by Calculated Risk on 7/05/2011 08:45:00 AM

Tuesday, July 05, 2011

Greece Update: Will ECB accept temporary default?

From Bloomberg: Trichet May Save Face With S&P, Fitch Greece Moves: Euro Credit

Standard & Poor’s and Fitch Ratings may enable European Central Bank President Jean-Claude Trichet to support a private investor rollover of Greek debt by saying a default rating would be partial and temporary.Many observers think the ECB will back down and still accept Greek government bonds as collateral.

By saying the default is temporary - and if at least one rating agency keeps the Greek government bonds above a default rating (even if the rating agency lowers Greece's issuer rating to “restricted default”) - this could give the ECB wiggle room to keep accepting Greek government bonds as collateral.

The policymakers appear to have a couple of months to find a solution. The yield for Greek 2 year bonds are up to 27% this morning, and the 10 year yield is at 16.5%. Portuguese and Irish 10 year yields are at (11.6% for Ireland, 11% for Portugal).

Monday, July 04, 2011

Some Employment Statistics

by Calculated Risk on 7/04/2011 08:28:00 PM

Weekend:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

• Schedule for Week of July 3rd

The key report for this week will be the June employment situation report to be released on Friday.

The following table summarizes some of the grim labor statistics and compares the current situation (May 2011) with the employment situation when the recession started (December 2007).

Since December 2007, the U.S. working age civilian population has increased by 6.157 million people - however the number of people saying the are in the labor force has actually declined.

Total nonfarm payrolls are still 6.94 million below the December 2007 level, and private payrolls are 6.69 million lower.

Some of the decline in the labor force participation is due to an aging population, but these numbers suggest the U.S. needs 6.94 million jobs, plus some percent of the increase in the labor force, to get back to the 2007 employment situation.

On unemployment, perhaps the most staggering number is the 6.2 million workers who have been unemployed for 27 weeks or more.

Recoveries following a housing/credit bubble and financial crisis are usually sluggish - so these numbers are not a surprise - but this is a reminder that the top priorities for policymakers remains jobs, jobs and jobs.

| Employment Statistics (Thousands or Percent)1 | |||

|---|---|---|---|

| May-11 | Dec-07 | Change | |

| Civilian noninstitutional population (16 and over) | 239,313 | 233,156 | 6,157 |

| Civilian labor force | 153,693 | 153,936 | -243 |

| Total nonfarm Payroll | 131,043 | 137,983 | -6,940 |

| Private Payroll | 108,916 | 115,606 | -6,690 |

| Unemployment Rate | 9.1% | 5.0% | 4.1% |

| Unemployed | 13,914 | 7,664 | 6,250 |

| Part-Time for Economic Reasons | 8,548 | 4,638 | 3,910 |

| Marginally Attached to Labor Force2 | 2,206 | 1,395 | 811 |

| Discouraged Workers2 | 822 | 363 | 459 |

| U-6 Unemployment rate3 | 15.8% | 8.8% | 7.0% |

| Unemployed for 27 Weeks & over | 6,200 | 1,327 | 4,873 |

1 The payroll numbers are from the Current Employment Statistics (establishment survey), and the remaining numbers are from the Current Population Survey (household survey).

2 BLS: "Discouraged workers are a subset of persons marginally attached to the labor force. The marginally attached are those persons not in the labor force who want and are available for work, and who have looked for a job sometime in the prior 12 months, but were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey. Among the marginally attached, discouraged workers were not currently looking for work specifically because they believed no jobs were available for them or there were none for which they would qualify."

3 BLS: "Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers"

Happy Independence Day!

by Calculated Risk on 7/04/2011 03:43:00 PM

Happy 4th of July!

Just thinking out loud (and enjoying the day) ...

All year I've been forecasting an increase in multi-family starts - and that is already happening. Multi-family starts are on a 156,000 annual pace over the first 5 months of 2011 compared to 115,700 starts for all of 2010. Historical this is a low level, but this is a nice increase over last year.

Now I'm starting to wonder if we will see a little increase in new home sales and single family housing starts in the 2nd half of 2011 on a seasonally adjusted (SA) basis.

