by Calculated Risk on 6/21/2011 10:00:00 AM

Tuesday, June 21, 2011

May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

The NAR reports: Existing-Home Sales Decline in May

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, fell 3.8 percent to a seasonally adjusted annual rate of 4.81 million in May from a downwardly revised 5.00 million in April, and are 15.3 percent below a 5.68 million pace in May 2010 when sales were surging to beat the deadline for the home buyer tax credit.

...

Total housing inventory at the end of May fell 1.0 percent to 3.72 million existing homes available for sale, which represents a 9.3-month supply at the current sales pace, up from a 9.0-month supply in April

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2011 (4.81 million SAAR) were 3.8% lower than last month, and were 15.3% lower than in May 2010.

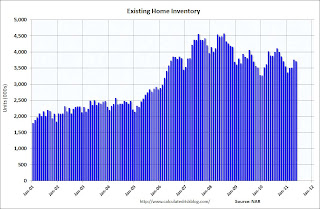

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.72 million in May from 3.76 million in April.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.Inventory should increase over the next couple of months months (the normal seasonal pattern), and the YoY change is something to watch closely this year.

Months of supply increased to 9.3 months in May, up from 9.0 months in April. This is much higher than normal. These sales numbers were slightly above the consensus of 4.75 million SAAR (Lawler's forecast was 4.8 million using the NAR method).

There was no mention of the coming revisions. I'll have more later.

Miami Condos: Foreign Cash Buyers

by Calculated Risk on 6/21/2011 09:05:00 AM

Existing home sales will be released soon.

Here is an article from Bloomberg: Brazilians Buy Miami Condos at Bargain Prices(ht Nanoo-Nanoo)

Surging real estate prices in Brazil and the currency’s 45 percent gain against the U.S. dollar since 2008 are sending Brazilians to South Florida in search of bargain vacation homes and property investments. That’s helping bolster Miami’s condo market ... As many as half of the downtown Miami condos that have been sold to foreigners for more than $500,000 since January were purchased by Brazilians.This doesn't help in most overbuilt areas. But it does help a little in some areas - like Miami - and they are paying all cash.

Monday, June 20, 2011

Greek Prime Minister Faces a confidence vote today

by Calculated Risk on 6/20/2011 08:13:00 PM

Or maybe a "no confidence" vote ...

From Bloomberg: Papandreou Faces Confidence Vote That May Decide Greece’s Fate

Greek Prime Minister George Papandreou faces a confidence vote in his government today that may determine whether Greece becomes the first euro-area country to default.If this is tonight (June 20), it is already after midnight in Athens.

...

The debate on the confidence motion, which began on June 19, will end around midnight.

I expect a vote of confidence ... I think everyone will try to put off a default for as long as possible.

Lawler: Closed Home Sales Down, Pending Sales Up in May

by Calculated Risk on 6/20/2011 03:45:00 PM

CR Note: Existing home sales for May will be released tomorrow and the Pending Home Sales Index on Wednesday June 29th. Hopefully the NAR will provide an update tomorrow on the timing of the benchmark revisions.

From economist Tom Lawler: Closed Home Sales Down, Pending Sales Up in May

Based on data from local realtor associations/boards/MLS, it certainly appears as if existing home sales declined on a seasonally adjusted basis in May relative to April, with sales based on the National Association of Realtors’ estimation methodology likely to come in at around a seasonally adjusted annual rate of around 4.75 - 4.80 million, down from 5.05 million in April.

The incoming data also suggest, however, that the NAR’s Pending Home Sales Index – which took a surprisingly sharply tumble in April (down 11.6% on a seasonally adjusted basis from March) – rebounded smartly in May.

Trying to “build up” a pending home sales index estimate from local data is challenging, as not all associations/boards/MLS report “new” pending sales – i.e., contracts signed in a month – to the public. Indeed, not all associations/boards/MLS even TRACK new pending sales, including many in the NAR’s existing home sales sample – and thus, of course, do not report new pending sales to the NAR. According to the NAR, the sample size for its pending home sales index is about half as large as the sample size used to estimate closed existing home sales. The NAR’s PHSI data also only goes back to 2001, making seasonal factors somewhat “imprecise.”

In looking at associations/boards/MLS/etc that DO report on new pending sales/contracts signed, however, it appears as if there was a substantial rebound in pending sales on a seasonally adjusted basis.

