by Calculated Risk on 8/16/2011 03:24:00 PM

Tuesday, August 16, 2011

Lawler: Early Read on Existing Home Sales in July

From economist Tom Lawler (this is an update to the short note yesterday):

While national existing home sales last month were clearly up from last July’s post-tax-credit cycle low (on a seasonally adjusted basis), it appears as if national closed sales last month did not rebound on a seasonally adjusted basis from June’s level – despite the increase in May and June pending sales. Indeed, based on my regional tracking (though I’m missing a lot of areas), and taking into account the lower business-day count this July than last July (which lower [the July 2011] seasonal factor relative to [July 2010]), I estimate that US existing home sales as measured by the National Association of Realtors may have actually declined slightly on a seasonally adjusted basis in July from June. This surprises me, given the rebound in pending sales in May and June. However, in quite a few areas of the country closed sales fell considerably short of what one would have expected given contract signings over the previous several months, either reflecting increased cancellations or closing delays. And in other areas, including some Florida markets, continued delays in the foreclosure process resulting in sizable declines in foreclosure sales.

To be sure, for areas with associations/MLS that have reported July stats, the degree to which sales last month rebounded from last July’s really low levels has varied massively, even for areas relatively close to one another (and some areas saw no rebound at all).

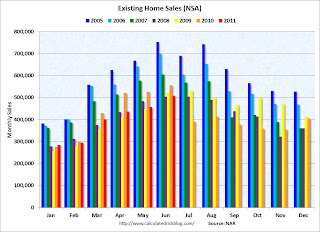

Just to remind folks, here are the NAR’s estimates of existing home sales (SF plus condo/coop) on both an unadjusted and a seasonally adjusted basis ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Note: CR graphs added.

Last July existing home sales on a seasonally adjusted basis plunged by 26.2% from June’s pace, and were down 25.2% from July 2009’s pace. Unadjusted sales were down 26.5% from July 2009.

[The following graph shows existing home sales Not Seasonally Adjusted (NSA).]

If existing home sales this July were to be flat on a seasonally adjusted basis to [June], they would have to be up 23.6% from last July’s pace. Given the calendar/lower business day count this July vs. [July 2010], I estimate that unadjusted sales this July would have to be up by around 20% from a year ago, and my regional tracking just doesn’t get that large an increase.

If existing home sales this July were to be flat on a seasonally adjusted basis to [June], they would have to be up 23.6% from last July’s pace. Given the calendar/lower business day count this July vs. [July 2010], I estimate that unadjusted sales this July would have to be up by around 20% from a year ago, and my regional tracking just doesn’t get that large an increase.

To be sure, there are many areas with YOY gains well above 20%, especially in the Midwest (where sales declined the sharpest last July). However, there are several large markets were this July’s sales were either little changed from last July (including the whole state of California and Northern Virginia) or even down from a year ago (including several Florida markets), and several more with only modest YOY gains (including Maryland, DC, South Carolina, Charlotte, Vegas, Long Island, and Albuquerque). Taken all the information I’ve seen so far, my “best” estimate (with a larger than normal forecast error) is that existing home sales (as measured by the NAR) ran at a SAAR of about 4.69 million in July, down 1.7% from June’s pace.

CR: This was from Tom Lawler. The NAR reported existing home sales at 4.77 million in June, and the consensus (from Bloomberg) is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July (the NAR will report on Thursday - take the under!).

Housing Starts and the Unemployment Rate

by Calculated Risk on 8/16/2011 02:26:00 PM

An update by request: The following graph shows single family housing starts (through July) and the unemployment rate (inverted) through July. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts have moved sideways for the last two and a half years. This is one of the reasons the unemployment rate has stayed elevated.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector hasn't been participating. This is what I expected when I first posted the above graph two years ago!

The good news is residential investment should increase modestly in 2011, mostly from multi-family and home improvement, but construction job growth will remain sluggish until the excess housing supply is absorbed.

Multi-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 8/16/2011 11:45:00 AM

I've been forecasting that:

• Multi-family starts will be up significantly this year, but

• Multi-family completions will be at or near a record low.

Since it takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - it makes sense that there will be a record low, or near record low, number of multi-family completions this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The rolling 12 month total for starts (blue line) is now above the rolling 12 month for completions (red line), and they are heading in opposite directions. Starts are picking up and completions are declining.

It is important to note that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). Still this is bright spot for construction.

