by Calculated Risk on 7/13/2011 07:21:00 AM

Wednesday, July 13, 2011

MBA: Mortgage Purchase Application activity decreases

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The seasonally adjusted Purchase Index decreased 2.6 percent from one week earlier. ... Refinance Index decreased 6.2 percent from the previous week, and was 42.1 percent lower than a year ago. The Refinance Index has decreased the past four consecutive weeks, reaching its lowest level since April 29, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.55 percent from 4.69 percent, with points increasing to 0.99 from 0.90 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average is still mostly moving sideways at about 1997 levels.

Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

Tuesday, July 12, 2011

Debt Ceiling Charade Update

by Calculated Risk on 7/12/2011 09:35:00 PM

I'm frequently asked why I'm not worried about the debt ceiling, and why the bond market doesn't seem to care.

The answer is the debt ceiling is a joke. It serves no purpose except political posturing.

The budget is about the deficit; the debt ceiling is about paying the bills - and the U.S. will pay its bills.

Here is what I wrote two months ago:

Congress will probably push this to the brink, but they will raise the debt ceiling before the country defaults. The first rule for most politicians is to get re-elected, and the easiest way to guarantee losing in 2012 is to throw the country back into recession. If that happened, I believe the voters would correctly blame the leaders of Congress, and I think Congress knows that too. Therefore it won't happen. I'm not worried and neither are investors.We are almost to the "brink".

Let me add: In this case, voters would blame the Republican party, and if the debt ceiling is not raised, the "Republican" brand would become toxic and synonymous with fiscal irresponsibility. The leaders of Congress know that and they will scramble to find a solution. I doubt this is the end of the GOP :-)

Earlier I argued the smart thing to do would be to eliminate the debt ceiling. Maybe we are headed in that direction. Today, Senator Mitch McConnell proposed something along those lines (not clean though).

Senate Minority Leader Mitch McConnell (R., Ky.) unveiled a new proposal that would allow President Barack Obama to raise on his own the federal borrowing limit by $2.4 trillion in three installments before the end of 2012, unless two-thirds of Congress votes to block it.Somehow the debt ceiling will be raised. Of course there is a huge battle ahead over the budget for the next fiscal year (the fiscal year starts on October 1st). It never ends.

DataQuick: SoCal Home Sales increase in June, Record Low New Home Sales

by Calculated Risk on 7/12/2011 05:15:00 PM

Special Note: It now appears the NAR will release the benchmark revisions in August (ht Mary Ellen). These revisions are expected to show significantly fewer sales and lower levels of inventory for the last few years. Hopefully the new methodology will be fully disclosed. Also, hopefully the NAR will release sales and inventory for all revisions (not just the last year).

From DataQuick: Southland Home Sales Quicken, Median Price Highest This Year

Southern California home sales last month shot up more than usual from May to the highest level for any month since June 2010, when the market got its last big boost from homebuyer tax credits. Sales of lower-cost homes, driven by investors and first-time buyers, and even high-end sales continued to outshine traditional move-up activity in middle price ranges ...This is another report suggesting an increase in existing home sales in June compared to the reported 4.81 million sold in May on a seasonally adjusted annual rate (SAAR) basis (before the benchmark revisions).

A total of 20,532 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in June. That was up 11.6 percent from 18,394 in May but down 14.0 percent from 23,871 in June 2010, according to San Diego-based DataQuick.

...

Builders continue to suffer on a scale not seen in decades: The 1,395 newly built houses and condos sold last month marked a 36 percent drop from a year earlier and the lowest new-home total for a June in DataQuick’s records.

...

Distressed property sales accounted for just over half of the Southland resale market last month. Roughly one out of three homes resold was a foreclosure, while almost one in five was a “short sale.”

On New Home sales: My understanding is DataQuick reports when the escrow closes, and the Census Bureau reports when a contract is signed. It usually takes about 6 months to close (builders usually build to contract with few speculative homes these days). So this low level is related to the Census Bureau reports for 6 months ago. Also, last year, June sales (reported at close) were boosted by the housing tax credit.

National existing home sales for June will be reported on July 20th, and new home sales will reported on July 26th.

Moody’s downgrades Ireland to Junk with negative outlook

by Calculated Risk on 7/12/2011 03:38:00 PM

Bloomberg reports that Moody's has downgraded Irish debt to junk (Ba1) with a negative outlook (further downgrades possible). This wasn't a surprise ...

