by Calculated Risk on 5/09/2011 09:15:00 AM

Monday, May 09, 2011

Another Downgrade for Greece

From MarketWatch: Greek CDS spreads widen after downgrade

Standard & Poor's lowered its credit rating on Greece to B from BB-minus. The spread on five-year Greek credit default swaps, or CDS, widened further to 1,375 basis points from around 1,360 basis points earlier in the day ...I've heard from an excellent source that there are EMU people working on the details of what a restructuring would look like - as a contingency plan - but nothing is imminent. Some sort of restructuring seems priced in with the yield on Greece ten year bonds is at 15.6% today and the two year yield at 25.2%.

Sunday, May 08, 2011

WSJ: Home Market Takes a Tumble

by Calculated Risk on 5/08/2011 11:59:00 PM

From Nick Timiraos and Dawn Wotapa at the WSJ: Home Market Takes a Tumble

Home values fell 3% in the first quarter from the previous quarter and 1.1% in March from the previous month, pushed down by an abundance of foreclosed homes on the market, according to data to be released Monday by real-estate website Zillow.com. Prices have now fallen for 57 consecutive months, according to Zillow.As I noted on Friday, Fannie and Freddie sold over 90,000 REOs in Q1; a new record. These foreclosure sales are pushing down house prices - and there are many more REOs coming (I'll try to summarize all the house price indexes, but most are showing prices at a post-bubble low).

...

[Stan Humphries, Zillow's chief economist] now believes prices won't hit bottom before next year and expects they will fall by another 7% to 9%.

...

Prices are decelerating in large part because the many foreclosed properties that often sell at a discount force other sellers to lower their prices.

Weekend:

• Schedule for Week of May 8th

• Summary for Week ending May 6th

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Updates on Greece and Ireland

by Calculated Risk on 5/08/2011 06:33:00 PM

First on Ireland from the Daily Mail: We won't pay off our debt... Fine Gael Minister admits Ireland plans to restructure €250bn borrowings

Ireland will never repay the €250bn it has borrowed from the EU and IMF, senior government insiders have admitted – but we will not default until our EU partners agree we have no choice.And from the Irish Times: Rabbitte 'hopeful' of interest rate cut

A senior minister last night told the Irish Mail on Sunday that the Cabinet expects our crippling debts to be ‘restructured’ within three years.

...

As Europe tried to ease the pressure with a 1% cut in our bail-out interest rate, ministers were admitting that the full amount could never be repaid.

‘It is not called defaulting – it’s code for a restructuring,’ said one senior minister.

Minister for Communications Pat Rabbitte Pat Rabbitte said today he “hopes” that Ireland will secure a lower interest rate on its bailout loans from the European Union.And on Greece from the WSJ: Greece Slips Farther Behind Budget-Cut Target

EU finance ministers are to hold meetings on May 16th and 17th to discuss the bailout for Portugal. Ireland's bailout is also expected to be on the agenda.

Mr Rabbitte said today Ireland would continue to negotiate for reduced rates. "The decision has not yet been made," he said.

Greece has been slipping farther behind its targets for cutting its budget deficit and is expected to need nearly €30 billion ($43 billion) of extra financing for 2012, according to euro-zone officials.The meeting next week should be interesting ...

The country's growing reliance on aid from other euro members is fueling a debate over whether Greece should hold talks with its private creditors about extending the maturity of its bonds, a step that Germany is quietly pushing but other euro nations are resisting.

Euro-zone finance ministers meeting in Brussels early next week are expected to debate Greece's debt burden, its need for additional aid, and its request for more time to meet its fiscal targets.

Weekend:

• Schedule for Week of May 8th

• Summary for Week ending May 6th

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Friday employment posts (with graphs):

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment: A dirty little secret and more graphs

• Employment Graph Gallery

Employment: A comment on the Birth/Death Model

by Calculated Risk on 5/08/2011 12:12:00 PM

On Friday, I wrote in frustration:

[A]nyone who adds (or subtracts) the Not Seasonally Adjusted (NSA) birth/death model numbers from the headline SA payroll employment is clueless. Someone sent me this "analysis" today: "... you exclude the 62K from McDonalds hirings, and 175K from the Birth Death Adjustment, and end up with.... +7K jobs". That is complete nonsense. The key issue with the birth/death model is it misses turning points; otherwise it is an important part of the monthly estimate.As I noted on Friday that "analysis" was complete nonsense. My suggestion is that most people should just ignore the model, but for those who want to understand it, below the fold is a slightly technical discussion with links to complete explanations.

To commentators: Please stop subtracting the BD numbers from the headline BLS numbers! You are misleading your readers.

