by Calculated Risk on 7/22/2011 08:49:00 AM

Friday, July 22, 2011

Greece: Fitch warns of ‘selective default’

Here it is - no surprise. From Bloomberg: Fitch Ratings Says Greece Faces ’Restricted Default’ After New Debt Pact

Yields have fallen sharply this morning ...

The Greek 2 year yield is down to 25.7% (was above 39%).

The Portuguese 2 year yield is down to 14.9% (was above 20%)

The Irish 2 year yield is down to 14.7% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.7%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Thursday, July 21, 2011

Greek Default and more

by Calculated Risk on 7/21/2011 10:23:00 PM

Earlier today:

• Philly Fed Survey: "Regional manufacturing remained weak in July"

This is a day to remember - Greece will now default - so this is probably worth one more post (I haven't seen a rating agency downgrade them yet). For details: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS.

Note: The history of the European bailouts is deny first, then act later. So naturally the following denial of additional defaults just raises the question of "when" for many observers:

"As far as our general approach to private sector involvement in the euro area is concerned, we would like to make it clear that Greece requires an exceptional and unique solution.And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of July 20th). The spreads have declined sharply since the Euro Zone announcement.

...

All other euro countries solemnly reaffirm their inflexible determination to honour fully their own individual sovereign signature and all their commitments to sustainable fiscal conditions and structural reforms."

From the Atlanta Fed:

In recent days, Italy has become the next euro-area member to come under financial market pressure. Along with Greece, Portugal, Spain, and Ireland, Italian bond spreads (over German bonds) have continued to widen.Note: I added arrows pointing to the various bailouts starting with the first bailout for Greece, followed by Ireland, Portugal and then Greece again.

• Early last week, amid political uncertainty over intra-euro zone negotiations, Italian bond spreads spiked higher. Since the June FOMC meeting, the 10-year Italian-to-German bond spread has widened by nearly 108 bps through July 19. The spreads for Ireland and Portugal have soared higher by 276 bps and 262 bps, respectively, over the same period.

• Greek bond spreads remain extremely elevated, 140 bps higher since the June FOMC meeting, at 16.3 percent over German bonds. Spain’s spread also rose 80 bps

Other House Price Indexes

by Calculated Risk on 7/21/2011 05:45:00 PM

In addition to Case-Shiller and CoreLogic, I follow the following house price indexes: : RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

CoreLogic already reported that the CoreLogic HPI increased 0.8% in May.

• FNC reported:

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicates that single-family home prices were up again in May at a seasonally unadjusted rate of 0.8%.You can see the FNC composite indexes, and prices for 30 cities here.

...

Minneapolis, Boston, Charlotte, Portland, Chicago, and Washington D.C. show the strongest price momentum – rising month-over-month since March by a cumulative total of 9.2%, 7.1%, 5.7%, 5.5%, 5.3% and 3.5% respectively. Orlando and Phoenix, on the other hand, lead the nation in home price declines during 2011–having lost close to 5.0% over the last five months, followed by Las Vegas, New York, and Miami at about 3.0%.

• The FHFA (GSEs only): FHFA House Price Index Rises 0.4 Percent in May; Second Consecutive Monthly Increase

U.S. house prices rose 0.4 percent on a seasonally adjusted basis from April to May, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.8 percent increase in April was revised to a 0.2 percent increase. For the 12 months ending in May, U.S. prices fell 6.3 percent.• From RadarLogic Weak Fundamentals Undermine Seasonal Strength in Home Prices:

While the RPX Composite increased somewhat during April and gained 1.2 percent month-over-month in May, these gains have barely offset declines inAnd RadarLogic's prediction for Case-Shiller Not Seasonally Adjusted:

January. In contrast to this year’s performance to date, the RPX Composite Price increased significantly over the same period during seven of the past ten years.

Home prices usually increase in the spring due to seasonal factors, and the bulk of the gains typically occur by May. The lackluster performance of the RPX Composite Price to date means that we are almost assured to see new post-bust lows in the fall, when seasonal strength comes to an end and softening demand pulls housing prices downward.