On a Not Seasonally Adjusted (NSA) basis, home sales and starts will probably decline in the 2nd half of 2011 (compared to the first half), but there is a strong seasonal pattern for new home sales and single family starts. The "strong" season for new home sales usually runs from March through July, and for starts from April through September or October.

We already know there was a weak homebuying season and the homebuilders are depressed. But I suspect sales (and starts) will not decline as much as usual in the 2nd half of 2011, and that would mean an increase in sales on a seasonally adjusted basis.

I'm not looking for a strong increase in sales - and we sure don't want the homebuilders starting a bunch of speculative homes - but we might see a little pickup seasonally adjusted. In 2nd half of 2010, new home sales were at a record low 140 thousand homes (Q3 and Q4), and I suspect this year will be stronger. Just a gut feeling at this point ... I'll try to add some supporting data over the next few weeks.

Weekend:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

• Schedule for Week of July 3rd

Greece Update: S&P says proposed Greece Debt Plan is "likely a Default"

by Calculated Risk on 7/04/2011 08:47:00 AM

From the WSJ: S&P: Greece Debt Plan Is a Default

Standard & Poor's Corp. said Monday that a leading proposal for easing repayment terms on Greece's sovereign debt would amount to a default under the ratings firm's criteria ... The European Central Bank has maintained that it won't accept bonds with a default rating as collateral. Hence, averting a selective default rating is crucial to ensure that banks holding Greek bonds aren't shut out from the ECB's liquidity operations for the few days that the country's bonds would be rated selective default.From Bloomberg: EU Rescue Effort May Prompt S&P Default Rating on Greece

...

A spokesman for the European Commission said euro-zone governments designing a second bailout for Greece intend to avoid a selective default and expect to have "clarity" on the outlines of the package by the July 11 meeting of finance ministers.

“It is our view that each of the two financing options described in the Federation Bancaire Francaise proposal would likely amount to a default,” S&P said in the statement. “But, once either option is implemented, we would assign a new issuer credit rating to Greece after a short time reflecting our forward-looking view of Greece’s sovereign credit risk.”It appears the euro-zone has some time to figure this out - or for someone to blink. The next meeting is July 11th, but it appears they don't have to have a deal until mid-September.

...

Even if S&P or other rating companies determined that the rollover plan constituted a default, the ruling wouldn’t necessarily trigger credit swaps insuring Greek debt. That decision may be made by the determinations committee of the International Swaps & Derivatives Association.

The yield for Greek 2 year bonds is down to 25.9%, and the 10 year yield is at 16.4%. Portuguese and Irish 10 year yields are at (11.6% for Ireland, 10.9% for Portugal).

Sunday, July 03, 2011

Next Deadline for Greece: Mid-September

by Calculated Risk on 7/03/2011 08:08:00 PM

I know everyone wants to know the next deadline for Greece. It looks like mid-September.

From the WSJ: Greece Awaits Further Rescue

Euro-zone finance ministers ... decided they would agree by September on arrangements for a new bailout ... German Finance Minister Wolfgang Schäuble said after the teleconference that a new aid package for Greece could be approved by autumn, in time for the next expected quarterly tranche of EU/IMF aid.That gives the finance ministers about 2 1/2 months to find a way for private creditors to participate - without the rating agencies calling it a default. This will heat up again soon enough.

The Greek finance ministry also said a deal was expected by mid-September.

Yesterday:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

• Schedule for Week of July 3rd

The Detroit Youth Movement

by Calculated Risk on 7/03/2011 12:53:00 PM

An interesting story of revitalization ...

From the NY Times: The Young and Entrepreneurial move to Downtown Detroit-Pushing its Economic Recovery (ht Brian).

Recent census figures show that Detroit’s overall population shrank by 25 percent in the last 10 years. But another figure tells a different and more intriguing story: During the same time period, downtown Detroit experienced a 59 percent increase in the number of college-educated residents under the age of 35, nearly 30 percent more than two-thirds of the nation’s 51 largest cities.This was in the "Fashion & Style" section, but it is really (hopefully) an economic story of renewal.

These days the word “movement” is often heard to describe the influx of socially aware hipsters and artists now roaming the streets of Detroit. Not unlike Berlin, which was revitalized in the 1990s by young artists migrating there for the cheap studio space, Detroit may have this new generation of what city leaders are calling “creatives” to thank if it comes through its transition from a one-industry.

