by Calculated Risk on 6/22/2011 01:57:00 PM

Wednesday, June 22, 2011

Bernanke Press Briefing 2:15 PM ET

Below is a live video feed for Ben Bernanke's press conference.

UPDATE: The forecast updates are below the video.

The FOMC statement was released at 12:30 PM. The FOMC noted that the recovery was "continuing at a moderate pace" although slower "than the Committee had expected". They also noted "inflation has picked up in recent months".

The FOMC believes the slowdown is temporary and the pickup in inflation is transitory.

Here are the new FOMC projections.

GDP growth was revised down to around 2.8% this year.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| June 2011 Projections | 2.7 to 2.9 | 3.3 to 3.7 | 3.5 to 4.2 |

The unemployment rate was revised up to 8.6% to 8.9% (this is Q4 unemployment rate). The FOMC thinks the unemployment rate will still be around 8% at the end of 2012!

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| June 2011 Projections | 8.6 to 8.9 | 7.8 to 8.2 | 7.0 to 7.5 |

Inflation was revised up for 2011.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| June 2011 Projections | 2.3 to 2.5 | 1.5 to 2.0 | 1.5 to 2.0 |

But core inflation is seen at levels still below the FOMC target.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| June 2011 Projections | 1.5 to 1.8 | 1.4 to 2.0 | 1.4 to 2.0 |

FOMC Statement: No Change, "Economic recovery is continuing at a moderate pace"

by Calculated Risk on 6/22/2011 12:30:00 PM

Note: the Press Conference with Fed Chairman Ben Bernanke is scheduled at 2:15p.m. EDT.

"[S]lower pace of the recovery reflects in part factors that are likely to be temporary (the Fed's forecast will be released at the press briefing). A little more on inflation, but still transitory.

From the Federal Reserve:

Information received since the Federal Open Market Committee met in April indicates that the economic recovery is continuing at a moderate pace, though somewhat more slowly than the Committee had expected. Also, recent labor market indicators have been weaker than anticipated. The slower pace of the recovery reflects in part factors that are likely to be temporary, including the damping effect of higher food and energy prices on consumer purchasing power and spending as well as supply chain disruptions associated with the tragic events in Japan. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Inflation has picked up in recent months, mainly reflecting higher prices for some commodities and imported goods, as well as the recent supply chain disruptions. However, longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The unemployment rate remains elevated; however, the Committee expects the pace of recovery to pick up over coming quarters and the unemployment rate to resume its gradual decline toward levels that the Committee judges to be consistent with its dual mandate. Inflation has moved up recently, but the Committee anticipates that inflation will subside to levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To promote the ongoing economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee will complete its purchases of $600 billion of longer-term Treasury securities by the end of this month and will maintain its existing policy of reinvesting principal payments from its securities holdings. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee will monitor the economic outlook and financial developments and will act as needed to best foster maximum employment and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

CoreLogic: Existing Home Shadow Inventory Continues to Decline

by Calculated Risk on 6/22/2011 10:04:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline

CoreLogic ... reported today that the current residential shadow inventory as of April 2011 declined to 1.7 million units, representing a five months’ supply. This is down from 1.9 million units, also a five months’ supply, from a year ago. The decline was due to fewer new delinquencies and the high level of distressed sales, which helped reduce the number of outstanding distressed loans.

CoreLogic estimates current shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.7 million current shadow inventory supply, 790,000 units are seriously delinquent (2.6 months’ supply), 440,000 are in some stage of foreclosure (1.4 months’ supply) and 440,000 are already in REO (1.4 months’ supply).

...

In addition to the current shadow inventory, there are 2 million current negative equity loans that are more than 50 percent or $150,000 “upside down.” These current but underwater loans have increased risk of entering the shadow inventory if the owners’ ability to pay is impaired while significantly underwater.