Last month, we predicted that the S&P/Case-Shiller 10-City composite for April 2011 would be about 153 and the 20-City composite would be roughly 140. In fact, the 10-City composite was 152.51 and the 20-City composite was 138.84.This suggests a slight increase for the Case-Shiller index on a seasonally adjusted basis.

This month, we expect the May 2011 10-City composite index to be about 154 and the 20-City index to be roughly 141.

Overall this suggests most of the recent increase in prices is seasonal, and we'd expect to see declines again late this year. The Case-Shiller index for May will be released Tuesday, July 26th at 9 AM ET.

European Summit Statement Approved

by Calculated Risk on 7/21/2011 03:03:00 PM

UPDATE2: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS

Update: Herman Van Rompuy said "Private sector involvement is for Greece and Greece only" (paraphrase). The lower interest rates are for Greece, Portugal and Ireland.

From Herman Van Rompuy, President of the European Council "Statement by the heads of state or government of the Euro area & EU institutions is approved. More details at the press conference."

Just a few resources ...

• The Guardian is providing live updates.

• The Telegraph is also providing live updates.

• There will be European Council press conference later today. The time is still uncertain. Here is the video feed Meeting of Heads of State or Government of the Euro area - press conference (time TBD).

• European Commission - Audiovisual services

• The press release should be available here.

• Any statement from the ECB will probably be here.

Europe Update: Some Details, More Later

by Calculated Risk on 7/21/2011 12:15:00 PM

The details are sketchy - it appears the EFSF will have new powers, terms will be extended for Greece, Portugal and Ireland at lower rates - and "selective default" for Greece will be allowed.

The announcement will be later today.

From the NY Times: Greek Rescue Plan May Allow for Default on Some Debt

According to the draft declaration, euro zone leaders gathered in Brussels are set to agree on a series of measures to lighten the burden on Greece, Ireland and Portugal ... the euro zone leaders were also being asked to give wide-ranging new powers to the region’s bailout fund, the European Financial Stability Facility, by allowing it to buy government bonds on the secondary market and to help recapitalize banks where necessary.From the WSJ: Euro Zone Moves Toward Greek Deal

...

According to the draft, the maturity of European loans to Greece would be extended from the current 7.5 years to a minimum of 15 years and at interest rates of around 3.5 percent.

Similar help through reduced borrowing costs would be extended to Portugal and Ireland.

Some of the options to ease Greece's debt to bondholders would probably cause losses to banks and others, and trigger a temporary assessment of default against Greece by credit-rating agencies.The Greek 2 year yield is down to 33.8% (was above 39%).

Finance Minister Jan Kees de Jager said Thursday that euro-zone governments seem to have accepted that Greece will be put into "selective default" when the country gets a new financial-aid package.

The Portuguese 2 year yield is down to 17.1% (was above 20%)

The Irish 2 year yield is down to 19.1% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Philly Fed Survey: "Regional manufacturing remained weak in July"

by Calculated Risk on 7/21/2011 10:00:00 AM

From the Philly Fed: July 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased to 3.2 from -7.7 [any reading above zero is expansion]. The demand for manufactured goods, as measured by the current new orders index, improved from last month but suggests flat demand: The index rose 8 points to a reading of zero ...This indicates a little expansion in July. This was about at the consensus of 5.0.

Firms’ responses suggest a slight improvement in the labor market compared to June. The current employment index increased 5 points and remained positive for the 11th consecutive month. ...

Diffusion indexes for prices paid and prices received were lower this month and suggest a continued trend of moderating price pressures. The prices paid index declined 2 points, following a sharp drop of 22 points last month.

...

The broadest indicator of future activity improved markedly this month, rebounding from its lowest reading in 31 months in June.

Click on graph for larger image in graph gallery.

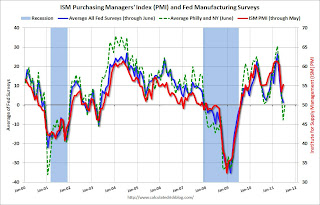

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The averaged Empire State and Philly Fed surveys are back close to zero combined. July was a little better than June for both surveys.

Weekly Initial Unemployment Claims increase to 418,000

by Calculated Risk on 7/21/2011 08:30:00 AM

The DOL reports:

Special Factor: Minnesota has indicated that approximately 1,750 of their reported initial claims are a result of state employees filing due to the state government shutdown.This is the 15th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January.

