by Calculated Risk on 6/03/2011 12:28:00 PM

Friday, June 03, 2011

ISM Non-Manufacturing Index indicates slightly faster expansion in May

Note: The traffic this morning overwhelmed the graph server. I'm working with the provider, and it appears everything is OK now. Here is the Employment graph gallery.

The May ISM Non-manufacturing index was at 54.6%, up from 52.8% in April. The employment index increased in May at 54.0%, up from 51.9% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2011 Non-Manufacturing ISM Report On Business®

activity in the non-manufacturing sector grew in May for the 18th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 54.6 percent in May, 1.8 percentage points higher than the 52.8 percent registered in April, and indicating continued growth at a faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 0.1 percentage point to 53.6 percent, reflecting growth for the 22nd consecutive month, but at a slightly slower rate than in April. The New Orders Index increased by 4.1 percentage points to 56.8 percent. The Employment Index increased 2.1 percentage points to 54 percent, indicating growth in employment for the ninth consecutive month and at a faster rate. The Prices Index decreased 0.5 percentage point to 69.6 percent, indicating that prices increased at a slightly slower rate in May when compared to April. According to the NMI, 16 non-manufacturing industries reported growth in May. Respondents' comments are mostly positive about overall business conditions. There is a sentiment that there is a degree of stability in the economy; however, a continued concern exists over fuel costs and various volatile commodities."

emphasis added

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Both moved up slightly in May, and this was slightly above expectations (a first for this week!)

Earlier Employment posts:

• May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment graph gallery

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 6/03/2011 10:15:00 AM

Note: Apparently the graph server had a problem this morning. It appears to be working now (all the links were OK). Here is the employment graph gallery. Sorry for the inconvenience.

This was a very disappointing report.

There were few jobs created (only 54,000 total and 83,000 private sector). The unemployment rate increased from 9.0% to 9.1%, even though the participation rate was unchanged at 64.2%. Note: This is the percentage of the working age population in the labor force. I expect the participation rate to move a little higher as the job market improves, and that will keep the unemployment rate elevated all year.

The average workweek was unchanged at 34.4 hours, and average hourly earnings increased slightly. "In May, average hourly earnings for all employees on private nonfarm payrolls increased by 6 cents, or 0.3 percent, to $22.98. Over the past 12 months, average hourly earnings increased by 1.8 percent."

We have to remember that this is just one month - even if the numbers were dismal. So far the economy has added 908,000 private sector jobs this year, or about 181 thousand per month. There have been 783,000 total non-farm jobs added this year or 157 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.95 million fewer payroll jobs than at the beginning of the 2007 recession. At this pace (157 thousand jobs per month), it will take almost 4 years just to get back to the pre-recession level, or sometime in late 2014 or early 2015!

There are a total of 13.9 million Americans unemployed and 6.2 million have been unemployed for more than 6 months. Very grim numbers.

Overall this was a weak report and reminds us that unemployment and underemployment are critical problems in the U.S.

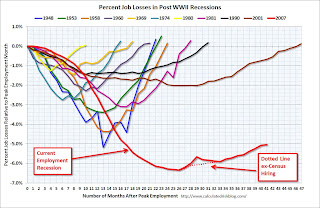

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at the start of the recession.

In the previous post, the graph showed the job losses aligned at maximum job losses.

In terms of lost payroll jobs, the 2007 recession is by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged in May at 8.5 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) decreased slightly to 8.548 million in May from 8.6 million in April.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased slightly to 15.8% in May from 15.9% in April. This is very high.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.2 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 5.839 million in April. This remains very high, and long term unemployment is one of the defining features of this employment recession.

• Earlier Employment post: May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

May Employment Report: 54,000 Jobs, 9.1% Unemployment Rate

by Calculated Risk on 6/03/2011 08:30:00 AM

From the BLS:

Nonfarm payroll employment changed little (+54,000) in May, and the unemployment rate was essentially unchanged at 9.1 percent, the U.S. Bureau of Labor Statistics reported today. Job gains continued in professional and business services, health care, and mining. Employment levels in other major private-sector industries were little changed, and local government employment continued to decline.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

...

The change in total nonfarm payroll employment for March was revised from +221,000 to +194,000, and the change for April was revised from +244,000 to +232,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The unemployment rate increased to 9.1% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in May (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.4% in May (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring. The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This was well below expectations for payroll jobs, and the unemployment rate was higher than expected (both worse). I'll have much more soon ...

