by Calculated Risk on 1/05/2011 03:07:00 PM

Wednesday, January 05, 2011

European Bond Yields

Just an update ...

• From the NY Times: Portugal's Borrowing Costs Rise as E.U. Sells Bonds for Irish Rescue

The European Union began issuing bonds on Wednesday to finance its rescue fund for Ireland, even as Portugal was required to pay more to sell short-term debt.• In addition to Portugal, yields are rising again in Ireland and Greece. The Ireland 10-year bond yield is over 9%, and the Greece 10-year bond yield is at a record 12.62%. Both Greece and Ireland are using the "bailout" funds, and the high yields suggest investors expect an eventual default.

... the Portuguese Treasury and Government Debt Agency sold €500 million of six-month bills ... The bills carried an average yield of 3.69 percent, far above the 2.05 percent Portugal paid for a similar issue in September.

• Update: From Bloomberg: Spanish Bank Stocks Drop on Funding Cost, Led by BBVA

It seems another blowup is inevitable.

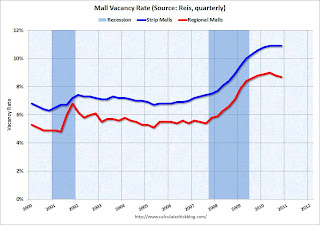

Reis: Strip Mall Vacancy rates steady in Q4

by Calculated Risk on 1/05/2011 12:05:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From Reuters: Rents at big U.S. malls up, but smaller centers lag

In the fourth quarter, vacancies at U.S. strip malls were flat at 10.9 percent ... Asking rent at strip malls fell 0.1 percent ... at large regional malls ... the vacancy rate fell ... to 8.7 percent ... Asking rents rose for the first time since the third quarter of 2008 ...At regional malls the record vacancy rate was 9.0% in Q2 2010 (Reis started tracking regional malls in 2000). The record vacancy rate for strip malls was in 1990 at 11.1%.

"We appear to be in a meandering sort of direction," said Reis economist Ryan Severino.

It appears both the mall and office vacancy rates have peaked (or are near a peak), but the rates are still very high - and it will take some time for the vacancy rates to come down enough to start building again.

ISM Non-Manufacturing Index showed expansion in December

by Calculated Risk on 1/05/2011 10:00:00 AM

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: October 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 12th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.This was a solid report, however the decline in the employment index is disappointing.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI (Non-Manufacturing Index) registered 57.1 percent in December, 2.1 percentage points higher than the 55 percent registered in November, and indicating continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 6.5 percentage points to 63.5 percent, reflecting growth for the 13th consecutive month at a faster rate than in November. The New Orders Index increased 5.3 percentage points to 63 percent, and the Employment Index decreased 2.2 percentage points to 50.5 percent, indicating growth in employment for the fourth consecutive month, but at a slower rate. The Prices Index increased 6.8 percentage points to 70 percent, indicating that prices increased significantly in December. According to the NMI, 14 non-manufacturing industries reported growth in December. Respondents' comments vary by company and industry, but overall are mostly positive about business conditions."

emphasis added

ADP: Private Employment increased by 297,000 in December

by Calculated Risk on 1/05/2011 08:15:00 AM

ADP reports:

Private-sector employment increased by 297,000 from November to December on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from October to November was revised down but only slightly, from the previously reported increase of 93,000 to an increase of 92,000.Note: ADP is private nonfarm employment only (no government jobs).

This month’s ADP National Employment Report suggests nonfarm private employment grew very strongly in December, at a pace well above what is usually associated with a declining unemployment rate. After a mid-year pause, employment seems to have accelerated as indicated by September’s employment gain of 29,000, October’s gain of 79,000, November’s gain of 92,000 and December’s gain of 297,000. Strength was also evident within all major industries and every size business tracked in the ADP Report.

The consensus was for ADP to show an increase of about 100,000 private sector jobs in December, so this was well above consensus.

The BLS reports on Friday, and the consensus is for an increase of 140,000 payroll jobs in December, on a seasonally adjusted (SA) basis, and for the unemployment rate to decline slightly to 9.7%.

MBA: Mortgage Purchase Application activity still low

by Calculated Risk on 1/05/2011 07:20:00 AM

The MBA reports: Mortgage Applications Drop the Week Before Christmas and Increase the Week After

For the week ending December 24, 2010, the Refinance Index decreased 7.2 percent from the previous week and the seasonally adjusted Purchase Index increased 3.1 percent from one week earlier. The following week, the Refinance Index increased 3.9 percent and the seasonally adjusted Purchase Index decreased 0.8 percent.

...

For the week ending December 31, 2010, the average contract interest rate for 30-year fixed-rate mortgages decreased to 4.82 percent with points increasing to 1.11.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at about the levels of 1997 - and about 17% below the levels of April this year - suggesting weak existing home sales through the first couple months of 2011.

