by Calculated Risk on 5/17/2011 03:45:00 PM

Tuesday, May 17, 2011

Lawler: The “Excess Supply of Housing” War

CR Note: A key piece of data for the housing market - and the U.S. economy - is the current number of excess vacant housing units.

Unfortunately it is very difficult to get a good handle on this excess supply (it is large, but how large?). Both Tom Lawler and I are hopeful that we can arrive at a more accurate estimate using the Census 2010 data to be released this month (the estimate will be as of April 1, 2010).

Please excuse Tom's punctuation - but he has been arguing for better housing data for years - and he is clearly frustrated!

By Tom Lawler: The “Excess Supply of Housing” War: Is the 3.5 Million Estimate “Gold” (Man, No!); or Can You Take the 1.2 Million Estimate to the (Deutsche) Bank?

A few weeks ago Goldman Sachs’ analysts made headlines by arguing that the “excess” supply of housing, or actually the number of US housing units sitting vacant “above and beyond normal seasonal and frictional vacancies,” was “about” 3.5 million. This week Deutsche Bank analysts estimated that at the end of 2010 there were about 1.2 million “excess” vacant housing units in the US. Both sets of analysts relied heavily on data “provided” by the US Bureau of the Census in deriving their “estimates.” And, to the best of my knowledge, neither set of analysts was comprised of imbeciles. Yet jiminy cricket, those are pretty huge differences with massively different implications about the prospects for the housing markets and home prices over the next few years!!!!! And the major reasons for these differences? You guessed it, massively disparate sets of data from different areas of the Census Bureau on US housing!!!!

As readers probably guessed, Goldman analysts’ estimates are based on what are almost certainly flawed and biased estimates of the occupied and vacant housing units from Census’ quarterly “Residential Vacancies and Homeownership” Reports, commonly referred to as the Housing Vacancy Survey (HVS). While there had already been strong evidence that the HVS dramatically overstated both homeownership rates and vacancy rates prior to the decennial Census 2010 (from the ACS), the incoming data from Census 2010 pretty much confirm that the HVS data has serious biases, probably related to serious sampling issues.

The Deutsche Bank analysts’ estimates are based on the Census 2010 gross vacancy rate versus a weighted average of the Census 1990 gross vacancy rate (weighted 75% for pretty flimsy reasons) and the Census 2000 gross vacancy rates (weighted, of course, 25%). (DB analysts “walk forward” the April 1 Census 2010 estimates to the end of 2010 using what I believe are “questionable” assumptions about household formations and net demolitions). Census 2010 has not yet released national data on vacant units by status (for rent, for sale, etc., and it was sorta weird that DB analysts didn’t just wait a few weeks to do a more “rigorous’ estimate based on more complete Census 2010 data.

DB’s piece includes a decently long and not “too” bad discussion (though with many errors and/or omissions) of the multiple and disparate sets of data on the US housing stock derived from various surveys done by different areas in the Census Bureau.

What is disturbing, of course, is not necessarily that different sets of analysts can come to different sets of conclusions when analyzing US housing data. Rather, it is that there are multiple and conflicting “official” sets of government-produced data on the US housing stock, with little or no discussion from government officials/analysts are which – if any – dataset should be used by analysts to estimate the “excess” supply of housing in the United States

Earlier:

• Housing Starts decline in April

• Industrial Production unchanged in April, Capacity Utilization declines slightly

• Multi-family Starts and Completions, and Quarterly Starts by Intent

Mutli-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 5/17/2011 12:20:00 PM

Also from the Housing Starts report this morning ...

Although the number of multi-family starts can vary significantly month to month, apartment owners are seeing falling vacancy rates, and some have started to plan for 2012 and will be breaking ground this year. So we should see a pickup in multi-family starts in 2011.

However, since it takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - there will be a record low number of multi-family completions this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

For 2011, we should expect multi-family completions to be at or near a record low, and an increase in multi-family starts. It appears that the rolling 12 month starts (blue line) will be above completions (red line) next month.

