by Calculated Risk on 5/23/2011 09:29:00 AM

Monday, May 23, 2011

European Woes

Not a good few days for Europe. S&P warned on Italy, Fitch downgraded Greece and said an extension of maturities would be considered a default. There were large protests in Spain and Iceland's Eyjafjallajökull volcano erupted.

From Bloomberg: Greece Readies Crisis-Fighting Steps

The cost to insure Greek debt against default rose to a record and the yield on its 10-year bonds increased to a euro- era high after Standard & Poor’s said May 20 it may cut Italy’s credit rating. That warning came hours after Fitch Ratings cut Greece three grades ... and said it would consider an extension of maturities as a default.Naturally bond yields are rising for some countries - and falling in Germany and in the U.S. (flight to quality). Here is a table for some European bond yields via Bloomberg (ht Nemo for the links). The Greece 10-year bond yield is now over 17% (another new record).

“Greece risks a sovereign default and finance ministers have expressed strong doubts about the sluggish progress,” French Finance Minister Christine Lagarde said in a May 20 interview with Austria’s Der Standard.

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

Chicago Fed: Economic activity weakened in April

by Calculated Risk on 5/23/2011 08:30:00 AM

From the Chicago Fed: Index shows economic activity weakened in April

Led by declines in production-related indicators, the Chicago Fed National Activity Index fell to –0.45 in April from +0.32 in March. April marked the lowest reading of the index since August 2010.

...

The index’s three-month moving average, CFNAI-MA3, declined to –0.12 in April from +0.08 in March, turning negative for the first time since December 2010. April’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. With regard to inflation, the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Production-related indicators made a contribution of –0.16 to the index in April, down sharply from +0.31 in March. Manufacturing production decreased 0.4 percent in April after rising for nine consecutive months, and manufacturing capacity utilization declined to 74.4 percent in April from 74.8 percent in March. Parts shortages that resulted from the earthquakes in Japan contributed to a decline in motor vehicle and parts production.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in April, but below trend.

Sunday, May 22, 2011

NY Times: The Glut of Foreclosed Homes

by Calculated Risk on 5/22/2011 11:52:00 PM

From Eric Dash at the NY Times: Banks Amass Glut of Homes, Chilling Sales

The nation’s biggest banks and mortgage lenders have steadily amassed real estate empires, acquiring a glut of foreclosed homes that threatens to deepen the housing slump and create a further drag on the economic recovery.The lenders definitely hold a large number of REOs (Real Estate Owned), however the RealtyTrac estimate looks a little high.

All told, they own more than 872,000 homes as a result of the groundswell in foreclosures, almost twice as many as when the financial crisis began in 2007, according to RealtyTrac, a real estate data provider. In addition, they are in the process of foreclosing on an additional one million homes and are poised to take possession of several million more in the years ahead.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from, economist Tom Lawler, shows an estimate of all the REO inventory at the end of Q4. Fannie, Freddie release their REO inventory quarterly, and FHA releases their data monthly. Lawler estimated the REOs for FDIC insured Banks & Thrifts using the FDIC Quarterly Banking Profile (QBP) - and the Private Label Securities (PLS) data is from Barclays.

We know the combined REO inventory for Fannie, Freddie and the FHA1 decreased to 287,184 at the end of Q1 2011, from a record 295,307 units at the end of Q4 as shown in the second graph (FHA1 data through February).

We know the combined REO inventory for Fannie, Freddie and the FHA1 decreased to 287,184 at the end of Q1 2011, from a record 295,307 units at the end of Q4 as shown in the second graph (FHA1 data through February).The pace of foreclosures is picking up, but so is the pace of REO sales. Freddie Mac noted REO sales were at record levels in Q1:

We expect the pace of our REO acquisitions to increase in the remainder of 2011, in part due to the resumption of foreclosure activity by servicers, as well as the transition of many seriously delinquent loans to REO.Fannie Mae also sold a record 62,814 REO in Q1, up from 38,095 in Q1 2010 and 185,744 for all of 2010. So Fannie and Freddie sold over 90,000 REO in Q1, and their combined inventory only declined by 16,185. They are foreclosing at record levels, but they are finally selling REOs faster than they acquire them.

REO disposition reached record levels in 1Q 2011 with over 30,000 homes sold ...