Tuesday, January 04, 2011

Largest Condo Project in Northwest goes back to Lenders

by Calculated Risk on 1/04/2011 07:57:00 PM

From Eric Pryne at the Seattle Times: Bellevue Towers developer turns project over to lenders

The developer of Bellevue Towers, the region's biggest condo project ever, has turned over the development to lenders to avoid foreclosure.More price declines coming ...

The new owners announced price cuts to help spur sales at the 539-unit development, where just 118 sales have closed since the two towers were completed nearly two years ago.

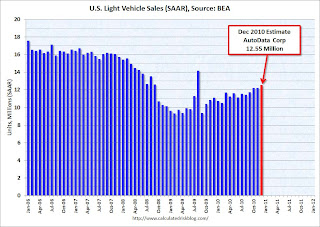

U.S. Light Vehicle Sales 12.55 million SAAR in December

by Calculated Risk on 1/04/2011 04:00:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.55 million SAAR in December. That is up 13.1% from December 2009, and up 2.7% from the November 2010 sales rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 12.55 million SAAR from Autodata Corp).

This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.3 million SAAR.

FOMC Minutes: Economic improvement "not sufficient" for QE2 changes

by Calculated Risk on 1/04/2011 02:00:00 PM

From the December 14, 2010 FOMC meeting. These are probably the key sentences:

While the economic outlook was seen as improving, members generally felt that the change in the outlook was not sufficient to warrant any adjustments to the asset-purchase program, and some noted that more time was needed to accumulate information on the economy before considering any adjustment. Members emphasized that the pace and overall size of the purchase program would be contingent on economic and financial developments; however, some indicated that they had a fairly high threshold for making changes to the program.And on the outlook:

Regarding their overall outlook for economic activity, participants generally agreed that, even with the positive news received over the intermeeting period, the most likely outcome was a gradual pickup in growth with slow progress toward maximum employment. However, they held a range of views about the risks to that outlook. A few mentioned the possibility that growth could pick up more rapidly than expected, particularly in light of the very accommodative stance of monetary policy currently in place. It was noted that such an acceleration would likely be accompanied by significantly more rapid growth in bank lending and in the monetary aggregates, suggesting that such indicators might prove to be useful sources of information. Others pointed to downside risks to growth. One common concern was that the housing sector could weaken further in light of the considerable supply of houses either on the market or likely to come to market. Another concern was the ongoing deterioration in the fiscal position of U.S. states and localities, which could lead to sharp cuts in spending and increases in taxes. In addition, participants expressed concerns about a possible worsening of the banking and financial strains in Europe, which could spill over to U.S. financial markets and institutions, and so to the broader U.S. economy. ...

Regarding the outlook for inflation, participants generally anticipated that inflation would remain for some time below levels judged to be most consistent, over the longer run, with maximum employment and price stability. In particular, most participants expected that underlying measures of inflation would bottom out around current levels and then move gradually higher as the recovery progresses.

General Motors: December U.S. sales increase 7.5% year-over-year

by Calculated Risk on 1/04/2011 11:03:00 AM

Note: The real key is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers.

From MarketWatch: GM posts 7.5% gain in December U.S. sales

[GM] reported a 7.5% increase in December U.S. sales to 224,185 cars and trucks.Once all the reports are released, I'll post a graph of the estimated total December light vehicle sales (SAAR) - usually around 4 PM ET. Most estimates are for an increase to 12.3 million SAAR in December from the 12.2 million SAAR in November. Sales in December 2009 were at a 11.1 million SAAR.

I'll add reports from the other major auto companies as updates to this post.

Update: MarketWatch reports: Ford 2010 sales up 19% vs year ago

From CNBC:

Chrysler says its sales for December of 2010 were up 16.4 percent from the same time in 2009. The carmaker sold 100,702 vehicles in December vesus 86,523 in the same month of 2009.

Reis: Office Vacancy Rate steady in Q4

by Calculated Risk on 1/04/2011 08:59:00 AM

From Bloomberg: U.S. Office Market Has First Gain in Occupied Space Since 2007, Reis Says

Office buildings added 2.5 million square feet ... of occupied space in the fourth quarter, compared with a loss of 14 million square feet a year earlier, Reis said in its report. It was the first rise in net absorption since the fourth quarter of 2007.

The office vacancy rate was unchanged from the third quarter at 17.6 percent, remaining at the highest level since 1993, as supply also increased. ... “Vacancy has finally appeared to have stabilized,” Ryan Severino, an economist at Reis, said ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate was at 17.6% in Q4 2010, the same as in Q3 and up from 17.0% in Q4 2009.

Reis should release the Mall and Apartment vacancy rates over the next few days.