by Calculated Risk on 4/12/2011 08:52:00 AM

Tuesday, April 12, 2011

Trade Deficit decreased in February to $45.8 billion

The Department of Commerce reports:

[T]otal February exports of $165.1 billion and imports of $210.9 billion resulted in a goods and services deficit of $45.8 billion, down from $47.0 billion in January, revised. February exports were $2.4 billion less than January exports of $167.5 billion. February imports were $3.6 billion less than January imports of $214.5 billion.

Click on graph for larger image.

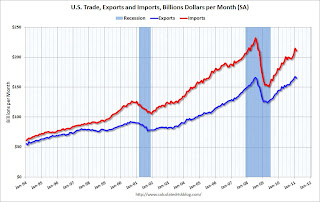

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through February 2011.

Both imports and exports declined slightly in February (seasonally adjusted). Still exports are now above the pre-recession peak.

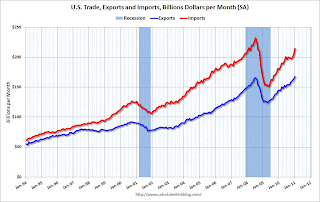

The second graph shows the U.S. trade deficit, with and without petroleum, through February.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased in February as the quantity declined even as import prices continued to rise - averaging $87.17 in February, up from $72.92 in February 2010. Prices will be even higher in March and April. The trade deficit with China was $18.8 billion (NSA) in February. The oil and China deficits are essentially the entire trade deficit.

The trade deficit was larger than the expected $44 billion.

NFIB: Small Business Optimism Index decreases in March

by Calculated Risk on 4/12/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Hiring Up, But Optimism Down in March

The Index of Small Business Optimism gave up 2.6 points in March, falling to 91.9. Four components rose or were unchanged, while six lost ground. The “hard” components of the Index (job creation, job openings, capital spending plans and inventory plans) added two points while the “soft” components (the other six in the table above) gave up 31 points. Index was driven by weaker expectations for real sales gains and business conditions and a marked deterioration in profit trends. The decline in the percent of owners expecting higher real sales and better business conditions in six months alone account for 76 percent of the decline in the Index.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been trending up, although the level is still very low.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans decreased slightly in March. According to NFIB: “The percent of owners reporting hard to fill job openings was unchanged at 15 percent, supporting the modest reductions in the unemployment rate recently observed. Unfortunately, the net percent of owners planning to create new jobs (increasing the total number of workers employed) lost three points, falling to a net 2 percent of all firms, low, but still 12 points better than the recession low reading of negative 10 percent reached in March 2009."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in March. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index (probably because of the high concentration of real estate related companies). Most of the decline was due to "soft" components, especially future expectations.

Monday, April 11, 2011

$4 Gasoline, Again

by Calculated Risk on 4/11/2011 08:21:00 PM

The average U.S. price is getting close to $4 per gallon.

From Ronald White at the LA Times: Gasoline prices continue climb

The U.S. average for a gallon of regular gasoline jumped 10.7 cents in the week ended Monday to $3.791, or 93.3 cents higher than a year earlier, according to the Energy Department's weekly survey of service stations.I think high gasoline prices are the top risk for the U.S. economy right now. Hopefully prices will decline soon; WTI crude futures declined slightly to $109 per barrel today.

The biggest regional increase was the 12.4-cent jump in the Midwest ... The Midwest average for regular gasoline reached $3.805 a gallon.

California drivers paid $4.161 for a gallon of self-serve regular gasoline ...

Shameless Puff Piece

by Calculated Risk on 4/11/2011 06:21:00 PM

I've been asked for some links to comments about my blog, so I put together this quick and shameless puff piece. I hope you all don't mind ... best to all, Bill (CR)

1) Time.com 25 Best Financial Blogs, March 2011

“If you only follow one economics blog, it has to be Calculated Risk, run by Bill McBride. The site provides concise and very accessible summaries of all the key economic data and developments. One of the reasons McBride is able to do this so well is that he has an almost uncanny knack of recognizing which facts really matter. He began the blog in 2005 because he saw a disaster brewing in the form of the housing bubble, and tried his best to warn the rest of us of what was coming. I've followed him closely ever since, and I don't know if he's ever been wrong. My advice is, if you've come up with a different conclusion from McBride on how economic developments are going to unfold, you'd be wise to think it over again!”

