by Calculated Risk on 9/11/2011 10:30:00 PM

Sunday, September 11, 2011

Sunday Night: Europe and Futures

Once again the focus is on Europe ...

• From the NY Times: Investors Brace as Europe Crisis Flares Up Again

Despite repeated pledges by Chancellor Angela Merkel to keep Europe together, the cacophony of dissent within Germany has been rising. That is creating fresh doubt — justified or not — about the nation’s commitment to the euro.• From the WSJ: Woes at French Banks Signal a Broader Crisis

Moody's Investors Service Inc. is expected to cut the ratings of BNP Paribas SA, Société Générale SA and Crédit Agricole SA because of the banks' holdings of Greek government debt ... Political brinksmanship over Greece, coupled with the darkening economic outlook across the Continent, has fueled a selloff in European bank shares in recent weeks• From the LA Times: Greece unveils more austerity measures

Under intense pressure from international lenders, Greece on Sunday announced a new set of austerity measures to meet deficit reduction targets ... The measures, which include a two-year property tax, are intended to make up for revenue shortfalls that come to about $3 billion this year alone.• From the WSJ: French Minister: Won't Lend To Greece If Efforts Insufficient

"The [bailout] plan has two aspects; aid to Greece with the guarantees, but also a Greek recovery plan. They have a privatization program, a spending-cut program, a program for taxing revenues. Greece must make efforts, otherwise we won't lend to them," [French budget minister and government spokeswoman Valerie Pecresse] said in an interviewThe Asian markets are red tonight with the Nikkei down 2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 12 points, and Dow futures are down about 100 points.

Oil: WTI futures are down to $86 and Brent is down under $112.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Distressed House Sales using Sacramento Data

by Calculated Risk on 9/11/2011 03:22:00 PM

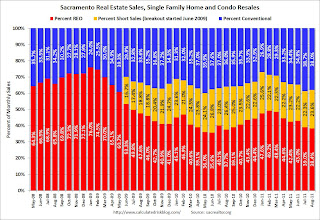

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

As I've written before: "I'm not sure what I'm looking for, but I'll know it when I see it!" (hopefully) At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in August compared to July. In August 2011, 62% of all resales (single family homes and condos) were distressed sales. This is up from 61.3% in July, and down from 64.0% in August 2010.

Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 14.8% over August 2010 (sales fell last July after the tax credit expired, so a year-over-year increase was expected). Sales were up 11% compared to August 2009.

Active Listing Inventory is down 22.6% from last August - we are seeing a sharp decline in inventory in many areas - something to watch. Once the foreclosure delays end, this data might be helpful in determining when the market is improving.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Greece Government announces new property tax

by Calculated Risk on 9/11/2011 12:20:00 PM

From Reuters: Greece opts for property levy to boost budget revenue

Greece on Sunday announced a new tax on real estate ... "It is a special levy on property which will be collected through electricity bills," Finance Minister Evangelos Venizelos [said].The tax is €4 per square meter (about $0.50 per sq. feet). The government is projecting this levy will make up for the revenue shortfall due to the sharper than expected contraction in the Greek economy.

The Greek 2 year yield is at 57%. The Portuguese 2 year yield is up to 15.7% (after falling below 12% in August). Also the Irish 2 year yield is at 9.3% (below 8% in August).

The next few weeks are "make or break" for the next Greek bailout.

Yesterday:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

A Day of Remembrance

by Calculated Risk on 9/11/2011 09:35:00 AM

I remember where I was – and everything I did on 9/11. Mostly I remember the overwhelming sense of shock and sadness, and the discussions of the events of that day with family and friends.

I wish everyone the best.

Saturday, September 10, 2011

Unofficial Problem Bank list declines to 986 Institutions

by Calculated Risk on 9/10/2011 08:51:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 9, 2011.

Changes and comments from surferdude808:

As anticipated, it was a quiet week for changes to the Unofficial Problem Bank List. This week, there were two removals and one addition, which leaves the list with 986 institutions and assets of $402.7 billion. A year ago, there were 849 institutions with assets of $415.3 billion.Earlier:

The removals were the failed The First National Bank of Florida, Milton, FL ($297 million) and Clarkston State Bank, Clarkston, MI ($111 million Ticker: HRTB), which had its actions terminated by the FDIC. The addition is Community Pride Bank, Isanti, MN ($92 million), which has been subject to a Consent Order by the State of Minnesota and not the FDIC since May 2010. This action just came to light when the Federal Reserve issued a Written Agreement against the bank's parent holding company.

Next week, we anticipate the OCC will release its actions through mid-August, which should contribute to more changes to the list.

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Greece Update

by Calculated Risk on 9/10/2011 06:25:00 PM

There was a rumor on Friday that Greece would default this weekend. That seems very unlikely, although Greece is running out of time. Also there are quite a few protests going on in Greece today.