Also today, the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q2 2011. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up seasonally in Q2. This was the 2nd weakest Q2 on record (slightly behind Q2 2009). Owner built starts were at a record low for a Q2, and condos built for sale are scrapping along the bottom.

Only the 'units built for rent' is showing any significant pickup. Some of the increase in 'built for rent' is seasonal, but this is almost a 30% increase from Q2 2010.

The largest category - starts of single family units, built for sale - is mostly moving sideways, and will remain weak until more of the excess vacant housing units are absorbed.

Earlier:

• Housing Starts decline slightly in July

• Industrial Production increased 0.9% in July, Capacity Utilization increases

Industrial Production increased 0.9% in July, Capacity Utilization increases

by Calculated Risk on 8/16/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production advanced 0.9 percent in July. Although the index was revised down in April, primarily as a result of a downward revision to the output of utilities, stronger manufacturing output led to upward revisions to production in both May and June. Manufacturing output rose 0.6 percent in July, as the index for motor vehicles and parts jumped 5.2 percent and production elsewhere moved up 0.3 percent. The output of mines advanced 1.1 percent, and the output of utilities increased 2.8 percent, as the extreme heat during the month boosted air conditioning usage. At 94.2 percent of its 2007 average, total industrial production for July was 3.7 percentage points above its year-earlier level. The capacity utilization rate for total industry climbed to 77.5 percent, a rate 2.2 percentage points above the rate from a year earlier but 2.9 percentage points below its long-run (1972--2010) average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is still "2.9 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 94.2.

Both industrial production and capacity utilization had been moving sideways for a few months. This was a fairly strong increase, although partially related to the extreme heat (and an increase in utilities). This was above the consensus forecast of a 0.5% increase in Industrial Production, and an increase to 77.0% for Capacity Utilization.

Housing Starts decline slightly in July

by Calculated Risk on 8/16/2011 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 604 000 This is 1.5 percent (±10 7%)* below the revised June estimate of 613,000, but is 9.8 percent (±10.8%)* above the July 2010 rate of 550,000.

Single-family housing starts in July were at a rate of 425,000; this is 4.9 percent (±8.9%)* below the revised June figure of 447,000. The July rate for units in buildings with five units or more was 170,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 597,000. This is 3.2 percent (±1.2%) below the revised June rate of 617,000, but is 3.8 percent (±2.2%) above the July 2010 estimate of 575,000.

Single-family authorizations in July were at a rate of 404,000; this is 0.5 percent (±0.9%)* above the revised June figure of 402,000. Authorizations of units in buildings with five units or more were at a rate of 171,000 in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 604 thousand (SAAR) in July, down 1.5% from the revised June rate of 613 thousand.

Single-family starts declined 4.9% to 425 thousand in July.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.This was slightly above expectations of 600 thousand starts in July. Multi-family starts are increasing in 2011 - although from a very low level.

I'll have more on housing starts later.

Monday, August 15, 2011

Misc: Europe and Summary

by Calculated Risk on 8/15/2011 09:44:00 PM

• From the Financial Times: ECB buys €22bn in eurozone bonds

The European Central Bank spent €22bn on government bonds last week ... The larger-than-expected display of fire-power highlights the scale of the challenge the central bank faces in keeping official borrowing costs under control for Italy and Spain ...• So far it is working ... here is a graph of the 10 year spread (Italy to Germany) from Bloomberg (currently 270). And for Spain to Germany (267).

excerpt with permission

• From the NY Times: Debt in Europe Fuels a Bond Debate

President Nicolas Sarkozy of France and Chancellor Angela Merkel of Germany are scheduled to meet in Paris on Tuesday but have vowed to avoid the issue of euro bonds altogether.It doesn't sound like anything significant will be announced following the meeting tomorrow.

Earlier:

• NAHB Builder Confidence index unchanged in August, Still Depressed

• Residential Remodeling Index at new high in June

• From the NY Fed Empire State Manufacturing Survey indicates contraction

• NY Fed Q2 Report on Household Debt and Credit

• Lawler Forecast: Existing Home Sales may "dip" in July

Lawler Forecast: Existing Home Sales may "dip" in July

by Calculated Risk on 8/15/2011 06:47:00 PM

Usually economist Tom Lawler sends me his forecast for existing home sales (and his forcasts have been very close). Tom has been extremely busy this month, but he sent me this short update today:

My early read of local MLS/association data suggests that national existing home sales as measured by the NAR may actually dip a bit on a seasonally adjusted basis in July -- of course, taking into account the lower business day count this July vs. last July.The NAR reported existing home sales at 4.77 million in June, and the consensus (from Bloomberg) is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July (the NAR will report on Thursday).