Hopefully I'll have an estimate for total Q1 REO from Lawler soon - the Q1 FDIC QBP will probably be released this week - but it appears the RealtyTrac estimate is a little high and that REO inventory is starting to decline since the lenders are selling again.

Although REO inventory might be overstated in the story, the number of loans in the foreclosure process is much higher than 1 million. The MBA reported last week that 4.52% of homes with first-lien mortgages were in the foreclosure process. There are approximately 50,000,000 homes with first-lien mortgages, and 4.52% would be 2.25 million. There are another 1.8 million homes were the borrower is more than 90 days delinquent.

Although the numbers in the story may be a little off - one thing is clear - there is still a huge of glut of distressed homes in the pipeline.

Survey: Gasoline prices down 9 cents over last two weeks

by Calculated Risk on 5/22/2011 07:00:00 PM

According to an AP report, the Lundberg Survey shows gasoline prices have fallen 9 cents per gallon over the last 2 weeks.

GasBuddy.com is showing a 16 cent per gallon decline in my area from the recent peak, and a decline of about 13 cents nationally. If WTI oil futures stay under $100 per barrel, I expect prices to fall 30 cents or more from the peak over the next few weeks.

It might be too early to see an increase in the Reuter's/University of Michigan's Consumer sentiment survey due to falling gasoline prices. Right now analysts are expecting a slight increase for May to 72.5 from the preliminary reading of 72.4. But if this trend of falling prices continues, I'd expect some improvement in June. (Note: Usually the two main drivers of sentiment are the unemployment rate and gasoline prices).

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

"Dismal Start" for Auto Sales in May

by Calculated Risk on 5/22/2011 11:45:00 AM

J.D. Power and Associates: High Gas Prices and Lower Incentive Levels Contributing to Dismal Start for May New-Vehicle Retail Sales (ht Tim waiting for 2012)

"Retail sales in May are being hit by several negative variables—specifically, high gas prices, lower incentive levels and some inventory shortages," said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates. "As a result, the industry will likely be dealing with a lower sales pace at least through the summer selling season, putting pressure on the 2011 outlook."J.D. Power is projecting total light vehicle sales of 11.9 million in May (SAAR: seasonally adjusted annual rate). This would be down from 13.2 million in April, and only up slightly from 11.6 million in May 2010.

The projected decline in sales is mostly due to the tragedy in Japan and related supply chain issues:

The earthquake, tsunami and resulting nuclear power plant crisis in Japan have caused numerous production disruptions thus far due to parts shortages for the Japanese manufacturers. This is expected to continue throughout the second quarter of 2011, with more than 400,000 units of production expected to be lost in the short term.However most of the decline in production will be in Japan:

The North American production forecast in 2011 has been reduced slightly, with volume now rounding down to 12.8 million units (from 12.9 million units).So auto production in the U.S. is forecast to decline slightly although retail sales will be off sharply over the next six months.

There are already articles suggesting smart buyers wait until the automakers start offering incentives again. From Jerry Hirsch at the LA Times: Best option for car shoppers: Postpone buying

"If people were paying attention they would have bought in March and April. Now, if they have the latitude, it is probably best to wait," said Jeremy Anwyl, chief executive of Edmunds.com

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows light vehicle sales since the BEA started keeping data in 1967.

The dashed line is April estimated sales rate of 13.2 million SAAR.

The sales rate will probably drop back to the level of last summer for the next 6 months or so, and then rebound later this year. This auto slowdown has already shown up in the regional manufacturing surveys - and also in the initial weekly unemployment claims.

The key is this decline is being driven mostly by events in Japan, and is not a sign of overall weakness in the economy. Although this will be drag on GDP growth in Q2 and Q3, I don't think the drag will be huge.

Yesterday ...

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

Unofficial Problem Bank list increases to 988 Institutions

by Calculated Risk on 5/22/2011 08:11:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 20, 2011.

Changes and comments from surferdude808:

There were many changes to Unofficial Problem Bank List because of failure and the OCC releasing its actions through mid-April 2011. In all, there were 12 additions and seven removals, which leaves the list at 988 institutions with assets of $423.9 billion. Last week, the list had 983 institutions with assets of $425.4 billion.Yesterday ...

