by Calculated Risk on 3/03/2011 08:30:00 AM

Thursday, March 03, 2011

Weekly Initial Unemployment Claims decline sharply, 4-Week average below 400,000

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 26, the advance figure for seasonally adjusted initial claims was 368,000, a decrease of 20,000 from the previous week's revised figure of 388,000. The 4-week moving average was 388,500, a decrease of 12,750 from the previous week's revised average of 401,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 12,750 to 388,500 - the first time under 400,000 since July 2008.

There is nothing magical about the 400,000 level, but breaking below 400,000 is a good sign. The sharp drop in weekly claims suggests improvement in the labor market.

Wednesday, March 02, 2011

Update on Possible Mortgage Servicer Settlement

by Calculated Risk on 3/02/2011 11:28:00 PM

Actually an update on the lack of progress ...

From Nelson Schwartz and David Streitfeld at the NY Times: Officials Disagree on Penalties for Mortgage Mess

The newly created Consumer Financial Protection Bureau is pushing for $20 billion or more in penalties, backed up by the attorneys general and the Federal Deposit Insurance Corporation.A key issue is what "$20 billion" means. Some regulators want the lenders to use the money to reduce principal for underwater borrowers or other modification efforts. Others argue that would be "a back-door bailout for delinquent homeowners" who weren't even harmed by the processing errors.

But other regulators, including the Office of the Comptroller of the Currency, which oversees national banks, and the Federal Reserve, do not favor such a large fine, contending a small number of people were the victims of flawed foreclosure procedures.

There is a long way to go - but it sounds like criminal charges are off the table.

Bernanke: Challenges for State and Local Governments

by Calculated Risk on 3/02/2011 08:11:00 PM

From Fed Chairman Ben Bernanke: Challenges for State and Local Governments

As the recession took hold, revenues dropped precipitously, especially at the state level. Driven partly by balanced-budget requirements under their constitutions, many governments have responded by cutting numerous programs and reducing workforces. As necessary as these cuts may have been, they have left some jurisdictions struggling to maintain essential services. The fiscal problems of state and local governments have also had national implications, as their spending cuts and tax increases have been a headwind on the economic recovery. Moreover, concerns about both the current fiscal condition of these governments and their longer-term commitments to provide pensions and health benefits have recently led to strains in municipal bond markets.This is one of the key downside risks this year along with oil prices, the European financial crisis and housing.

And on the muni bond market:

Around the turn of the year ... investor concerns about the fiscal situations of many governments, including those of some populous states, resulted in increased yields on municipal bonds relative to Treasury bonds as well as a widening of credit default swap spreads for a number of states. Fortunately, although these measures of risk in the municipal bond market remain elevated, they have been looking somewhat better recently, presumably reflecting expectations of continuing improvement in the finances of states and localities. The Federal Reserve will continue to monitor the municipal bond market closely.And on the long run challenges:

[S]tate and local governments are also confronting some difficult fiscal challenges in the longer term. Indeed, with the retirement of public employees who are part of the baby-boom generation and the continued rise in health-care costs, meeting obligations for pension and retiree health-care expenses will become increasingly difficult for many states and localities. Estimates of state and local governments' unfunded pension liabilities for the nation as a whole span a wide range, with some researchers putting the figure in the neighborhood of $2 trillion to $3 trillion.

Oil Prices and PCE

by Calculated Risk on 3/02/2011 06:29:00 PM

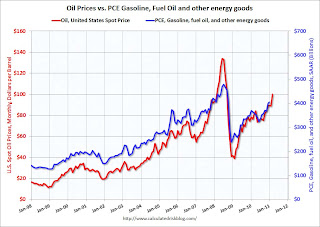

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

As oil prices fell sharply in late 2008, consumption of gasoline and other energy goods fell sharply too. On a quarterly basis, PCE, "Gasoline and other energy goods" peaked at $467 billion (SAAR) in Q3 2008, and fell sharply to $265 billion (SAAR) in Q1.