Schedule for Week of May 8th

by Calculated Risk on 5/08/2011 08:14:00 AM

The key reports this week are April Retail Sales on Thursday, the Consumer Price Index (CPI) on Friday and the monthly Trade Balance report on Wednesday.

10:00 AM ET: New York Fed Q1 Quarterly Household Debt and Credit Report

7:30 AM: NFIB Small Business Optimism Index for April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been mostly trending up, although the level is still very low.

8:30 AM: Import and Export Prices for April. The consensus is a for a 1.8% increase in import prices.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through mid-year (not counting all cash purchases).

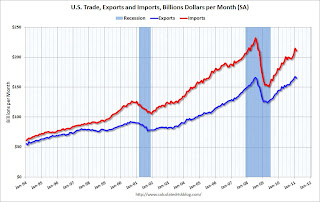

8:30 AM: Trade Balance report for March from the Census Bureau.

This graph shows the monthly U.S. exports and imports in dollars through February 2011.

This graph shows the monthly U.S. exports and imports in dollars through February 2011.Exports are up sharply and are now above the pre-recession peak. The consensus is for the U.S. trade deficit to be around $47.0 billion, up from $45.8 billion in February.

9:00 AM ET: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for April (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims increased sharply last week partially due to some one time factors. The consensus is for a decrease to 428,000 from 474,000 last week, however the storms in the south might impact the report this week.

8:30 AM: Retail Sales for April.

This graph shows retail sales since 1992. This is monthly retail sales including food service, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales including food service, seasonally adjusted (total and ex-gasoline).Retail sales are up 16.0% from the bottom, and now 2.5% above the pre-recession peak.

The consensus is for retail sales to increase 0.6% in April (0.6% increase ex-auto).

8:30 AM: Producer Price Index for April. The consensus is for a 0.6% increase in producer prices (0.2% core).

10:00 AM: Manufacturing and Trade: Inventories and Sales for March. The consensus is for a 0.9% increase in inventories.

10:00 AM: Testimony of Fed Chairman Ben Bernanke before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, "Dodd-Frank Implementation: Monitoring Systemic Risk and Promoting Financial Stability"

8:30 AM: Consumer Price Index for April. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.2%.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for May. The consensus is for a slight increase to 70.0 from 69.8 in April.

Best wishes to All!

Saturday, May 07, 2011

Greece Update: "Further adjustment programme" needed, Next meeting May 16th

by Calculated Risk on 5/07/2011 11:20:00 PM

Just an update .. from Reuters: Analysis: Europe groping for new Greek crisis plan

"We think that Greece does need a further adjustment programme," [Claude Juncker, chairman of the zone's finance ministers] said, after meeting with the finance ministers of Germany, France, Italy, Spain and Greece as well as European Union monetary affairs commissioner Olli Rehn and European Central Bank President Jean-Claude Trichet.Investors clearly expect some sort of restructuring fairly soon; either haircuts or an extension of maturities.

"This has to be discussed in detail and will be taken up at the next Eurogroup meeting on May 16."

...

A new Greek economic plan could push back the deadlines to hit budget targets ... Euro zone official sources told Reuters that a new plan would probably also involve softening the terms on the 80 billion euro portion of emergency loans extended by the EU under the bailout.

...

Greek and European officials, wary of panicking the markets, insist a restructuring is not on the cards, but privately EU officials are increasingly open about the possibility.

Earlier:

• Summary for Week ending May 6th

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Friday employment posts (with graphs):

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment: A dirty little secret and more graphs

• Employment Graph Gallery

No Surprise: Gasoline prices expected to fall sharply

by Calculated Risk on 5/07/2011 07:15:00 PM

A brief comment: If oil prices stay at the current level, gasoline prices will probably fall 30 cents per gallon or more over the next few weeks. This AP article says some analysts expect a "drop of nearly 50 cents" by June.

I'll be checking GasBuddy.com. They are already showing a 2 cent decline since yesterday in my area (not much, but a start). Since I've felt that oil and gasoline prices are the biggest downside risk to the economy, this is welcome news.

The preliminary Reuter's/University of Michigan's Consumer sentiment index for May will be released next Friday and that is too soon to see the impact of falling gasoline prices. But the final index for the month will be released on May 27th, and that might show a nice rebound in confidence if gasoline prices fall sharply.

Professor Hamilton has been discussing the impact of oil prices on the economy: Will high oil prices bring a new recession?. Hamilton noted: "[O]nce energy expenditures get above 6% of average consumer spending, we start to see significant changes in spending patterns. We crossed that threshold in March ..." It is not clear that oil prices have declined enough to put the energy expenditures below 6%, but it will probably be close.