Professor James Hamilton, Economics, University of California, San Diego

2) By John Carney Senior Editor, CNBC.com

"It’s very clear to me that this fact of the extension of unemployment benefits is widely misunderstood—and would have remained widely misunderstood if not for the meticulous and clarifying genius of Calculated Risk."

3) By Alen Mattich at the WSJ: The Best Economics Blogs

"Calculated Risk, produced by Bill McBride, is more focused on U.S. economic developments, particularly in the real-estate market. But investment banking research rarely gets to the nub of the issue as quickly or pithily as McBride following data releases and market developments. If you’re following U.S. macro trends, it’s a blog that demands frequent visits."

4) By David Weidner at the WSJ: Ten Wall Street Blogs You Need To Bookmark Now

5) Nobel economist Paul Krugman in the NY Times:

"Calculatedrisk, my go-to site on housing matters."

6) "[B]y far the broadest, deepest, and smartest coverage of the subprme crisis and housing meltdown comes not from any newspaper but rather from the blog Calculated Risk."

Felix Salmon, Condé Nast (now at Reuters)

7) "Calculated Risk, ... posts not only offer running commentary on the news but also break down the economics of the mortgage game. ... Some of the commentary can be a slog, but no other site offers this level of analysis."

Business Week

8) Recent mention in the NY Times:

"Consider this chart from the Calculated Risk blog (and revisit it regularly). As the picture shows so vividly, we are still waiting for employment to turn back up decisively. Compared with previous recessions, the delay is simply stunning."

9) More recent mentions in the WSJ (just excerpts from my blog):

Here and here.

Housing Starts: Vacant Units and Unemployment Rate

by Calculated Risk on 4/11/2011 02:51:00 PM

An update to a couple of graphs ...

The first graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S.

Back in 2009, I used this chart to argue that there would be no "V shaped" recovery, and that housing starts wouldn't rebound rapidly. See: Housing Starts and Vacant Units: No "V" Shaped Recovery.

Note: Housing starts are through February, and the combined vacancy rate through Q4 based on the Census Bureau HVS vacancy rates for owner occupied and rental housing.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The good news is the total vacancy rate is declining (and based on recent Reis' data, the vacancy rate will fall further in Q1 2011). We know that the homebuilders will complete a record low number of housing units in 2011, and the declining vacancy rate suggests more households are being formed than net housing units added to the housing stock, or in other words, the excess supply is being absorbed.

There will be some increase in building this year (mostly in multi-family), but the recovery in construction will remain sluggish until more of the excess supply is absorbed. I'd like to see this measure of vacancy down to 4.5% or even 4.0%.

Looking at the graph, the vacancy rate continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Then some hidden inventory (like some 2nd homes) probably became available for sale or for rent, and also some households doubled up because of tough economic times.

The second graph shows single family housing starts (through February) and the unemployment rate (inverted) through March. Note: there are many other factors too impacting unemployment, but housing is a key sector.

The second graph shows single family housing starts (through February) and the unemployment rate (inverted) through March. Note: there are many other factors too impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) have declined recently - but have mostly moved sideways for the last two years. This is one of the reasons the unemployment rate has stayed elevated compared to previous recoveries.

The good news is residential investment should increase modestly this year, and that will help push down the unemployment rate. But I still think the labor market recovery will be sluggish until the excess housing supply is absorbed.

Fed's Yellen: Inflation Transitory, will not "impede the economic recovery"

by Calculated Risk on 4/11/2011 12:15:00 PM

From Fed Vice Chair Janet Yellen: Commodity Prices, the Economic Outlook, and Monetary Policy. Yellen discusses the recent surge in commodity prices and the possible impact on underlying inflation. She doesn't think the increase in commodity prices will impede the economic recovery.

