by Calculated Risk on 6/01/2011 11:07:00 AM

Wednesday, June 01, 2011

General Motors: U.S. May sales decrease 1.2% year-over-year

From MarketWatch: General Motors U.S. May sales fall 1.2%

[GM] said Wednesday that May U.S. car sales fell 1.2% to 221,192 vehicles from 223,822 a year ago.The key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total May light vehicle sales (SAAR) - usually around 4 PM ET.

The consensus is for a decrease to 12.8 million SAAR in May from 13.2 million SAAR in April, however I think we will see a sharper decline because of supply chain issues. Sales in May 2010 were at a 11.62 million SAAR. I'll add the reports from the other major auto companies as updates to this post.

Update from MarketWatch: Ford U.S. May sales virtually flat

Ford said Wednesday U.S. May sales were virtually flat, declining 0.1% to 192,102 vehicles, compared with 192,253 in the year-ago period.Yesterday on housing:

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Lawler: Census 2010 and the US Homeownership Rate

• Home Prices Graph Gallery

ISM Manufacturing index declines to 53.5 in May

by Calculated Risk on 6/01/2011 10:00:00 AM

PMI was at 53.5% in May, sharply down from 60.4% in April. The employment index was at 58.2 and new orders at 51.0. All lower than in April.

From the Institute for Supply Management: May 2011 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 53.5 percent and indicates expansion in the manufacturing sector for the 22nd consecutive month. This month's index, however, registered 6.9 percentage points below the April reading of 60.4 percent, and is the first reading below 60 percent for 2011, as well as the lowest PMI reported for the past 12 months. Slower growth in new orders and production are the primary contributors to this month's lower PMI reading. Manufacturing employment continues to show good momentum for the year, as the Employment Index registered 58.2 percent, which is 4.5 percentage points lower than the 62.7 percent reported in April. Manufacturers continue to experience significant cost pressures from commodities and other inputs."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was well below expectations of 57.5%, but pretty much in line with the regional surveys.

ADP: Private Employment increased by 38,000 in May

by Calculated Risk on 6/01/2011 08:15:00 AM

ADP reports:

Employment in the nonfarm private business sector rose 38,000 from April to May on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from March 2011 to April 2011 was revised down slightly to 177,000 from the previously reported increase of 179,000.Note: ADP is private nonfarm employment only (no government jobs).

...

May’s ADP Report estimates employment in the service-providing sector rose by 48,000, marking 17 consecutive months of employment gains while employment in the goods-producing sector fell 10,000 following six months of increases. Manufacturing employment fell 9,000 in May following seven consecutive monthly gains.

This was well below the consensus forecast of an increase of 178,000 private sector jobs in May. The BLS reports on Friday, and the consensus is for an increase of 190,000 payroll jobs in May, on a seasonally adjusted (SA) basis. This is a very weak ADP report - and more evidence that the BLS report will be below consensus on Friday.

Yesterday ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

MBA: Mortgage Purchase application activity flat, Refinance activity declines

by Calculated Risk on 6/01/2011 07:18:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

Refinance Index decreased 5.7 percent from the previous week. The seasonally adjusted Purchase Index was essentially unchanged from one week earlier.

...

"Interest rates fell last week as incoming economic data was weaker than anticipated. Despite this drop in rates, the number of refinance applications fell. In fact, the last time mortgage rates were this low, refinance volume was more than twenty percent higher. It is likely that many borrowers still cannot qualify to refinance given the lack of equity in their homes," said Mike Fratantoni, MBA's Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.58 percent from 4.69 percent, with points increasing to 1.01 from 0.69 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The 30-year rate is the lowest since November 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Refinance activity decreased even as mortgage rates declined - probably because most people who can refinance did so last year when rates were lower.

The four week average of purchase activity is at about 1997 levels. Of course this doesn't includes cash buyers - and there is a very high percentage of cash buyers right now. This suggests weak existing home sales through mid-year (not counting cash buyers).

Tuesday, May 31, 2011

Lawler: Census 2010 and the US Homeownership Rate

by Calculated Risk on 5/31/2011 07:32:00 PM

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

CR Note: The following is from economist Tom Lawler. He points out that the homeownership rate in April 2010 was significantly lower than previously thought. Tom also notes that the age adjusted homeownership rate was lower in April 2010 than in April 1990! Yeah, 1990.

Economist Tom Lawler writes: Census 2010 and the US Homeownership Rate: Where’s the Media?

