by Calculated Risk on 7/08/2011 02:10:00 PM

Friday, July 08, 2011

More Employment: Return of the Teen! and Unemployment by Duration and Education

First a reminder: The main reason employment growth is sluggish is because the U.S. is recovering from a housing and credit bubble, and the subsequent financial crisis. There is still too much excess capacity in most of the economy for a large contribution from new investment (except in equipment and software). We see this excess capacity in housing, and in overall industrial production. There is also excess capacity in office space, retail space, and other categories of commercial real estate. In addition, household debt, as a percent of income, remains very high and household deleveraging is ongoing. That is why so many companies identify their number one problem as "lack of customers".

Until the excess capacity is absorbed, and household balance sheets are back in order, the recovery will remain sluggish.

In addition there were some (hopefully) temporary factors that impacted employment in May and June: the supply chain disruption and high oil and gasoline prices.

But it is very disappointing to hear politicians incorrectly identify the reasons for the sluggish employment growth. From President Obama today:

[T]o put our economy on a stronger and sounder footing for the future, we’ve got to rein in our deficits and get the government to live within its means, while still making the investments that help put people to work right now and make us more competitive in the future. ...I know there are policymakers who think the problem is confidence and deficits. But this is incorrect. Misdiagnosing the causes of weak employment growth will lead to the wrong policies. Oh well ... this reminds me of 2005 when I couldn't get any policymakers to pay attention to the housing bubble. Frustrating.

The sooner we get this done, the sooner that the markets know that the debt limit ceiling will have been raised and that we have a serious plan to deal with our debt and deficit, the sooner that we give our businesses the certainty that they will need in order to make additional investments to grow and hire and will provide more confidence to the rest of the world as well, so that they are committed to investing in America.

Here are a few more graphs based on the employment report ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Two key categories are moving up again. The 27 weeks and more (the long term unemployed) has moved up for two consecutive months and is now at 6.3 million workers, or 4.1% of the labor force.

Also the less than 5 weeks category is increasing again and that is very concerning.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down, although only High School Graduates, No College" and "Bachelors degree and higher" declined in June.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

This is a little more technical. The BLS diffusion index for total private employment was at 53.4 in June, about the same as in May, and for manufacturing, the diffusion index increased slightly to 52.5.

This is a little more technical. The BLS diffusion index for total private employment was at 53.4 in June, about the same as in May, and for manufacturing, the diffusion index increased slightly to 52.5. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

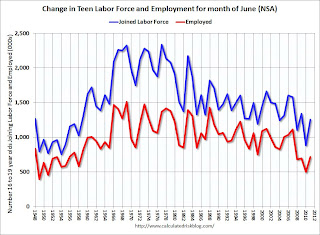

According to the BLS, 714,000 teens (ages 16 to 19) found jobs in June 2011 NSA compared to only 497,000 last year (June is the key months for summer employment). This is the most teen jobs added in June since 2007.

This graph shows the number of teens looking for work and the number of teens found jobs in June (data is not seasonally adjusted).

This graph shows the number of teens looking for work and the number of teens found jobs in June (data is not seasonally adjusted).The doesn't show the participation rate for teens, but that has been trending down for years.

The job market was so bad last summer few teens even bothered to look for work. Although the trend is still down for teen employment, this is a better summer for teenagers looking for work. A little silver lining ...

Best to all

Here are the earlier employment posts (with graphs):

• June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 7/08/2011 10:25:00 AM

The only good news is that June is over.

There were few jobs created in June (only 18,000 total and 57,000 private sector). The unemployment rate increased from 9.1% to 9.2%, and the participation rate declined to 64.1%. Note: This is the percentage of the working age population in the labor force.

The employment population ratio fell to 58.2%, matching the lowest level during the current employment recession.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%, the highest level this year.

The BLS revised down April and May payrolls showing 44,000 fewer jobs were created than previously reported.

The average workweek declined slightly to 34.3 hours, and average hourly earnings ticked down. "In June, average hourly earnings for all employees on private nonfarm payrolls decreased by 1 cent to $22.99. Over the past 12 months, average hourly earnings have increased by 1.9 percent."

This is the second consecutive month with dismal numbers.

Through the first six months of 2011, the economy has added 757,000 total non-farm jobs or just 126 thousand per month. There have been 945,000 private sector jobs added, or about 158 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.98 million fewer payroll jobs than at the beginning of the 2007 recession.

There are a total of 14.1 million Americans unemployed and 6.3 million have been unemployed for more than 6 months. Very grim numbers.

Overall this was a weak report and reminds us that unemployment and underemployment are critical problems in the U.S.

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

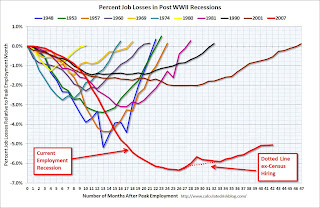

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in June at 8.6 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased slightly to 8.552 million in June.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in June from 15.8% in May. This is the highest level this year (highest since December 2010).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.289 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.2 million in May. This is very high, and long term unemployment is one of the defining features of this employment recession.