A few excerpts:

[T]he recent run-up in commodity prices is likely to weigh somewhat on consumer spending in coming months because it puts a painful squeeze on the pocketbooks of American households. In particular, higher oil prices lower American income overall because the United States is a major oil importer and hence much of the proceeds are transferred abroad. Monetary policy cannot directly alter this transfer of income abroad, which primarily reflects a change in relative prices driven by global demand and supply balances, not conditions in the United States. Thus, an increase in the price of crude oil acts like a tax on U.S. households, and like other taxes, tends to have a dampening effect on consumer spending.And her conclusion:

The surge in commodity prices may also dampen business spending. Higher food and energy prices should boost investment in agriculture, drilling, and mining but are likely to weigh on investment spending by firms in other sectors. Assuming these firms are unable to fully pass through higher input costs into prices, they will experience some compression in their profit margins, at least in the short run, thereby causing a decline in the marginal return on investment in most forms of equipment and structures. Moreover, to the extent that higher oil prices are associated with greater uncertainty about the economic outlook, businesses may decide to put off key investment decisions until that uncertainty subsides. Finally, with higher oil prices weighing on household income, weaker consumer spending could discourage business capital spending to some degree.

Fortunately, considerable evidence suggests that the effect of energy price shocks on the real economy has decreased substantially over the past several decades. During the period before the creation of the Organization of the Petroleum Exporting Countries (OPEC), cheap oil encouraged households to purchase gas-guzzling cars while firms had incentives to use energy-intensive production techniques. Consequently, when oil prices quadrupled in 1973-74, that degree of energy dependence resulted in substantial adverse effects on real economic activity. Since then, however, energy efficiency in both production and consumption has improved markedly.

Consequently, while the recent run-up in commodity prices is likely to weigh somewhat on consumer and business spending in coming months, I do not anticipate that those developments will greatly impede the economic recovery as long as these trends do not continue much further.

In summary, the surge in commodity prices over the past year appears to be largely attributable to a combination of rising global demand and disruptions in global supply. These developments seem unlikely to have persistent effects on consumer inflation or to derail the economic recovery and hence do not, in my view, warrant any substantial shift in the stance of monetary policy.

Fed's Dudley: Not "enthusiastic about tightening policy too early"

by Calculated Risk on 4/11/2011 08:59:00 AM

From Bloomberg: Dudley Says Fed Shouldn’t Rush to Tighten Policy ‘Too Early’

“We’re probably going to have excess slack in the U.S. labor market at least through the end of 2012, and that’s one reason that colored my view that we shouldn’t be overly enthusiastic about tightening monetary policy too early,” [NY Fed President William] Dudley told a forum in Tokyo today.It is extremely unlikely that the Fed will raise rates this year - and as Dudley notes - there will probably be excess slack in the labor markets next year too.

Weekend:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Sunday, April 10, 2011

Softer Commodity Prices?

by Calculated Risk on 4/10/2011 08:19:00 PM

A couple of articles:

From the WSJ: Warning Signs for Copper Market (ht Brian)

Copper prices have almost quadrupled after a two-year rally ... evidence has recently surfaced of previously unreported copper stockpiles, a sign that much of the purchased copper hasn't been put to use.And from the WSJ: Steel Price Softens As Supply Solidifies

The world's steelmakers are increasing output despite softer demand, pushing down prices. ... But U.S. prices—especially for hot-rolled steel, a key component used in most steel products—could be headed lower tooLower commodity prices would definitely help - especially oil. Unfortunately WTI futures are up again to over $113 per barrel.

Earlier:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Economic Outlook and Downside Risks

by Calculated Risk on 4/10/2011 02:45:00 PM

Earlier:

• Summary for Week ending April 8th

• Schedule for Week of April 10th

Just an update: My general outlook for 2011 remains the same ...

• GDP growth slightly above trend and strong than the 2.9% growth rate in 2010 (although Q1 2011 will be sluggish).

• Payroll employment growth to be better in 2011 than in 2010 (940 nonfarm payroll jobs added in 2010, 1.17 million private payroll jobs). My forecast is private payrolls will increase 2.4 million in 2011, although total payroll growth will be less because of state and local government layoffs. With 7.25 million fewer payrolls jobs than before the recession, this is still disappointing payroll growth.

I also watch the downside risks carefully. Here is a brief update to a list from last month with my view if the risk to the economy is increasing or decreasing:

1) Higher oil prices and a possible supply shock. Risk increasing.

U.S. oil prices have risen to $112.79 per barrel. At the moment this appears to the be the top risk to the U.S. economy. With gasoline prices over $4 per gallon in some areas, this has to be starting to hurt.

2) Possible Federal government cutbacks (even shutdown). Risk increasing.