In the week ending July 16, the advance figure for seasonally adjusted initial claims was 418,000, an increase of 10,000 from the previous week's revised figure of 408,000. The 4-week moving average was 421,250, a decrease of 2,750 from the previous week's revised average of 424,000.

The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased slightly this week to 421,250.

This increase was about at expectations. With all the recent layoff announcements (Borders, Cisco, etc), there is some concern that weekly claims will rise over the next couple of months. From the WSJ:

Companies are laying off employees at a level not seen in nearly a year, hobbling the job market and intensifying fears about the pace of the economic recovery.

Cisco Systems Inc., Lockheed Martin Corp. and troubled bookstore chain Borders Group Inc. are among those that have recently announced hefty cuts

Wednesday, July 20, 2011

Report: Germany and France Agree on Greek Bailout

by Calculated Risk on 7/20/2011 09:31:00 PM

Details tomorrow ...

• From the Financial Times: Germany and France reach Greek accord

• From the WSJ: German-French Harmony on Greece

[German Chancellor Angela Merkel and] French President Nicolas Sarkozy [with] European Central Bank President Jean-Claude Trichet ... managed to find a mutually acceptable formula for how to involve Greece's bondholders in the expected new rescue package, according to a senior official present at the talks.Earlier today:

The official didn't give details of the joint proposal ...

• AIA: Architecture Billings Index indicates declining demand in June

• Moody's: Commercial Real Estate Prices increased in May

• From NY Fed VP Brian Sack: The SOMA Portfolio at $2.654 Trillion. Note: Dr. Sack outlined two possible methods for further accomodation: 1) additional asset purchases (like "QE2"), or 2) "shifting the composition of the SOMA portfolio rather than expanding its size." An interesting comment.

And on Existing Home Sales:

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

NY Fed's Brian Sack: The SOMA Portfolio at $2.654 Trillion

by Calculated Risk on 7/20/2011 07:00:00 PM

From NY Fed VP Brian Sack: The SOMA Portfolio at $2.654 Trillion. Sack discusses previous actions, and then discusses possible future actions:

Future Evolution of the SOMA PortfolioCurrently the Fed is engaged in Quantitative Neutrality (hold the balance sheet steady by reinvesting). If they decide to launch QE3, they could either 1) buy more assets, or 2) change the composition.

While I am sure you are happy to hear more about our actions to date, I realize that you may be even more interested in the evolution of the SOMA portfolio going forward. Just to be clear, I will not be saying anything about the likelihood of prospective policy actions beyond what has been conveyed in FOMC communications. However, I would like to make a few points about the portfolio under those prospective actions.

As noted earlier, the current directive from the FOMC is to reinvest principal payments on the securities we hold in order to maintain the level of domestic assets in the SOMA portfolio. This approach can be interpreted as keeping monetary policy on hold. Indeed, one can generally think of the stance of monetary policy in terms of two tools—the level of the federal funds rate, and the amount and type of assets held on the Federal Reserve's balance sheet. The FOMC has decided to keep both of these tools basically unchanged for now.

Given the considerable amount of uncertainty about the course of the economy, market participants have observed that the next policy action by the FOMC could be in either direction. If economic developments lead the FOMC to seek additional policy accommodation, it has several policy options open to it that would involve the SOMA portfolio, as noted by Chairman Bernanke in his testimony last week. One option is to expand the balance sheet further through additional asset purchases, with the just-completed purchase program presenting one possible approach. Another option involves shifting the composition of the SOMA portfolio rather than expanding its size. As noted earlier, a sizable portion of the additional risk that the SOMA portfolio has assumed to date came from a lengthening of its maturity, suggesting that the composition of the portfolio can be used as an important variable for affecting the degree of policy stimulus. Lastly, the Chairman mentioned that the FOMC could give guidance on the likely path of its asset holdings, as the effect on financial conditions presumably depends on the period of time for which the assets are expected to be held.