This was a terrible report and the only good news is Q2 is over.

• Earlier Employment post: June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

June Employment Report: 18,000 Jobs, 9.2% Unemployment Rate

by Calculated Risk on 7/08/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment was essentially unchanged in June (+18,000), and the unemployment rate was little changed at 9.2 percent, the U.S. Bureau of Labor Statistics reported today. Employment in most major private-sector industries changed little over the month. Government employment continued to trend down.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for April was revised from +232,000 to +217,000, and the change for May was revised from +54,000 to +25,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate increased to 9.2% (red line).

The Labor Force Participation Rate declined to 64.1% in June (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio declined to 58.2% in June (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was very weak and well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). A terrible report. I'll have much more soon ...

Reis: Mall Vacancy Rates increase in Q2

by Calculated Risk on 7/08/2011 12:22:00 AM

From Reuters: US mall vacancies rise in 2nd quarter, rents flat

Preliminary figures by real estate research firm Reis show the vacancy rate at ... regional malls rose to 9.3 percent ... up from 9.1 percent in the first quarter.

The picture was even bleaker for U.S. strip malls where retailers gave up over half million more square feet than they rented. The vacancy rate at these local retail strips was 11 percent versus 10.9 percent in the first quarter, almost matching the 11.1 percent record set 20 years ago ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.As noted in the article, some tenants are still leaving as their leases expire. This is especially grim for strip malls.

To summarize the vacancy reports: Apartment vacancy rates are falling fast, office vacancy rates are moving sideways, and malls are still get crushed.

Earlier on vacancy rates:

• Reis: Office Vacancy Rate flat in Q2 at 17.5 Percent

• Reis: Apartment Vacancy Rate falls to 6% in Q2

Thursday, July 07, 2011

Cost of Living and CPI-Chained

by Calculated Risk on 7/07/2011 06:13:00 PM

I haven't been following the debate about using Chained-CPI instead of CPI-W for the Cost of Living Adjustment (COLA). (ht Andre).

Menzie Chinn at Econbrowser wrote today: Chained CPI

Recent reports ([WSJ RTE] [Bloomberg] [The Hill]) indicate that under consideration as one approach to curtailing entitlement spending growth is to resort to Chained CPI, as opposed to the current official CPI series, which is based on a quasi-Laspeyres formula.From the BLS: Frequently Asked Questions about the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)

I haven't been following this, but chained CPI is a relatively new series (started in 2002), and measures inflation at a slightly lower rate than CPI or CPI-W - and over time this would add up both for Social Security payments and also for revenue (tax brackets would increase slower using chained CPI than using currently).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The graph shows the year-over-year change in headline CPI, CPI-W, and chained CPI.

There isn't much difference on a year-over-year basis, but notice the blue line is mostly below the other two all the time. Those small differences add up over time as the following table shows.

This table shows the 10 year change in each measure (from May 2001 to May 2011) and the annualized change over that period. If we were using chained CPI instead of CPI-W over the last 10 years, Social Security benefits would be about 3.6% lower than they are now.

| 10 Year Increase | Annualized | |

|---|---|---|

| CPI (headline) | 27.2% | 2.43% |

| CPI-W | 27.8% | 2.49% |

| CPI (chained) | 24.2% | 2.19% |

European Financial Crisis: Portugal Update

by Calculated Risk on 7/07/2011 02:09:00 PM

For a classic hockey stick formation, check on the 2 year yields for Portuguese and Irish bonds (table below). For Portugal, the 2 year yield is up to 17.5%, and for Ireland, the yield is 15.6%.

The yields for Italy and Spain are up too, and of special concern is the sharp increase in the Italian 10 year yield up to 5.2%.

From the ECB this morning: ECB announces change in eligibility of debt instruments issued or guaranteed by the Portuguese government

The Governing Council of the European Central Bank (ECB) has decided to suspend the application of the minimum credit rating threshold in the collateral eligibility requirements for the purposes of the Eurosystem’s credit operations in the case of marketable debt instruments issued or guaranteed by the Portuguese government. This suspension will be maintained until further notice.I guess they are tired of the credit agency downgrades.

The Portuguese government has approved an economic and financial adjustment programme, which has been negotiated with the European Commission, in liaison with the ECB, and the International Monetary Fund. The Governing Council has assessed the programme and considers it to be appropriate. This positive assessment and the strong commitment of the Portuguese government to fully implement the programme are the basis, also from a risk management perspective, for the suspension announced herewith.

The suspension applies to all outstanding and new marketable debt instruments issued or guaranteed by the Portuguese government.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Employment Situation Preview: More Payroll Jobs Added, Still Weak Overall

by Calculated Risk on 7/07/2011 10:50:00 AM

Tomorrow the BLS will release the June Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 110,000 payroll jobs in June, and for the unemployment rate to hold steady at 9.1%.