The sharp decline in oil prices provided a cushion for the U.S. economy in early 2009.

Now, with U.S. spot prices over $100 per barrel, gasoline and other energy goods PCE will probably come in around $425 billion (SAAR) in Q1 2011 (up from $379 billion (SAAR) in Q4 2010. This was already over $400 billion SAAR in January.

This is a drag on consumers of about $5 to $6 billion per month, at the current oil price, compared to the average for 2010.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product

Oil prices from EIA: U.S. Spot Prices

Fed's Beige Book: Economic activity continued to expand at a modest to moderate pace

by Calculated Risk on 3/02/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that overall economic activity continued to expand at a modest to moderate pace in January and early February.And on real estate:

...

Retail sales increased in all Districts, except Richmond and Atlanta, although Boston, New York, Philadelphia, Atlanta, and Kansas City noted that severe snowstorms had a negative impact on merchant activity.

...

All Districts, except St. Louis, experienced solid growth in manufacturing production, and new orders improved for Philadelphia, Atlanta, Chicago, Kansas City, and San Francisco.

...

Manufacturing and retail contacts across Districts reported rising input costs. Manufacturers in many Districts conveyed that they were passing through higher input costs to customers or planned to do so in the near future. ... There is little evidence of wage pressures across Districts.

...

Labor market conditions continued to strengthen modestly, with all Districts reporting some degree of improvement. The Boston, Cleveland, Minneapolis, and Dallas Districts cited noticeable improvements in the manufacturing sector, and the Boston and Cleveland Districts also observed increased labor demand in the healthcare and medical sectors.

Recent activity in residential real estate varied, but overall sales and construction remained at low levels across all Districts.Still "modest to moderate expansion". The good news is "labor market conditions continued to strengthen", but unfortunately "modestly". The bad news is rising input costs. This was based on data gathered before February 18th (late January, early February).

...

Reports on home prices were mixed. Atlanta and Kansas City observed persistent downward price pressure. Home prices continued to fall according to Philadelphia reports, but mainly at the high-end of the market. Cleveland and Chicago contacts described prices as little changed.

...

Commercial real estate activity showed signs of gaining traction according to a number of District reports. Boston, Chicago and Dallas reported that commercial real estate activity improved overall, while Richmond, Kansas City, and San Francisco noted increases in leasing activity. Kansas City described the market as stabilizing, while Philadelphia and Minneapolis reported that markets were flat overall, and New York described conditions as "slack" and St. Louis as "soft."

DOT: Vehicle Miles Driven increased in December

by Calculated Risk on 3/02/2011 11:55:00 AM

The Department of Transportation (DOT) reported that vehicle miles driven in December were up 0.6% compared to December 2009:

Travel on all roads and streets changed by +0.6% (1.4 billion vehicle miles) for December 2010 as compared with December 2009. Travel for the month is estimated to be 243.4 billion vehicle miles.

Cumulative Travel for 2010 changed by +0.7% (20.5 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

• Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 37 months - another record that will be broken soon.

• For the year (2010), this was the most vehicle miles traveled since 2007 and the third-highest ever behind both 2006 and 2007.

• In December U.S. oil prices averaged just under $90 per barrel, and we might see $100 oil lead to a decrease in driving in March or April.

Fed Testimony: Surpluses Forever!

by Calculated Risk on 3/02/2011 10:06:00 AM

Fed Chairman Ben Bernanke is testifying before the House Committee on Financial Services today. The prepared testimony will be the same as yesterday (before the Senate).

Here is the CSpan feed.

Here is the CNBC feed.

It is probably a good time to revisit then Fed Chairman Alan Greenspan's testimony to the same committee 10 years ago today. Here is his testimony on March 2, 2001:

Both the Bush Administration and the Congressional Budget Office project growing on-budget surpluses under current policy over the next decade.How did that work out?

...

The most recent projections from OMB and CBO indicate that, if current policies remain in place, the total unified surplus will reach about $800 billion in fiscal year 2010, including an on-budget surplus of almost $500 billion. Moreover, the admittedly quite uncertain long-term budget exercises released by the CBO last October maintain an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs.