• From the Financial Times: Greece vows to avoid default at all cost

[Prime Minister] George Papandreou has vowed to fully implement reforms ... so that Greece will be able to avoid default and remain a member of the eurozone. ... ”We’re travelling on an uphill road during an international storm … but our first priority is to save the country from bankruptcy.”• From the WSJ: Greek Leader Vows To Press Changes

...

He also [said] several struggling Greek banks ... would be nationalised ...

excerpt with permission

Prime Minister George Papandreou vowed Saturday that the country would meet its budget targets and press ahead with difficult reforms, even as thousands demonstrated against those reforms on the streets of Greece's second largest city.• On France from Reuters: French banks braced for credit-rating downgrade-sources

...

"Even if the recession this year is appreciably bigger than the original forecasts…Greece will meet its fiscal targets doing all it has to do," Mr. Papandreou said.

France's top banks are bracing themselves for a likely credit rating downgrade from Moody's ... Several sources said on Saturday that BNP Paribas , Societe Generale and Credit Agricole were expecting an "imminent" decision from the ratings agency, which first put them under review for possible downgrade on June 15.Earlier:

• Schedule for Week of Sept 11th

• Summary for Week ending September 9th

Schedule for Week of Sept 11th

by Calculated Risk on 9/10/2011 01:45:00 PM

Earlier:

• Summary for Week ending September 9th

Several key reports will be released this week: Retail Sales, Industrial Production, and the Consumer Price Index (CPI).

There will also be a special focus on the monthly surveys for some improvement from the dismal readings in August: both the Philly Fed and NY Fed (Empire state) manufacturing surveys for September will be released on Thursday, and the preliminary consumer sentiment survey for September will be released on Friday.

Both retail sales and Industrial Production were probably weak in August.

Note: The Greek bailout issue will be headline news.

The opening of the National September 11 Memorial & Museum at the World Trade Center. Live cam feeds at the World Trade Center.

No scheduled releases.

7:30 AM: NFIB Small Business Optimism Index for August.

7:30 AM: NFIB Small Business Optimism Index for August. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index decreased to 89.9 in July from 90.8 in June. Optimism has declined for five consecutive months now.

8:30 AM: Import and Export Prices for August. The consensus is a for a 0.9% decrease in import prices.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for August (a measure of transportation).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months and the four average was at 1995 levels last week.

8:30 AM: Producer Price Index for August. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

8:30 AM: Retail Sales for August.

8:30 AM: Retail Sales for August. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The consensus is for retail sales to be a 0.2% increase in August, and for a 0.3% increase ex-auto.

10:00 AM: Manufacturing and Trade: Inventories and Sales for July. The consensus is for a 0.5% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 412,000 from 414,000 last week.

8:30 AM ET: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of -3.6, up from -7.7 in August (above zero is expansion).

8:30 AM: Consumer Price Index for August. The consensus is for a 0.2% increase in prices. The consensus for core CPI is an increase of 0.2%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for August. This graph shows industrial production since 1967. Industrial production increased in July to 94.2.

The consensus is for a 0.1% increase in Industrial Production in August, and for Capacity Utilization to be unchanged at 77.5%.

10:00 AM: Philly Fed Survey for September. This index fell off a cliff in August. The consensus is for a reading of -15.0 (above zero indicates expansion), up from -30.7 last month.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for September.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for September. Consumer sentiment declined sharply in July and August - from 71.5 in June to 63.7 in July and to 55.7 in August - this is just above the crisis low off 55.3 in November 2008.

The consensus is for a slight increase to 56.0 from 55.7 in August.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2011

12:00 PM: Q2 Flow of Funds Accounts from the Federal Reserve.

Summary for Week ending Sept 9th

by Calculated Risk on 9/10/2011 08:15:00 AM

This was a light week for economic data and the focus was mostly on the financial crisis in Europe, and also on speeches by President Obama (a new stimulus proposal) and by Fed Chairman Ben Bernanke (the Fed appears prepared to act after the two day meeting ending on Sept 21st).

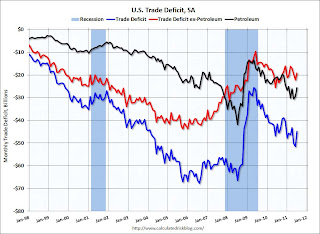

There was some good news: the trade deficit declined sharply in July (and the trade deficit was revised down for earlier months). This led Goldman Sachs to upgrade their Q3 GDP forecast yesterday: "We revised up our Q3 GDP growth forecast from 1% to 2% (annual rate) on the back of better-than-expected trade and consumer spending data." The ISM non-manufacturing index was weak, but still indicated expansion in the service sector - and that was better than expected.

Next week will be busier for U.S. economic data, including a few surveys for September that will probably show improvement since August. Of course Europe - and Greece - will remain a major focus.

Here is a summary in graphs:

• Trade Deficit decreased sharply in July

Click on graph for larger image.

Click on graph for larger image.