With these new residents have come the trappings of a thriving youth culture: trendy bars and restaurants that have brought pedestrians back to once-empty streets.

...

Part of the allure of Detroit lies in simple economics. Real estate is cheap by urban standards (Ms. Myles lives in a $900-a-month one-bedroom apartment with a garage), and the city is so eager to draw educated young residents that it is offering numerous subsidies to new arrivals. Ms. Myles, for instance, received $3,500 from her employer, which, like many companies in the city, is offering rent or purchasing subsidies to staff members who choose to live in the city.

Yesterday:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

• Schedule for Week of July 3rd

NY Times: Principal Reductions for some Option ARMs

by Calculated Risk on 7/03/2011 09:14:00 AM

From David Streitfeld at the NY Times: Big Banks Easing Terms on Loans Deemed as Risks

Two of the nation’s biggest lenders, JPMorgan Chase and Bank of America, are quietly modifying loans for tens of thousands of borrowers who have not asked for help but whom the banks deem to be at special risk.These principal reduction programs are not new. Here was a story about a Wells Fargo program last year:

Rula Giosmas is one of the beneficiaries. Last year she received a letter from Chase saying it was cutting in half the amount she owed on her condominium.

...

Banks are proactively overhauling loans for borrowers like Ms. Giosmas who have so-called pay option adjustable rate mortgages ...

Ms. Giosmas bought her two-bedroom, two-bath apartment north of downtown Miami for $359,000 in early 2006, according to real estate records. She made a large down payment, but because each month she paid less than was necessary to pay off the loan, her debt swelled to about $300,000.

Meanwhile, the value of the apartment nosedived. By the time Ms. Giosmas got the letter from Chase, the condominium was worth less than half what she paid. “I would not have defaulted,” she said. “But they don’t know that.”

The letter, which Ms. Giosmas remembers as brief and “totally vague,” said Chase was cutting her principal by $150,000 while raising her interest rate to about 5 percent.

Wells Fargo has forgiven an average of $46,000 in principal, or 15 percent, for the 43,500 option-ARM loans it has modified this year through September, said Franklin Codel, chief financial officer at the bank’s home-lending unit. The San Francisco-based lender has cut as much as 30 percent off the loan principal in a few “rare exceptions,” with the ceiling typically capped at 20 percent, Codel said.The banks have kept these programs somewhat quiet - imagine what would happen to Chase or Wells Fargo if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments? The delinquency rate would increase sharply.

Instead the banks quietly approach "high risk" borrowers with substantial negative equity - and who are current on their loans. These are usually borrowers with option ARMs, who made substantial downpayments, and who have solid credit ratings. Although the banks can't be sure who will default, their models suggest these modifications will lead to lower losses.

Also these banks (like Chase and Wells) took substantial write-downs when they inherited these loans, from WaMu and Wachovia respectively, so they can reduce principal on selected loans without incurring further losses.

Saturday, July 02, 2011

Schedule for Week of July 3rd

by Calculated Risk on 7/02/2011 08:03:00 PM

Earlier:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

The key report this week will be the employment situation report for June on Friday.

Note: Reis is expected to release their Q2 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, rising vacancy rates for regional malls, and the first decline (small) in the office vacancy rate since 2007.

Independence Day: All US markets will be closed in observance of the Independence Day holiday.

10:00 AM ET: Manufacturers' Shipments, Inventories and Orders for May. The consensus is for a 1.0% increase in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through early summer (not counting all cash purchases).

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a slight decrease to 54.0 in June.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index. The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May to 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for +70,000 payroll jobs in June, up from the 38,000 reported in May.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 420,000 from 428,000 last week.

8:30 AM: Employment Report for June.

The consensus is for an increase of 110,000 non-farm payroll jobs in June, up from the 54,000 jobs added in May.

The consensus is for an increase of 110,000 non-farm payroll jobs in June, up from the 54,000 jobs added in May. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for June is in blue.

The consensus is for the unemployment rate to hold steady at 9.1% in June.

