by Calculated Risk on 6/25/2011 08:26:00 AM

Saturday, June 25, 2011

Unofficial Problem Bank list at 1,001 Institutions and Transition Matrix

Note: this is an unofficial list of Problem Banks compiled only from public sources. This post includes an update to the transition matrix (see comments and table at bottom).

Here is the unofficial problem bank list for June 24, 2011.

Changes and comments from surferdude808:

As anticipated, the FDIC released its actions for May 2011, which contributed to many changes to the Unofficial Problem Bank List. This week there are eight additions and three removals. The net five additions push the list back over the 1,000 threshold to 1,001. Assets total $419.2 billion, up $2.5 billion from last week. For the month of June, changes included 17 additions and 13 removals, with four from failure, two from unassisted mergers, and seven from action terminations.

Removals this week include the failed Mountain Heritage Bank, Clayton, GA ($104 million) and action terminations against Commercial State Bank of El Campo, El Campo, TX ($127 million) and Slovak Savings Bank, Pittsburgh, PA ($85 million). This month the FDIC terminated 13 consent orders and two Prompt Corrective Action orders, but, strangely, nine of the terminations were for banks that had failed.

Among the eight additions this week are Patriot Bank, Houston, TX ($1.3 billion); American Bank of the North, Nashwauk, MN ($644 million); and Stonebridge Bank, Exton, PA ($365 million). One other change of note includes the FDIC issuing a Prompt Corrective Action Order against Colorado Capital Bank, Castle Rock, CO ($718 million).

With this being the last Friday of the second quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table below).

Over the past 22 months, about 49 percent or 192 institutions have been removed from the original list with 125 due to failure, 49 due to action termination, and 18 due to unassisted merger. About 32 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List.

Since the publication of the original list, another 1,009 institutions have been added. However, only 804 of those 1,009 additions remain on the current list as 205 institutions have been removed in the interim. Of the 205 interim removals, 134 were from failure, 44 were from an unassisted merger, 25 from action termination, and two from voluntary liquidation.

In total, 1,398 institutions have made an appearance on the Unofficial Problem Bank List and 259 or 18.5 percent have failed. Of the 397 total removals, the primary way of exit from the list is failure at 259 or 65 percent. Only 74 or 18.6 percent have been rehabilitated while another 62 or 15.6% have found merger partners. Total assets that have appeared on the list amount to $768.9 billion and $258.6 billion have been removed due to failure. The average asset size of removals from failure is nearly $1 billion.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 49 | (12,581,702) | |

| Unassisted Merger | 18 | (3,105,440) | |

| Voluntary Liquidation | 0 | - | |

| Failures | 125 | (169,470,405) | |

| Asset Change | (20,083,711) | ||

| Still on List at 6/24/2011 | 197 | 71,072,171 | |

| Additions | 804 | 348,177,411 | |

| End (6/24/2011) | 1001 | 419,249,582 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 25 | 22,538,068 | |

| Unassisted Merger | 44 | 31,856,880 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 134 | 89,146,292 | |

| Total | 205 | 144,374,807 | |

| 1Institution not on 8/7/2009 or 6/24/2011 list but appeared on a list between these dates. | |||

Friday, June 24, 2011

Las Vegas: Bubble Monuments

by Calculated Risk on 6/24/2011 09:39:00 PM

Steve Kanigher at the Las Vegas Sun presents several photos of bubble monuments in Nevada: Abandoned projects leave lasting reminder of economic crash

"It wasn’t long ago that hotels, high-rise condominiums and massive retail and office complexes sprang up in Southern Nevada seemingly faster than one could drive from one end of the valley to the other. Take that same drive today, though, and you’ll likely see vestiges of the Great Recession: partially built structures with exposed foundations or steel beams ..."Check out the photos ...

It sure seemed like projects with names like "Manhattan West" (see the 4th slide) or "Central Park West" were doomed.