Thursday, June 02, 2011

HUD Secretary Donovan: Foreclosure Settlement in a "matter of weeks"

by Calculated Risk on 6/02/2011 09:31:00 PM

From the LA Times: Foreclosure settlement to come in a 'matter of weeks,' HUD secretary says

A settlement between a coalition of federal and state agencies and banks over foreclosure practices will come in a “matter of weeks,” Shaun Donovan, secretary of Housing and Urban Development, told the Los Angeles Times.This isn't just about the amount, but also how the money is counted. The banks want to count "cash for keys" payments and possibly even principal reduction - in other words for costs they are already paying. Not much of a penalty.

...

Banks have said they are willing to pay a settlement of $5 billion, according to Bloomberg News, while government officials have pushed for a settlement of as much as $25 billion, according to Times reporting.

Labor Mobility: Starting to Increase

by Calculated Risk on 6/02/2011 05:44:00 PM

From the Financial Times: US job relocation activity picks up sharply

Companies that specialise in corporate relocations said they were seeing double-digit increases in their businesses compared with the same period a year ago. They added that corporate relocations ... are far outpacing more modest gains in other types of moves such as those by members of the military or government employees.This may be increasing, but it is from a very low level.

excerpt with permission

Challenger, Gray & Christmas tracks manager mobility each quarter. In 2010, there were a record low percent of job seekers who relocated for a new position (percent of those who found jobs). The percentage picked up a little in Q1 2011, but it is an easy comparison to last year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is the quarterly data from Challenger, Gray through Q1 2011. Mobility has been trending down for some time, but collapsed in 2010.

It appears the lower mobility was related to the housing market. The Financial Times notes that the first question many companies ask when interviewing out-of-area potential hires is: "What do you owe on your house?"

It is tough to move when you can't sell your home. Sometimes the new employer will pick up the short fall for key executives and managers, but it is probably too expensive for potential hires with serious negative equity.

Greece Report: Agreement on New Bailout, Some Investor Participation, No "intrusive" Supervision

by Calculated Risk on 6/02/2011 02:22:00 PM

There are no specifics yet ...

From Reuters: EU agrees in principle on new Greek plan-source

Senior euro zone officials have agreed in principle on a new three-year adjustment programme for Greece to run until mid-2014 ... involve some participation of private sector investors ... involve detailed commitments by Greece on the governance of a new national wealth agency and the timing of specific privatisations, but it would stop short of intrusive international supervision ...There had been some discussion of "adult supervision" or what some were calling the loss of Greek sovereignty - apparently that isn't included. It isn't clear what the "participation of private sector investors" means, but the article suggests it will not trigger a credit event.

Employment Situation Preview: Fewer Payroll Jobs Added, Grim Overall

by Calculated Risk on 6/02/2011 11:30:00 AM

Tomorrow the BLS will release the May Employment Situation Summary at 8:30 AM ET. As I noted in the weekly schedule, the consensus forecast for payroll jobs seems too high; Bloomberg is showing the consensus is for an increase of 190,000 payroll jobs in May, and for the unemployment rate to decline to 8.9%.

Of course many analysts have reduced their forecasts this week based on the ISM manufacturing survey and the ADP employment report. As an example, in a note last night, Goldman chief economist Jan Hatzius wrote:

"We have lowered our forecast for nonfarm payroll growth in May to +100,000 from +150,000 previously. This shift is a direct response to the downbeat data so far this week, including big disappointments in the ADP report on private-sector employment, the ISM manufacturing survey, and the Conference Board's consumer confidence index. Our forecasts for the unemployment rate and average hourly earnings remain unchanged at 8.9% and +0.2%, respectively."Here is a summary of recent data:

• The ADP employment report (private sector only) showed an increase of only 38,000 payroll jobs in May. This was significant below the 194 thousand per month average for the first four months of the year.

• Initial weekly unemployment claims have averaged 425,500 per week in May, about the same as in December 2010 and January 2011. The BLS reported an average of just over 100 thousand payroll jobs added during those two months (although there were some weather issues in January).

• The ISM manufacturing index slowed sharply in May, however the Institute for Supply Management noted: "Manufacturing employment continues to show good momentum for the year, as the Employment Index registered 58.2 percent, which is 4.5 percentage points lower than the 62.7 percent reported in April." This suggests manufacturers were still expanding their payrolls in May (the regional manufacturing surveys also showed payroll expansion).

A few examples of regional reports: The Chicago PMI reported: "Breadth of EMPLOYMENT expansion softened but remained strong." The employment index decreased to a still strong 60.8 from 63.7 (above 50 is expansion). And the Philly Fed reported: "Firms’ responses continue to indicate overall improvement in the labor market despite weaker activity ..." and the Empire State survey showed "The index for number of employees inched up to 24.7, indicating that employment levels expanded over the month, and the average workweek index rose thirteen points to 23.7, a multi-year high." (above 0 is expansion).

So even as activity slowed, manufacturers continued to hire. This suggests that many manufacturers believe the slowdown is temporary.