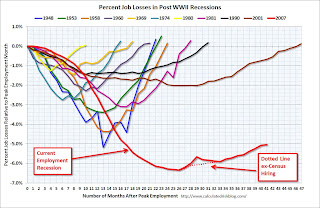

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through May. This shows the severe job losses during the recent recession.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through May. This shows the severe job losses during the recent recession. So far this year, the economy has added 908,000 private sector jobs, or about 181 thousand per month. There have been 783,000 total non-farm jobs added this year or 157 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.95 million fewer payroll jobs than at the beginning of the 2007 recession.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.6% increase in inventories.

3:00 PM: Consumer Credit for May. The consensus is for a $4.3 billion increase in consumer credit.

Best wishes to All!

Greece Update: Loan Approved

by Calculated Risk on 7/02/2011 05:18:00 PM

From the WSJ: Euro-Zone Ministers Release Greek Aid

The [euro-zone finance] signed off their portion of the €12 billion ($17.39 billion) loan tranche in an evening conference call. The International Monetary Fund is expected to approve its part of the loan next week.From Bloomberg on the next aid package: Euro Area Backs Greek Payment, Shifts Focus to New Bailout

“The precise modalities and scale of private-sector involvement and additional funding from official sources will be determined in the coming weeks.” [the 17 euro-area finance chiefs said in an e-mailed statement today]The next key dates aren't clear yet, but this €12 billion tranche will not last long. Greece will be back in the news very quickly.

Earlier:

• Summary for Week Ending July 1st

• Unofficial Problem Bank list at 1,003 Institutions and State Stress Level

Summary for Week Ending July 1st

by Calculated Risk on 7/02/2011 11:11:00 AM

We were looking for “hints of improvement” last week, and although the data was mixed, we found more than “hints”!

There were several regional manufacturing reports that came in stronger than expected (Dallas, Richmond, Kansas City and Chicago PMI), and by Friday everyone expected a somewhat decent ISM manufacturing report – and the report still surprised to the upside.

On housing, both the Case-Shiller (April) and the CoreLogic (May) house price indexes showed seasonal increases. Although prices will probably fall seasonally later this year, this suggests the pace of declines might have slowed. Also the Pending Home Sales index rebounded in May, and mortgage delinquencies declined a little.

There was some more weak news too: auto sales fell further in June (although it appears sales will pick up in July and August), personal consumption was especially weak in May, and consumer sentiment decreased in June.

Over in Europe, the Greek parliament approved another round of austerity, and the euro zone Finance ministers are expected to approve the disbursement of the next tranche of aid (€12 billion) this weekend. This doesn’t solve the problem, but it buys a little more time.

I expect economic activity to increase in the second half of 2011 (although I expect activity to be sluggish relative to the slack in the system), and it appears that the pickup is starting now.

Below is a summary of economic data last week mostly in graphs:

• Case Shiller: Home Prices increase in April

From S&P:April Seasonal Boost in Home Prices

Data through April 2011 ... show a monthly increase in prices for the 10- and 20-City Composites for the first time in eight months. The 10- and 20-City Composites were up 0.8% and 0.7%, respectively, in April versus March. Both indices are lower than a year ago; the 10-City Composite fell 3.1% and the 20-City Composite is down 4.0% from April 2010 levels.

Click on graph for larger image in graph gallery.

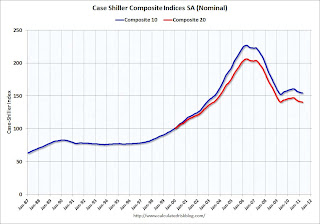

Click on graph for larger image in graph gallery. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and up slightly in April (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and down slightly in April (SA). The Composite 20 is slightly below the May 2009 post-bubble bottom seasonally adjusted.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.Prices increased (SA) in 9 of the 20 Case-Shiller cities in April seasonally adjusted. Prices in Las Vegas are off 58.6% from the peak, and prices in Dallas only off 8.8% from the peak.

Real Prices: The next graph shows the Case-Shiller Composite 20 index, the Case-Shiller National Index (through Q1) and the CoreLogic index (May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to January 2000.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to January 2000. In real terms, all appreciation in the last decade is gone.

Price-to-rent: In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to February 2000.

