by Calculated Risk on 12/16/2010 02:29:00 PM

Thursday, December 16, 2010

Hotels: RevPAR up 11.5% compared to same week in 2009

A weekly update on hotels from HotelNewsNow.com: STR: San Francisco tops weekly increases

Overall, the industry’s occupancy increased 8.6% to 52.2%, ADR was up 2.6% to US$98.75, and RevPAR ended the week up 11.5% to US$51.56.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.2% compared to last year and 2.6% below the median for 2000 through 2007.

This is the slow season for hotels, and the key will be if business travel picks up early next year.

Note: RevPAR (revenue per available room) was up 2.7% compared to the same week two years ago (in 2008) for the second time this year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

CoreLogic: House Prices declined 1.9% in October

by Calculated Risk on 12/16/2010 11:17:00 AM

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from September to October 2010. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

From CoreLogic: Home Price Index Shows Decline for Third Straight Month, October Home Prices Declined 3.93 Percent Year Over Year

CoreLogic ... today released today released its October Home Price Index (HPI) which shows that home prices in the U.S. declined for the third month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 3.93 percent in October 2010 compared to October 2009 and declined by 2.43 percent* in September 2010 compared to September 2009. Excluding distressed sales, year-over-year prices declined by 1.5 percent in October 2010 compared to October 2009. ...

“We are continuing to see the weakness in home prices without artificial government support in the form of tax credits. The stubborn unemployment levels and seasonality are also coming into play,” said Mark Fleming, chief economist for CoreLogic. “When you combine these factors with high shadow and visible inventories, the prospect for a housing recovery in early 2011 is fading.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 3.93% over the last year, and off 30.2% from the peak.

The index is 2.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

Housing Starts increase slightly in November

by Calculated Risk on 12/16/2010 08:57:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 555 thousand (SAAR) in November, up 3.9% from the revised October rate of 534 thousand, and up 16% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

The increase this month was due to single-family starts, but the level is still very low. Single-family starts increased 6.9% to 465 thousand in November.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was close to expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 555,000. This is 3.9 percent (±12.0%)* above the revised October estimate of 534,000, but is 5.8 percent (±12.0%)* below the November 2009 rate of 589,000.

Single-family housing starts in November were at a rate of 465,000; this is 6.9 percent (±13.5%)* above the revised October figure of 435,000.

Building Permits:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 530,000. This is 4.0 percent (±2.9%) below the revised October rate of 552,000 and is 14.7 percent(±1.7%) below the November 2009 estimate of 621,000.

Single-family authorizations in November were at a rate of 416,000; this is 3.0 percent (±1.0%) above the revised October figure of 404,000.

Weekly Initial Unemployment Claims decline to 420,000

by Calculated Risk on 12/16/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 11, the advance figure for seasonally adjusted initial claims was 420,000, a decrease of 3,000 from the previous week's revised figure of 423,000. The 4-week moving average was 422,750, a decrease of 5,250 from the previous week's revised average of 428,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 5,250 to 422,750.

This is the lowest level for the 4-week moving average since the first week in August 2008. The level is still high, but the decline in the 4-week average is good news.

Wednesday, December 15, 2010

Europe Update

by Calculated Risk on 12/15/2010 11:59:00 PM

The slow motion train wreck continues in Europe.

From the NY Times: Europe Staggers as Critical Summit Looms

Europe’s smoldering financial crisis flared up on Wednesday, with riots over austerity spending in Greece, new signs of troubles in Spain and little indication that European leaders were moving any closer to agreement on a systemic approach to long-term stability.And from the Financial Times: German MPs clash on future of eurozone

The day’s events emphasized the complex social, political and economic challenges facing government leaders at a European Union summit meeting on Thursday and Friday in Brussels.

The question is when the crisis will flare up again - and where (Spain?)

Earlier today:

• Mortgage Applications decline, Mortgage rates rise sharply

• The Empire State Manufacturing Survey showed expansion

• Industrial Production, Capacity Utilization increased in November

• NAHB Builder Confidence Flat in December

• Tax Legislation Passes in Senate 81 to 19

• Inflation: Core CPI, Median CPI, 16% trimmed-mean CPI remain below 1% YoY

Thursday:

• 8:30 AM: The initial weekly unemployment claims report will be released.

• 8:30 AM: Housing Starts for November.

Best to all

DataQuick: SoCal Home Sales off 15.5% from November 2009

by Calculated Risk on 12/15/2010 07:17:00 PM

From DataQuick: Southland Home Sales Dip; Prices Change Little

Southern California home sales fell in November to the second-lowest level for that month in 18 years, reflecting the weak economic recovery, a dormant new-home market and tight credit conditions. ...The last comment on the new-home market is one of the reasons I track the "distressing gap" (the change in the ratio between new and existing home sales). In most areas the builders just can't compete with distressed sales - although in some areas they are competing by building much smaller homes.

