by Calculated Risk on 6/28/2011 02:05:00 PM

Tuesday, June 28, 2011

Richmond Fed: Manufacturing Activity Stabilized in June

Earlier today from the Richmond Fed: Manufacturing Activity Stabilized in June; Expectations Edge Higher

In June, the seasonally adjusted composite index of manufacturing activity — our broadest measure of the sector — picked up nine points to 3 from May's reading of −6. Among the index's components, shipments added twelve points to −1, new orders rose sixteen points to finish at 1, while the jobs index slipped two points to 12.This is the second regional survey to show expansion in June and was slightly stronger than expected (the Dallas Fed showed slower expansion in June).

...

Hiring activity at District plants was also mixed in June. The manufacturing employment index eased two points to 12 and the average workweek measure turned negative, losing five points to −5. However, wage growth edged higher, gaining three points to finish at 9.

Earlier this month, the Philly and Empire State surveys indicated contraction. So far these regional surveys suggest the ISM index will be in the low 50s in June (or possibly even below 50). I'll post a graph of the regional surveys vs. the ISM index on Thursday. The ISM index will be released Friday.

Earlier ...

• Case Shiller: Home Prices increase in April

• Update: Real House Prices and Price-to-Rent

Update: Real House Prices and Price-to-Rent

by Calculated Risk on 6/28/2011 11:13:00 AM

First a comment on the Case-Shiller seasonal adjustment: A few years ago, several people (including me), noticed that the seasonal adjustments weres getting pretty "wild". This was because of all the distressed sales - distressed sales are distributed throughout the year (with no seasonal pattern), and non-distressed sales were still following the usual pattern. So there was a very large percentage of distressed sales in the winter, and this led to huge swings in the seasonal adjustment.

In response, S&P started reporting on the Not Seasonally Adjusted (NSA) data. This is OK, but it can be a little confusing. Seasonally prices usually increase in April from March - so some of the increase this morning was due to seasonal factors. In fact the Seasonally Adjusted (SA) Case-Shiller composite 20 index was at a new post-bubble low. Note: April is still a seasonally weak month (the NSA index is below the SA index), but not as weak as March.

Just on a seasonal basis, the NSA index should increase through September. Starting in June, the NSA index will be above the SA index. A little confusing.

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 1999/2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through April) and CoreLogic House Price Indexes (through April) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to January 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to January 2000.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• Real prices are probably still too high. This isn't like in 2005 when prices were way out of the normal range. In many areas - with an increasing population and land constraints - there is an upward slope to real prices (see: The upward slope of Real House Prices)

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to February 2000.

Earlier ...

• Case Shiller: Home Prices increase in April

Case Shiller: Home Prices increase in April

by Calculated Risk on 6/28/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April (actually a 3 month average of February, March and April).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:April Seasonal Boost in Home Prices

Data through April 2011 ... show a monthly increase in prices for the 10- and 20-City Composites for the first time in eight months. The 10- and 20-City Composites were up 0.8% and 0.7%, respectively, in April versus March. Both indices are lower than a year ago; the 10-City Composite fell 3.1% and the 20-City Composite is down 4.0% from April 2010 levels.

...

Six of the 20 MSAs showed new index lows in April – Charlotte, Chicago, Detroit, Las Vegas, Miami and Tampa. Thirteen of the cities and both composites posted positive monthly changes. With index levels of 152.51 and 138.84, respectively, both the 10- and 20-City Composites are above their March 2011 levels, which had been a new crisis low for the 20-City Composite.

Click on graph for larger image in graph gallery.

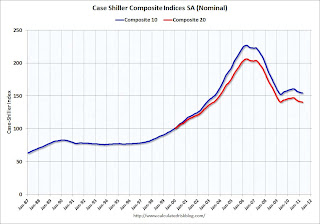

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and up slightly in April (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and down slightly in April (SA). The Composite 20 is slightly below the May 2009 post-bubble bottom seasonally adjusted.

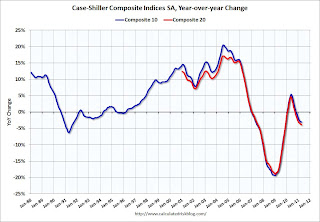

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.1% compared to April 2010.

The Composite 20 SA is down 3.9% compared to April 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in April seasonally adjusted. Prices in Las Vegas are off 58.6% from the peak, and prices in Dallas only off 8.8% from the peak.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in April seasonally adjusted. Prices in Las Vegas are off 58.6% from the peak, and prices in Dallas only off 8.8% from the peak.From S&P (NSA):

As of April 2011, 19 of the 20 MSAs and both Composites are down compared to April 2010. Washington D.C. continues to be the only market to post a year-over-year gain, at +4.0%. Minneapolis was the only city that demonstrated a double-digit annual decline, -11.1%. While 13 markets rose on a monthly basis, 16 markets saw their annual rates of change fall deeper into negative territory.There could be some confusion between the SA and NSA numbers, but this is some improvement over the last few months.