While the data released for Census 2010 on households and housing was probably the most important “macro” housing data released by Census over the last several years, media coverage was surprisingly scant. (I am not including blogs in my definition of “media.) Many newspapers and other media that religiously report on the quarterly Housing Vacancy Survey data, especially the homeownership rate, failed to run stories highlighting that the homeownership rate last April was in fact substantially lower than previous HVS estimates had suggested, and was significantly below the homeownership rate in 2000. Indeed, a Bloomberg/Business Week story today entitled “Rising Rents Risk U.S. Inflation as Fed Restraint Questioned” noted that “the rate of homeownership has fallen to 66.4 percent, the lowest since 1998, data from the Census Bureau show,” citing HVS estimates for Q1/2011, but it failed to mention that new Census 2010 data indicated that the US homeownership rate in the middle of the first half of last year was 65.1%, far below the HVS estimate of 67%.

Here is a table from last week’s report on the various estimates of the US homeownership rate from different Census Bureau reports.

| Various Estimates, US Homeownership Rate | ||||

|---|---|---|---|---|

| HVS (Annual Avg) | ACS (Annual Avg) | Census (April 1) | CPS/ASEC (March) | |

| 1990 | 63.9% | N/A | 64.2% | 64.1% |

| 2000 | 67.5% | 65.3% | 66.2% | 67.2% |

| 2001 | 67.9% | 65.7% | 67.8% | |

| 2002 | 67.9% | 66.4% | 68.1% | |

| 2003 | 68.3% | 66.8% | 68.2% | |

| 2004 | 69.0% | 67.1% | 68.8% | |

| 2005 | 68.9% | 66.9% | 69.3% | |

| 2006 | 68.8% | 67.3% | 68.5% | |

| 2007 | 68.1% | 67.2% | 68.3% | |

| 2008 | 67.8% | 66.6% | 67.9% | |

| 2009 | 67.4% | 65.9% | 67.3% | |

| 2010 | 66.9% | N/A | 65.1% | 67.0% |

The Decennial Census numbers are far and away the most accurate. No one knows for sure why both the CPS/ASEC and the CPS/HVS estimates have been pretty far off the mark for over a decade.

Clearly, the housing and mortgage market collapse in the second half of last decade has resulted in a MUCH steeper drop in the US homeownership rate than previous CPS/HVS reports had suggested, though from what level is not crystal clear.

The decline in the US homeownership rate from 2000 to 2010 is especially striking given the fact that the age distribution of the US shifted materially to an “older” population. Older age groups typically have materially higher headship rates and homeownership rates than do younger households, and ceteris paribus a shift in the age distribution such as that seen over the last decade would have resulted in a HIGHER homeownership rate.

While Census has not yet released household and housing tenure by age groups from Census 2010, it has released the distribution of the population by age. Here is a comparison of Census 1990, Census 2000, and Census 2010 for various age groups. (These are the “official” 1990 and 2000 numbers).

| Census Population by Age | Percent of Total 15+ | |||||

|---|---|---|---|---|---|---|

| Age | 2010 | 2000 | 1990 | 2010 | 2000 | 1990 |

| 15-24 | 43,626,342 | 39,183,891 | 36,774,327 | 17.6% | 17.7% | 18.8% |

| 25-34 | 41,063,948 | 39,891,724 | 43,175,932 | 16.6% | 18.0% | 22.1% |

| 35-44 | 41,070,606 | 45,148,527 | 37,578,903 | 16.6% | 20.4% | 19.3% |

| 45-54 | 45,006,716 | 37,677,952 | 25,223,086 | 18.2% | 17.0% | 12.9% |

| 55-64 | 36,482,729 | 24,274,684 | 21,147,923 | 14.7% | 11.0% | 10.8% |

| 65-74 | 21,713,429 | 18,390,986 | 18,106,558 | 8.8% | 8.3% | 9.3% |

| 75+ | 18,554,555 | 16,600,767 | 13,135,273 | 7.5% | 7.5% | 6.7% |

| Percent greater than 45 | 49.2% | 43.8% | 39.8% | |||

| Percent less than 35 | 34.2% | 35.8% | 41.0% | |||

Here’s some history of homeownership rates and headship rates for these age groups. The “headship rate” shown is simply the number of households in each age group divided by the population in that age group.