Summary for Week ending May 6th

by Calculated Risk on 5/07/2011 11:51:00 AM

This was a busy week and the data was mixed. Let’s start with employment:

The BLS reported that payroll employment increased 244,000 in April and that the unemployment rate increased to 9.0%. So far the economy has added 854,000 private sector jobs this year, or 213,500 per month. There have been 768,000 total non-farm jobs added this year or 192,000 per month.

This pace of job growth is just more than enough to keep up with the growth in the labor force, so it has pushed down the unemployment rate slowly this year. The unemployment rate has declined from 9.4% in December 2010 to 9.0% in April.

Overall this was another small step in the right direction for payroll jobs, but this report reminds us that unemployment and underemployment are critical problems in the U.S. There are 6.955 million fewer payroll jobs now than before the recession started in 2007 with 13.75 million Americans currently unemployed. Another 8.6 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 5.8 million have been unemployed for six months or more. Clearly the overall employment situation remains grim.

I’ve argued that oil and gasoline prices are the biggest downside risk to the economy. If so, this was a great week as WTI oil prices plunged to $97.18 per barrel, from $113.39 a week ago. Brent crude futures were down from almost $127 per barrel to $109 per barrel. Of course a key reason for the decline was evidence of demand destruction – suggesting high prices are impacting consumer spending and behavior.

Other data was mixed. The ISM manufacturing index remained strong, but the ISM non-manufacturing index indicated sharply slower expansion. Auto sales were above expectations (although sales will probably slow due to supply disruption issues) and same store retail reports were positive.

According to Clear Capital, house prices are now at new post bubble lows, and Fannie and Freddie reported record REO sales in Q1 (and are now foreclosing again). Europe remains a key risk. Portugal has agreed to a bailout, and Greece is struggling to avoid restructuring their debt.

Overall it appears the recovery is continuing, but at a sluggish pace.

Below is a summary of economic data last week mostly in graphs:

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The unemployment rate increased to 9.0% (red line).

The Labor Force Participation Rate was unchanged at 64.2% in April (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio decreased slightly to 58.4% in April (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The current employment recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

In general, all four categories are trending down, although the "less than 5 weeks" category increased this month. Note that the "less than 5 weeks" used to be much higher, even during periods of strong job growth.

• ISM Manufacturing at 60.4 in April

From the Institute for Supply Management: April 2011 Manufacturing ISM Report On Business®

PMI at 60.4% in April, down from 61.2% in March. The employment index was at 62.7 and new orders at 61.7. All slightly slower than in March, but still very strong.

PMI at 60.4% in April, down from 61.2% in March. The employment index was at 62.7 and new orders at 61.7. All slightly slower than in March, but still very strong.

Here is a long term graph of the ISM manufacturing index.

This was a strong report and above expectations of 59.5%.

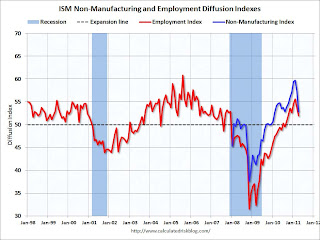

• ISM Non-Manufacturing Index indicates sharply slower expansion in April

From the Institute for Supply Management: April 2011 Non-Manufacturing ISM Report On Business®

The April ISM Non-manufacturing index was at 52.8%, down from 57.3% in March. The employment index indicated slower expansion in April at 51.9%, down from 53.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

The April ISM Non-manufacturing index was at 52.8%, down from 57.3% in March. The employment index indicated slower expansion in April at 51.9%, down from 53.7% in March. Note: Above 50 indicates expansion, below 50 contraction.

This was well below expectations of 58.0%.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

• Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

Special Note: Because of late reporting at the FHA, this graph only includes FHA REO through February. Also see: Lawler: Monthly Report to Commissioner Suggests Serious REO Inventory Problem at FHA

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 287,184 at the end of Q1 (see FHA special note above) from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 287,184 at the end of Q1 (see FHA special note above) from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2011 (FHA through Feb 2011).

Freddie Mac noted REO sales were at record levels in Q1:

REO disposition reached record levels in 1Q 2011 with over 30,000 homes sold, two-thirds of which were sold to owner occupants, or buyers who intend to live in the home.Fannie Mae also sold a record 62,814 REO in Q1, up from 38,095 in Q1 2010 and 185,744 for all of 2010.

• U.S. Light Vehicle Sales 13.2 million SAAR in April

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.17 million SAAR in April. That is up 17% from April 2010, and up 0.8% from the sales rate last month (March 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.17 million SAAR in April. That is up 17% from April 2010, and up 0.8% from the sales rate last month (March 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was above the consensus estimate of 13.0 million SAAR.

Note: The Japanese supply chain disruptions will impact sales over the next several months and I expect sales to be below this level for the next 6 months or so.

• Construction Spending increased in March

The Census Bureau reported this week that overall construction spending increased in March compared to February (seasonally adjusted).