Also today, the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q1 2011. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up slightly from Q4, but still near a record low. Owner built starts were at a record low, and condos built for sale are scrapping along the bottom.

Only the 'units built for rent' is showing any significant pickup.

The largest category - starts of single family units, built for sale - is moving sideways, and will remain weak until more of the excess vacant housing units are absorbed.

Industrial Production unchanged in April, Capacity Utilization declines slightly

by Calculated Risk on 5/17/2011 09:30:00 AM

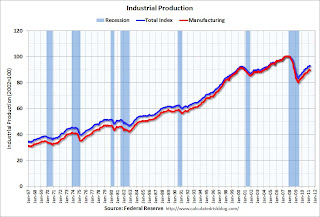

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in April after having increased 0.7 percent in March. Output in February is now estimated to have declined 0.3 percent; previously it was reported to have edged up 0.1 percent. In April, manufacturing production fell 0.4 percent after rising for nine consecutive months. Total motor vehicle assemblies dropped from an annual rate of 9.0 million units in March to 7.9 million units in April, mainly because of parts shortages that resulted from the earthquake in Japan. Excluding motor vehicles and parts, factory production rose 0.2 percent in April. The output of mines advanced 0.8 percent, while the output of utilities increased 1.7 percent. At 93.1 percent of its 2007 average, total industrial production was 5.0 percent above its year-earlier level. The rate of capacity utilization for total industry edged down 0.1 percentage point to 76.9 percent, a rate 3.5 percentage points below its average from 1972 to 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 9.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.9% is still "3.5 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Edit: typo on graph, it should read 2007 = 100.

Industrial production was unchanged in April at 93.1; previous months were revised down, so this is a decline from the previously reported level in March.

Production is still 7.6% below the pre-recession levels at the end of 2007.

The consensus was for a 0.4% increase in Industrial Production in April, and an increase to 77.6% for Capacity Utilization. So this was well below expectations - partly because of the earthquake in Japan.

Housing Starts decline in April

by Calculated Risk on 5/17/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

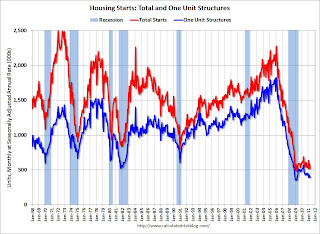

Total housing starts were at 523 thousand (SAAR) in April, down 10.6% from the revised March rate of 585 thousand.

Single-family starts decreased 5.1% to 394 thousand in April.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was well below expectations of 570 thousand starts in April. I'll have more on starts later ... I expect starts to stay low until more of the excess inventory of existing homes is absorbed.

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 523,000. This is 10.6 percent (±13.0%)* below the revised March estimate of 585 000 and is 23 9 percent (±7 0%) below the revised April 2010 rate of 687 000.

Single-family housing starts in April were at a rate of 394,000; this is 5.1 percent (±10.2%)* below the revised March figure of 415,000. The April rate for units in buildings with five units or more was 114,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 551,000. This is 4.0 percent (±1.1%) below the revised March rate of 574,000 and is 12.8 percent (±1.2%)below the revised April 2010 estimate of 632,000.

Single-family authorizations in April were at a rate of 385,000; this is 1.8 percent (±1.0%) below the revised March figure of 392,000. Authorizations of units in buildings with five units or more were at a rate of 143,000 in April.

Monday, May 16, 2011

Gasoline, Oil prices decline

by Calculated Risk on 5/16/2011 11:22:00 PM

Just an update from Reuters: Gasoline price falls first time in 8 weeks: Energy Department

Regular unleaded gasoline declined half a penny over the last week to a national price of $3.96 a gallon, which is still up $1.10 from a year ago.Not much of a decline yet nationally, but GasBuddy.com is showing a 6 cent decline in my area from the peak.

I think high oil and gasoline prices the biggest downside risk to the U.S. economy - and a decline in prices would definitely be helpful.

