by Calculated Risk on 4/13/2011 01:23:00 PM

Wednesday, April 13, 2011

President Obama on the Fiscal Policy: 1:35 PM ET

As a reminder, we can divide the deficit into three components:

1) Structural deficit (General Fund ex-health care).

2) Cyclical deficit - a result of the severe recession and includes lower tax revenue, stimulus spending, and larger safety net costs.

3) Long term health care.

The structural deficit was introduced in 2001, and was based on some bad math and faulty projections. Back in 2001, the White House was projecting a budget surplus of $800 billion in 2010, and an "on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation".

With those projections, it was natural to want to return the surpluses to the people. That policy was supported by Representatives Eric Cantor and Paul Ryan, and also Senator Mitch McConnell. I single those three out because they are always talking about the deficit, but no one in the media asks them about their role in creating the deficit!

Of course those projections a decade ago were faulty. Some people argue the shortfalls were because of recession and war, but there were recessions in the '60, '70, '80 and '90s ... so a recession should have been expected. And there were wars in the '60s, '70s, and '90s, and a huge defense buildup in the '80 because of the cold war. A war contingency should have been included too.

The cyclical deficit was a result of the housing bubble and bust, and the financial crisis that followed. When I was predicting a housing bust back in 2005, I was concerned that we would be piling a huge cyclical deficit on top the structural deficit.

So by 2005 - for those paying attention - we already knew there was a huge structural deficit, a cyclical deficit coming, and that healthcare would be a serious problem in the future because of demographics.

Still it is possible to make progress. As the economy recovers, the cyclical deficit will fade away. And since the forecasts were wrong in 2001, the baseline approach would be to reverse those policies. David Leonhardt at the NY Times suggests doing that: Do-Nothing Congress as a Cure.

That still leaves healthcare - and that isn't an easy problem, but I think that should be the focus of Obama's speech.

And from the White House:

BLS: Job Openings increase in February, Highest since 2008

by Calculated Risk on 4/13/2011 10:26:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.1 million job openings on the last business day of February 2011, the U.S. Bureau of Labor Statistics reported today. The job openings rate (2.3 percent) increased over the month. The hires rate (3.0 percent) and total separations rate (2.9 percent) were little changed over the month.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The job openings level has trended up since the end of the recession in June 2009 (as designated by the National Bureau of Economic Research) but remains well below the 4.4 million openings when the recession began in December 2007.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and are up 23% from February 2010.

The overall turnover remains low.

Retail Sales increased 0.4% in March

by Calculated Risk on 4/13/2011 08:30:00 AM

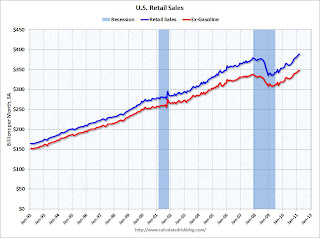

On a monthly basis, retail sales increased 0.4% from February to March (seasonally adjusted, after revisions), and sales were up 7.1% from March 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.0% from the bottom, and now 2.5% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.8% on a YoY basis (7.1% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $389.3 billion, an increase of 0.4 percent (±0.5%)* from the previous month, and 7.1 percent (±0.7%) above March 2010.This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.8%; slightly above expectations of a 0.7% increase.

Retail sales ex-gasoline were only up 0.1% in March - and this shows the impact of higher gasoline prices.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 4/13/2011 07:20:00 AM

The MBA reports: Applications Decrease in Latest MBA Weekly Survey

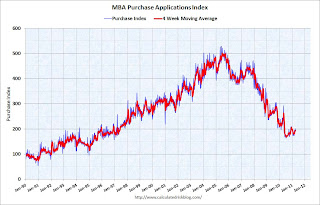

The Refinance Index decreased 7.7 percent to its lowest level since February 11, 2011. The seasonally adjusted Purchase Index decreased 4.7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased for the fourth consecutive week to 4.98 percent from 4.93 percent, with points increasing to 0.93 from 0.69 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest average contract rate reported since February 18, 2011.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

As expected, purchase activity declined last week after the slight boost the previous week as some buyers tried to beat the increase in FHA insurance premiums. This suggests weak home sales through May (not counting cash buyers).

