by Calculated Risk on 12/21/2010 08:50:00 AM

Tuesday, December 21, 2010

Moody's Warns it may downgrade Portugal's Credit Rating

From the Reuters: A Warning to Portugal as Spain Sells Bonds

Moody’s ... put Portugal on review for a possible downgrade, almost a week after doing the same to Spain, and having cut Ireland by five notches last week.Europe was one of the Ten Economic Questions for 2011 I posted over the weekend. I hope to post some thoughts on each of those questions before the New Year, but it sure seems another blowup is likely in Europe.

Monday, December 20, 2010

Streitfeld: Homes at Risk, and No Help From Lawyers

by Calculated Risk on 12/20/2010 11:44:00 PM

From David Streitfeld at the NY Times: Homes at Risk, and No Help From Lawyers

Lawyers throughout California say they have no choice but to reject clients ... because of a new state law that sharply restricts how they can be paid. Under the measure ... lawyers who work on loan modifications cannot receive any money until the work is complete. ...The problem was widespread modification fraud:

The law, which has few parallels in other states, was devised to eliminate swindles in which modification firms made promises about what their lawyers could do, charged hefty fees and then disappeared. But foreclosure specialists say there has been an unintended consequence: the honest lawyers can no longer afford to assist [borrowers] ...

Two years ago, the state bar association had seven complaints of misconduct in loan modifications. By March 2009, there were more than 100 complaints, and a task force was formed to deal with the problem. Soon, there were thousands of complaints. ... The president of the bar association wrote in a column last year that “hundreds, and perhaps thousands, of California lawyers” were victimizing people “at the most vulnerable point in their lives.”Several lawyers emailed me about this possibility before the law passed, but no one seemed to have a good solution for the widespread fraud. Very sad.

ATA Truck Tonnage Index decreases slightly in November

by Calculated Risk on 12/20/2010 08:04:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.1 Percent in November

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1 percent lower in November after increasing a revised 0.9 percent in October. In September and October, tonnage increased a total of 2.8 percent. The latest reduction put the SA index at 109.7 (2000=100) in November from 109.9 in October

...

ATA Chief Economist Bob Costello said that he is not overly concerned with the small decrease in tonnage during November. “Tonnage increased for two consecutive months in September and October and I don’t expect volumes to rise every month. Additionally, the decrease in November is much smaller than the gains during the previous two months.” Costello said he expects truck freight tonnage to grow modestly during the first half of 2011 before accelerating in the later half of the year into 2012.

Click on map for larger image.

Click on map for larger image.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

The line is added to show the index has been mostly moving sideways this year.

Moody's: Commercial Real Estate Prices increase in October

by Calculated Risk on 12/20/2010 03:29:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 1.3% in October. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are about 42% below the peak in 2007.

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

Here is an article from Bloomberg: http://www.bloomberg.com/news/2010-12-20/u-s-commercial-property-rises-for-second-consecutive-month-moody-s-says.html

Analysis: Decline in home prices impacting small business borrowing

by Calculated Risk on 12/20/2010 02:16:00 PM

From Mark Schweitzer and Scott Shane at the Cleveland Fed: The Effect of Falling Home Prices on Small Business Borrowing

The researchers analyze small business borrowing, and note that homes equity borrowing is an "important source of capital for small business owners and that the impact of the recent decline in housing prices is significant enough to be a real constraint on small business finances."

Here is their conclusion:

Everyone agrees that small business borrowing declined during in the recession and has not yet returned to pre-recession levels. Lesser consensus exists around the cause of the decline. Decreased demand for credit, declining creditworthiness of small business borrowers, an unwillingness of banks to lend money to small businesses, and tightened regulatory standards on bank loans have all been offered as explanations.There is no easy replacement for this source of borrowing.

While we would agree that these factors have had an effect on the decline in small business borrowing through commercial lending, we believe that other limits on the credit of small business borrowers are also at play and could be harder to offset. Specifically, the decline in home values has constrained the ability of small business owners to obtain the credit they need to finance their businesses.

Of course, not all small businesses have been equally affected by the decline in home prices. While many small business owners use residential real estate to finance businesses, not all do. Those more likely do so to include companies in the real estate and construction industries, those located in the states with the largest increases in home prices during the boom, younger and smaller businesses, companies with lesser financial prospects, and those not planning to borrow from banks. These patterns are also evident in the data sources we examined.