• ISM Manufacturing index increases in June

From the Institute for Supply Management: June 2011 Manufacturing ISM Report On Business®

PMI was at 55.3% in June, up from 53.5% in May. The employment index was at 59.9%, up from 58.2% and new orders increased to 51.6%, up from 51.0%. All better than in May.

PMI was at 55.3% in June, up from 53.5% in May. The employment index was at 59.9%, up from 58.2% and new orders increased to 51.6%, up from 51.0%. All better than in May. Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%. Earlier in the month it looked like the ISM was going to be weak, but recent regional reports indicated improvement towards the end of June.

• U.S. Light Vehicle Sales 11.45 million Annual Rate in June

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.45 million SAAR in June. That is up 2.8% from June 2010, and down 2.6% from the sales rate last month (May 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.45 million SAAR in June. That is up 2.8% from June 2010, and down 2.6% from the sales rate last month (May 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was well below the consensus estimate of 12 million SAAR. However I expect a bounce back in sales over the next couple of months.

• CoreLogic: Home Price Index increased 0.8% in May

CoreLogic is now reporting almost a month ahead of Case-Shiller!

From CoreLogic: CoreLogic® Home Price Index Shows Second Consecutive Month-Over-Month Increase

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 0.8% in May, and is down 7.4% over the last year, and off 32.7% from the peak.

This is the tenth straight month of year-over-year declines, and the index is still 2.4% below the March 2009 low (the previous post-bubble low).

Some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 7.4% from last May (the largest year-over-year decline since Sept 2009).

• Personal Income increased 0.3% in May, PCE increased less than 0.1%

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).PCE increased less than 0.1% in May, but real PCE decreased 0.1% as the price index for PCE increased 0.2 percent in May. The graph shows that real PCE declined in the first two month of Q2.

This puts real PCE growth in Q2 on pace for only about 1% (an average of Q2 over Q1) - the slowest pace since Q4 2009.

• Construction Spending declined in May

The Census Bureau reported:

[Private] Residential construction was at a seasonally adjusted annual rate of $228.9 billion in May, 2.1 percent (±1.3%) below the revised April estimate of $233.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $248.3 billion in May, 1.2 percent (±1.4%)* above the revised April estimate of $245.4 billion.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential spending is 66% below the peak in early 2006, and non-residential spending is 40% below the peak in January 2008.

The small increase in non-residential in May was mostly due to power.

Construction spending is still mostly moving sideways (and a little down). I expect some pickup in residential construction spending as more multi-family units are started.

• Consumer Sentiment declines in June

The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 72.0.

• LPS: Mortgage Delinquency Rates decreased slightly in May

According to LPS, 7.96% of mortgages were delinquent in May, down slightly from 7.97% in April, and down from 9.74% in May 2010.

LPS reports that 4.11% of mortgages were in the foreclosure process, down from 4.14% in April. This gives a total of 12.07% delinquent or in foreclosure. It breaks down as:

• 2.27 million loans less than 90 days delinquent.

• 1.92 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.35 million loans delinquent or in foreclosure in May.

This graph shows the total delinquent and in-foreclosure rates since 1995.

This graph shows the total delinquent and in-foreclosure rates since 1995.The total delinquent rate has fallen to 7.96% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is still a long way to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million).

• Fannie Mae and Freddie Mac Serious Delinquency Rates decline in May

Fannie Mae reported that the serious delinquency rate decreased to 4.14% in May, down from 4.19% in April. This is down from 5.15% in May of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Fannie Mae reported that the serious delinquency rate decreased to 4.14% in May, down from 4.19% in April. This is down from 5.15% in May of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.Freddie Mac reported that the Single-Family serious delinquency rate decreased to 3.53% in May from 3.57% in April. This is down from 4.06% in May 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

The serious delinquency rate is falling as Fannie and Freddie work through the backlog of loans and either modify the loan, foreclose, short sale, or the loan cures.

• Other Economic Stories ...

• ATA Trucking index decreased 2.3% in May

• Texas Manufacturing survey shows slower expansion in June

• Richmond Fed: Manufacturing Activity Stabilized in June

• Kansas City Manufacturing Survey: Manufacturing activity rebounded solidly in June

• Chicago PMI indicated a rebound in June

• Restaurant Performance Index decreases in May

• From the NAR: Pending Home Sales Turn Around in May

Best wishes to all!