Tuesday, April 12, 2011

Misc: Goldman says Q1 finished strong, Rail Car Woes

by Calculated Risk on 4/12/2011 08:58:00 PM

• Earlier I noted that several analysts have lowered their forecasts for Q1 GDP growth. However, in a research note released this afternoon, Goldman argued that high frequency indicators suggest growth picked up late in Q1:

At present, the current activity measure carries a clear message: US growth likely had considerable momentum in late Q1 ... our “bean-count” model of Q1 GDP suggests growth of 2.5% or lower ... [however high frequency indicators] showed growth of 3.6% in February [and] more than 4% [in March] ... [this is] consistent with our forecast that GDP growth will accelerate again in the second quarter.• From the WSJ: Rail Woes Hit Auto Deliveries

As the U.S. economy contracted during the recession, railroad operators put hundreds of thousands of rail cars into storage and cut their staffs. Now that shipments of autos, coal and consumer goods are rising again, the nation's railroads don't have enough rolling stock for fast deliveries.This sounds like a short term problem, but also suggests business is still picking up.

The rail industry, which ran at slower speeds in the first quarter due to heavy snow storms, also was caught off guard by the quarter's 11.4% surge in automotive railcar demand as auto makers ramped up production ...

As of March 1, 1.53 million railcars were in use, down from 1.6 million on July 1, 2009, when the recession was in full swing, according to the most recent data released by the Association of American Railroads.

Earlier posts:

• NFIB: Small Business Optimism Index decreases in March

• Trade Deficit decreased in February to $45.8 billion

• Ceridian-UCLA: Diesel Fuel index increases in March

Existing Home Inventory is confusing too

by Calculated Risk on 4/12/2011 05:07:00 PM

CR note: With all of the discussion of shadow inventory, it is important to note that there are questions about the "visible inventory" too. The following is an excerpt from an article by economist Tom Lawler:

When trying to “measure” the “months’ supply” of homes for sale, most folks compare the number of active homes listed for sale on a MLS (active listings) to the number of homes actually sold (some analysts prefer to look at listings vs. contracts signed, but most folks – and the NAR – compare listings to home closings.)

What may surprise some folks, however, is that there is actually some controversy over how the inventory of homes “for sale” should be measured. E.g., should one include listings on which there are contracts “pending”? Should one include only some pending sales, but not others – e.g., not “contingent” listings or listings that require the approval of a lender (e.g., short sales)?

The issue has become more “interesting” over the last few years as the number of “contingent” listings and short sales listings has surged.

As an example of this issue, here is a comparison of various “inventory” measures from the Tucson MLS, a wholly owned subsidiary of the Tucson Association of Realtors.

| Tucson MLS "Active" Inventory | |||

|---|---|---|---|

| 3/31/2011 | 3/31/2010 | 3/31/2009 | |

| Normal Active Listings | 6,703 | 6,799 | 7,415 |

| Normal Pending | 565 | 457 | 339 |

| Active Contingent | 1,228 | 928 | 753 |

| Active CAPA | 359 | 164 | 116 |

| Total Inventory | 8,855 | 8,348 | 8,623 |

“Active Contingent” means that the Seller has already accepted an offer, but that there is still some condition, or contingency, to be met, such as inspection, buyer’s final loan approval, appraisal, etc. For ‘Active CAPA,” CAPA stands for “can accept purchase offer,” and traditionally this category has been used when the seller has agreed to sell the home to the buyer, but the buyer must first sell his/her home. However, in March 2008 the Tucson MLS board of directors, in response to the rising number of short sales in the area, made the following recommendation:

Effective immediately, the MLS Board of Directors recommends the following regarding Short Sales: Short Sales are to be reported as ‘Active CAPA’ if there is supporting language written into the Purchase Contract. If the language supporting ‘Active Capa’ is not present and written into the Purchase Contract, the status should be reported as ‘Active Contingent’. This is in addition to the statement ‘Short Sale, subject to court or lender approval’ being written into the Agent Only Remarks.As best as I can tell, a short sale where the lender has not yet approved the sale could show up as either an “active CAPA” or a “Active Contingent,” depending on the contract language.

In its press release, the Tucson Association of Realtors’ summary tables show “active listings” as being the first line item in the above table. By this measure, the inventory of homes “for sale” in Tucson has declined from 7,415 in March 2009 to 6,799 in March 2010 to 6,703 in March 2011.

If instead one used the broader measure of “inventory” (shown later in the TAR report) to include all homes listed for sale, then the “inventory” of Tucson homes for sale last month was HIGHER not just a year ago, but two years ago as well! Note that the % of “total inventory” that is either “contingent” or “CAPA” has gone from 10.1% in March 2009 to 17.9% in March 2011!

As I’ve noted many times before, in a number of markets around the country the “fallout” rate for pending sales has been much higher over the last few years than was the case many years ago, especially in the “more depressed” markets. As such, an inventory number that excludes ALL pendings, including contingents and “CAPAs,” doesn’t seem “quite right.”