“The key driver for today’s rating action is the growing possibility that following the end of the current EU/IMF support program at year-end 2013 Ireland is likely to need further rounds of official financing before it can return to the private market, and the increasing possibility that private sector creditor participation will be required as a precondition for such additional support, in line with recent EU government proposals."The Irish 10 year yield is up to a record 13.3%.

But most yields were down today (see table below).

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Seattle: The Downtown Apartment Boom

by Calculated Risk on 7/12/2011 01:29:00 PM

From Eric Pryne at the Seattle Times: Apartment developers bypass suburbs, target Seattle (ht David)

More new apartments will come on the market in King and Snohomish counties in 2013 than in any year since 1991, one researcher projects.This article touches on several themes we've been discussing:

This apartment boom, however, is different from those that preceded it.

This time it's focused almost entirely on Seattle. Developers, for the most part, are bypassing the suburbs.

...

Observers attributed the turnaround to a host of influences: foreclosed homeowners re-entering the rental market; an economic recovery that was sufficiently strong to allow some young adults to finally move into their own places; and growing disillusionment with homeownership.

Thanks to the recession, however, there was little new supply on the horizon to meet this surge in demand: In King and Snohomish counties, 2011 is shaping up as the worst year for new-project completions since at least 2004.

Now apartment developers are rushing to fill that gap, inspired in part by projections that growing demand will continue to push rents up — perhaps another 25 percent by 2015 ...

• Multi-family completions in 2011 will be at record lows (also total completions).

• Starts for multi-family will pick up sharply this year, but the new supply will not be on the market until 2012 or 2013.

• this lack of supply will put upward pressure on rents (and lower the price-to-rent ratio for homes).

• And there is more "disillusionment with homeownership"

BLS: Job Openings unchanged in May

by Calculated Risk on 7/12/2011 10:25:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in May was 3.0 million, unchanged from April. The number of job openings in May was 862,000 higher than in July 2009 (the series trough) but remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent (and even more dismal) employment report was for June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in May - and are up about 7% year-over-year compared to May 2010.

Overall turnover is increasing too, but remains low. Quits increased again and have been trending up - and quits are now up about 10% year-over-year (usually a sign of more confidence in the labor market).

Trade Deficit increased sharply in May to $50.2 billion

by Calculated Risk on 7/12/2011 08:30:00 AM

The Department of Commerce reports:

[T]otal May exports of $174.9 billion and imports of $225.1 billion resulted in a goods and services deficit of $50.2 billion, up from $43.6 billion in April, revised. May exports were $1.0 billion less than April exports of $175.8 billion. May imports were $5.6 billion more than April imports of $219.4 billion.The first graph shows the monthly U.S. exports and imports in dollars through May 2011.

Click on graph for larger image.

Click on graph for larger image.Exports decreased in May and imports increased (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to May 2010; imports are almost back to the pre-recession peak, and up about 16% compared to May 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in May as both prices and the quantity of oil imported increased. Oil averaged $108.70 per barrel in May, up from $103.18 per barrel in April, and up from $76.95 in May 2010. There is a bit of a lag with prices, and import prices will probably be a little lower in June.

The trade deficit with China increased to $24.96 billion, so once again the deficit is mostly oil and China.

NFIB: Small Business Optimism Index "basically unchanged" in June

by Calculated Risk on 7/12/2011 07:30:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Stagnates

NFIB’s monthly Small-Business Optimism Index dropped one tenth of a point (0.1) in June, settling at 90.8, an unsurprising reading, basically unchanged from the previous month and solidly in recession territory. While some indicators rose slightly – including expected capital outlays – pessimism about future business conditions and expected real sales gains tugged the Index down, causing a small but disappointing drop in the Index for the fourth consecutive month.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase from May and an indication that the unemployment rate will ease back below 9 percent in the late summer or early fall.

...

Inflation has slowed slightly, due in part to a leveling of gas prices.

...

The sales outlook for small firms continues to look grim as expectations have declined for 4 months in a row and “poor sales” continues to be the #1 problem for owners in operating their business.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 90.8 in June from 90.9 in May.

This index is still very low - and had been trending up - but optimism has declined for four consecutive months now.

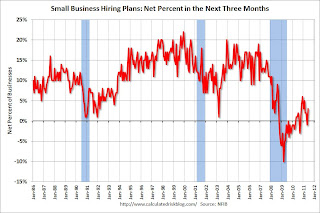

The second graph shows the net hiring plans for the next three months.

Hiring plans increased in June and this is the highest level since February.