From their 2006/2007 peaks, six MSAs posted new index level lows in April 2011, a modest improvement over March’s report when 12 MSAs reported new lows. Thirteen of the markets rose in April over March, with six of them increasing by more than 1.0%. Washington DC, once again, stands out with a +3.0% monthly increase and a +4.0% annual growth rate.

With respective index levels of 100.36 and 101.95, Phoenix and Atlanta are two markets that are close to losing any value gained since January 2000. As of April 2011, Cleveland, Detroit and Las Vegas are the three markets where average home prices are lower than where they were 11 years ago.

I'll have more ...

Monday, June 27, 2011

Greece: 48-hour general strike begins

by Calculated Risk on 6/27/2011 09:57:00 PM

From the BBC: Greece general strike: Unions act amid cuts debate

Trade unions in Greece have begun a 48-hour general strike, hours after PM George Papandreou urged parliament to back an austerity package.We will probably wake up to images of the strike in Greece. The austerity votes are scheduled for Wednesday and Thursday.

Huge crowds of protesters are expected on the streets of Athens, while public transport is set to grind to a halt.

...

More than 5,000 police officers are due to be deployed in the centre of Athens on Tuesday morning, when tens of thousands of striking workers are expected to march towards parliament at 1000 (0700 GMT).

...

Airports will be shut for hours at a time, with air traffic controllers walking out between 0800 and 1200 (0500-0900 GMT) and 1800 and 2200 (1500-1900 GMT). Ferries, buses and trains will also stop running.

Note: Case-Shiller house prices will be released at 9 AM ET tomorrow.

Greece Update

by Calculated Risk on 6/27/2011 05:51:00 PM

From the WSJ: European Bankers Tackle Greece Debt Plan

The efforts to get a meaningful private-sector contribution to the bailout, as demanded by Germany and other governments, face a tight deadline. Finance ministers of Greece's fellow members of the 17-nation euro zone will meet to discuss a new rescue on Sunday ...They are trying to find a way for the private-sector to participate without it being called a default. Not easy ... and of course all of this is contingent on Greece passing the new austerity plan.

The ECB has taken a hard-line public stance against any private-sector participation that would result in a default rating for Greece.

Looks like next Sunday will be interesting ...

The yield for Greek 2 year bonds is up to 29.4%, and the 10 year yield are down to 16.8%. Portuguese and Irish 10 year yields are up to new record highs (12.1% for Ireland, 11.7% for Portugal).

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

ATA Trucking index decreased 2.3% in May

by Calculated Risk on 6/27/2011 01:05:00 PM

From ATA Trucking: ATA Truck Tonnage Index Fell 2.3% in May

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 2.3% in May after decreasing a revised 0.6% in April 2011. April’s drop was slightly less than the 0.7% ATA reported on May 25, 2011.

...

Compared with May 2010, SA tonnage climbed 2.7%, although this was the smallest year-over-year gain since February 2010. In April, the tonnage index was 4.8% above a year earlier.

“Truck tonnage over the last four months shows that the economy definitely hit a soft patch this spring,” ATA Chief Economist Bob Costello said. “With our index falling in three of the last four months totaling 3.7%, it is clear why there is some renewed anxiety over the economic recovery.”

However, Costello added that he is cautiously optimistic that freight volumes will improve in the second half of the year along with economic activity.

“With oil prices falling and some of the Japan-related auto supply problems ending, I believe this was a soft patch and not a slide back into recession, and we should see better, but not great, economic activity in the months ahead,” he said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Obviously economic activity was weak in May as the Personal Income and Outlays report indicated this morning. Some of the weakness was due to supply chain issues and the sharp decline in auto sales - and some of the weakness was probably due to high oil and gasoline prices.

Texas Manufacturing survey shows slower expansion in June

by Calculated Risk on 6/27/2011 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Rises but at a Slower Pace

Texas factory activity expanded in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, remained positive but fell from 12.7 to 5.6, suggesting output growth slowed this month.There are two more regional manufacturing surveys that will be released this week (Richmond and Kansas City), and those surveys will probably show weakness similar to the Philly and Empire State surveys. So far the regional surveys suggest the ISM index will be in the low 50s in June - and might show contraction (below 50) for the first time since July 2009.

Other measures of current manufacturing conditions indicated flat activity, while new orders picked up. ... The new orders index rose from 1.1 in May to 6.4 in June, its eighth consecutive month in positive territory. ... Labor market indicators reflected slower growth in labor demand. The employment index came in at 5.3, with 14 percent of manufacturers reporting hiring new workers compared with 9 percent reporting layoffs. ... Price and wage pressures moderated this month.

Personal Income increased 0.3% in May, PCE increased less than 0.1%

by Calculated Risk on 6/27/2011 08:30:00 AM

Note: sorry for typos.