Although there was a budget deal reached on Friday, the fiscal cutting rhetoric has increased. There is even the possibility (remote) of the first default in history because of political ideology. The "debt ceiling" debate is just political grandstanding, but you never know what will happen. Even assuming the debt ceiling is raised, it appears there will be more cutting than originally expected - and that will be a drag on U.S. growth this year.

3) U.S. Housing Crisis. Same.

House prices are at new post-bubble lows and still falling. And there will be many foreclosures and more distressed supply coming on the market. But it does appear the excess supply is being absorbed (based on falling vacancy rates), but there is still a long way to go.

4) The European financial crisis. Same.

Portugal finally requested a bailout. That was expected. From Dow Jones: IMF Will Join In Assessment Of Portugal Tuesday

"Following a request by the Portuguese authorities, IMF experts will join European Commission and European Central Bank teams for a technical assessment of the current situation of the Portuguese economy," the statement said.If another European country, in addition to Greece, Ireland and Portugal, requests a bailout - or any of those countries default - the situation could get worse. Also the second round of bank stress tests might reveal additional problems.

The assessment will serve as the basis for policy discussions scheduled to begin April 18, the IMF said.

European authorities are planning a bailout for Portugal. They are trying to close a deal by mid-May ...

5) State and local government cutbacks. Same.

6) Inflation (a two sided coin). Same.

Although I think core inflation will remain below the Fed's target in 2011, it is possible that inflation could pick up more - or that policymakers will overreact.

7) Risks from the earthquake in Japan. Risk Diminished.

This was a horrible tragedy for the people of Japan, however it appears the risks from the nuclear and supply disruption issues have diminished.

Overall the downside risks have increased over the last few weeks - especially from oil prices and government policy.

Schedule for Week of April 10th

by Calculated Risk on 4/10/2011 08:35:00 AM

NOTE: The Schedule is available all week in the menu bar above.

Earlier:

• Summary for Week ending April 8th

The key reports this week are March Retail Sales on Wednesday, and the Consumer Price Index (CPI) on Friday. The monthly Trade Balance report will be released on Tuesday, and Industrial Production/Capacity Utilization on Friday. Also J.P. Morgan (Weds) and Bank of America (Fri) report Q1 results this week and they might provide comments on foreclosure issues.

12:15 PM ET: Fed Vice Chair Janet Yellen speaks, "Commodity Prices, the Economic Outlook, and Monetary Policy", At the Economic Club of New York Luncheon, New York, New York

7:30 AM: NFIB Small Business Optimism Index for March. This index has been showing some increase in optimism.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. The index increased to 94.5 in February from 94.1 in January.

Although still fairly low, this is the highest level for the index since December 2007.

8:30 AM: Trade Balance report for February from the Census Bureau.

This graph shows the monthly U.S. exports and imports in dollars through January 2011.

This graph shows the monthly U.S. exports and imports in dollars through January 2011.Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

The consensus is for the U.S. trade deficit to be around $44.0 billion, down from $46.3 billion in January.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales in spring 2011.

7:00 AM: J.P. Morgan First Quarter 2011 Financial Results

8:30 AM: Retail Sales for March.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The consensus is for retail sales to increase 0.5% in March (0.7% increase ex-auto).

10:00 AM: Manufacturing and Trade: Inventories and Sales for February. The consensus is for a 0.8% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

2:00 PM ET: The Fed Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 380,000 from 382,000 last week.

8:30 AM: Producer Price Index for March. The consensus is for a 1.0% increase in producer prices (0.2% core).

7:00 AM: Bank of America First-Quarter Financial Results

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 17.0, down slightly from 17.5 in March.

8:30 AM: Consumer Price Index for March. The consensus is for a 0.5% increase in prices. The consensus for core CPI is an increase of 0.2%.

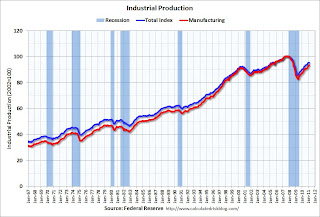

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for March.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Production is still 5.2% below the pre-recession levels at the end of 2007.The consensus is for a 0.5% increase in Industrial Production in March, and an increase to 77.4% (from 76.3%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for April. The consensus is for a slight increase to 69.0 from 67.5 in March.

Best wishes to All!