Bloomberg is showing WTI futures at $96.86 per barrel tonight (down from $114 at the end of April), and Brent at $110.

Earlier:

• NAHB Builder Confidence index unchanged at low level in May

• And this weekend post has generated a lot of feedback: The upward slope of Real House Prices.

Housing Data: Making foreclosure and default data publicly available

by Calculated Risk on 5/16/2011 07:05:00 PM

The housing bubble and bust exposed the poor quality of publicly available U.S. housing data. One area of improvement is the various house price indexes now available that didn't exist in January 2005 when I started this blog. But that data isn't always timely, and the details aren't always public.

There is a long long ways to go. The NAR data for existing home sales and inventory is still suspect, the Census Bureau could change their methodology so new home sales matched up better with builder reports (change the timing of sales and handling of cancellations), there is no good data available for housing demolitions, the total housing stock numbers are almost useless for analyzing the excess supply, and there is no timely data for household formation. But maybe we will have better publicly available data for foreclosures and delinquencies soon:

From Alex Ulam at National Mortgage News: Should Mortgage Servicing Data Be a Public Utility

[T]hanks to a little-discussed provision of the Dodd-Frank Act, legislators, regulators and even nonprofit housing activists may eventually get a more comprehensive picture of the mortgage servicing industry.Hopefully the database will include the number of REOs, the number of mortgages in the foreclosure process, and all the deliquency data by census tract. That would help.

Section 1447 of the law calls for the Department of Housing and Urban Development to establish and maintain a comprehensive national database on foreclosures and defaults on mortgages and to make the information publicly available. The data is supposed to drill down to the census tract level and include the number and percentage of loans that are delinquent by more than 30 days; those that are in the foreclosure process; and those that are underwater.

Misc: Existing Home Sales forecast, California Revenue increase, MBA Quarterly Delinquency report

by Calculated Risk on 5/16/2011 03:52:00 PM

• From economist Tom Lawler:

Based on my regional tracking – with a caveat that some local MLS are late in issuing statistical reports – I estimate that existing home sales ran at a seasonally adjusted annual rate of 5.15 million in April, up 1% from March’s pace, but down 11.2% from last April’s tax-credit-goosed pace. Unadjusted sales should show a larger YOY decline of about 13.9%, reflecting one fewer business day this April than last April. Seasonal adjustment is a bit tricky this April, given the exceptionally late Easter. Sales in areas that last April saw the largest YOY gains generally saw the largest YOY declines, while sales in many “distressed” areas show much less “tax-credit-related” swings.CR Note: they are interesting to me! The NAR reports on Thursday and the consensus is for sales of 5.2 million (SAAR).

My tracking of homes listing for sale suggests a modest 1.5-2.0% increase from March to April. However, in each of the last two years the NAR has “shown” a MASSIVELY higher monthly increase in listings from March to April. Looking at year-ago numbers, I’d “guesstimate” that homes listing for sale were down about 8% nationwide at the end of this April vs. last April. If NAR numbers show comparable YOY declines, then NAR would report a 4.4% monthly increase. Listings in Florida compared to a year ago are down especially sharply.

These aggregate forecasts aren’t much different from “consensus,” and as such are not very interesting.

• An addition to the weekly schedule (updated every Sunday in the menu bar above). On Thursday at 10:00 AM ET: Mortgage Bankers Association (MBA) 1st Quarter 2011 National Delinquency Survey (NDS). This is expected to show a significant decline in overall delinquencies. I'll be on the conference call at 10:30 AM.

• From the LA Times: Unexpected state revenue leaps to $6.6 billion. The state is now forecasting $6.6 billion more in revenue of the next year (probably thanks to the tech boom).

• And this weekend post has generated a lot of feedback: The upward slope of Real House Prices.