Bank Failure #48 in 2011: Mountain Heritage Bank, Clayton, Georgia

by Calculated Risk on 6/24/2011 05:38:00 PM

From the FDIC: First American Bank and Trust Company, Athens, Georgia, Assumes All of the Deposits of Mountain Heritage Bank, Clayton, Georgia

As of March 31, 2011, Mountain Heritage Bank had approximately $103.7 million in total assets and $89.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.1 million. ... Mountain Heritage Bank is the 48th FDIC-insured institution to fail in the nation this year, and the fourteenth in Georgia.What a surprise ... a bank in Georgia fails. That is a pretty big percentage loss.

NY Times: Overbuilding in Spain

by Calculated Risk on 6/24/2011 05:31:00 PM

Oh my ...

From the NY Times: Overbuilding in Spain Leaves Many White Elephants

Last March, local officials inaugurated a brand new airport in Castellón, a small city on Spain’s Mediterranean coast. They are still waiting for the first scheduled flight.That made me laugh ...

Castellón Airport, built at a cost of €150 million, or $213 million, is not the only white elephant that now dots Spain’s infrastructure landscape. ... Across the country, nearly empty toll roads are struggling to turn a profit. Other projects are surviving only with continued public financing ...This sounds like a classic bubble attitude: "Build it and they will come". Just a reminder that during a bubble, every project seems to make sense ... on paper.

Hotels: Occupancy Rate increased 3.7 percent compared to same week in 2010

by Calculated Risk on 6/24/2011 01:55:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: STR: Luxury segment leads weekly increases

Overall, the U.S. hotel industry’s occupancy rose 3.7% to 69.2%, ADR increased 3.3% to US$101.73, and RevPAR finished the week up 7.2% to US$70.37.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The summer leisure travel season is now starting, and the occupancy rate will increase over the next few of months. Right now the occupancy rate is tracking closer to 2008 than to 2010 - and well above 2009.

Even though the occupancy rate has mostly recovered back to 2008 levels, ADR and RevPAR are below the pre-recession levels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

By request, here are links to the posts and graph for May Home Sales:

• New Home Sales in May at 319 Thousand SAAR

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Graph Galleries: New Home sales and Existing Home sales

FHA sells record number of REO in May, Freddie Mac Serious Delinquency Rate declines

by Calculated Risk on 6/24/2011 11:27:00 AM

A couple of updates ...

• FHA Sells record number of REO (Real Estate Owned) in May.

In Q1, Fannie and Freddie were foreclosing at record levels - and selling REO even faster - so their REO inventory actually declined. However, the FHA was apparently having REO inventory problems and the FHA's REO inventory increased in Q1.

It now appears the FHA REO problem has been solved. The FHA sold a record number of REO in April, and even more in May.

According to data from HUD (ht Keith Jurow), the FHA acquired 6,727 REO in May and sold a record 12,671 properties. The FHA REO inventory has declined from 69,9581 at the end of Q1 2011, to 60,587 at the end of May 2011. It appears REO at the F's will decline again in Q2.

1REO for March was revised up slightly.

• Freddie Mac reported that the Single-Family serious delinquency rate decreased to 3.53% in May from 3.57% in April. This is down from 4.06% in May 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

The normal serious delinquency rate is under 1%, so this is still very high, but at least it is declining. (I'll post a graph when Fannie release their monthly delinquency report).

Note: These are loans that are "three monthly payments or more past due or in foreclosure".

Q1 real GDP growth revised up to 1.9%, Durable-goods orders up 1.9%

by Calculated Risk on 6/24/2011 08:30:00 AM

From the BEA: Gross Domestic Product: First Quarter 2011 (Third Estimate). This small upward revision, compared to the 2nd estimate, was because of a slight increase in Net exports, and a larger contribution from the change in private inventories - partially offset by a larger decrease in state and local government spending.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders May 2011

New orders for manufactured durable goods in May increased $3.6 billion or 1.9 percent to $195.6 billion, the U.S. Census Bureau announced today. This increase, up two of the last three months, followed a 2.7 percent April decrease. Excluding transportation, new orders increased 0.6 percent. Excluding defense, new orders increased 1.9 percent.This was above the consensus of a 1.6 percent increase.

