by Calculated Risk on 7/13/2011 10:00:00 AM

Wednesday, July 13, 2011

Bernanke Testimony: Semiannual Monetary Policy Report to the Congress

Note: Testimony starts at 10 AM ET.

Here is the CSpan feed

Here is the CNBC feed.

Prepared testimony from Fed Chairman Ben Bernanke: Semiannual Monetary Policy Report to the Congress

Ceridian-UCLA: Diesel Fuel index increased in June

by Calculated Risk on 7/13/2011 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Pulse of Commerce Index Rebounds – Up 1.0 Percent In June

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation rose 1.0 percent in June on a seasonally and workday adjusted basis, a welcome rebound following declines in the previous two months. Despite the stronger performance in June, the economy continues to remain in idle with the PCI remaining below its level at the end of the first quarter.

“Over the past year the U.S. economy has been in ‘she loves me, she loves me not’ mode,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “Bad news has been alternating with good, leaving investors and forecasters nervous and unable to identify sustainable trends.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

“The June PCI is anticipating industrial production to show modest growth of 0.17 percent for June when the number is released by the Government on July 15, 2011,” [said Craig Manson, senior vice president and Index expert for Ceridian]This index has mostly been moving sideways all year. As Leamer noted, this "could be the start of a positive trend, but a one month spike does not make a trend, particularly in light of the many false starts experienced over the last year."

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Notes: I've heard from other sources that trucking picked up a little at the end of June - perhaps because of lower fuel prices. This index does appear to track Industrial Production over time (with plenty of noise).

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 7/13/2011 07:21:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The seasonally adjusted Purchase Index decreased 2.6 percent from one week earlier. ... Refinance Index decreased 6.2 percent from the previous week, and was 42.1 percent lower than a year ago. The Refinance Index has decreased the past four consecutive weeks, reaching its lowest level since April 29, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.55 percent from 4.69 percent, with points increasing to 0.99 from 0.90 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average is still mostly moving sideways at about 1997 levels.

Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

Tuesday, July 12, 2011

Debt Ceiling Charade Update

by Calculated Risk on 7/12/2011 09:35:00 PM

I'm frequently asked why I'm not worried about the debt ceiling, and why the bond market doesn't seem to care.

The answer is the debt ceiling is a joke. It serves no purpose except political posturing.

The budget is about the deficit; the debt ceiling is about paying the bills - and the U.S. will pay its bills.

Here is what I wrote two months ago:

Congress will probably push this to the brink, but they will raise the debt ceiling before the country defaults. The first rule for most politicians is to get re-elected, and the easiest way to guarantee losing in 2012 is to throw the country back into recession. If that happened, I believe the voters would correctly blame the leaders of Congress, and I think Congress knows that too. Therefore it won't happen. I'm not worried and neither are investors.We are almost to the "brink".

Let me add: In this case, voters would blame the Republican party, and if the debt ceiling is not raised, the "Republican" brand would become toxic and synonymous with fiscal irresponsibility. The leaders of Congress know that and they will scramble to find a solution. I doubt this is the end of the GOP :-)

Earlier I argued the smart thing to do would be to eliminate the debt ceiling. Maybe we are headed in that direction. Today, Senator Mitch McConnell proposed something along those lines (not clean though).

Senate Minority Leader Mitch McConnell (R., Ky.) unveiled a new proposal that would allow President Barack Obama to raise on his own the federal borrowing limit by $2.4 trillion in three installments before the end of 2012, unless two-thirds of Congress votes to block it.Somehow the debt ceiling will be raised. Of course there is a huge battle ahead over the budget for the next fiscal year (the fiscal year starts on October 1st). It never ends.

DataQuick: SoCal Home Sales increase in June, Record Low New Home Sales

by Calculated Risk on 7/12/2011 05:15:00 PM

Special Note: It now appears the NAR will release the benchmark revisions in August (ht Mary Ellen). These revisions are expected to show significantly fewer sales and lower levels of inventory for the last few years. Hopefully the new methodology will be fully disclosed. Also, hopefully the NAR will release sales and inventory for all revisions (not just the last year).

From DataQuick: Southland Home Sales Quicken, Median Price Highest This Year

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges ...This is another report suggesting an increase in existing home sales in June compared to the reported 4.81 million sold in May on a seasonally adjusted annual rate (SAAR) basis (before the benchmark revisions).

A total of 20,532 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in June. That was up 11.6 percent from 18,394 in May but down 14.0 percent from 23,871 in June 2010, according to San Diego-based DataQuick.

...

Builders continue to suffer on a scale not seen in decades: The 1,395 newly built houses and condos sold last month marked a 36 percent drop from a year earlier and the lowest new-home total for a June in DataQuick’s records.

...

Distressed property sales accounted for just over half of the Southland resale market last month. Roughly one out of three homes resold was a foreclosure, while almost one in five was a “short sale.”