Now inquiring minds probably want to know: what do other MLS “mean” when they report the number of “active listings” or “months’ supply,” and what do they report to the National Association of Realtors, which uses the “months’ supply” measure supplied by the MLS in the sample it uses to estimate national home sales and the national inventory of existing homes for sale?

On the first question the answer for many is “I don’t know,” as only some report a breakdown by type of listing. And on the second question, the answer I got from a NAR spokesperson was “it depends on the local MLS!!!”

CR Note: This is from economist Tom Lawler.

Here come the downgrades for Q1 GDP Growth: Part III

by Calculated Risk on 4/12/2011 02:02:00 PM

More downgrades today ... Note: Part I (my call) and Part II.

From MarketWatch: Q1 GDP estimates slashed post-trade data (ht jb)

Morgan Stanley slashed their estimate to 1.5% from 1.9% after what they called "a very weak report." RBS Securities cut their estimates to 1.7% from 2% ...And from Catherine Rampell at Economix: G.D.P. Forecast for First Quarter Slides

Today, after an especially weak report on February’s trade deficit, the [Macroeconomic Advisers'] economists lowered their first quarter G.D.P. estimate to a sorry 1.5 percent annualized.So Macroeconomic Advisers' forecast has gone from a "paltry" 2.3% to a "sorry" 1.5%!

The advance GDP report will be released on Thursday April 28th. Still time for more downgrades. What comes after "paltry" and "sorry"? Putrid?

Ceridian-UCLA: Diesel Fuel index increases in March

by Calculated Risk on 4/12/2011 10:57:00 AM

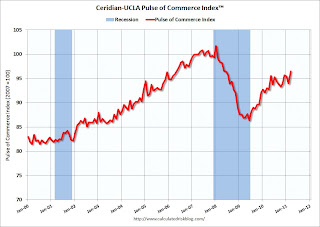

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 2000.

Press Release: Pulse of Commerce Index Jumps 2.7% in March

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation rose 2.7% on a seasonally and workday adjusted basis in March, more than offsetting the 0.3% decline in January and the 1.5% decline in February. On a quarter over quarter basis, the PCI is up 3.9% at an annualized rate, a welcome acceleration from the weak growth of the PCI in the 3rd and 4th quarter of 2010. It’s better, but not yet exceptional ...This index was useful in tracking the slowdown last summer, and the increase in March - after back-to-back to monthly declines - is welcome news.

The PCI growth of 3.9% for the first quarter of 2011 is a middle-of the-road number, signaling that we are not in either one of the extremes: the recession is over, but a robust recovery isn’t here.

...

Over time, the PCI has shown a substantial correlation with Industrial Production. Last month, the PCI suggested Industrial Production for February would come in flat to slightly down at -.02% , and it did. The strong March PCI suggests a 0.8% gain in industrial production for March when that data are released by the Federal Reserve on April 15.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise) and this suggests a strong reading for March. Industrial Production for March will be released on April 15th.

Trade Deficit decreased in February to $45.8 billion

by Calculated Risk on 4/12/2011 08:52:00 AM

The Department of Commerce reports:

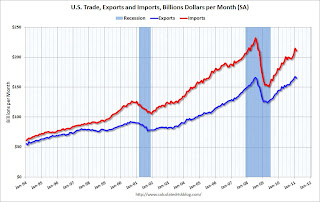

[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised. February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February, up from $72.92 in February 2010. Prices will be even higher in March and April. The trade deficit with China was $18.8 billion (NSA) in February. The oil and China deficits are essentially the entire trade deficit.

The trade deficit was larger than the expected $44 billion.

NFIB: Small Business Optimism Index decreases in March

by Calculated Risk on 4/12/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points. Index was driven by weaker expectations for real sales gains and business conditions and a marked deterioration in profit trends. The decline in the percent of owners expecting higher real sales and better business conditions in six months alone account for 76 percent of the decline in the Index.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans decreased slightly in March. According to NFIB: “The percent of owners reporting hard to fill job openings was unchanged at 15 percent, supporting the modest reductions in the unemployment rate recently observed. Unfortunately, the net percent of owners planning to create new jobs (increasing the total number of workers employed) lost three points, falling to a net 2 percent of all firms, low, but still 12 points better than the recession low reading of negative 10 percent reached in March 2009."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index (probably because of the high concentration of real estate related companies). Most of the decline was due to "soft" components, especially future expectations.