Below is a table showing the YOY % change in the NOT seasonally adjusted NAR PHSI compared to the YOY % change in new pending sales/contracts written reported by various associations/etc1 that together comprised over 52,000 pending sales last month. It is NOT a sample representative of the country as a whole, though it does have data from all broad regions.

| YOY % Change, New Pending Sales, 2011 v 2010 | NAR PHSI (NSA) | NAR PHSI (SA) | ||||

|---|---|---|---|---|---|---|

| NAR PHSI | Select MLS | 2010 | 2011 | 2010 | 2011 | |

| Jan | -4.4% | 1.1% | 74.3 | 71.0 | 90.3 | 88.9 |

| Feb | -10.5% | -3.9% | 88.3 | 79.0 | 98.9 | 89.5 |

| Mar | -12.9% | -9.0% | 119.7 | 104.3 | 106.2 | 92.6 |

| Apr | -26.8% | -24.3% | 133.4 | 97.6 | 111.5 | 81.9 |

| May | 27.9% | 89.0 | 78.3 | |||

The table suggests that pending sales in the sample I’m looking at did not decline as much from a year ago as did pending sales in the NAR’s sample, though the YOY declines certainly follow a similar pattern.

Last year, pending sales plunged in most of the country from April to May following the expiration of the federal home buyer tax credit. From last May’s depressed level, however, the vast bulk of associations/etc. have reported sizable gains in pending sales – sufficient to suggest a strong rebound in the pending home sales index from April.

Of course, this May had one more business day than last May, suggesting that this year’s seasonal factor will be higher than last year’s -- meaning that the YOY % change in the seasonally adjusted number will be below that of the not seasonally adjusted numbers.

Still, after allowing for changing seasonal factors the incoming data suggest that the May pending home sales index on a seasonally adjusted basis is likely to show a double-digit gain from April’s level.

DOT: Vehicle Miles Driven decreased -2.4% in April compared to April 2010

by Calculated Risk on 6/20/2011 11:30:00 AM

This data is for April and gasoline prices were at the highest level of the year at end of April and in early May - so the YoY decline might be less in June.

Note: WTI future oil prices are down to $92.53 per barrel (down from $113.39 on April 29th), and Brent Crude is at $112.04 per barrel (down from $126.64). Gasoline prices are off over 30 cents per gallon from the recent peak.

The Department of Transportation (DOT) reported that vehicle miles driven in April were down 2.4% compared to April 2010:

Travel on all roads and streets changed by -2.4% (-6.1 billion vehicle miles) for April 2011 as compared with April 2010. Travel for the month is estimated to be 250.5 billion vehicle miles.

Cumulative Travel for 2011 changed by -0.8% (-7.1 billion vehicle miles). The Cumulative estimate for the year is 939.2 billion vehicle miles of travel.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 41 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the decline in oil and gasoline prices, the YoY decline in miles driven will probably not be as large in June.

Morning Greece: Deal Postponed

by Calculated Risk on 6/20/2011 08:40:00 AM

From the NY Times: Deal on Lifeline to Avert Greek Bankruptcy Is Postponed

Europe’s finance ministers unexpectedly put off approval early Monday of the next installment of aid to debt-laden Greece, delaying the decision until July and demanding that the Greek Parliament first approve spending cuts and financial reforms ... Athens needs the next payout of 12 billion euros from its existing 110 billion euro bailout package by mid-July in order to remain solvent.From the WSJ: Finance Ministers Struggle With Long-Term Fix, but Get Closer on Short-Term Cash

Greece will run out of cash in the middle of next month unless funds earmarked under last year's bailout are released. Unwilling to let that happen, finance ministers are likely to approve disbursement of €8.7 billion; the International Monetary Fund, which is also contributing to the bailout, would likely agree to pay out €3.3 billion in the coming weeks.The Greek 2 year yield is at 28.4%. The ten year yields are up to 17.4%.

...

In the early hours of Monday morning, [finance ministers] released a statement saying they would decide on the "main parameters" of a new bailout package in July. The statement said the new bailout would include "informal and voluntary" arrangements with creditors that would produce a "substantial reduction" in the amount of new funding necessary—but without casting Greece into default.

Weekend:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

• FOMC Meeting Preview

Sunday, June 19, 2011

Housing Bust Winners: Some Farmers in Illinois

by Calculated Risk on 6/19/2011 07:03:00 PM

Here is a story about some farmers who sold land to home builders during the bubble - and are now buying back land at a fraction of the price ...

From Mary Ellen Podmolik at the Chicago Tribune: Shrewd investments enable farmers to live off the land they sold, then bought

... the [Baltz] brothers stood ... on 246 acres that, at their peak, sold for $65,000 an acre and in 2005 were annexed by the village and zoned for more than 400 single-family detached homes.And another example (not buying back the same land - but similar):

The Baltz brothers paid $3.6 million, or about $14,500 an acre, for land that already has subdivision utilities brought to the property line. This year, though, the only thing rising out of the dirt will be the corn that Bob Baltz planted last month.

Bob Dhuse, whose family has been farming southwest of Chicago since the 1850s, decided to split up the family's Kendall County land seven years ago, selling 90 acres for $34,000 to a housing developer.Nice timing!

... last fall he paid $12,000 to $15,000 an acre for land on the west side of Joliet that was to be a project of Neumann Homes, which, like competitors Kimball Hill, Kirk Corp. and Pasquinelli, all went bankrupt.

Earlier:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 6/19/2011 12:15:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to reinvest principal payments, or to the Large Scale Asset Purchase program that is scheduled to end this month (LSAP, aka "QE2"). Basically the Fed is on hold.

Jon Hilsenrath at the WSJ summed it up last week: No Fed Shift Seen at June Gathering

Fed officials are neither looking to tighten nor to ease monetary policy as they prepare for the meeting June 21 and 22 of the Federal Open Market Committee, the Fed's decision-making body.On Friday, Goldman Sachs economist Sven Jari Stehn argued that there is a large "zone of inaction" for the Fed, and it would take a large surprise (much slower economy or much higher inflation) to get the Fed to take action. From Stehn:

With job gains potentially slowing, housing prices sliding and consumers spending cautiously, officials don't want to tighten financial conditions. This means they will maintain short-term interest rates near zero and keep the central bank's $2.6 trillion of securities holdings from shrinking. At the same time, because inflation has picked up, they're reluctant to embrace new initiatives aimed at boosting growth.

"Our analysis ... suggests that larger surprises than those seen in recent weeks are needed for the FOMC to move out of its zone of inaction. We conclude that the ... weakness in growth and uncertainty about the effect of temporary factors will keep policy and, most likely, policy communication unchanged for the foreseeable future.Concerning the recent slowdown - it is difficult to distinguish between temporary factors or something worse - so the Fed will probably remain on hold until the situation is more clear. The temporary factors include the supply chain issues related to the tragic events in Japan, the sharp increase in oil and gasoline prices partially attributable to events in the Middle East and North Africa, and possibly the severe weather in the U.S.

The implication of this analysis for next week’s FOMC press conference is that Chairman Bernanke is likely to stay far away from indicating any changes in the policy stance. Most likely, he will be “balanced” by emphasizing both the disappointment in the activity indicators and the higher inflation data. So the press conference is unlikely to be pleasant for either the chairman or his audience."

Remember, in early April Bernanke said:

"I think the increase in inflation will be transitory," ... He attributed the strong gain in global energy and food prices to supply and demand conditions, adding he reckons these prices "will eventually stabilize."Since then oil and gasoline prices have fallen sharply, but core inflation has ticked up a little.

Some things to look for:

1) Fed Chairman Press Briefing. This is the second of the new press briefings. The FOMC statement will be released earlier than usual - around 12:30 PM ET on Wednesday, and the Chairman's press briefing will be held at 2:15 PM.

At the press briefing, Chairman Bernanke is expected to discuss the new FOMC forecasts (these forecasts used to be released a few weeks after the FOMC meeting with the minutes). Growth forecasts have probably been revised down since April, the unemployment rate revised up, and inflation forecasts might have been revised up.

Here are the updated forecasts through April. The FOMC GDP forecasts for 2011 were revised down in April, and will probably be revised down again in June.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| June 2011 Projections | ??? | ??? | ??? |

The unemployment rate was revised down in April, but with the uptick in the unemployment rate over the last two months to 9.1%, the unemployment rate for Q4 2011 will probably be revised up this time.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| June 2011 Projections | ??? | ??? | ??? |

I suspect inflation will be a key topic at the FOMC meeting. The forecasts for overall and core inflation were revised up in April and will probably be revised up again in June.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| June 2011 Projections | ??? | ??? | ??? |

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| June 2011 Projections | ??? | ??? | ??? |

2) Possible Statement Changes. I don't expect the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" to be changed any time soon.

There will probably be some changes to the first paragraph to mention the recent softer economic data and pickup in inflation - however the statement will probably say the increase in inflation is expected to be transitory. I expect the phrase "the economic recovery is proceeding at a moderate pace" to be downgraded a little. And the word subdued might be changed in the phrase on inflation: "Inflation has picked up in recent months, but longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued."

3) Timeline for the Fed. Remember all those "analysts" saying QE2 would end early and predicting the Fed would raise rates this year? Wrong again ...

QE2 will end in June as scheduled. It also appears the Fed will continue to reinvest maturing securities - at least for a couple of months following the end of QE2 (the next meeting is in August). This means the Fed's balance sheet will remain stable following the completion of QE2 - until the economy weakens further or the pace of growth picks up.

The next step for the Fed - after the end of QE2 - will be to either: 1) end the reinvestment (if economic growth improves), or 2) launch QE3 (if the economy weakens). I don't think either action is likely in the near term.

And this means the Fed will not raise rates for, well, an "extended period". If they do end reinvestment in the next few months, they will probably wait even longer to drop the "extended period" language, and then a couple more meetings (at least) before they raise rates.

Yesterday:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

NY Times on Backlog of Foreclosures

by Calculated Risk on 6/19/2011 09:27:00 AM

From David Streitfeld at the NY Times: Backlog of Cases Gives a Reprieve on Foreclosures

In New York State, it would take lenders 62 years at their current pace, the longest time frame in the nation, to repossess the 213,000 houses now in severe default or foreclosure, according to calculations by LPS Applied Analytics, a prominent real estate data firm.Of course, because the denominator has declined - and the numerator is still very high - these time frames seem absurd. As an example:

Clearing the pipeline in New Jersey, which like New York handles foreclosures through the courts, would take 49 years. In Florida, Massachusetts and Illinois, it would take a decade.

In the 27 states where the courts play no role in foreclosures, the pace is much more brisk — three years in California, two years in Nevada and Colorado — but the dynamic is the same: the foreclosure system is bogged down by the volume of cases ...

Last September, before the documentation crisis, nearly 1,500 New Yorkers lost their houses as a result of foreclosure, according to LPS. The average over the last six months: 286.So in New York, with 213,000 homes in severe default or foreclosure, and only 286 completed foreclosures per month, gives a backlog of 62 years.

Some of this is due to process delays for some lenders. Some is because lenders are trying to modify more loans. Some is because the lenders already have plenty of REOs (Real Estate Owned).

It won't take anything like 62 years to clear the backlog, but it does show there is a long way to go.

Note: This doesn't quite fit with the recent reports that Fannie, Freddie and the FHA are all completing foreclosures (and selling REO) at a record pace right now ...

Saturday, June 18, 2011

Some Stats on Income Inequality

by Calculated Risk on 6/18/2011 10:28:00 PM

Earlier:

• Summary for Week Ending June 17th

• Schedule for Week of June 19th

From the WaPo: With executive pay, rich pull away from rest of America

The top 0.1 percent of earners make about $1.7 million or more, including capital gains. Of those, 41 percent were executives, managers and supervisors at non-financial companies, according to the analysis, with nearly half of them deriving most of their income from their ownership in privately-held firms. An additional 18 percent were managers at financial firms or financial professionals at any sort of firm.Here is the most recent paper I could find from Saez: Striking it Richer: The Evolution of Top Incomes in the United States

...

Income inequality has been on the rise for decades in several nations, including the United Kingdom, China and India, but it has been most pronounced in the United States, economists say.

In 1975, for example, the top 0.1 percent of earners garnered about 2.5 percent of the nation’s income, including capital gains, according to data collected by University of California economist Emmanuel Saez. By 2008, that share had quadrupled and stood at 10.4 percent.

The phenomenon is even more pronounced at even higher levels of income. The share of the income commanded by the top 0.01 percent rose from 0.85 percent to 5.03 percent over that period. For the 15,000 families in that group, average income now stands at $27 million.

In world rankings of income inequality, the United States now falls among some of the world’s less-developed economies.

The WaPo article focuses on the incomes of non-financial business executives, but I'd focus more on the 18% who were managers at financial firms.