Hiring plans increased in June and this is the highest level since February.According to NFIB: “Although June’s employment growth was weak, 15 percent (seasonally adjusted) of small firms reported unfilled job openings, a 3 point increase and an indication that the unemployment rate will ease back below 9 percent in the coming months. "

Weak sales is still the top business problem with 24 percent of the owners reporting that weak sales continued to be their top business problem in June.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.There was some good news this month in the survey - employment plans are increasing, expected capital outlays are also increasing, and "poor sales" as the biggest problem is decreasing. However the recovery continues to be sluggish for this index, probably somewhat due to the high concentration of real estate related companies.

Monday, July 11, 2011

Misc: New Policy Ideas for housing being discussed, Realtor group overstates house prices

by Calculated Risk on 7/11/2011 10:58:00 PM

• From Nick Timiraos at the WSJ: U.S. Tackles Housing Slump

The Obama administration is ramping up talks on how to revive the housing market ... Policy ideas include having taxpayer-owned mortgage giants Fannie Mae and Freddie Mac relax their rules for loans to investors, allowing those buyers to vacuum up excess housing inventory. In certain markets, Fannie and Freddie could hold some foreclosed homes off the market and rent them out ... Officials also could sweeten incentives for banks to reduce loan balances for borrowers who are underwater ...I'll have some thoughts on this later this week, but some of these proposals (like converting some owners to renters) make sense.

• From Mary Ellen Podmolik at the Chicago Tribune: Realty trade group overreported Chicago home prices (ht Eric, Austin, Peter)

The Illinois Association of Realtors dramatically overreported the median price of condominiums sold within the city of Chicago in May, with the price tumbling 23 percent year-over-year, not rising 10.3 percent as the trade group said.A key sentence was at the bottom of the story:

The state Realtors' group acknowledged the error after the Tribune, acting on a tip, questioned the accuracy of the data.

In February, questions arose about the accuracy of home sales data as reported monthly by the National Association of Realtors, and whether the trade group had been overestimating the volume of existing home sales since 2007.So we might get the revisions in August (Note: I broke this story about the revisions in January, not February).

Possibly as soon as August, the national group will issue revised- and revised downward - national home sales numbers going back at least three years.

Statement by the Eurogroup

by Calculated Risk on 7/11/2011 07:46:00 PM

I know everyone was waiting for this ... here is the statement by the Eurogroup

Ministers reaffirmed their absolute commitment to safeguard financial stability in the euro area. To this end, Ministers stand ready to adopt further measures that will improve the euro area’s systemic capacity to resist contagion risk, including enhancing the flexibility and the scope of the EFSF, lengthening the maturities of the loans and lowering the interest rates, including through a collateral arrangement where appropriate. Proposals to this effect will be presented to Ministers shortly.It sounds like they will expand the EFSF to buy back bonds of Greece, Ireland and Portugal. That might buy some time, but there is no mention of Italy - and if Italy goes, the EU has lost containment.

Ministers discussed the main parameters of a new multi-annual adjustment programme for Greece, which will build on strong commitments to fiscal consolidation, ambitious growth-enhancing structural reforms and a substantial privatisation of state assets. Ministers welcomed the reinforcement of monitoring mechanisms of the programme of Greece, the nomination of the board of the privatisation agency, which comprises two observers representing euro area Member States and the European Commission, and agreed to provide extended technical assistance to Greece. They called upon the Greek government to sustain its on-going efforts to meet these commitments in full and on time.

Ministers welcomed the decision by the IMF to disburse the latest tranche of financial assistance to Greece, as well as the proposals from the private sector to voluntarily contribute to the financing of a second programme, building on the work already underway. The ECB confirmed its position, reaffirmed by its Governing Council last Thursday, that a credit event or selective default should be avoided.

While the responsibility for resolving the crisis in Greece lies primarily with Greece, Ministers recognised the need for a broader and more forward-looking policy response to assist the government in its efforts to bolster debt sustainability and thereby safeguard financial stability in the euro area.

In this context, Ministers have tasked the Eurogroup Working Group to propose measures to reinforce the current policy response to the crisis in Greece. The Eurogroup Working Group will notably explore the modalities for financing a new multi-annual adjustment programme, steps to reduce the cost of debt-servicing and means to improve the sustainability of Greek public debt. This reinforced strategy should provide the basis for an agreement in the Eurogroup on the main elements and financing of a second adjustment programme for Greece shortly.

Ministers commit to continue negotiating with the European Parliament the

legislative proposals to reinforce economic governance in the European Union in order to agree on an ambitious reform as soon as possible. The reinforced governance should be fully operational without delay.