Last month I argued the consensus for payroll jobs added seemed too high; this month I think the consensus is too low. Note: Recently I've mostly been correct when I've taken the "under" for payroll jobs, but only right about half the time when I've taken the "over" - so flip a coin!

Here is a summary of recent data:

• The ADP employment report (private sector only) showed an increase of 157,000 payroll jobs in June. This was well above the 36,000 reported for May, but still below the 198,000 per month average for the first four months of 2011.

• Initial weekly unemployment claims averaged about 425,000 per week in June, about the same as in December 2010, and January and May 2011. The BLS reported an average of just 90 thousand payroll jobs added during those three months.

• The ISM manufacturing employment index increased to 59.9%, up from 58.2% in May, and the ISM non-manufacturing index increased slightly to 54.1%. Based on a historical correlation between the ISM indexes and the BLS employment report, these readings would suggest close to 200,000 private payroll jobs added for services and manufacturing in June.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices. Of course gasoline prices were falling in June - so this suggests weakness in the labor market.

• And on the unemployment rate from Gallup: Gallup Finds U.S. Unemployment at 8.7% in June

Unemployment, as measured by Gallup without seasonal adjustment, is at 8.7% at the end of June -- similar to the 8.9% in mid-June, but down from 9.2% at the end of May. It is also lower than it was during the same period a year ago.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate increases in June as teenagers join the labor force looking for summer jobs. A decline in the NSA unemployment from May suggests a decline in the SA rate too.

These indicators are mixed. Initial weekly unemployment claims and consumer sentiment suggests a pretty weak payroll report, but the ADP and ISM reports suggest a little better report. And of course state and local governments are still reducing payrolls.

My guess is payroll growth will still be weak in June - as expected following a housing bubble and financial crisis - but I'll take the over on payroll jobs and the under on the unemployment rate.

Weekly Initial Unemployment Claims decline to 418,000

by Calculated Risk on 7/07/2011 08:30:00 AM

The DOL reports:

In the week ending July 2, the advance figure for seasonally adjusted initial claims was 418,000, a decrease of 14,000 from the previous week's revised figure of 432,000. The 4-week moving average was 424,750, a decrease of 3,000 from the previous week's revised average of 427,750.This is the 13th straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January.

Special Factor: Minnesota has indicated that approximately 2,500 of their reported initial claims are a result of state employees filing due to the state government shutdown.

The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased slightly this week to 424,750.

Weekly claims were below 400 thousand in March, and have increased back to just over 400 thousand for the last three months.

ADP: Private Employment increased by 157,000 in June

by Calculated Risk on 7/07/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 157,000 from May to June on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from April to May was revised down, but only slightly, to 36,000 from the initially reported 38,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Today’s ADP National Employment Report estimates employment in the service-providing sector rose by 130,000 in June, nearly three times faster than in May, marking 18 consecutive months of employment gains. Employment in the goods-producing sector rose 27,000 in June, more than reversing the decline of 10,000 in May. Manufacturing employment rose 24,000 in June, which has seen growth in seven of the past eight months.

This was well above the consensus forecast of an increase of 70,000 private sector jobs in June. The BLS reports on Friday, and the consensus is for an increase of 110,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

As I mentioned last night, the ISM employment indexes suggest that the consensus for June is a little low - and this ADP report also suggests that the BLS report might be above consensus on Friday.

Last night ...

• Reis: Apartment Vacancy Rate falls to 6% in Q2

Reis: Apartment Vacancy Rate falls to 6% in Q2

by Calculated Risk on 7/07/2011 12:32:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 6.0% in Q2 from 6.2% in Q1. The vacancy rate was at 7.8% in Q2 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Rents Rise, Vacancies Go Down

Vacancies ... fell in 72 of the 82 markets during the second-quarter vacancy rate to 6%, the lowest since 2008 and compared with 7.8% a year earlier, according to Reis.

...

The average effective rent, the amount paid after discounting, was $997 in the second quarter of the year, up from $974 a year earlier ...

Landlords filled a net 33,000 units in the second quarter, a slowdown from the 45,000 units they filled in the first quarter.

...

Meanwhile, supply remains constrained. Roughly 8,700 new apartment units opened during the second quarter, the second-lowest quarterly tally for new completions since Reis began collecting data in 1999.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

A few key points we've been discussing:

• Vacancy rates are falling fast (the excess supply is being absorbed). Note: The excess housing supply includes both apartments and single family homes.

• A record low number of multi-family units will be completed this year (2011). Only 8,700 apartments came on the market in Q1 (in the Reis survey area). This is the second lowest quarter since Reis has been tracking completions - the lowest was 6,000 last quarter.

• The falling vacancy rate is pushing push up effective rents. This also pulls down the price-to-rent ratio for house prices.

• Multi-family starts are increasing, and that will help both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably decline all year.