The BEA released the Personal Income and Outlays report for May:

Personal income increased $36.2 billion, or 0.3 percent ... Personal consumption expenditures (PCE) increased $4.6 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE decreased 0.1 percent, the same decrease as in April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased less than 0.1% in May, but real PCE decreased 0.1% as the price index for PCE increased 0.2 percent in May. The graph shows that real PCE declined in the first two month of Q2.

Note: The PCE price index, excluding food and energy, increased 0.3 percent.

The personal saving rate was at 5.0% in May.

Personal saving -- DPI less personal outlays -- was $591.1 billion in May, compared with $568.0 billion in April. Personal saving as a percentage of disposable personal income was 5.0 percent in May, compared with 4.9 percent in April.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the May Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the May Personal Income report.The saving rate has declined recently even as growth for real personal consumption expenditures has slowed. Part of this is due to higher overall inflation and higher oil / gasoline prices.

This would have been the first monthly decline in real PCE since January 2010 - except April was revised down too. This puts real PCE growth in Q2 on pace for only about 1% (an average of Q2 over Q1) - the slowest pace since Q4 2009.

Sunday, June 26, 2011

Sunday Night Futures

by Calculated Risk on 6/26/2011 11:39:00 PM

Earlier:

• Summary for Week Ending June 24th

• Unofficial Problem Bank list at 1,001 Institutions and Transition Matrix

• Schedule for Week of June 26th

The Asian markets are red tonight with the Nikkei off almost 1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is off about 2.7 points, and Dow futures are off about 30 points.

Oil: WTI futures are down to $90.60 and Brent is down to $104.47.

Of course we will be watching Greece again tomorrow: The Greek 2 year yield is at 28.3% and the ten year yield is at 16.8%.

Best to all.

Week Ahead: Better or Worse News?

by Calculated Risk on 6/26/2011 06:45:00 PM

Although I expect the recovery to remain sluggish and choppy, I do think some of the recent slowdown was temporary, and I expect some pickup in U.S. economic activity in Q3. There are downside risks to this forecast, such as spillover from the European financial crisis, another surge in oil and gasoline prices (or a supply shock), and more rapid fiscal tightening in the U.S. - to name a few risks.

Even though most of the U.S. data will be weak, there might be a few hints of improvement this week, although events overseas might overshadow U.S. economic data once again.

There are several regional manufacturing surveys that will be released this week (Richmond, Dallas and Kansas City), and all will probably show weakness similar to the Philly and Empire State surveys. The Chicago PMI will probably be weak too, and the closely watched ISM manufacturing survey might show contraction (below 50) for the first time since July 2009.

Also the Personal Income and Outlays report for May (to be released Monday) will probably show the first monthly decline in real PCE since early last year. So there will be plenty of "bad news".

However auto sales should be a little better in June than in May, although the supply chain issues are still impacting sales. And falling oil and gasoline prices might lead to a little more positive consumer sentiment - and a pickup in consumer spending in June and July.

On housing, the monthly mortgage delinquency reports from LPS and Fannie Mae will probably show a lower serious delinquency rate (continuing the recent trend). And even though expectations are for the Pending Home Sales index to show a 2% decline in May, housing economist Tom Lawler expects an increase in this index (based on limited data).

And on house prices, expectations are for the Case-Shiller index (NSA) to show a 0.3% decline in April, about half the decline reported in March. However several house prices indexes showed an increase in April:

• From CoreLogic: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010

• FNC reported:

Despite broad economic and job market weakness, home prices have increased for the first time since the withdrawal of the homebuyer tax credits a year ago.

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicated that single-family home prices in April were up from March at a seasonally unadjusted rate of 0.5%.

• The FHFA (GSEs only): FHFA House Price Index Rises 0.8 Percent in April; First Monthly Increase Since May 2010

• And Radar Logic went further and predicted the Case-Shiller index will show an increase for April:

Last month, we predicted that the S&P/Case-Shiller 10-City composite for March 2011 would be about 152 and the 20-City composite would be roughly 138. In fact, the 10-City composite was 151.66 and the 20-City composite was 138.16.EDITED for clarity: Seasonally April is usually slightly stronged than March, even though March is still a weak month (The NSA index will be below the SA index). However this means the NSA index would show a larger increase than the SA index. That might be a little confusing since S&P reports the NSA index, and I report the SA numbers.

This month, we expect the April 2011 10-City composite index to be about 153 and the 20-City index to be roughly 140.

It looks like the sharp house price declines are over for the summer months. I still think prices will fall further in real terms over the next couple of years (inflation adjusted), but I think we are close to the bottom nationally in nominal terms.

Overall most of the news flow will still be negative this week.

Earlier:

• Summary for Week Ending June 24th

• Unofficial Problem Bank list at 1,001 Institutions and Transition Matrix

• Schedule for Week of June 26th