The removals include the three failures this week -- Atlantic Southern Bank, Macon, GA ($781 million Ticker: ASFNE); First Georgia Banking Company, Franklin, GA ($780 million); and Summit Bank, Burlington, WA ($147 million). Actions were terminated against Central Pacific Bank, Honolulu, HI ($3.9 billion Ticker: CPF); CenTrust Bank, National Association, Northbrook, IL ($103 million); and The First National Bank of Farragut, Shenandoah, IA ($35 million). The other removal is Union National Community Bank, Lancaster, PA ($446 million), which merged on an unassisted basis with Union Community Bank FSB, Lancaster, PA.

Among the 12 additions are Old Second National Bank, Aurora, IL ($2.1 billion Ticker: OSBC); Great Lakes Bank, National Association, Blue Island, IL ($642 million Ticker: GLFL); and SCB Bank, Shelbyville, IN ($256 million Ticker: BRBI). Also, the OCC issues a Consent Order against Southwestern National Bank, Houston, TX ($319 million), which was removed prematurely two weeks ago when the OCC terminated the Formal Agreement against the bank.

Next week, the FDIC should release its actions through April 2011. Given that the list stands at 988 institutions, there is an outside chance the could go over 1,000 institutions next week.

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

Saturday, May 21, 2011

Walking Away in Chicago

by Calculated Risk on 5/21/2011 09:54:00 PM

From Mary Ellen Podmolik at the Chicago Tribune: Sinking values prompting homeowners to consider strategic default as best business decision (ht Ann)

Marty Likier ... put almost 20 percent down to purchase a $312,000 townhouse in Westmont in 2006 and lived there until two years ago, when he remarried and bought a home in Chicago Ridge. For a year he rented the townhouse. When a change in rules at the community meant Likier's days as a landlord would end, he called his lender and asked if he could rework the loan, but he didn't have enough equity left to refinance the $240,000 mortgage.A few comments:

...

Likier ... decided last fall that the struggle wasn't worth it.

He listed the townhouse ... [and has dropped the price to] $179,000, which is lower than the unit sold for when it was built in 1999. He stopped paying the mortgage in January and recently was served with foreclosure papers.

Despite the fact that he and his wife are employed and have an annual household income near $150,000, he's comfortable with his decision.

• These properties with large negative equity positions are like ticking time bombs for the banks. Eventually these owners will grew tired of the monthly loss, and try to take action. Corelogic reported there were 11.1 million properties with negative equity at the end of last year, and close to 5 million properties with more than 25% negative equity.

• It sounds like this owner could afford the payment as long as he had the unit rented. If the homeowner association changed the rules, he might have legal recourse.

• And talking about recourse ... Illinois is a judicial foreclosure state and a deficiency judgment is pretty automatic. With his household income, Mr. Likier will probably be hearing from the bill collectors soon (Ann notes that it would help if his new wife makes most of the income since she probably wasn't on the condo loan).

Earlier ...

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

Greece Soft Restructuring Talk, and Italy Outlook Downgraded

by Calculated Risk on 5/21/2011 07:07:00 PM

Since the world didn't end ...

• Summary for Week Ending May 20th

• Schedule for Week of May 22nd

From the WSJ: France Signals a Shift on Greece

French Finance Minister Christine Lagarde signaled Paris might support a rescheduling of Greek debt, warning that Greece is at risk of default if it doesn't do more to bring its public finances into order.Lagarde's comments carry significant weight, and she is the leading candidate to become the new IMF managing director, from the Irish Times: EU leaders set to nominate Lagarde for IMF post

...

"What we certainly don't want is a state bankruptcy, a default, in Europe," Ms. Lagarde said in an interview published Friday in Austria's Der Standard newspaper. "You can use a lot of words—reprofiling, restructuring, re-this, re-that—but what there won't be is a restructuring of Greek debt." At the same time, she said: "We would accept anything that is based on a voluntary accommodation by banks."