On New Home sales: My understanding is DataQuick reports when the escrow closes, and the Census Bureau reports when a contract is signed. It usually takes about 6 months to close (builders usually build to contract with few speculative homes these days). So this low level is related to the Census Bureau reports for 6 months ago. Also, last year, June sales (reported at close) were boosted by the housing tax credit.

National existing home sales for June will be reported on July 20th, and new home sales will reported on July 26th.

Moody’s downgrades Ireland to Junk with negative outlook

by Calculated Risk on 7/12/2011 03:38:00 PM

Bloomberg reports that Moody's has downgraded Irish debt to junk (Ba1) with a negative outlook (further downgrades possible). This wasn't a surprise ...

“The key driver for today’s rating action is the growing possibility that following the end of the current EU/IMF support program at year-end 2013 Ireland is likely to need further rounds of official financing before it can return to the private market, and the increasing possibility that private sector creditor participation will be required as a precondition for such additional support, in line with recent EU government proposals."The Irish 10 year yield is up to a record 13.3%.

But most yields were down today (see table below).

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Seattle: The Downtown Apartment Boom

by Calculated Risk on 7/12/2011 01:29:00 PM

From Eric Pryne at the Seattle Times: Apartment developers bypass suburbs, target Seattle (ht David)

More new apartments will come on the market in King and Snohomish counties in 2013 than in any year since 1991, one researcher projects.This article touches on several themes we've been discussing:

This apartment boom, however, is different from those that preceded it.

This time it's focused almost entirely on Seattle. Developers, for the most part, are bypassing the suburbs.

...

Observers attributed the turnaround to a host of influences: foreclosed homeowners re-entering the rental market; an economic recovery that was sufficiently strong to allow some young adults to finally move into their own places; and growing disillusionment with homeownership.

Thanks to the recession, however, there was little new supply on the horizon to meet this surge in demand: In King and Snohomish counties, 2011 is shaping up as the worst year for new-project completions since at least 2004.

Now apartment developers are rushing to fill that gap, inspired in part by projections that growing demand will continue to push rents up — perhaps another 25 percent by 2015 ...

• Multi-family completions in 2011 will be at record lows (also total completions).

• Starts for multi-family will pick up sharply this year, but the new supply will not be on the market until 2012 or 2013.

• this lack of supply will put upward pressure on rents (and lower the price-to-rent ratio for homes).

• And there is more "disillusionment with homeownership"

BLS: Job Openings unchanged in May

by Calculated Risk on 7/12/2011 10:25:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in May was 3.0 million, unchanged from April. The number of job openings in May was 862,000 higher than in July 2009 (the series trough) but remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent (and even more dismal) employment report was for June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in May - and are up about 7% year-over-year compared to May 2010.

Overall turnover is increasing too, but remains low. Quits increased again and have been trending up - and quits are now up about 10% year-over-year (usually a sign of more confidence in the labor market).

Trade Deficit increased sharply in May to $50.2 billion

by Calculated Risk on 7/12/2011 08:30:00 AM

The Department of Commerce reports:

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.The first graph shows the monthly U.S. exports and imports in dollars through May 2011.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion, so once again the deficit is mostly oil and China.

NFIB: Small Business Optimism Index "basically unchanged" in June

by Calculated Risk on 7/12/2011 07:30:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Stagnates

NFIB’s monthly Small-Business Optimism Index dropped one tenth of a point (0.1) in June, settling at 90.8, an unsurprising reading, basically unchanged from the previous month and solidly in recession territory. While some indicators rose slightly – including expected capital outlays – pessimism about future business conditions and expected real sales gains tugged the Index down, causing a small but disappointing drop in the Index for the fourth consecutive month.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase from May and an indication that the unemployment rate will ease back below 9 percent in the late summer or early fall.

...

Inflation has slowed slightly, due in part to a leveling of gas prices.

...

The sales outlook for small firms continues to look grim as expectations have declined for 4 months in a row and “poor sales” continues to be the #1 problem for owners in operating their business.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.

This index is still very low - and had been trending up - but optimism has declined for four consecutive months now.

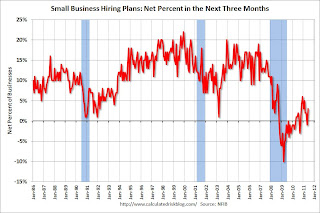

The second graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Hiring plans increased in June and this is the highest level since February.According to NFIB: “Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase and an indication that the unemployment rate will ease back below 9 percent in the coming months. "

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.There was some good news this month in the survey - employment plans are increasing, expected capital outlays are also increasing, and "poor sales" as the biggest problem is decreasing. However the recovery continues to be sluggish for this index, probably somewhat due to the high concentration of real estate related companies.