These most recent projections, granted their tentativeness, nonetheless make clear that the highly desirable goal of paying off the federal debt is in reach and, indeed, would occur well before the end of the decade under baseline assumptions.

As an aside, the policy of returning the surpluses to the people was supported by both Rep. Ron Paul (current Chairman House Committee on Financial Services) and Rep. Paul Ryan (current Chairman House Subcommittee for Domestic Monetary Policy and Technology).

In Greenspan's defense, he did suggest any tax cut to reduce the surpluses should have a trigger to reduce the tax cut if deficits reappeared:

Conceivably, [a surplus reduction tax plan] could include provisions that, in some way, would limit surplus-reducing actions if specified targets for the budget surplus or federal debt levels were not satisfied. Only if the probability were very low that prospective tax cuts or new outlay initiatives would send the on-budget accounts into deficit, would unconditional initiatives appear prudent.Of course that never happened.

...

With today's euphoria surrounding the surpluses, it is not difficult to imagine the hard-earned fiscal restraint developed in recent years rapidly dissipating. We need to resist those policies that could readily resurrect the deficits of the past and the fiscal imbalances that followed in their wake.

ADP: Private Employment increased by 217,000 in February

by Calculated Risk on 3/02/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 217,000 from January to February on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from December 2010 to January 2011 was revised up to 189,000 from the previously reported increase of 187,000.Note: ADP is private nonfarm employment only (no government jobs).

This month’s ADP National Employment Report suggests continued solid growth of nonfarm private employment early in 2011. The recent pattern of rising employment gains since the middle of last year was reinforced by today’s report, as the average gain from December through February (217,000) is well above the average gain over the prior six months (63,000).

This was above the consensus forecast of an increase of about 180,000 private sector jobs in February.

The BLS reports on Friday, and the consensus is for an increase of 180,000 payroll jobs in February, on a seasonally adjusted (SA) basis, and for the unemployment rate to increase slightly to 9.1%.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 3/02/2011 07:38:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

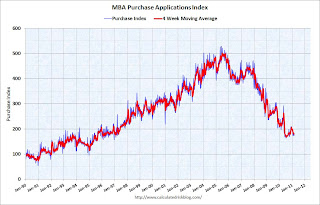

The Refinance Index decreased 6.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.84 percent from 5.00 percent, with points increasing to 1.30 from 0.96 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at 1997 levels - however there are have been a large percentage of cash buyers recently and cash buyers do not apply for a mortgage - still this suggests weak home sales through the first few months of 2011.

Tuesday, March 01, 2011

ISM Manufacturing Index and Employment

by Calculated Risk on 3/01/2011 10:33:00 PM

It is time for a scatter graph ...

Earlier today, I noted that the ISM manufacturing employment index was the highest level since January 1973 at 64.5, but the impact on overall employment would be less than in '73. This is because manufacturing employment is a much smaller percentage of overall U.S. employment now. In 1973, almost 30% of private payroll employment was manufacturing (18.3 million), today it is less than 11% (at 11.6 million). So the same ISM manufacturing employment reading today suggests a much smaller impact on overall U.S. employment than in 1973.

It is still good news, and the ISM survey suggests manufacturing employment grew at around 60,000 in February.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the relationship between the ISM manufacturing employment index and the change in BLS manufacturing employment (as a percent of the previous month employment).

The two yellow dots are for January 2011 (61.7 ISM and 49,000 jobs), and a forecast for February based on the ISM employment reading of 64.5.

There was a time when a 64.5 might mean a couple hundred thousand payroll jobs, but now it suggests around 60,000 jobs (with plenty of noise). Still helpful, but not the same overall impact as in the '50s, '60s or even '70s.

Earlier:

• ISM Manufacturing Index increases in February

• Private Construction Spending decreases in January

• U.S. Light Vehicle Sales 13.44 million SAAR in February

• Graphs: ISM manufacturing, Construction Spending, Vehicle Sales