"If the banks decided unilaterally after contacting the Greek authorities to offer a lengthening of the repayment time frame, she wouldn't be against it," Ms. Lagarde's spokesman said

And from Bloomberg: Italy Outlook Revised to Negative by S&P, Prompting Vow of Faster Reforms

Italy’s “current growth prospects are weak, and the political commitment for productivity-enhancing reforms appears to be faltering,” S&P said. “Potential political gridlock could contribute to fiscal slippage. As a result, we believe Italy’s prospects for reducing its general government debt have diminished.”The yield on Greece ten year bonds increased to a record 16.6% and the two year yield was up slightly to 25.5%.

Here are the ten year yields for Ireland at 10.5%, Portugal at 9.4%, Italy at 4.8%, and Spain at 5.5%.

Schedule for Week of May 22nd

by Calculated Risk on 5/21/2011 02:11:00 PM

Earlier:

• Summary for Week Ending May 20th

The key reports this week will be New Home Sales on Tuesday (more depression for homebuilders), the second estimate for Q1 GDP on Thursday (expect an upward revision), and the Personal Income and Outlays report for April on Friday (an early hint at consumer spending in Q2).

There are also a number of regional Fed speeches this week, and the FDIC will probably release the Q1 quarterly banking profile, although no release date is scheduled.

It will be interesting to see if lower gasoline prices show up in the final Reuter's/University of Michigan's Consumer sentiment report on Friday. Also the initial weekly unemployment claims on Thursday will be closely watched for signs of renewed labor market weakness.

8:30 AM ET: Chicago Fed National Activity Index (April). This is a composite index of other data.

8:25 AM: Speech, Fed Governor Elizabeth Duke on Financial Education,

At the Conference on "The Future of Life-Cycle Saving and Investing," Boston, Massachusetts

10:00 AM: New Home Sales for April from the Census Bureau.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for sales at a 300 thousand Seasonally Adjusted Annual Rate (SAAR) in April, unchanged from the March sales rate.

10:00 AM: Richmond Fed Manufacturing Survey for May. The consensus is for the survey to show modest expansion with a reading of 10.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through mid-year (not counting all cash purchases).

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 3.0% decrease in durable goods orders after increasing 4.1% in March.

10:00 AM: FHFA House Price Index for March. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims increased over the last month, although claims appear to be trending down again.. The consensus is for a decrease to 404,000 from 409,000 last week.

8:30 AM: Q1 GDP (second estimate). This is the second estimate for Q1 GDP from the BEA.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The advance estimate was for 1.8% annualized growth in Q1. This was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system. The blue column is for Q1.

The consensus is for an upward revision to 2.1% annualized real GDP growth.

11:00 AM: Kansas City Fed regional Manufacturing Survey for May. The index was at 14 in April, down from a record 27 in March.

8:30 AM: Personal Income and Outlays for April. The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars).

PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.

PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.The consensus is for a 0.4% increase in personal income in April, and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a slight increase to 72.5 from the preliminary reading of 72.4.

10:00 AM: Pending Home Sales Index for April.

Best wishes to All!

Summary for Week Ending May 20th

by Calculated Risk on 5/21/2011 08:15:00 AM

The economic data was soft last week. The Empire State and Philly Fed manufacturing surveys showed much slower growth in May. And industrial production from the Fed (for April) showed no change, although this was probably related to supply chain issues and the earthquake in Japan.

For housing, the data was weak as usual. The NAHB survey showed builders are still depressed and the Census Bureau reported housing starts declined in April. Existing home sales also declined in April, although inventory declined year-over-year (for anyone looking for a small silver lining). But there is still 9.2 months of supply on the market - and that doesn't include the shadow inventory.

The MBA reported the percentage of delinquent first lien loans, including loans in the foreclosure process, was unchanged at the end of Q1 on a seasonally adjusted basis. This was disappointing because other indicators suggested a decline in overall delinquencies.

There was a little good news for the U.S. economy - gasoline prices are now down about 10 cents per gallon nationally from the recent peak, and initial weekly unemployment claims declined last week.

Below is a summary of economic data last week mostly in graphs:

• April Existing Home Sales: 5.05 million SAAR, 9.2 months of supply

The NAR reported: April Existing-Home Sales Ease

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2011 (5.05 million SAAR) were 0.8% lower than last month, and were 12.9% lower than in April 2010. According to the NAR, inventory increased to 3.87 million in April from 3.52 million in March.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory - so the increase in months-of-supply during the Spring is expected.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.