Mark Fleming, chief economist for CoreLogic commented, “The shadow inventory has declined by nearly one-fifth since it peaked in early 2010, in large part due to a reduced flow of newly delinquent loans in recent months. However, it will probably take several years for the shadow inventory to be absorbed given the long timelines in processing and completing foreclosures.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

This report provides a couple of key numbers: 1) there are 1.7 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale, and 2) there are about 2 million current negative equity loans that are more than 50 percent or $150,000 “upside down”.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 6/22/2011 07:36:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 7.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2.8 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.57 percent from 4.51 percent, with points decreasing to 0.91 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of purchase activity is still at about 1997 levels - and mostly moving sideways. Of course there is a very high percentage of cash buyers right now, but this suggests weak existing home sales through July.

AIA: Architecture Billings Index indicates declining demand in May

by Calculated Risk on 6/22/2011 12:15:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From the WSJ: Momentum Gone in Design Services

The Architecture Billings Index decreased again last month, dropping to 47.2 during May from 47.6 in the previous month [according to the American Institute of Architects (AIA)].

...

"Whatever positive momentum that there had been seen in late 2010 and earlier this year has disappeared," said Kermit Baker, chief economist of the American Institute of Architects.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index decreased in May to 47.2 from 47.6 in April. Anything below 50 indicates a decrease in billings.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests another dip in CRE investment towards the end of this year - and into 2012.

Tuesday, June 21, 2011

Irvine: Luxury Condos become Rental Apartments

by Calculated Risk on 6/21/2011 09:32:00 PM

From the O.C. Register: Luxury Irvine condo towers go rental (ht SGIP)

The luxe new high-rise condos at Astoria in Irvine’s Central Park West are no longer for sale — they’re for rent.This is part of the Central Park West project in Irvine. This project was built by Lennar and mothballed in 2007. Part of the project was brought back on the market in 2010, but they only sold six condos since then in this high rise building - so it is time to convert them to rentals!

...

The apartments at Astoria, once priced to sell from $415,000 to $779,000 – along with homeowner association (HOA) dues ranging from $915 to $965 a month — now rent beginning at $2,590.

This is shadow inventory that I expect will be converted back to condos eventually.

Earlier:

• FOMC Meeting Preview

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Misc: ARMs Comeback, Greek TV, and More

by Calculated Risk on 6/21/2011 03:35:00 PM

UPDATE: No surprise, from CNBC: Greek PM Wins Crucial Vote, But Outlook Remains Dire

• From Tara Siegel Bernard: Borrowers Wade Back Into Adjustable-Rate Mortgages. CR Note: We have to remember that not all ARMs are bad - just like not all "subprime" is bad. During the bubble, many borrowers didn't understand the product and were frequently qualified at an absurdly low teaser rate - if they were qualified at all, with little or no proof of income. As long as people understand the terms, and the underwriting is solid - this probably isn't too bad (although I'm sure there are people who will get burned).

• The Greek confidence vote is scheduled to start at 5 PM ET. Here is the online Greek TV (it is all Greek to me). It is pretty clear that Prime Minister Papandreou will receive a vote of confidence (just more theater - like the debt ceiling charade in the U.S.). So they will receive a few billion more ...

• Here is the Conference of Mayor's report with some local data: U.S. Metro Economies Report: 2011 Release

• And from the LA Times: Controller says he won’t pay legislators

California lawmakers must forfeit their pay as of mid-June because the budget they passed last week -- which Gov. Jerry Brown vetoed less than 24 hours later -– was not balanced, the state controller said Tuesday.Earlier:

...

Voters approved a law last fall that empowered legislators to pass a budget with a simple majority vote but also threatened to strip them of pay for every day the blueprint is late. The measure makes no mention of approving a balanced budget, but other laws on the books dictate that state budgets be balanced.