The link between home prices and small business credit poses important challenges for policy makers seeking to improve small business owners’ access to credit. The solution is far more complicated than telling bankers to lend more or reducing the regulatory constraints that may have caused them to cut back on their lending to small companies. Returning small business owners to pre-recession levels of credit access will require an increase in home prices or a weaning of small business owners from the use of home equity as a source of financing. Neither of those alternatives falls into the category of easy and quick solutions.

DOT: Vehicle miles driven increased in October

by Calculated Risk on 12/20/2010 11:28:00 AM

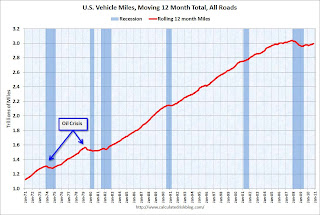

The Department of Transportation (DOT) reported that vehicle miles driven in October were up 1.9% compared to October 2009:

Travel on all roads and streets changed by +1.9% (4.9 billion vehicle miles) for October 2010 as compared with October 2009. Travel for the month is estimated to be 259.5 billion vehicle miles.

Cumulative Travel for 2010 changed by +0.6% (16.0 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased 1.2% from the bottom of the recession.

Miles driven are still 1.4% below the peak in 2007. This is another indicator of a sluggish recovery.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 35 months - another record that will be broken soon.

Chicago Fed: Economic Activity Slowed in November

by Calculated Risk on 12/20/2010 08:30:00 AM

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity slowed in November

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.46 in November from –0.25 in October. Three of the four broad categories of indicators that make up the index deteriorated from October to November, with only the production and income category improving.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.41 in November from –0.42 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was sluggish in November.

Weekend:

• Ten Economic Questions for 2011

• The economic schedule for the coming week.

• Summary for Week ending December 18th

Sunday, December 19, 2010

Las Vegas: A tour of the Preposterous

by Calculated Risk on 12/19/2010 09:47:00 PM

Patrick Coolican at the Las Vegas Sun takes a drive around Las Vegas: Boom-bust era leaves architectural scars across valley

A couple of excerpts:

Now we’re on Gibson Road in Henderson, up the hill from Interstate 215, and there sits Vantage, a boxy, glassy modernist condo development; a historical artifact of the era of the credit boom, and, perhaps, delusional exuberance. It was a $160 million project, but no one lives there. It sits on the hill, surrounded by suburbia, like a hipster who’s stumbled into a church that he thought was a nightclub.This quote from the article captures the bubble insanity: "It seemed any project, no matter how preposterous, could make money." They were wrong.

...

We drive east on 215 to ManhattanWest on Russell Road, another half-finished mixed-use development. Dense, high-rise urbanism plopped down in the suburbs, its name a great irony. Some windows are covered with plywood, like an abandoned property in a city that suffered a natural disaster.

It’s like a Hollywood set. But of what? It imagines that it’s supposed to look this way because somewhere, there’s something that’s cool and authentic and looks like this, perhaps? But there is no such place.

Ten Economic Questions for 2011

by Calculated Risk on 12/19/2010 03:56:00 PM

Just some questions looking forward to next year:

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)? Will house prices bottom in 2011?

2) Residential Investment: It appears residential investment (RI) bottomed in 2010, and will probably make a positive contribution to GDP growth in 2011 for the first time since 2005. RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Historically RI has been the best leading indicator for the economy, but the growth in RI will probably be modest because of the large overhang of excess housing units. How much will RI grow in 2011?

3) Distressed house sales: Foreclosure activity is very high, although activity has slowed recently - probably because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) is increasing again, although still below the levels of late 2008. How much will foreclosure activity pick up in 2011? Will the number of REOs peak in 2011 and start to decline?

4) Economic growth: After I took the "over" for 2011 back in November, a number of analysts have upgraded their forecasts. As an example, Goldman Sachs noted Friday:

The US economic outlook for 2011 has improved further with enactment of the fiscal compromise, as well as a stronger trend in recent data. As we forewarned, we are revising up our forecasts to incorporate this news and now expect real GDP to rise 3.4% in 2011 and 3.8% in 2012 (up from 2.7% and 3.6%) ...It does appear GDP growth will increase in 2011, although GDP growth will probably still be sluggish relative to the slack in the system. How much will the economy grow in 2011?

