673.83 and the index for 2007 was $40,405.48. So $41,673.83 divided by $40,405.48 multiplied by $106,800 is approximately $110,000.

So the contribution base will increase to around $110,000 in 2012.

NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained

Housing Starts increased in September

by Calculated Risk on 10/19/2011 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 658,000. This is 15.0 percent (±13.7%) above the revised August estimate of 572,000 and is 10.2 percent (±13.3%)* above the September 2010 rate of 597,000.

Single-family housing starts in September were at a rate of 425,000; this is 1.7 percent (±9.4%)* above the revised August figure of 418,000. The September rate for units in buildings with five units or more was 227,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 594,000. This is 5.0 percent (±1.3%) below the revised August rate of 625,000, but is 5.7 percent (±2.6%) above the September 2010 estimate of 562,000.

Single-family authorizations in September were at a rate of 417,000; this is 0.2 percent (±1.0%)* below the revised August figure of 418,000. Authorizations of units in buildings with five units or more were at a rate of 158,000 in September.

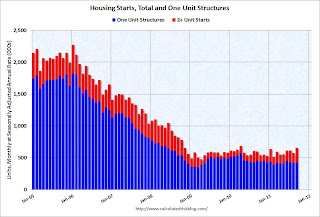

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 658 thousand (SAAR) in September, up 15.0% from the revised August rate of 572 thousand. Most of the increase was for multi-family starts.

Single-family starts increased 1.7% to 425 thousand in September.

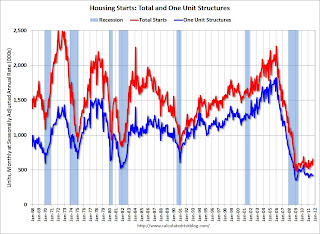

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for about two years and a half years - with slight ups and downs due to the home buyer tax credit.Multi-family starts are increasing in 2011 - although from a very low level. This was well above expectations of 590 thousand starts in September.

Single family starts are still "moving sideways".

MBA: Mortgage Purchase Application Index at Lowest Level Since 1996

by Calculated Risk on 10/19/2011 07:25:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index decreased 16.6 percent from the previous week. The seasonally adjusted Purchase Index decreased 8.8 percent from one week earlier and is at the lowest level in the survey since December 1996.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.33 percent from 4.25 percent, with points increasing to 0.48 from 0.47(including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 4.64 percent from 4.59 percent, with points decreasing to 0.45 from 0.49 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This was a sharp decrease in the purchase index, and the index is now at the lowest level since December 1996. This does not include cash buyers, but this suggests weaker home sales in November and December.

Tuesday, October 18, 2011

Countdown to Euroday Oct 23rd: Another wild day

by Calculated Risk on 10/18/2011 10:38:00 PM

Another wild day in Euroland ...

Early today, the Guardian reported: France and Germany ready to agree €2tn euro rescue fund

But later in the day, right before the close, Dow Jones reported: EU Source: No EFSF Deal Til Friday, EUR2 Trillion Number 'Simplistic'

European officials are still debating the size of the bailout fund for the euro zone and reports that an agreement has been reached to leverage it to EUR2 trillion are "totally wrong," an official familiar with the negotiations said.There are discussions concern insuring debt so the EFSF would take the first losses. If the first 20% was insured, the €440 billion EFSF could insure close to €2tn in debt - except it isn't that simple. First, the EFSF only has about €300 that can be deployed, and second, the amount of insurance will vary by country. So the €2tn was "simplistic".

Also Moody's downgraded Spain. From Bloomberg: Spain’s Rating Cut to A1 by Moody’s

Moody’s yesterday reduced its ranking to its fifth-highest investment grade, cutting it by two levels to A1 from Aa2, with the outlook remaining negative. ... Moody’s, in a statement, cited the “continued vulnerability of Spain to market stress” that is driving up the cost of borrowing, as well as weaker growth prospects.And from the NY Times: France Defends Its Credit Rating After Moody’s Warning

The discussions have taken on greater urgency since Moody’s warned late Monday of a possible downgrade to France’s flawless credit rating.And from the Financial Times: French warning to euro summit

President Nicolas Sarkozy said that “an unprecedented financial crisis will lead us to take important, very important decisions in the coming days”.The clock is ticking and the rumors are flying.