| Homeownership Rate | Headship Rate | |||||

|---|---|---|---|---|---|---|

| 2010 | 2000 | 1990 | 2010 | 2000 | 1990 | |

| 15-24 | 17.9% | 17.1% | 14.1% | 13.7% | ||

| 25-34 | 45.6% | 45.3% | 45.9% | 46.0% | ||

| 35-44 | 66.2% | 66.2% | 53.1% | 54.3% | ||

| 45-54 | 74.9% | 75.3% | 56.5% | 56.7% | ||

| 55-64 | 79.8% | 79.7% | 58.7% | 58.5% | ||

| 65-74 | 81.3% | 78.8% | 62.6% | 63.6% | ||

| 75+ | 74.7% | 70.4% | 64.1% | 64.4% | ||

| US Total | 65.1% | 66.2% | 64.2% | |||

If 2010 headship rates and homeownership rates for each age group had been the same as in 1990, the US homeownership rate would have been 66.7% instead of 65.1%. If 2010 headship rates and homeownership rates had been the same as in 2000, the US homeownership rate would have been 67.3%!

In fact, the aggregate data suggest that in 2010 the homeownership for most age groups was probably below 1990 rates!!!

Last week’s report, then, was clearly the BIGGEST STORY ON US HOMEOWNERSHIP in many, many years. So ... why the lack of media coverage?

I can’t easily say, but there may be several reasons. First, of course, Census 2010 took a snapshot of the US over a year ago, and as such some reporters may have viewed the data as “stale,” and would rather report on more current data from the CPS/HVS even though that report has now been discredited. Second, trying to write a story on WHY the CPS/HVS data substantially overstated the US homeownership rate for at least a decade, with the “miss” clearly growing, in a fashion that readers could understand is not an easy task, requiring thought, analysis, and an ability to write about complex issues in an understandable way.

But ... it’s a pretty sad statement about journalists covering the US housing market!! Ditto, by the way, on vacancies, but that’s another piece!

CR Note: This indicates that the age adjusted homeownership rate has fallen below the 1990 homeownership rate. All my previous analysis was based on the HVS data, and now that Census 2010 data has been released, the previous analysis is unfortunately incorrect (I need to think about the implications).

Here is a spreadsheet of Lawler's tables, plus a calculation of the age adjusted homeownership rates using the 1990 and 2000 data. Most of the increase in the homeownership rate in the from 1990 to 2000 was simply due to the aging of the population (older people generally have a higher homeownership rate).

As Lawler mentions, this means that when the Census 2010 age group homeownership rate data is released, the homeownership rates for most age groups will probably below both the 1990 and 2000 rates.

Renters and the Mini-Boom in Miami

by Calculated Risk on 5/31/2011 03:43:00 PM

From Arian Campo-Flores at the WSJ: Miami Renters Fuel a Boomlet

When the real estate market collapsed five years ago, this city's downtown soon became an emblem of the worst excesses of the building boom. Glittering new towers sat mostly vacant.This is an example of excess inventory being absorbed. Many of these condos were bought by international buyers and / or investors, and many are now occupied by renters. These are not "accidental landlords" (homeowners who rented their homes because they couldn't sell) - these are cash flow investors. Yes, some investors will sell if prices start to increase, keeping prices from rising quickly, but they can also be patient since many paid cash - so I wouldn't count this as shadow inventory.

Those towers are filling up much sooner than some analysts predicted. The new arrivals, mostly renters, are spurring the establishment of restaurants, bars and shops.

...

Condo sales here began surging after property owners slashed prices about two years ago, sometimes by 50% or more. ... Fewer than 4,000 out of the 22,000 new units built since 2003 remain unsold, according to Condo Vultures.

Note: The Case-Shiller index indicated prices in Miami are off 50.4% from the peak - and many of these condos sold for more than half off.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

Real House Prices and Price-to-Rent: Back to 1999

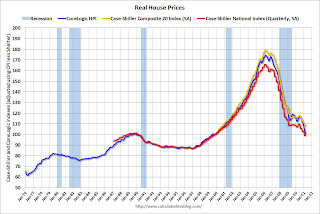

by Calculated Risk on 5/31/2011 12:35:00 PM

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 1999/2000 levels.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through March) in nominal terms (as reported).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is slightly above the May 2009 lows (and close to June 2003 levels), and the CoreLogic index is back to January 2003.

Note: The not seasonally adjusted Case-Shiller Composite 20 Index (NSA) is back to April 2003 levels.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to November 1999.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range. In many areas - with an increasing population and land constraints - there is an upward slope to real prices (see: The upward slope of Real House Prices)

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to December 1999.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• The Excess Vacant Housing Supply

Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

by Calculated Risk on 5/31/2011 10:58:00 AM

• From the Chicago Business Barometer™ Dropped: The overall index decreased to 56.6 from 67.6 in April. This was below consensus expectations of 62.3. Note: any number above 50 shows expansion.