• The final May Reuters / University of Michigan consumer sentiment index increased to 74.3 from the preliminary reading of 72.4, and from 69.8 in April. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the slight improvement in May).

• The final May Reuters / University of Michigan consumer sentiment index increased to 74.3 from the preliminary reading of 72.4, and from 69.8 in April. This is frequently coincident with improvements in the labor market - but also strongly related to gasoline prices (Gasoline was probably the reason for the slight improvement in May). • And on the unemployment rate from Gallup: U.S. Unemployment Stagnant in May

Unemployment, as measured by Gallup without seasonal adjustment, stood at 9.2% at the end of May -- unchanged from mid-May and down slightly from 9.4% at the end of April. It is also slightly lower than it was at the same time last year (9.5%).NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. This suggests the unemployment rate will be about the same or decline slightly in May.

• Even if the payroll report shows improvement, the employment situation remains grim. There are 6.955 million fewer payroll jobs now than before the recession started in 2007 with 13.7 million Americans currently unemployed. Another 8.6 million are working part time for economic reasons, and about 4 million more workers have left the labor force. And 5.84 million have been unemployed for six months or more. Numbers to remember.

• Oh, one thing is for sure, some commentators will incorrectly use the BLS birth/death model!

Obviously the economy slowed in May, and the employment report will most likely reflect this slowdown. I expect something close to 100 thousand payroll jobs.

Weekly Initial Unemployment Claims decline slightly to 422,000

by Calculated Risk on 6/02/2011 08:40:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 28, the advance figure for seasonally adjusted initial claims was 422,000, a decrease of 6,000 from the previous week's revised figure of 428,000. The 4-week moving average was 425,500, a decrease of 14,000 from the previous week's revised average of 439,500.The following graph shows the 4-week moving average of weekly claims for the last 40 years.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 425,500.

This is the eight straight week with initial claims above 400,000, and the 4-week average is at about the same the level as in January when there were fewer payroll jobs being added.

Wednesday, June 01, 2011

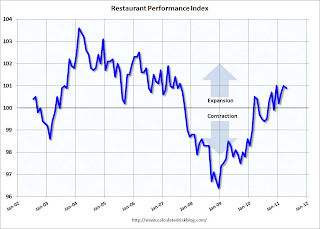

Restaurant Performance Index indicates expansion in April

by Calculated Risk on 6/01/2011 10:29:00 PM

Earlier today the economic data was weak:

• ADP: Private Employment increased by 38,000 in May

• ISM Manufacturing index declines to 53.5 in May

• U.S. Light Vehicle Sales 11.8 million SAAR in May

The restaurant index is one of several industry specific indexes I track each month. The following report is for April.

From the National Restaurant Association: Restaurant Industry Outlook Remains Positive as Restaurant Performance Index Stood Above 100 for Fifth Consecutive Month

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.9 in April, essentially unchanged from a level of 101.0 in March. In addition, April represented the fifth consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Restaurant operators continued to report net positive same-store sales results in April. ... Restaurant operators also reported a net increase in customer traffic in April, although levels were somewhat softer than the March results.

...

Capital spending activity among restaurant operators trended upward in recent months. Forty-eight percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the highest level in nearly three years.

...

For the seventh consecutive month, restaurant operators reported a positive outlook for staffing levels in the coming months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index decreased to 100.9 in April (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This report was for April, and the economy clearly slowed in May (so the report next month will be interesting). This is a minor report (really not even "D-List" data), but I'd expect discretionary spending to slow sharply if consumers become really worried.

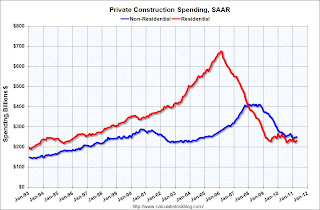

Construction Spending increased 0.4% in April

by Calculated Risk on 6/01/2011 06:55:00 PM

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in April:

[C]onstruction spending during April 2011 was estimated at a seasonally adjusted annual rate of $765.0 billion, 0.4 percent (±1.6%) above the revised March estimate of $762.1 billion. The April figure is 9.3 percent (±1.6%) below the April 2010 estimate of $843.1 billion.Private construction spending also increased in April:

Spending on private construction was at a seasonally adjusted annual rate of $483.0 billion, 1.7 percent (±1.4%) above the revised March estimate of $474.7 billion. Residential construction was at a seasonally adjusted annual rate of $232.1 billion in April, 3.1 percent (±1.3%) above the revised March estimate of $225.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $250.8 billion in April, 0.5 percent (±1.4%)* above the revised March estimate of $249.6 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

The small increase in non-residential in April was mostly due to power. Office and lodging construction spending declined.

Residential spending is 65.7% below the peak in early 2006, and non-residential spending is 39.4% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.