Raising the sense of urgency, the French president added: “Allowing the destruction of the euro is to take the risk of the destruction of Europe. Those who destroy Europe and the euro will bear responsiblity for resurgence of conflict and division on our continent.”

excerpt with permission

Housing: A comment on Shadow Inventory

by Calculated Risk on 10/18/2011 06:10:00 PM

Several readers have sent me an article by Toluse Olorunnipa at McClatchy Newspapers: Millions of homes lurk on bank inventories, casting doubts of rebound

This article is decent if you understand the numbers (ignore the headline). Unfortunately some commentary about this article is wrong.

First, what is "shadow inventory"? There are different definitions for shadow inventory, but this is usually considered inventory that will be coming on the market soon, but is NOT currently listed for sale. Inventory that is listed for sale is "visible inventory".

An all encompassing definition of shadow inventory would probably include bank owned property (Real Estate Owned), properties in the foreclosure process, other properties with delinquent mortgages (both serious delinquencies of over 90+ days, and less serious), condos that were converted to apartments (and will be converted back), investor owned rental properties, and homeowners "waiting for a better market", and a few other categories - as long as the properties were not currently listed for sale. But many of these properties will not come on the market for several years, and that isn't exactly "soon".

A more conservative estimate would just be the number of 90+ day delinquencies, properties in-foreclosure and REOs not currently listed for sale. That is CoreLogic's approach - they compare the addresses of REO and delinquent properties with current listings and at the end of Q2 CoreLogic reported:

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent, 430,000 are in some stage of foreclosure and 390,000 are already in REO.Now compare those numbers to the McClatchy article:

Calculating the size of the shadow market has proved difficult, and estimates range from 1.6 million to 7 million homes.The first number appears to come from RealtyTrac. This number is too high. The total REO is probably lower and a number of those are listed for sale. As the McClatchy article notes:

...

The McClatchy analysis found the following shadow inventory:

* 644,000 houses already owned by lenders but not yet for sale.

* 2.2 million homes whose owners have received initial foreclosure notices or notices of default but haven't yet been foreclosed on.

* 1.9 million properties whose owners are 90 days or more behind on their payments but haven't yet been served with foreclosure notices.

... Fannie Mae, Freddie Mac and the Federal Housing Administration hold about 250,000 homes. ... at least 100,000 of those aren't yet on the marketThat suggests close to 150,000 are listed for sale for just Fannie, Freddie and the FHA. The 250,000 is based on the same sources I use, and we can see how CoreLogic came up with the 390,000 REO not listed for sale.

The in-foreclosure and seriously delinquent numbers come from LPS Applied Analytics most recent report for August. LPS reported in August that there were:

• 1.87 million loans 90+ days delinquent.

• 2.15 million loans in foreclosure process.

That is just over 4 million loans, but many of these are listed for sale and are not "shadow inventory". The McClatchy article incorrectly stated they were all "shadown inventory".

CoreLogic estimated that 430,000 of the in-foreclosure properties are not listed for sale, and 770,000 of the 90+ day delinquent properties are not listed for sale. Note: CoreLogic compares addresses of delinquent properties with listed properties.

CoreLogic's estimate might be low (their estimate seems reasonable based on their definition), but the range given in the article of "1.6 million to 7 million homes" of shadow inventory is absurd. The only way to get to 7 million is to add the 'less than' 90 day delinquencies (2.38 million loans), 90+ day delinquencies (1.87 million loans), in-foreclosure (2.15 million loans) and total REO (and their estimate for REO is too high). And that ignores the visible inventory and that a certain percentage of loans will cure - especially for the shorter delinquency loans.

Although this article is a decent overview of several housing issues, it is unfortunately misleading and contains obvious errors. The "644,000 houses already owned by lenders but not yet for sale" appears too high. And the article incorrectly includes all of the properties in-foreclosure and with seriously delinquent loans as "shadow inventory" even though many are listed for sale.

Housing: A comment on Builder Confidence

by Calculated Risk on 10/18/2011 03:55:00 PM

A few comments ... We have to remember that the increase in October builder confidence, released this morning by the NAHB, is just one month of survey responses and could be noise.

Also, a reading of 18 is still very low. Before the current housing bust, the record low for the builder confidence survey was 20 in 1991 - and that was considered very depressed.