5) Employment: The U.S. economy added about 87 thousands payroll jobs per month in 2010 through November. This was extremely weak payroll growth for a recovery. How many payroll jobs will be added in 2011?

6) Unemployment Rate: The post-Depression record for consecutive months with the unemployment rate above 9% was 19 months in the early '80s. That record will be broken this month, and it is very possible that the unemployment rate will still be above 9% in December 2011. This high level of unemployment - and the number of long term unemployed - is an economic tragedy. The economy probably needs to add around 125 thousand payroll jobs per month just to keep the unemployment rate from rising (payroll jobs and unemployment rate come from two different surveys, so there is no perfect relationship, and the rate also depends on the participation rate). What will the unemployment rate be in December 2011?

7) State and Local Governments: How much of a drag will state and local budget problems have on economic growth and employment? Will there be any significant muni defaults?

8) Europe and the Euro: What will happen in Europe? When will the next blowup happen? How much of a drag will the problems in Europe have on U.S. growth?

9) Inflation: With all the slack in the system, will the U.S. inflation rate stay below target? Will there be any spillover from rising inflation rates in China and elsewhere?

10) Monetary Policy: Will the Fed expand QE2 (probably not)? Will the Fed reverse any of the Large Scale Asset Purchases? Probably not. Will the Fed raise the Fed Funds rate? Very unlikely.

OK, some of the questions were really multiple questions - and I ventured a guess on the last one.

Earlier:

• The economic schedule for the coming week.

• Summary for Week ending December 18th

Summary for Week ending December 18th

by Calculated Risk on 12/19/2010 09:20:00 AM

Note: here is the economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs. A key story was that the proposed tax legislation was passed by the Senate and House, and was signed into law on Friday.

• Housing Starts increased slightly in November

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

Total housing starts were at 555 thousand (SAAR) in November, up 3.9% from the revised October rate of 534 thousand, and up 16% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

This was close to expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed.

• Industrial Production, Capacity Utilization increased in November

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This was slightly above consensus expectations of a 0.3% increase in Industrial Production, and an increase to 75.0% for Capacity Utilization.

• Retail Sales increased 0.8% in November

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 12.8% from the bottom, and only off 0.3% from the pre-recession peak.

This was above expectations for a 0.6% increase (and October was revised up). Retail sales ex-autos were up 1.2%, above expectations of a 0.6% increase.

• CoreLogic: House Prices declined 1.9% in October

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 3.93% over the last year, and off 30.2% from the peak.

The index is 2.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

• NFIB: Small Business optimism improved in November

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• CoreLogic: 10.8 Million U.S. Properties with Negative Equity in Q3

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q3 2010 negative equity report this week.

CoreLogic reports that 10.8 million, or 22.5 percent, of all residential properties with mortgages were in negative equity at the end of the third quarter of 2010, down from 11.0 million and 23 percent in the second quarter. This is due primarily to foreclosures of severely negative equity properties rather than an increase in home values.Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home. About 10% of homeowners with mortgages have more than 25% negative equity - although the percent of homeowners with severe negative equity has been declining over the last few quarters mostly because of homes lost to foreclosure.

The second graph shows the break down of equity by state.

The second graph shows the break down of equity by state.In Nevada very few homeowners with mortgages have any equity, whereas in New York almost half have over 50%.

As CoreLogic's Mark Fleming noted, the number of homeowners with negative might increase over the next few quarters with declining home prices.

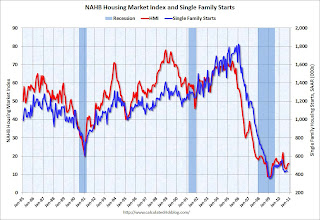

• NAHB Builder Confidence Flat in December

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (graph before November housing starts were released).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

• Other Economic Stories ...

• From the NY Times: Moody’s Slashes Ireland’s Credit Rating

• Here come the '99ers

• Unofficial Problem Bank list increases to 920 Institutions

Best wishes to all!