by Calculated Risk on 3/11/2011 09:55:00 AM

Friday, March 11, 2011

Consumer Sentiment declines sharply in March

The preliminary March Reuters / University of Michigan consumer sentiment index declined to 68.2 from 77.5 in February, the lowest level since October 2010.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was well below the consensus forecast of 76.5.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

My initial guess is this decline was because of higher gasoline prices.

Retail Sales increased 1.0% in February

by Calculated Risk on 3/11/2011 08:30:00 AM

On a monthly basis, retail sales increased 1.0% from January to February(seasonally adjusted, after revisions), and sales were up 8.9% from February 2010. The December 2010 to January 2011 percent change was revised from +0.3% to +0.7%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 15.3% from the bottom, and now 1.9% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 8.0% on a YoY basis (8.9% for all retail sales).

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $387.1 billion, an increase of 1.0 percent (±0.5%) from the previous month, and 8.9 percent (±0.7%)above February 2010. ... The December 2010 to January 2011 percent change was revised from +0.3 percent (±0.5%)* to +0.7 percent (±0.3%).This was at expectations for a 1.0% increase. Retail sales ex-autos were up 0.7%; also at expectations of a 0.7% increase. Including the upward revision to January retail sales, this was a solid report.

Thursday, March 10, 2011

Misc: Libya, Europe and Summary

by Calculated Risk on 3/10/2011 08:58:00 PM

• The Libya situation is grim.

From the NY Times: U.S. Escalates Pressure on Libya Amid Mixed Signals

From the WSJ: Gadhafi Forces Escalate Attacks

• Friday is the so-called "Day of Rage" in Saudi Arabia

From Reuters: Shooting and injuries before Saudi day of protest

Saudi police fired in the air to disperse protesting Shi'ites and three people were injured on the eve of a day of protests called for Friday by activists using the Internet.U.S. WTI oil prices fell slightly to $102.75 today.

Protests were planned in other Gulf countries such as Yemen, Kuwait and Bahrain.

• European Financial Crisis

From Bloomberg: Spain's Rating Downgraded to Aa2 by Moody's Over Bank Cost Concerns

From the Financial Times: Eurozone leaders to meet on stabilisation pact. Not much is expected at this meeting - this was a prelude to the meeting of all 27 EU leaders in Brussels on March 24th and 25th.

• House Prices declined 2.5% in January, Prices at New Post-bubble low, see Graph here

• Trade Deficit increased in January to $46.3 billion, see Graph here

• Weekly Initial Unemployment Claims increase to 397,000, see Graph here.

• Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

State Unemployment Rates generally unchanged in January

by Calculated Risk on 3/10/2011 05:25:00 PM

Earlier today from the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally unchanged in January. Twenty-four states recorded unemployment rate decreases, 10 states registered rate increases, and 16 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 14.2 percent in January. The states with the next highest rates were California, 12.4 percent, and Florida, 11.9 percent. North Dakota reported the lowest jobless rate, 3.8 percent, followed by Nebraska and South Dakota, 4.2 and 4.7 percent, respectively.

One state, Colorado, set a new series high, 9.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Seven states are still at the recession maximum (no improvement): Colorado (new high), Georgia, Idaho, Louisiana, Montana, New Mexico, and Texas.

Q4 Flow of Funds: Household Real Estate assets off $6.3 trillion from peak

by Calculated Risk on 3/10/2011 02:35:00 PM

The Federal Reserve released the Q4 2010 Flow of Funds report this morning: Flow of Funds.

According to the Fed, household net worth is now off $8.8 Trillion from the peak in 2007, but up $8.1 trillion from the trough in Q1 2009.

Update: Household net worked peaked at $65.7 trillion in Q2 2007. Net worth fell to $48.7 trillion in Q1 2009 (a loss of almost $17 trillion), and net worth was at $56.8 trillion in Q4 2010 (up $8.1 trillion from the trough).