"Breadth of EMPLOYMENT expansion softened but remained strong." The employment index decreased to a still strong 60.8 from 63.7. The new orders index decreased to 53.5 from 66.3.

• From the Dallas Fed: Texas Manufacturing Activity Expands

Texas factory activity increased in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 8 to 13 with 27 percent of respondents noting output increased from April.This is the last of the regional Fed surveys for May. The regional surveys provide a hint about the ISM manufacturing index - and most of the regional surveys were weak this month as the following graph shows.

Other measures of current manufacturing conditions also indicated growing activity, although the pace of new orders slowed. ... Labor market indicators reflected more hiring and longer workweeks. The employment index came in at 12, with the share of manufacturers adding workers reaching its highest level this year. The hours worked index jumped up from -1 in April to 13 in May.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through May), and averaged five Fed surveys (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The regional surveys suggest the ISM manufacturing index will fall to the mid-50s or so. The ISM index for May will be released tomorrow, June 1st, and expectations are for a decrease to 57.5 from 60.4 in April (I think the consensus is too high).

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

Case Shiller: National Home Prices Hit New Low in 2011 Q1

by Calculated Risk on 5/31/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March (actually a 3 month average of January, February and March).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities), plus the Q1 2011 quarterly national house price index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:National Home Prices Hit New Low in 2011 Q1

Data through March 2011 ... show that the U.S. National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter’s data and posted an annual decline of 5.1% versus the first quarter of 2010. Nationally, home prices are back to their mid-2002 levels.

...

As of March 2011, 19 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to March 2010. Twelve of the 20 MSAs and the 20-City Composite also posted new index lows in March. With an index value of 138.16, the 20-City Composite fell below its earlier reported April 2009 low of 139.26. Minneapolis posted a double-digit 10.0% annual decline, the first market to be back in this territory since March 2010 when Las Vegas was down 12.0% on an annual basis. In the midst of all these falling prices and record lows, Washington DC was the only city where home prices increased on both a monthly (+1.1%) and annual (+4.3%) basis.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2010.

The Composite 20 SA is down 3.5% compared to March 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011. ... Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle. Washington D.C. was the only MSA displaying positive trends with an annual growth rate of +4.3% and a 1.1% increase from its February level.There could be some confusion between the SA and NSA numbers. The National index and Composite 20 (NSA) are both at new post-bubble lows.

I'll have more soon ...

Monday, May 30, 2011

The Excess Vacant Housing Supply

by Calculated Risk on 5/30/2011 09:45:00 PM

Last week economist Tom Lawler looked at the national excess vacant housing supply by using the Census 2010 data and comparing to the 2000 and 1990 census data.

I've been looking at the same data, but on a state by state basis. As Tom noted, trying to determine the excess supply as of April 1, 2010 requires an estimate of the normal vacancy rates. Some states always have high vacancy rates on April 1st because of the large number of second homes - like Maine - so what we need to do is compare the 2010 state vacancy rates to the previous census vacancy rates.

But we also have to remember what was happening in 1990 and 2000. There was a regional housing bubble in California, Arizona and several other states in the late '80s, and the 2000 Census happened at the end of stock bubble when the demand for housing was strong (so the excess vacant inventory was probably below normal).

So calculating excess inventory by comparing to the 2000 Census probably gives a number that is too high - and comparing to the 1990 Census gives a number that is too low. So, like Lawler, I also calculated an excess supply based on a combination of the 1990 and 2000 data.

A few notes:

• For those interested, here is the spreadsheet (with the 1990, 2000, and 2010 data and some calculations).

• Just because a state appears to have no vacant excess inventory doesn't mean there isn't any inventory - this calculation is based on an estimate of a normal level of inventory.

• Remember that this is for April 1, 2010. The builders have a completed a record low number of housing units over the last 14 months, and the excess supply is probably lower now.

• House prices depend on local supply and demand - and also on the number of distressed homes on the market (forced sellers). But the excess vacant inventory is important for forecasting when new construction will increase - assuming the builders can compete with all the distressed homes on the market (that story yesterday on San Diego was interesting).

The columns are sortable in the following table. My guess is the excess inventory was above 1.8 million on April 1, 2010, and that the excess is probably several hundred thousand units lower now. Tom Lawler thought the excess was in the 1.6 to 1.7 million range on April 1, 2010, and is probably in the 1.2 to 1.4 million range now.

It is no surprise that Florida has the largest number of excess vacant units and that Nevada has the largest percentage of excess vacant units. What might be a surprise to some is that California is below the U.S. average.

Weekend ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th