But we also to have remember that housing will not be depressed forever. As the excess supply of vacant housing units is absorbed, the home builders will start building more homes. The excess vacant supply isn't spread evenly geographically. Some areas have a large supply; other areas are probably getting close to exhausting the local excess supply.

Earlier this year, economist Tom Lawler estimated the national excess vacant supply was "in the 1.6 to 1.7 million range" as of April 1, 2010 (using the Census 2010 data). I came up with a similar estimate on a state by state basis: The Excess Vacant Housing Supply (see post for table).

These estimates were for April 1, 2010; about 18 months ago. The population is still growing and the economy is adding jobs (slowly), and the U.S. is adding households. At the same time, the builders delivered a record low number of housing units last year - and will probably break that record again this year. With more households, and few units being added, the excess supply is probably declining fairly rapidly.

Unfortunately there is no timely estimate of household formation. Note: the Freddie Mac chief economist put out an esimtate yesterday for household formation, but that was based on the HVS - and that is not an accurate survey for household formation.

So at some point we'd expect pockets of improvement. As I noted, the increase in October might just be noise, but it also might indicate some areas are improving slightly. If the latter, the survey should show further increases - and housing starts should begin to pick up too (the builder survey was for October, so we will have to wait until the October housing starts are released to see if there is any related increase in starts, seasonally adjusted).

Finally, it is important to distinguish between the large number of houses with seriously delinquent mortgages and the excess vacant housing supply. Some people might assume that new home sales will not pick up until the number of delinquent mortgages declines to normal. That is not correct. Most of the houses with seriously delinquent mortgages are occupied, and the units that are vacant are included in the above estimates of the excess supply. The large number of delinquent loans - and loans in the foreclosure process - will keep pressure on house prices for some time, but that is a different issue. Building will pick up as the excess supply is exhausted in each area.

So maybe the increase in confidence indicates the excess supply has been absorbed in a few areas - or maybe it was just noise. We will have to watch and see.

DataQuick: California Foreclosure Activity Back Up

by Calculated Risk on 10/18/2011 02:50:00 PM

From DataQuick: California Foreclosure Activity Back Up

A total of 71,275 Notices of Default (NoDs) were recorded at county recorders offices during the third quarter. That was up 25.9 percent from 56,633 for the prior three months, and down 14.4 percent from 83,261 in third-quarter 2010, according to San Diego-based DataQuick.Some of this increase was due to the surge in filings by BofA in August.

Last quarter's 71,275 NoDs, which mark the first step in the formal foreclosure process, jumped back to levels seen earlier this year and late last year. Lenders filed 68,239 NoDs during first-quarter 2011 and 69,799 in fourth-quarter 2010. NoDs peaked in first-quarter 2009 at 135,431.

...

"The way it looks right now, it's reasonable to expect default filings to run at a somewhat higher level than we saw earlier this year," [John Walsh, DataQuick president] said. "Obviously, some lenders and loan servicers have begun to plow through their backlogs of delinquent loans more aggressively."

Most of the loans going into default are still from the 2005-2007 period: the median origination quarter for defaulted loans is still third-quarter 2006. That has been the case for almost three years, indicating that weak underwriting standards peaked then.

And on completed foreclosures:

Trustees Deeds recorded (TDs), or the actual loss of a home to foreclosure, totaled 38,895 during the third quarter. That was down 8.4 percent from 42,465 for the prior quarter, and down 14.3 percent from 45,377 for third-quarter 2010. The all-time peak was 79,511 in third-quarter 2008. The state's all-time low was 637 in the second quarter of 2005, DataQuick reported.California is a non-judicial state, and it still takes an average of 10 months to foreclose after the Notice of Default is filed (the shortest possible period is 3 months and 21 days).

...

On average, homes foreclosed on last quarter took 9.9 months to wind their way through the formal foreclosure process, beginning with an NoD. That's about even with 10 months in the prior quarter but up from 8.7 months a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the annual Notices of Default (NODs) filed in California. The current year was estimated at the total for Q1 through Q3, plus Q4 the same as Q3.

California had a significant housing bust in the early '90s, with defaults peaking - and prices bottoming - in 1996. That bust was mild compared to the recent housing bust - and defaults are still way above the 1996 peak.