Alternatively, economic developments could instead lead to a policy change in the direction of normalization. The FOMC minutes released last week provided valuable information on the sequence of steps that might be followed in that case. The minutes indicated that the removal of policy accommodation was expected to begin with a decision to stop reinvesting some or all of the principal payments on assets held in the SOMA. If all asset classes in the SOMA were allowed to run off, the portfolio would decline by about $250 billion per year on average over the first several years.

Under the interpretation of the policy stance noted earlier, this shrinkage of the balance sheet would amount to a tightening of policy. However, one should realize that this step represents a relatively gradual and limited policy tightening. Indeed, using the mapping that has been discussed by Chairman Bernanke, this path for the balance sheet would, in terms of its effects on the economy, be roughly equivalent to raising the federal funds rate by just over 25 basis point per year over the course of several years.

The minutes also described asset sales as part of the strategy, indicating that this step would likely occur relatively late in the normalization process. From the perspective of the balance sheet and the stance of monetary policy, sales accomplish the same thing as redemptions, as they also shrink the balance sheet over time. The minutes indicated that such sales are likely to be gradual and predictable, which makes them even more similar in nature to redemptions.

Together, the combination of asset redemptions and asset sales, once underway, should put the size of the portfolio on a path to a more normal level over several years. Thus, they represent an important part of the normalization of the policy stance. However, if the approach follows the gradual and predictable path described by the minutes, one can think of this adjustment as a relatively passive part of the policy tightening. In these circumstances, adjustments to the federal funds rate would generally be the active policy instrument, responding as needed to economic developments.

The sequence of policy steps described in the minutes indicates how the size of the SOMA portfolio is likely to be normalized. However, simply reducing the size of the portfolio would still leave its duration at historically elevated levels. The FOMC might decide it was happy with this outcome, or it could decide at some stage to renormalize the duration of the portfolio as well. Depending on the precise timing of the steps that will occur in the exit sequence, there will likely be opportunities to do so. For example, there is a good chance that the Desk will still be selling MBS at the time when the SOMA portfolio gets back to its normal size. In such circumstances, the Federal Reserve would have to then engage in sizable Treasury purchases to offset the ongoing sales of MBS and to expand the SOMA portfolio as needed to meet currency demand and other factors. This period of Treasury purchases would allow the FOMC to rebuild its Treasury portfolio with the maturity structure that it sees as optimal.

If they decide to normalize, the first step would be to stop reinvesting.

Earlier on Existing Home Sales:

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

European Commission president: Now is the Time to Act

by Calculated Risk on 7/20/2011 04:05:00 PM

The emergency EU summit in Brussels on Thursday is viewed as critical. The Finance Ministers will meet in the morning, and the European leaders later in the day. I don't expect an announcement until late in the evening (probably well after U.S. markets close tomorrow).

From Bloomberg: Barroso Says Summit Failure on Greece Would Cause Global Damage

“Nobody should be under any illusion; the situation is very serious. It requires a response. Otherwise, the negative consequences will be felt in all corners of Europe and beyond.From the WSJ: Pressure Mounts on Greece Meeting

...

“The minimum we must do tomorrow is to provide clarity on the following: measures to ensure the sustainability of Greek public finances; feasibility and limits of private-sector involvement; scope for more flexible action through the European Financial Stability Facility, the EFSF; repair of the banking sector still needed; and measures to ensure the provision of liquidity to our banking system.”

“Most of the decisions to be taken tomorrow belong to the competence of the member states. They have reserved the instruments to themselves and they have said they will do what it takes to ensure the stability of the euro area. Well, now is the time to make good on that promise.

French Finance Minister François Baroin said euro-zone leaders are expected to deliver a "strong message" at the summit, while Foreign Minister Alain Juppe said on French television he was "convinced" leaders will find an agreement. "There are difficult technical aspects and slowness in the decision process, but on the objective there is a large consensus," said Mr. Juppe.Earlier on Existing Home Sales:

The French optimism contrasts with comments Tuesday from Ms. Merkel, who said there won't be "one spectacular step" at the Brussels summit, and that it would rather be the first of a "step-by-step measures ... with the final goal of finally getting to the roots of (the) problem."

...

"Today we have a historic choice," said Mr. Juppe. "Either we go backwards, and we let what we've built collapse. That would be an absolute catastrophe for every country. Or we go further."

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs