by Calculated Risk on 6/17/2011 06:55:00 PM

Friday, June 17, 2011

Bank Failures #46 & 47 in 2011: Georgia and Florida

Wont' keep the Feds far away

As McIntosh found.

by Soylent Green is People

From the FDIC: Hamilton State Bank, Hoschton, Georgia, Assumes All of the Deposits of McIntosh State Bank, Jackson, Georgia

As of March 31, 2011, McIntosh State Bank had approximately $339.9 million in total assets and $324.4 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $80.0 million. ... McIntosh State Bank is the 46th FDIC-insured institution to fail in the nation this year, and the thirteenth in Georgia.

Not by ye scurvy pirates...

Buccaneer banksters!

by Soylent Green is People

From the FDIC: Stonegate Bank, Fort Lauderdale, Florida, Assumes All of the Deposits of First Commercial Bank of Tampa Bay, Tampa, Florida

As of March 31, 2011, First Commercial Bank of Tampa Bay had approximately $98.6 million in total assets and $92.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $28.5 million. ... First Commercial Bank of Tampa Bay is the 47th FDIC-insured institution to fail in the nation this year, and the sixth in Florida.

Lawler: CAR vs. “Reality,” and the NAR Benchmarking

by Calculated Risk on 6/17/2011 04:09:00 PM

CR Note: The California Association of Realtors (CAR) released their May home sales data this week: May sales and price report

Economist Tom Lawler writes:

Using a “reasonable” estimate of the California Association of Realtors’ (CAR) seasonal factor for May (I have some history of CAR’s NSA numbers), the CAR’s May home sales report would imply an estimate of about 45,000 existing SF detached home sales on an unadjusted basis last month. That number is about 26.6% higher than Dataquick’s (DQ) count of new and existing sales of SF homes and condos in California last May, indicating that the CAR’s existing home sales estimates continue to vastly overstate overall existing home sales in the state.

CAR, of course, uses a methodology similar to the National Association of Realtors (NAR) to estimate existing home sales – it estimated total existing home sales (including sales outside of MLS) in 1999 based on data from the 2000 decennial Census and from the 2001 Residential Finance Survey, and then assumes that total existing home sales growth has been the same as MLS-reported home sales growth since then.

While CAR’s and DQ’s estimates of existing SF home sales in California were reasonably close in 2005 and 2006, they started to diverge significantly in 2007 and by even more so in 2008 and 2009 – with CAR’s estimate materially exceeding DQ’s estimates. Similar “gaps” emerged in other states between the NAR’s estimate of state sales and sales based on property records. Of course, I noted this growing gap back in 2009, and discussed some of the reasons why it was occurring. The gap gained media attention earlier this year following a piece by CoreLogic on the growing disparity between NAR estimates and property records data.

The NAR has pretty much acknowledged that its methodology has probably resulted in an overstatement of existing home sales over the past several years. Normally the NAR would wait for detailed Public Use Microdata Sample (PUMS) data from the decennial Census, as well as data from decennial Residential Finance Survey. These data come out with a long lag, and the NAR’s benchmark revisions for 1999 existing home sales didn’t come out until 2004.

The 2010 decennial Census, however, did not include the “long-form questionnaire” that provided many of the data elements needed for NAR’s decennial benchmarking exercise (the benchmarking methodology, seemed “OK” for principal residence purchases but seemed “iffy” for investor/vacant home sales). As such, the NAR cannot use the same benchmarking methodology as it has done – but just once a decade – in the past.

Recent media attention on what appears to be a growing gap between the NAR’s estimates and “actual” home sales has put pressure on the NAR to accelerate some sort of “rebenchmarking, leading the NAR in February to issue a set of “Q&A’s” on the topic, including this one.

Q: When will the new benchmarking take place?Since I have had discussions in the past with the NAR on this topic, a number of folks have asked me “what’s up” with the NAR’s benchmarking, and when will it release new existing home sales estimates? My answer is, “I don’t know,” and I’m not even sure what methodology the NAR will use.

A: In 2010 Census, a long-form questionnaire was not used. Therefore, the Census no longer asked about whether people moved and bought a home. So another brand new benchmarking process is needed. NAR has already been in contact with all key housing economists in the industry and government agencies and a few in the academia about finding a new benchmarking process. We expect a new clean, agreed-upon benchmark figure by the summer of this year.

In addition, we will be determining a new way to re-benchmark on a more frequent basis, possibly annually to lessen any drift that can accumulate over time. This frequent re-benchmarking, rather than wait every 10 years, is needed since the Census no longer collects the long-form questionnaire. As with all benchmarking, we will be working with various outside housing economists to develop a new-agreed upon method.

One approach NAR had been looking at was whether it could use data from either the American Community Survey (latest 2009) or the American Housing Survey (latest 2009, and small sample), to try to estimate existing home sales (note: the 2009 ACS/AHS would be used to estimate home sales over the second part of 2008 and the first part of 2009). Aside from the fact that (1) these data sources aren’t consistent; and (2) the housing stock estimates are not updated, these data sources also have nothing on investor/second homes. In my view this approach is fatally flawed.

A second approach favored by myself and most other housing economists is for the NAR to use property records wherever available, and to develop methodologies where property records are not available to derive sales estimates in these other areas. Relative to when the NAR first developed its “benchmarking” approach decades ago, there has been a dramatic increase in the availability of/access to property records across most of the country. As a result, in many parts of the country one can directly measure total and existing home sales – though there are some “technical” issues associated with excluding non-arms-length transactions and/or properties acquired by a lender/servicer via foreclosures, as well as in some states identifying new vs. existing homes.

This second approach, however, is not a trivial task. In many states property records are not updated in a timely fashion, and in some cases the lags from sale to recordation in publicly-available files can be pretty long. E.g., CoreLogic’s first published estimate of “non-distressed” existing home sales for the first half of 2010 (published in September 2010) was 1.191 million, but it’s latest count for the first half of 2010 (published in May 2011) was 1.352 million. Last August CL;s count of non-distressed existing homes for 2009 was 2.485 million, but this May’s count was 2.607 million.

There are also often issues on data quality/accuracy, file/data formats, etc., that require significant resources/attention. (The NAR could, of course, contract out this process.)

In addition, estimating sales in areas where no data are available is not a trivial task, and requires certain assumptions that may or may not be valid. Still, this approach is head and shoulders better than any approach using either the ACS or the AHS.

So ..(1) is the NAR going to follow the suggestions of competent housing economists and develop a benchmark based on property records? Don’t know. (2) Will the NAR come out with a new benchmark figure this summer? Don’t know, but if they do I’d bet it would not be based on property records, mainly because I doubt if they have had time to develop robust estimates (unless they have hired a third-party vendor to so do). (3) When they come out with a “benchmark” revision, what year will the benchmark number be for? Don’t know, but if they do it is likely because of data availability to be for either 2008 or 2009, and not 2010. And (4) if/when any benchmark revision comes out, will they show sizable downward revisions? For the 2008-2011 period, absolutely, regardless of what methodology the NAR employs.

CR Note: Now that summer is almost here (starts next week), maybe it is time for the NAR to provide an update on when the benchmark revision will be available - and perhaps some discussion of the new methodology. It is important to understand that the NAR estimates of home sales were probably too high over the last few years (perhaps 10% or more too high last year), and that their estimate of inventory was probably also too high.

This makes it difficult to analyze or use the data - and might have led to policy errors and also means the BEA probably overestimated the Brokers' commissions portion of Residential Investment (slightly) over the last few years!

Hotels: Occupancy Rate increased 3.0 percent compared to same week in 2010

by Calculated Risk on 6/17/2011 01:20:00 PM

Here is the weekly update on hotels from HotelNewsNow.com: STR: US results for week ending 11 June

In year-over-year comparisons for the week, occupancy rose 3.0 percent to 67.7 percent, average daily rate increased 3.5 percent to US$102.09, and revenue per available room finished the week up 6.6 percent to US$69.09.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average for the occupancy rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The summer leisure travel season is now starting, and the occupancy rate will increase over the next few of months. Right now the occupancy rate is tracking closer to 2008 than to 2010 - and well above 2009.

Even though the occupancy rate has mostly recovered back to 2008 levels, ADR and RevPAR are still below the pre-recession levels. ADR is about 3.4% below the level of the same week in 2008 and RevPAR is about 4.6% below.

ADR is up 6.6% from 2009 (same week) and RevPAR is up 17.2% (a combination of higher ADR and much higher occupancy rate - 2009 was the worst year for hotels since the Great Depression).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

State Unemployment Rates "little changed" in May

by Calculated Risk on 6/17/2011 10:45:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

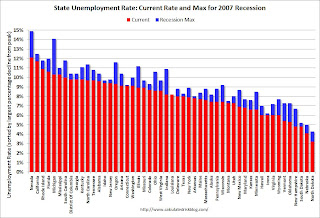

Regional and state unemployment rates were little changed in May. Twenty-four states recorded unemployment rate decreases, 13 states and the District of Columbia registered rate increases, and 13 states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue (only Louisiana in May), the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.1 percent in May. California recorded the next highest rate, 11.7 percent. North Dakota reported the lowest jobless rate, 3.2 percent ...

Nevada recorded the largest jobless rate decrease from May 2010 (-2.8 percentage points). Two other states had rate decreases of more than 2.0 percentage points -- Michigan (-2.5 points) and Indiana (-2.2 points).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Nevada saw the most improvement year-over-year in May, but still has the highest state unemployment rate.

One state is still at the recession maximum (no improvement): Louisiana. Every other state has seen some improvement and only seven states have double digit unemployment now (19 states had double digit unemployment during the worst of the great recession).

Consumer Sentiment declines in June

by Calculated Risk on 6/17/2011 09:55:00 AM

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 74.0.

Morning Greece: Merkel Agrees to "voluntary participation of private creditors"

by Calculated Risk on 6/17/2011 08:39:00 AM

From the NY Times: Germany Backs Down From Confrontation With E.C.B. Over Greece

Germany backed away Friday from a confrontation with the European Central Bank over a new bailout package for Greece, agreeing under pressure from France not to force private investors to shoulder some of the burden.I wonder how much pressure there will be on the private creditors? And how long will "voluntary" remain "voluntary"?

...

“We would like to have a participation of private creditors on a voluntary basis,” Mrs. Merkel said at joint news conference with Mr. Sarkozy.

“This should be worked out jointly with the E.C.B.,” she added. “There shouldn't be any dispute with the E.C.B. on this.”

The Greek 2 year yield is off sharply to 28.2%. Seems strange to say the yields have fallen to 28.2%!

The ten year yields are down to 17.1%.

From the WSJ: Greece Reshuffles Cabinet

Greece's embattled Socialist government announced a sweeping cabinet reshuffle Friday, replacing the country's finance minister in an effort to shore up support for unpopular economic reforms.I think being "unpopular" is part of Greek finance minister's job.

In a statement, spokesman George Petalotis said the government had appointed Evangelos Venizelos as finance minister, replacing George Papaconstantinou.

ECB's Trichet: Greek Default Should Be Avoided

by Calculated Risk on 6/17/2011 01:09:00 AM

From Dow Jones: Trichet: Clear Position Is Greek Default Should Be Avoided - Report

It is the clear position of the European Central Bank that a Greek default in any form should be avoided, as should any action in the Greek crisis that would spawn a credit event, ECB President Jean-Claude Trichet says in an interview to be released Friday.Trichet also said no one is considering that Greece, Portugal or Ireland leave the euro zone.

...

"We are telling them that doing anything that would create a credit event or selective default or default is not advisable," he says.

Still it remains the decision of political authorities and the ECB will act accordingly, based on decisions made, he notes. "But again, we are saying very clearly that they should avoid compulsion, credit event, or selective default or default. Our position is clear."

Earlier from the WSJ: EU Rehn Confident Next Greece Loan Tranche Approval Sunday

Euro-zone governments will agree at a meeting starting Sunday in Luxembourg to pay the next installment of rescue loans for Greece, while delaying the final decision on a longer-term Greek aid package until July, European Union economics commissioner Olli Rehn said in a statement Thursday.This would be a break from the IMF's history ... interesting times.

Rehn strongly implied that the International Monetary Fund, which must also sign off on the loan payment, would agree even if euro-zone governments haven't put a multi-year financing plan in place for the country.

Thursday, June 16, 2011

Another House Price Index shows a small gain in April

by Calculated Risk on 6/16/2011 07:18:00 PM

Back when I started this blog in January 2005, everyone followed the OFHEO index for house prices (now called the FHFA index), and none of the other indexes were publicly available. Although Case-Shiller was made available to the public in 2006, it wasn't widely followed until 2007.

Most reporters just used median prices from the NAR in 2005, but median prices are distorted by the mix of homes sold.

The first mention of the Case-Shiller index on my blog that I could find was in May 2007. The first report about the index in the LA Times appears to be on June 27, 2007 (ht Alex).

This is just a reminder that we were flying blind in 2005 and 2006!

Now the most followed house price indexes are Case-Shiller and CoreLogic; both repeat sales indexes. The FHFA index is still followed, but not as closely - it is also a repeat sales index, but only for homes with loans sold to or guaranteed by Fannie Mae or Freddie Mac.

There are several other house price indexes that I follow now: RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

Recently Scott Sambucci, VP of Analytics at Altos Research, presented his outlook: Catfish Recovery: The Future Of US Housing

I'm planning on mentioning these other indexes, in addition to Case-Shiller and CoreLogic, and discussing some of the differences.

FNC released their house price indexes for April today. According to FNC, their Composite index of 20 cities (same cities as Case-Shiller) was up 0.7% in April. You can see the FNC composite indexes, and prices for 30 cities here.

Earlier this month, CoreLogic reported: CoreLogic® Home Price Index Shows First Month-over-Month Increase since mid-2010 (graphs here).

Other indexes - like Zillow - are still showing declines in April.

I prefer more data to almost no data, like back in 2005. But now we have to sort through all these indexes and figure out what they mean. It does appear the price declines have slowed - or prices might have increased slightly in April (CoreLogic and FNC). Some of this could be seasonal ...

Earlier:

• Housing Starts increase in May

• Residential Investment: Mutli-family Starts and Completions

• Philly Fed Survey: "Regional manufacturing activity weakened in June"

• Weekly Initial Unemployment Claims decrease to 414,000

Building Home Equity the Old-fashioned Way

by Calculated Risk on 6/16/2011 03:32:00 PM

From Prashant Gopal at Bloomberg: Homeowners Refinance to 15-Year Mortgages to Add Equity (ht Brian)

Cecelia Kirchman happily added $250 to her payment when she refinanced last August. ... [The Kirchmans] are among the growing number of “equity builders” -- creditworthy homeowners with steady jobs and enough cash to lock in near record-low interest rates and shorten the length of their loans ...Ahhh ... building equity the old-fashioned way.

The portion of borrowers refinancing in January who took 15-year mortgages rose to 29 percent from 11 percent two years earlier ...

The share of cash-in refinancings reached a record 44 percent in the fourth quarter, according to data from Freddie Mac dating to 1985. (see Freddie Mac: Very low Cash-Out Refinance Activity for more stats) ...

“They are people who -- rather than waiting for home values to rise -- are taking matters into their own hands,” [Stuart Feldstein, president of SMR Research Corp] said. “They are building equity on their own.”

And that brings up the topic of "burning the mortgage" - a quaint old traditional that might make a come back ...

The text reads: “Burning the Mortgage – a memorable event in the typical American home. The toast – with MILLER HIGH LIFE, of course”

The "typical American home"? I wonder what they would have thought of all the mortgage brokers a few years ago talking about home equity being "dead money"?

And from the Bloomberg article:

Switching to a 15-year term made sense for Kirchman, 55, who has no plans of moving anytime soon and is looking ahead to retirement. ... “I’ll be retiring in 10 to 12 years,” Kirchman said. “I don’t like the thought of still having that as an expense. I’d rather be taking trips.”I hope she plans a nice mortgage burning party!

Residential Investment: Mutli-family Starts and Completions

by Calculated Risk on 6/16/2011 12:11:00 PM

Also from the Housing Starts report this morning ...

Although the number of multi-family starts can vary significantly from month to month, apartment owners are seeing falling vacancy rates, and some have started to plan for 2012 and 2013 and will be breaking ground this year. So I've been forecasting a pickup in multi-family starts this year.

However, since it takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - there will be a record low, or near record low, number of multi-family completions this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

The rolling 12 month total for starts (blue line) is now at the same level as the rolling 12 month for completions (red line), but they are heading in opposite directions. Starts are picking up and completions are declining.

It is important to note that even if there is a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). The following table shows RI in Q1 2011:

| Residential Investment, Q1 2011 | ||

|---|---|---|

| Dollars (millions) SAAR | Percent of RI | |

| Single-family structures | $106,736 | 32.9% |

| Improvements | $151,622 | 46.8% |

| Multifamily structures | $12,734 | 3.9% |

| Brokers' commissions on sale of structures | $52,152 | 16.1% |

| Other | $888 | 0.3% |

Usually investment in single-family structures is over half of RI, but obviously single-family is very depressed right now. A strong pickup in multi-family might only add a couple of percent to residential investment, but it also appears that home improvement is picking up a little. And some increase for both multi-family and home improvement is why I expect RI to make a positive contribution to both GDP and employment (residential construction) in 2011 for the first time since 2005.

Anecdotal evidence: I visited the local planning department yesterday, and I was told that permit activity has picked up over the last couple of months. I went upstairs to chat, and when I came back down the lobby was full - something they haven't seen for some time.