Bernanke: Effects of the Great Recession on Central Bank Doctrine and Practice

by Calculated Risk on 10/18/2011 01:15:00 PM

From Fed Chairman Ben Bernanke: Effects of the Great Recession on Central Bank Doctrine and PracticeA few excerpts:

My guess is that the current framework for monetary policy--with innovations, no doubt, to further improve the ability of central banks to communicate with the public--will remain the standard approach, as its benefits in terms of macroeconomic stabilization have been demonstrated. However, central banks are also heeding the broader lesson, that the maintenance of financial stability is an equally critical responsibility. Central banks certainly did not ignore issues of financial stability in the decades before the recent crisis, but financial stability policy was often viewed as the junior partner to monetary policy. One of the most important legacies of the crisis will be the restoration of financial stability policy to co-equal status with monetary policy.In other words, the Fed did not pay enough attention to regulation, and allowed the banks to engage in risky practices with far too much leverage.

The financial crisis of 2008 and 2009 will leave a lasting imprint on the theory and practice of central banking. With respect to monetary policy, the basic principles of flexible inflation targeting--the commitment to a medium-term inflation objective, the flexibility to address deviations from full employment, and an emphasis on communication and transparency--seem destined to survive. However, following a much older tradition of central banking, the crisis has forcefully reminded us that the responsibility of central banks to protect financial stability is at least as important as the responsibility to use monetary policy effectively in the pursuit of macroeconomic objectives.

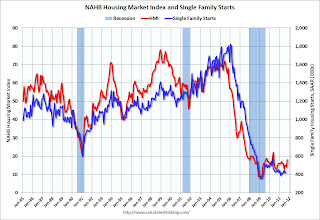

NAHB Builder Confidence index increases in October

by Calculated Risk on 10/18/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in October to 18 from 14 in September. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Home Builder Confidence Rises Four Points in October

Builder confidence in the market for newly built, single-family homes rose four points to 18 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for October, which was released today. This is the largest one-month gain the index has seen since the home buyer tax credit program helped spur the market in April of 2010.

"Builder confidence regained some ground in October due to modest improvements in buyer interest in select markets where economic recovery is starting to take hold and where foreclosure activity has remained comparatively subdued," said NAHB Chairman Bob Nielsen, a home builder from Reno, Nev.

...

"This latest boost in builder confidence is a good sign that some pockets of recovery are starting to emerge across the country as extremely favorable interest rates and prices catch consumers' attention," said NAHB Chief Economist David Crowe. "However, it's worth noting that while some builders have shifted their assessment of market conditions from 'poor' to 'fair,' relatively few have shifted their assessments from 'fair' to 'good.' One reason is that builders are facing downward pricing pressures from foreclosed homes at the same time that building materials costs are rising, and this is further squeezing already tight margins."

...

Each of the HMI's three component indexes recorded substantial gains in October. The component gauging current sales conditions rose four points to 18, the component gauging sales expectations in the next six months rose seven points to 24, and the component gauging traffic of prospective buyers rose three points to 14.

Regionally, the West led all other areas of the country with its nine-point gain to 21 – the highest HMI score for that region since August of 2007. The Midwest and South each recorded four-point gains, to 15 and 19, respectively, while the Northeast held unchanged at 15.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years. This is still very low, but this is the highest level since early 2010 - and that boost was due to the housing tax credit.

Report: Lenders Approving more Short Sales

by Calculated Risk on 10/18/2011 08:48:00 AM

From Bloomberg: Home Short Sales Rise in ‘Dramatic Shift’ That May Boost U.S. House Prices (ht Mike in Long Island)

There has been a “dramatic shift” in banks’ willingness sell a property for less than the mortgage balance to avoid foreclosing ... short sales, typically change hands at a discount of about 20 percent to homes not in financial distress, compared with a 40 percent price cut for bank-owned homes, according to RealtyTrac Inc. Short sales jumped 19 percent in the second quarter from the prior three months while foreclosure sales were flat, the data seller said.The main concern for the lenders about short sales is short sale fraud (under-the-table payments, sales to related parties, etc). In general a short sales is much better than foreclosure for all parties - especially if the seller can clear all deficiencies.

... Banks are starting to “get their act together” with short sales, said Cameron Novak, a broker with The Homefinding Center in Corona, California. The company handles about 15 of the transactions a month, he said.

“There’s been improvement in the last few months, and response times are getting to be a little quicker,” Cameron said in a telephone interview. “It’s about time.”