The Department of Commerce reported "[T]otal July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion."

Exports increased and imports decreased in July (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to July 2010; imports are up about 13% compared to July 2010.

The trade deficit was well below the consensus forecast of $51 billion.

The second graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The second graph shows the U.S. trade deficit, with and without petroleum, through July. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The decline in the trade deficit was due to an increase in exports. Also the trade deficit for the first six months of the year was revised down - especially in Q2.

• ISM Non-Manufacturing Index indicates expansion in August

The August ISM Non-manufacturing index was at 53.5%, up from 52.7% in July. The employment index decreased in August to 51.6%, down from 52.5% in July. Note: Above 50 indicates expansion, below 50 contraction.

The August ISM Non-manufacturing index was at 53.5%, up from 52.7% in July. The employment index decreased in August to 51.6%, down from 52.5% in July. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 50.5% and indicates slightly faster expansion in August than in July.

• BLS: Job Openings "little changed" in July

From the BLS: Job Openings and Labor Turnover Summary "The number of job openings in July was 3.2 million, little changed from June. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in July was 1.1 million openings higher than in July 2009 (the most recent trough)."

From the BLS: Job Openings and Labor Turnover Summary "The number of job openings in July was 3.2 million, little changed from June. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in July was 1.1 million openings higher than in July 2009 (the most recent trough)."

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in July - and are up about 13% year-over-year compared to July 2010.

Overall turnover is increasing too, but remains low. Quits increased slightly in July, and have been trending up - and quits are now up about 9% year-over-year.

• Weekly Initial Unemployment Claims increase to 414,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 414,750.

Weekly claims increased slightly, and the 4-week average is still elevated - and remains above the 400,000 level.

• Mortgage Rates fall to Record Low

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again "Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows ..."

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again "Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows ..."

Here is a long term graph of 30 year mortgage rate in the Freddie Mac survey. The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years (mortgage rates were close to this range in the '50s).

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®. Refinance activity declined a little last week, but activity was up significantly in August compared to July.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®. Refinance activity declined a little last week, but activity was up significantly in August compared to July.

With 30 year mortgage rates now at record lows, mortgage refinance activity will probably pick up some more in September - but so far activity is lower than in '09 - and much lower than in 2003.

• Other Economic Stories ...

• Fed's Beige Book: "Economic activity continued to expand at a modest pace"

• From Chicago Fed President Charles Evans: The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy

• CBO: An Evaluation of Large-Scale Mortgage Refinancing Programs

• From Jon Hilsenrath at the WSJ: Fed Prepares to Act

• From Fed Chairman Ben Bernanke: The U.S. Economic Outlook

• The American Jobs Act

• AAR: Rail Traffic mixed in August

• Lawler: Early Read on Existing Home Sales in August

Friday, September 09, 2011

Greece: Articles on financial crisis

by Calculated Risk on 9/09/2011 09:07:00 PM

• From Kash Mansori at The Street Light: When Fear Dominates

Today's twin pieces of news out of Germany - that the ECB's most prominent German, Juergen Stark, is resigning, and the unconfirmed report that the German government is preparing a contingency plan to support its banks in the event of a Greek default - had the effect of fanning the flames of fear running through world financial markets.• From the WSJ: Default and Dissent Threaten Greece

Greece is being buffeted on several fronts. It is in danger of missing budget-cutting targets that its euro-zone rescuers insist are the price of continued aid. Participation by banks in a crucial debt-restructuring plan may be less than planned. And euro-zone countries are mired in a debate over whether Greece must provide collateral to secure its bailout money.• From the Financial Times: Greek PM to give key speech amid hostility

There is little room for anything to go wrong. Without more aid, Greece will run out of cash within weeks, senior Greek government officials say.

Meanwhile, popular dissent in Greece is seething. Mass protests are expected to greet Prime Minister George Papandreou in Thessaloniki, Greece's second city, where he is slated to give a speech Saturday at the international trade fair, defending the harsh fiscal cuts his government has pledged.

The Greek prime minister will face a hostile audience on Saturday when he makes a key economic policy speech ... his finance minister was on Friday forced to dismiss market speculation that the country might default over the weekend [calling] the rumours “a game in bad taste; an organised piece of speculation against the euro and the eurozone countries”.

excerpt with permission

Bank Failure #71 in 2011: The First National Bank of Florida, Milton, Florida

by Calculated Risk on 9/09/2011 06:34:00 PM

F. D. I. C. 9. 1. 1.

F. U. B. A. R.

by Soylent Green is People

From the FDIC: CharterBank, West Point, Georgia, Assumes All of the Deposits of The First National Bank of Florida, Milton, Florida

As of June 30, 2011, The First National Bank of Florida had approximately $296.8 million in total assets and $280.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $46.9 million. ... The First National Bank of Florida is the 71st FDIC-insured institution to fail in the nation this year, and the eleventh in Florida.It is Friday!