Thursday, June 23, 2011

Greece Update and European Bond and CDS Spreads

by Calculated Risk on 6/23/2011 07:57:00 PM

First from the WSJ: EU Stops Greek Backtracking

European Union leaders fended off an effort by Greece to water down an austerity and privatization package that is the price for new aid, and EU President Herman Van Rompuy said they were nearing approval on a new rescue program to take Athens until the end of 2014.More austerity ...

...

"We have a deal after the Greek government agreed to more spending cuts and some higher taxes," said the [Greek] official.

And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released yesterday (graph as of June 22nd).

From the Atlanta Fed:

Since the April FOMC meeting, the 10-year Greece-to-German bond spread has widened by nearly 400 basis points (bps) through June 22. The spreads for Ireland and Portugal have soared by 157 bps and 199 bps, respectively, over the same period.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The spreads for Greece, Ireland and Portugal are all near record highs. The spreads for both Ireland and Portugal are about as high as Greece a couple of months ago!

Spreads for Spain and Italy have increased recently, but are still much lower than for Greece, Ireland and Portugal.

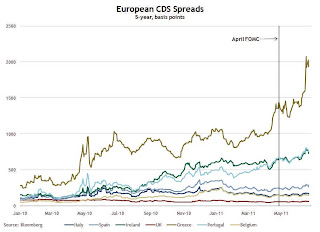

The second graph shows the Credit Default Swap (CDS) spreads:

From the Atlanta Fed:

From the Atlanta Fed: The CDS spread on Greek debt has widened about 500 basis points (bps) since the April FOMC meeting, while those on Portuguese and Irish debt continue to be high.The Greek 2 year yield was up to 28.6% today. The ten year yield was up to 16.9%.

Misc: Release of Oil Reserves, Greek Agreement, another House Price index shows increase

by Calculated Risk on 6/23/2011 04:10:00 PM

• The big story of the day was the announcement of the release of oil from reserves. From the WSJ: U.S., IEA to Release Oil from Reserves

[T]he International Energy Agency said its members will release 60 million barrels of crude from emergency stocks, half from the U.S. strategic reserve, to offset production lost to the unrest in Libya, only the third time in its history that the IEA has intervened in this way.• From CNBC: Greece Agrees on Austerity Plan With EU, IMF: Report

Greece won the consent of a team of EU-IMF inspectors for its new five-year austerity plan after committing to an additional round of tax rises and spending cuts, both Reuters and Dow Jones reported Thursday.• And on house prices from Radar Logic:

The 25-MSA RPX Composite price increased two percent month over month ... Nevertheless, the change in the RPX Composite from January to April was negative for only the third time in the last ten yearsThe Radar Logic index is based on public records of all closed housing transactions nationally for the month of April, expressed as a price per square foot (not a repeat sales index). This is another index showing a bounce in April.

Radar Logic has a pretty good track record of predicting Case-Shiller house prices, so this prediction was especially interesting:

Last month, we predicted that the S&P/Case-Shiller 10-City composite for March 2011 would be about 152 and the 20-City composite would be roughly 138. In fact, the 10-City composite was 151.66 and the 20-City composite was 138.16.This is for the Not Seasonally Adjusted (NSA) Case-Shiller data - and usually April is seasonally a tough month for Case-Shiller (since it is an average of closed transactions in February, March and April). This would be the first increase in Case-Shiller NSA since last July, and the first increase seasonally adjusted (SA) since last June.

This month, we expect the April 2011 10-City composite index to be about 153 and the 20-City index to be roughly 140.

The Case-Shiller index will be released next Tuesday.

And on May Home Sales:

• New Home Sales in May at 319 Thousand SAAR

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Graph Galleries: New Home sales and Existing Home sales

Chicago Fed: Economic growth remained below average in May

by Calculated Risk on 6/23/2011 03:22:00 PM

No surprise (this is a composite index) ... from the Chicago Fed: Index shows economic growth remained below average in May

The index’s three-month moving average, CFNAI-MA3, declined to –0.19 in May from –0.15 in April, remaining negative for a second consecutive month and reaching its lowest level since November 2010. May’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. With regard to inflation, the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in May, but below trend.