Best to all

Debt Ceiling: False Comparisons to 1995 / 1996

by Calculated Risk on 5/16/2011 01:47:00 PM

In discussions of the debt ceiling, I keep seeing comparisons to the 1995/1996 government shutdown (here is an example from the WSJ)

In fiscal 1995, the economy was in the middle of a strong expansion with the unemployment rate around 5.6%. There was no cyclical deficit (from a recession), just a left over structural deficit that was steadily being reduced. The deficit in fiscal 1995 was 2.2% of GDP (about 10.8% of outlays).

This year, the economy is fragile, the unemployment rate is at 9.0%, and the deficit is a combination of both a structural deficit and a cyclical deficit (from the great recession). The total deficit is now close to 9% of GDP and about 37% of outlays.

In fiscal 1995, the government could do the same "extraordinary measures" as today to delay the day of reckoning, and then eventually cut off all non-essential discretionary outlays (the "government shutdown"). That was enough to buy more time, and the government didn't have to default on the debt, or cut Social Security or Medicare payments.

Now there is a cyclical deficit on top of an even larger structural deficit. It is impossible to just shutdown non-essential discretionary outlays - the cuts will have to go deeper. So the comparison isn't valid.

From the numbers, here is the CBO analysis and historical data.

Clearly Stanley Druckenmiller (quoted in the WSJ article) is wrong in assessing the impact by comparing to 1995. Interesting that Mr. Druckenmiller was apparently warning about the long term deficit in the mid-'90s, so I find it strange that there is no mention of his stance on the "surpluses forever" position of Greenspan and the Bush administration in 2001 - since that was a key turning point and led to the large structural deficits. (note: if someone has Druckenmiller's 2001 comments on the deficit, please send them to me).

The good news is the cyclical deficit will decline over the next few years, and (hopefully) be gone by 2015 or so. That will still leave us with the structural deficit - and we will need to address the long term costs of health care - but I think those issues are solvable.

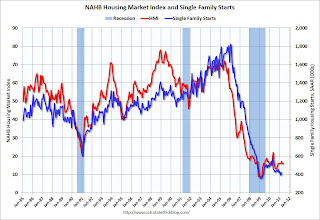

NAHB Builder Confidence index unchanged at low level in May

by Calculated Risk on 5/16/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged at 16 in May, the same level as in April. This was below expectations for a reading of 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Press release from the NAHB: Builder Confidence Unchanged in May

Builder confidence in the market for newly built, single-family homes held unchanged at the low level of 16 in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The index has now remained at this level for six out of the past seven months.Builders are still depressed, and the HMI has been below 25 for forty-seven consecutive months - almost 4 years.

...

“The HMI component index measuring traffic of prospective buyers increased by one point for the second time this year as prospective buyers show growing interest but remain extremely hesitant due to a number of factors,” said NAHB Chief Economist David Crowe. “Asked to identify reasons that potential customers are holding back at this time, 90 percent of builders surveyed said clients are concerned about being able to sell their existing home at a favorable price, while 73 percent said consumers think it will be difficult for them to get financing.”

...

Both the index gauging current sales conditions and the index gauging traffic of prospective buyers inched up one point in May, to 16 and 14, respectively. While still very low, the traffic gauge is now at its highest point since May of 2010. Meanwhile, the index gauging sales expectations in the next six months declined two points to 20 in May.

Empire State Manufacturing Survey indicates slower growth in May

by Calculated Risk on 5/16/2011 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in May, but at a slower pace than in April. The general business conditions index fell ten points to 11.9. The new orders index declined five points to 17.2, and the shipments index slipped three points to 25.8. The inventories index climbed to 10.8, its highest level in a year. The prices paid index rose to 69.9, its highest level since mid-2008, while the prices received index held firm at 28.0. Future indexes continued to convey a high level of optimism about the six-month outlook, although prices are widely expected to rise.This was below expectations of a reading of 20.0. This is the first regional survey released for May and shows that manufacturing is expanding, but at a slower rate.

The index for number of employees inched up to 24.7, indicating that employment levels expanded over the month, and the average workweek index rose thirteen points to 23.7, a multi-year high.