Although inventory increased from March to April (as usual), inventory decreased 3.9% year-over-year in April from April 2010. This is the third consecutive month with a YoY decrease in inventory.

Inventory should increase over the next few months and peak in the summer (the normal seasonal pattern), and the YoY change is something to watch closely this year.

• Housing Starts declined in April

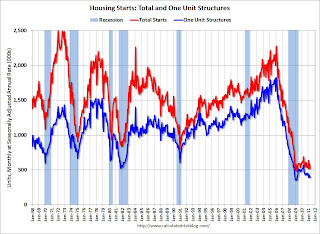

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand. Single-family starts decreased 5.1% to 394 thousand in April.

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit. This was well below expectations of 570 thousand starts in April.

• MBA: Total Delinquencies essentially unchanged in Q1 Seasonally Adjusted

The MBA reported that 12.84 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q1 2011 (seasonally adjusted). This is essentially the same as in Q4. There was a significant decline in Not Seasonally Adjusted (NSA) delinquencies, but that is the usual seasonal pattern.

The following graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.35% from 3.26% in Q4. This is below the average levels of the last 2 years, but still higher than normal.

Loans 30 days delinquent increased to 3.35% from 3.26% in Q4. This is below the average levels of the last 2 years, but still higher than normal.

Delinquent loans in the 60 day bucket were unchanged at 1.35%; this is the lowest since Q2 2008. There was a slight increase in the 90+ day delinquent bucket. This increased from 3.62% in Q4 to 3.65% in Q1 2011.

The percent of loans in the foreclosure process decreased to 4.52%.

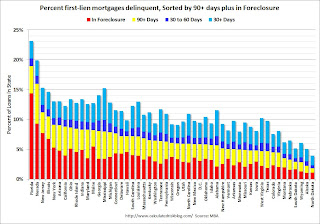

The following graph is for each state and includes all delinquent loans (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Arizona and California.

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Arizona and California.

And the next graph shows the change in the percent delinquent based on Q1 2007, Q1 2010 (the peak of the crisis nationally), and Q1 2011. These are the 10 worst states sorted by the current percent seriously delinquent.

For each state there are 3 columns (Q1 2007, 2010, and 2011). In Ohio and Indiana, delinquency rates were already elevated by Q1 2007.

For each state there are 3 columns (Q1 2007, 2010, and 2011). In Ohio and Indiana, delinquency rates were already elevated by Q1 2007.

Some states have made progress: Arizona, Nevada and California. For other states like New Jersey and New York, serious delinquencies were higher in Q1 2011 than in Q1 2010.

But even though there has been some progress, there is a long way to go to get back to the 2007 rates.

Here is a post for the remaining 40 states.

• Industrial Production unchanged in April, Capacity Utilization declines slightly

From the Fed: Industrial production and Capacity Utilization

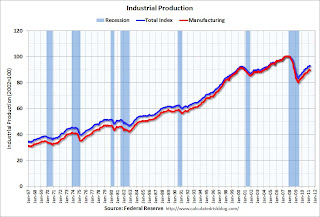

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.

Industrial production was unchanged in April at 93.1; previous months were revised down, so this is a decline from the previously reported level in March.

Production is still 7.6% below the pre-recession levels at the end of 2007.

The consensus was for a 0.4% increase in Industrial Production in April, and an increase to 77.6% for Capacity Utilization. So this was well below expectations - partly because of the earthquake in Japan.

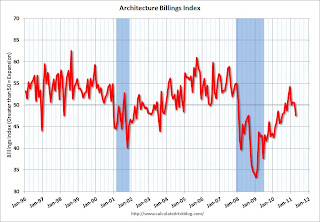

• AIA: Architecture Billings Index indicates declining demand in April

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: US architecture billings index falls in April-AIA

This graph shows the Architecture Billings Index since 1996. The index showed billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

This graph shows the Architecture Billings Index since 1996. The index showed billings decreased in April (index at 47.6, anything below 50 indicates a decrease in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction.

• Other Economic Stories ...

• Empire State Manufacturing Survey indicates slower growth in May

• Philly Fed Survey shows "regional manufacturing activity grew slightly in May"

• Residential Remodeling Index increases in March

• NAHB Builder Confidence index unchanged at low level in May

Best wishes to all!