The Fed estimated that the value of household real estate fell $260 billion to $16.37 trillion in Q4 2010. The value of household real estate has fallen $6.3 trillion from the peak - and is still falling in 2011.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2010, household percent equity (of household real estate) declined to 38.5% as the value of real estate assets fell by almost $260 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.5% equity - and 11.1 million households have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $55 billion in Q4. Mortgage debt has now declined by $542 billion from the peak. Studies suggest most of the decline in debt has been because of defaults, but some of the decline is from homeowners paying down debt.

Assets prices, as a percent of GDP, have fallen significantly and are only slightly above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

CoreLogic: House Prices declined 2.5% in January, Prices at New Post-bubble low

by Calculated Risk on 3/10/2011 11:04:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from December to January 2011. The CoreLogic HPI is a three month weighted average of November, December and January and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month

CoreLogic ... January Home Price Index (HPI) which shows that home prices in the U.S. declined for the sixth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.7 percent in January 2011 compared to January 2010 after declining by 4.7 percent in December 2010 compared to December 2009. Excluding distressed sales, year-over-year prices declined by 1.6 percent in January 2011 compared to January 2010 and by 3.2 percent in December 2010 compared to December 2009. Distressed sales include short sales and real estate owned (REO) transactions.

The January data shows home prices continuing to slide. Mark Fleming, chief economist with CoreLogic, said, “A number of factors continue to dampen any recovery in the housing market. Negative equity, which limits the mobility of homeowners, weak demand and the overhang of shadow inventory all continue to exert downward pressure on housing prices. We are looking out for renewed demand in the coming months as the spring buying season gets underway to hopefully reduce the downward pressure.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.7% over the last year, and off 32.8% from the peak.

This is the sixth straight month of year-over-year declines, and the seventh straight month of month-to-month declines. The index is now 1.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

Trade Deficit increased in January to $46.3 billion

by Calculated Risk on 3/10/2011 09:12:00 AM

The Department of Commerce reports:

[T]otal exports of $167.7 billion and imports of $214.1 billion resulted in a goods and services deficit of $46.3 billion, up from $40.3 billion in December, revised. January exports were $4.4 billion more than December exports of $163.3 billion. January imports were $10.5 billion more than December imports of $203.6 billion.

Click on graph for larger image.

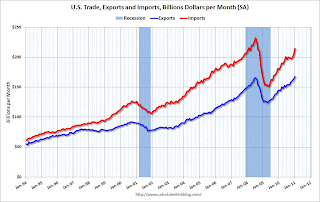

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2011.

Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

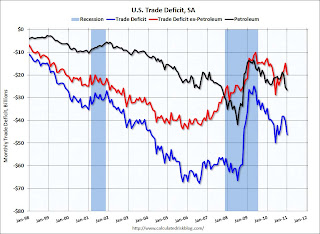

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in January as both quantity and import prices continued to rise - averaging $84.34 in January, up from $79.78 in December. Prices will be even higher in February and March. The trade deficit with China was $23.3 billion (NSA) in January. Once again the oil and China deficits are essentially the entire trade deficit (or even more).

Weekly Initial Unemployment Claims increase to 397,000

by Calculated Risk on 3/10/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 397,000, an increase of 26,000 from the previous week's revised figure of 371,000. The 4-week moving average was 392,250, an increase of 3,000 from the previous week's revised average of 389,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 3,000 to 392,250.

The 4-week average is still below the 400,000 level, and although there is nothing magical about 400,000 - staying below that level is a good sign for the labor market.

Wednesday, March 09, 2011

California Realtors: Only three out of five short sale transactions close

by Calculated Risk on 3/09/2011 11:35:00 PM

The previous post was about the problems with principal reductions. One effective way to reduce principal is a short sale ... but it is a very difficult process.

The president of the California Association of Realtors, Beth Peerce, sent out an "open letter" tonight. Here is an excerpt on short sales:

Short sales can play an important role in our state’s economic recovery by accelerating the pace of home sales and reducing the inventory of bank-owned homes on the market. There are other benefits as well. ...

Unfortunately, many homeowners are unable to successfully negotiate a short sale. According to a recent survey of 2,150 California REALTORS® who have assisted clients with a short sale, only three out of five transactions closed – even when there was an interested and qualified buyer.