The Census Bureau reported this week that overall construction spending increased in March compared to February (seasonally adjusted).This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 66% below the peak in early 2006, and non-residential spending is 40% below the peak in January 2008.

I expect residential spending to pick up a little this year (mostly multifamily) - and residential will probably be above non-residential spending by the end of the year.

• NMHC Quarterly Apartment Survey: Market Conditions Tighten

From the National Multi Housing Council (NMHC): Apartment Sector Sets Records In Market Tightness And Equity Availability, NMHC Market Conditions Survey Finds

This graph shows the quarterly Apartment Tightness Index.

This graph shows the quarterly Apartment Tightness Index.The index has indicated tighter market conditions for the last five quarters and increased to a record 90 in April. A reading above 50 suggests the vacancy rate is falling and / or rents are rising. This data is a survey of large apartment owners only.

Two key points I've made over and over are 1) with falling vacancy rates and rising rents, the number of multi-family starts will pick up sharply this year (but still be well below normal), and 2) this pickup will lead to a positive contribution to GDP and payroll jobs for construction in 2011, the first positive contribution for either since 2005. This survey reinforces both points.

• Clear Capital Home Price Index shows Double Dip

From Clear Capital: Clear Capital® Reports National Double Dip

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.

This is one of several house prices indexes I follow in addition to Case-Shiller and CoreLogic. This is especially interesting this month for two reasons: 1) the index is showing a double dip in house prices, and 2) the graph showing house prices and REO saturation.These graphs from Clear Capital show their home price index and the percent REO saturation.

We know that a higher percentage of distress sales put downward pressure on house prices, and these graphs make that relationship pretty clear.

Note: REO saturation usually peaks early in the year - so some of the recent increase is seasonal.

• Other Economic Stories ...

• ADP: Private Employment increased by 179,000 in April

• From Bloomberg: Portugal Agrees on Aid Plan With Wider Deficit Targets

• From the Fed April 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices shows banks more willing to make loans.

• Unofficial Problem Bank list at 983 Institutions

Best wishes to all!

Unofficial Problem Bank list at 983 Institutions

by Calculated Risk on 5/07/2011 09:02:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 6, 2011.

Changes and comments from surferdude808:

After many changes last week, activity was muted this week with two removals and one addition to the Unofficial Problem Bank List.

The list stands at 983 institutions with assets of $422.1 billion. Removals are the failed Coastal Bank, Cocoa Beach, FL ($133 million) and an action termination against Southwestern National Bank, Houston, TX ($319 million).

The single addition is Bank of the Carolinas, Mocksville, NC ($534 million Ticker: BCAR). With next Friday being the 13th day of the month, there is an outside chance the OCC will release its actions through mid-April 2011. However, the OCC typically releases on the Friday following the 14th day on the month.

Friday, May 06, 2011

Total Fannie, Freddie, FHA REO inventory declined in Q1, Fannie and Freddie REO Sales at Record Levels

by Calculated Risk on 5/06/2011 09:20:00 PM

Special Note: Because of late reporting at the FHA, this graph only includes FHA REO through February. Also see: Lawler: Monthly Report to Commissioner Suggests Serious REO Inventory Problem at FHA

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 287,184 at the end of Q1 (see FHA special note above) from a record 295,307 units at the end of Q4. The REO inventory increased 37% compared to Q1 2010 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2011 (FHA through Feb 2011).

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. The pace of foreclosures is picking up, but so is the pace of REO sales. Freddie Mac noted REO sales were at record levels in Q1:

We expect the pace of our REO acquisitions to increase in the remainder of 2011, in part due to the resumption of foreclosure activity by servicers, as well as the transition of many seriously delinquent loans to REO.Fannie Mae also sold a record 62,814 REO in Q1, up from 38,095 in Q1 2010 and 185,744 for all of 2010.

REO disposition reached record levels in 1Q 2011 with over 30,000 homes sold, two-thirds of which were sold to owner occupants, or buyers who intend to live in the home.

So Fannie and Freddie sold over 90,000 REO in Q1, and their combined inventory only declined by 16,185. The are foreclosing at record levels, but they are finally selling REOs faster than they acquire them.

This will go on for some time. From Fannie Mae:

[G]iven the large current and anticipated supply of single-family homes in the market, we anticipate that it will take years before our REO inventory is reduced to pre-2008 levels.Also, this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

As Freddie noted, the pace of foreclosures will pick up this year, and so will the pace of REO sales. This will keep pressure on house prices (see this graph from Clear Capital comparing house prices and REO saturation).

Here are the earlier employment posts (with graphs):

• April Employment Report: 244,000 Jobs, 9.0% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• Employment: A dirty little secret and more graphs

• Employment Graph Gallery