LA Port Traffic in July

by Calculated Risk on 8/15/2011 05:15:00 PM

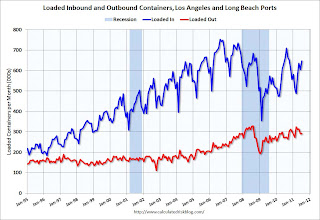

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for July. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.2% from June, and outbound traffic is up 0.6%.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of July, loaded inbound traffic was down 2% compared to July 2010, and loaded outbound traffic was up 7% compared to July 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Imports were down from last year, and are below the levels of July in 2006 and 2007 too. This is the 2nd month in a row with a year-over-year decline in imports - but there will probably be a surge in imports over the next couple of months as goods arrive for the holiday season.

DataQuick on SoCal: Lowest July Home Sales in Four Years

by Calculated Risk on 8/15/2011 03:14:00 PM

From DataQuick: Southland Housing Market's Vital Signs Remain Weak

Southern California home sales fell last month to the lowest level for a July in four years ... A total of 18,090 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in July. That was down 11.9 percent from 20,532 in June and down 4.5 percent from 18,946 in July 2010, according to San Diego-based DataQuick.About half the sales in SoCal are distressed (foreclosure resales or short sales) and about 24% of sales were to absentee homeowners (mostly investors).

...

"The latest sales figures look a bit worse than they really are, given this July was a fairly short month, but they still suggest some potential homebuyers got spooked. Reports on the economy became increasingly downbeat and, no doubt, some people fretted over the possibility the country would default on its obligations," said John Walsh, DataQuick president.

"If there's a shred of good news in the data it's that last month's sales weren't much worse than a year earlier. For the first time in many months, we get an apples-to-apples comparison to year-ago sales, given that in July 2010 the market lost its crutch -- federal homebuyer tax credits."

...

Overall home sales in July fell across all price categories compared with June. Sales declined 11.2 percent from June for homes priced below $200,000, while they fell 13.3 percent month-to-month for $300,000-to-$800,000 homes and fell 20.5 percent for homes over $800,000.

...

Foreclosure resales -- properties foreclosed on in the prior 12 months -- made up 32.5 percent of the Southland resale market in July ... Short sales, where the sale price fell short of what was owed on the property, made up an estimated 17.3 percent of Southland resales last month.

The NAR reports existing home sales for July on Thursday.

NY Fed Q2 Report on Household Debt and Credit

by Calculated Risk on 8/15/2011 12:15:00 PM

This report shows some minor household credit improvement, but that the pace of deleveraging has slowed.

From the NY Fed: New York Fed’s Quarterly Report on Household Debt and Credit Shows Continued Signs of Healing in Consumer Credit Markets

The Federal Reserve Bank of New York today released its Household Debt and Credit Report for the second quarter of 2011. Consistent with last quarter's findings, the report shows continued signs of healing in the consumer credit markets.Here is the Q2 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

"Outstanding consumer debt remained essentially flat, down just $50 billion, in what was basically a repeat of the previous quarter. This is more evidence that the pace of consumer deleveraging that began in late 2008 has slowed," said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. "During the next few quarters we will gain a better understanding of whether this is a permanent or temporary break in the decline of total outstanding consumer debt."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows aggregate consumer debt decreased slightly in Q2. From the NY Fed:

As of June 30, 2011, total consumer indebtedness was $11.4 trillion, a reduction of $1.08 trillion (8.6%) from its peak level at the close of 2008Q3, and $50 billion (0.4%) below its March 31, 2011 level. Mortgage

balances shown on consumer credit reports fell very slightly ($20 billion or 0.2%) during the quarter; home equity lines of credit (HELOC) balances fell by $20 billion (3.0%). ... Consumer indebtedness excluding mortgage and HELOC balances fell very slightly ($10 billion or about 0.4%) in the quarter.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Total household delinquency rates declined for the sixth consecutive quarter in 2011Q2. As of June 30, 9.9% of outstanding debt was in some stage of delinquency, compared to 10.5% on March 31 and 11.4% a year ago. About $1.1 trillion of consumer debt is currently delinquent, with $833 billion seriously delinquent (at least 90 days late or “severely derogatory”). Compared to a year ago, both delinquent and seriously delinquent balances have fallen 15%.There are a number of credit graphs at the NY Fed site.