• FOMC Meeting Preview

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Existing Home Sales: Comments and NSA Graph

• Existing Home Sales graphs

Existing Home Sales: Comments and NSA Graph

by Calculated Risk on 6/21/2011 12:15:00 PM

A few comments and a graph (of course):

• There was no mention of the "benchmark revision" that was supposed to be announced this summer (Summer starts now!). I was hoping for at least a mention on the timing of the release. This revision is expected to show significant fewer homes sold over the last few years (perhaps 10% to 15% fewer homes in 2010), and also fewer homes for sale.

Hopefully the NAR will provide an update soon - and hopefully the NAR will provide 1) the revised data for the last decade and 2) a description of the new methodology (as part of this revision, the NAR is expected to change their method for estimating sales and inventory).

• The NAR continues to complain about lending standards. NAR economist Lawrence Yun said: “There’s been a pendulum swing from very loose standards which led to the housing boom to unnecessarily restrictive practices as an overreaction to the housing correction – this overreaction is clearly holding back the recovery.”

Actually standards are fairly reasonable for qualified buyers. Of course many qualified buyers bought last year - using the ill-considered homebuyer tax credit - and that pulled demand forward. The housing market is still paying the price for that policy mistake.

Of course the NAR never complained about the "very loose standards" during the housing bubble!

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The red columns are for 2011.

Sales NSA are well below the tax credit boosted level of sales in May 2010, but slightly above the level of May sales in 2009. The level of sales is still elevated due to investor buying. The NAR noted:

All-cash transactions stood at 30 percent in May, down from 31 percent in April; they were 25 percent in May 2010; investors account for the bulk of cash purchases.• As Tom Lawler noted yesterday, the Pending Home Sales Index will probably show a significant increase in May - so reported sales in June and July will probably be higher. The Pending Home Sales Index will be released on Wednesday June 29th.

First-time buyers purchased 35 percent of homes in May, down from 36 percent in April; they were 46 percent in May 2010 when the tax credit was in place. Investors accounted for 19 percent of purchase activity in May compared with 20 percent in April; they were 14 percent in May 2010.

Earlier:

• FOMC Meeting Preview

• May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

• Existing Home Sales graphs

May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

by Calculated Risk on 6/21/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Decline in May

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, fell 3.8 percent to a seasonally adjusted annual rate of 4.81 million in May from a downwardly revised 5.00 million in April, and are 15.3 percent below a 5.68 million pace in May 2010 when sales were surging to beat the deadline for the home buyer tax credit.

...

Total housing inventory at the end of May fell 1.0 percent to 3.72 million existing homes available for sale, which represents a 9.3-month supply at the current sales pace, up from a 9.0-month supply in April

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2011 (4.81 million SAAR) were 3.8% lower than last month, and were 15.3% lower than in May 2010.

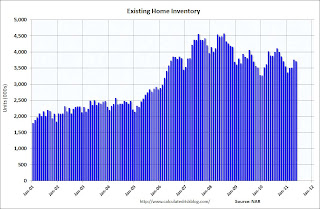

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.72 million in May from 3.76 million in April.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.Inventory should increase over the next couple of months months (the normal seasonal pattern), and the YoY change is something to watch closely this year.

Months of supply increased to 9.3 months in May, up from 9.0 months in April. This is much higher than normal. These sales numbers were slightly above the consensus of 4.75 million SAAR (Lawler's forecast was 4.8 million using the NAR method).

There was no mention of the coming revisions. I'll have more later.

Miami Condos: Foreign Cash Buyers

by Calculated Risk on 6/21/2011 09:05:00 AM

Existing home sales will be released soon.

Here is an article from Bloomberg: Brazilians Buy Miami Condos at Bargain Prices(ht Nanoo-Nanoo)

Surging real estate prices in Brazil and the currency’s 45 percent gain against the U.S. dollar since 2008 are sending Brazilians to South Florida in search of bargain vacation homes and property investments. That’s helping bolster Miami’s condo market ... As many as half of the downtown Miami condos that have been sold to foreigners for more than $500,000 since January were purchased by Brazilians.This doesn't help in most overbuilt areas. But it does help a little in some areas - like Miami - and they are paying all cash.