A total of 16,208 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 3.2 percent from 16,744 sales in October, and down 15.5 percent from 19,181 in November 2009, according to MDA DataQuick of San Diego.

...

In the new-home market, sales were the slowest for a November since at least 1988. In many growth areas the math for builders just doesn’t work: The cost to construct is higher than what buyers can afford or are willing to pay. Often builders can’t compete with the pricing of nearby resale homes, especially foreclosures and short sales.

This report is consistent with Tom Lawler's initial read of 4.57 million existing home sales in November (seasonally adjusted annual rate).

Inflation: Core CPI, Median CPI, 16% trimmed-mean CPI remain below 1% YoY

by Calculated Risk on 12/15/2010 03:47:00 PM

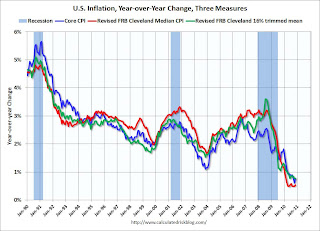

In addition to the CPI release this morning from the BLS, the Cleveland Fed released the median CPI and the trimmed-mean CPI:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.0% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.1% annualized rate) during the month. ...So these three measures: core CPI, median CPI and trimmed-mean CPI, all increased less than 1% over the last 12 months.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.5% annualized rate) in November. The CPI less food and energy increased 0.1% (1.2% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.1%, and the CPI less food and energy rose 0.8%

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

The indexes for rent and owners' equivalent rent both increased in November.

The indexes for rent and owners' equivalent rent both increased in November.It appears that rents have bottomed and are starting to increase again (this fits with earlier reports of falling vacancy rates and rising rents). I don't expect rents to push up inflation very much (I think core inflation will stay low for some time with all the slack in the system), but rising rents suggests that the excess rental housing units are being absorbed - a necessary step for an eventual recovery in residential investment.

More from Mark Thoma on inflation expectations at Economist's View: (Lack of) Inflation Watch

Tax Legislation Passes in Senate 81 to 19

by Calculated Risk on 12/15/2010 01:34:00 PM

Here is the roll call vote. On to the House ...

Commentary: Subprime Thinking

by Calculated Risk on 12/15/2010 01:01:00 PM

When I started this blog in January 2005, one of my goals was to alert people to the housing bubble, and to discuss the possible consequences of the then approaching housing bust. Residential investment has historical been one of the best leading indicators for the economy, and I was deeply concerned a major housing bust - both in terms of activity and house prices - would take the economy into recession.

There were others sounding the alarm - Robert Shiller, Tom Lawler, Dean Baker, Doris "Tanta" Dungey, and others. There was discussion of loose lending standards (including, but not limited to subprime), lack of regulatory supervision, agency problems with the originate-to-distribute model, and more. And although we might have disagreed on the exact causes of the bubble, as far as I know none of the people who are commonly credited with identifying the bubble, and predicted the bust, blamed it primarily on Fannie and Freddie or the Community Reinvestment Act (CRA).

When the Financial Crisis Inquiry Commission was announced, I was skeptical if they'd be willing to address the willful lack of regulatory supervision, and the role of Wall Street in the crisis. This morning, Shahien Nasiripour at the HuffPo wrote: Financial Crisis Panel In Turmoil As Republicans Defect; Plan To Blame Government For Crisis

The Republicans, led by the commission's vice chairman, former congressman and chair of the House Ways and Means Committee Bill Thomas, will likely focus their report on the explosive growth of subprime mortgages and the heavy role played by the federal government in pushing mortgage giants Fannie Mae and Freddie Mac to purchase and insure them. They'll also likely focus on the Community Reinvestment Act, a 1977 law that encourages banks to lend to underserved communities, these people said.How depressing.

...

During a private commission meeting last week, all four Republicans voted in favor of banning the phrases "Wall Street" and "shadow banking" and the words "interconnection" and "deregulation" from the panel's final report, according to a person familiar with the matter and confirmed by Brooksley E. Born, one of the six commissioners who voted against the proposal.

If Nasiripour story is correct, the explanations offered by these four individuals are blatantly false. Lets name names: Bill Thomas, Peter Wallison, Keith Hennessey and Douglas Holtz-Eakin. These are all subprime thinkers.

NAHB Builder Confidence Flat in December

by Calculated Risk on 12/15/2010 10:00:00 AM

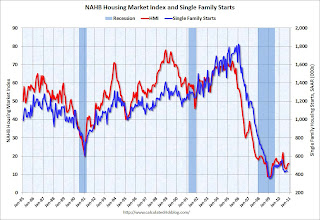

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (November housing starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Remains Flat in December

Builder confidence in the market for newly built, single-family homes remained unchanged in December from the previous month at 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

Two out of three components of December's HMI remained unchanged from the previous month, including the component gauging current sales conditions (which remained at 16) and the component gauging sales expectations in the next six months (which was flat at 25). The component gauging traffic of prospective buyers fell a single point, to 11.