What’s the problem? For one, no two mortgage agreements are the same, so it can be difficult to standardize short sale processes and procedures. Many homeowners have second mortgages, which further complicate matters. Then there’s the challenge of convincing multiple parties to take a financial loss or, in the case of loan servicers, to forego fees they otherwise might earn during the course of the foreclosure process. Poor and slow service by many banks and servicers has only exacerbated the problem. Horror stories abound from potential homebuyers and REALTORS® forced to wait 90 or more days for a response to a purchase offer or being required to fax short sale applications or other paperwork as many as 50 times. These delays discourage potential homebuyers from considering a short sale purchase ...

Increasing the number of closed short sales by speeding up and streamlining the short sale process is one important way we can help California families avoid foreclosure and move our economy closer to recovery. ... We’re meeting with major banks, U.S. Treasury officials, government-sponsored entities (including Fannie Mae and Freddie Mac), and others to urge them to standardize processes, comply with federal guidelines, improve communication with other stakeholders and increase staffing with the goal of eliminating service issues. ...

But we can’t do it alone. That’s why we’re focusing the spotlight on short sales and calling on regulators, elected officials, nonprofits, business organizations, companies, and individuals with a stake in California’s economic future to resolve this issue and others that get in the way of a recovery.

Research: "The flawed logic of principal reduction"

by Calculated Risk on 3/09/2011 07:10:00 PM

From Chris Foote, Kris Gerardi and Paul Willen at the Atlanta Fed: The seductive but flawed logic of principal reduction (ht Dean).

The researchers point out that principal reduction seems to make sense if a borrower is going to default and the lender foreclose, but that it is hard to predict exactly who is going to default (and not cure). If lenders aggressively offered principal reductions to underwater homeowners who are delinquent, then borrowers who are current would have an incentive to stop paying their mortgages.

I noted this a couple of years ago:

If it became widely known that lenders routinely reduce the principal balance for delinquent borrowers with negative equity, this would be an incentive for a large number of additional homeowners to stop paying their mortgages.And from another old post:

Some people point to Lewis Ranieri's apparent success with principal reductions, from Fortune: Lewis Ranieri wants to fix the mortgage messHere are some excerpts from the new research:

Now Ranieri is championing an inventive solution for fixing the mess he's accused of enabling in the first place. Ranieri has raised $825 million from 31 foundations and corporate and public pension funds, including the South Carolina Retirement Systems, to form the Selene Residential Mortgage Opportunity Fund.This only works because Ranieri bought the distressed mortgages at a deep discount, and his company has no reputation risk. Ranieri wants his borrowers to know that he will reduce their principal.

Selene's mission is simple: to buy delinquent mortgages at a deep discount, work with homeowners to get them paying again, and resell the now stable loans for profit. To get homeowners to do their part, Ranieri is taking the radical step of substantially lowering their mortgage balances.

Imagine what would happen to Wells Fargo or Bank of America if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments. The delinquency rate and losses would skyrocket

The idea of principal reduction starts with a correct premise: borrowers with positive equity—that is, houses worth more than the unpaid principal balance on their mortgages—rarely ever lose their homes to foreclosure.I think that is the key reason lenders have been reluctant to offer principal reductions.

...

With this idea in mind, it then follows that if we could somehow get everyone back into positive-equity territory, then we could end the foreclosure crisis. To do that, we either need to inflate house prices, which is difficult to do and probably a bad idea anyway, or reduce the principal mortgage balances for negative-equity borrowers. So we have a cure for the foreclosure crisis: if we can get lenders to write down principal to give all Americans positive equity in their homes, the housing crisis would be over.

...

The logic that principal reduction can prevent foreclosures at no cost is compelling and seductive, and proposals to encourage principal reduction were common early in the foreclosure crisis.

...

Ultimately the reason principal reduction doesn't work is what economists call asymmetric information: only the borrowers have all the information about whether they really can or want to repay their mortgages, information that lenders don’t have access to. If lenders weren't faced with this asymmetric information problem—if they really knew exactly who was going to default and who wasn't—all foreclosures could be profitably prevented using principal reduction.