by Calculated Risk on 12/13/2010 10:15:00 PM

Monday, December 13, 2010

Tax Legislation passed cloture in Senate by 83 to 15 vote

The Senate voted 83 to 15 for cloture on the bill containing the proposed tax legislation. Here is the roll call. (This means further debate will be limited to 30 hours). The actual vote will probably be on Wednesday. The House is expected to vote later in the week.

And the economic schedule for tomorrow:

7:30 AM: NFIB Small Business Optimism Index for November. This index has been showing that small businesses remain pessimistic.

8:30 AM: Retail Sales for November. The consensus is for a 0.6% increase from October. (0.6% increases ex-auto).

8:30 AM: Producer Price Index for November. The consensus is for a 0.6% increase in producer prices.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.9% increase in inventories.

2:15 PM: FOMC Meeting Announcement. Here is a preview - no changes are expected to either interest rates or QE2.

Research Papers: Strategic Defaults on 2nds, and MBS "Skin in the Game"

by Calculated Risk on 12/13/2010 06:45:00 PM

A couple of new research papers ...

• From Julapa Jagtiani and William W. Lang at the Philly Fed: Strategic Default on First and Second Lien Mortgages During the Financial Crisis

The researchers look at the data and notice that a large percentage of borrowers who are in default on their first mortgage and still making payments on their 2nd. They ask "Why might households default on their first mortgage but not default on their home equity loans?"

They offer several explanations, and conclude:

Our results overall suggest that people default strategically as their home value falls below the mortgage value; they exercise the put option to default on their first mortgage. However, they tend to keep their HELOCs current in order to maintain the credit line available to them, particularly for those who have already used their credit card lines.Another possible explanation that the authors didn't explore is that the 2nd is recourse, and the borrower has sufficient other assets and believes the 2nd lender will pursue them.

• From Christopher M. James as the SF Fed: Mortgage-Backed Securities: How Important Is “Skin in the Game”?

This economic letter explores the importance of lenders having "skin in the game". The recent financial regulation require securitizers to retain at least 5% of the credit risk for residential MBS. The author looks at several deals where the originator had some risk (through affiliated deals) and concludes:

Overall, these results suggest significant performance differences based on the loss exposure of the mortgage originator. In short, skin in the game matters for performance. More important, because in this study the residual interest retained by the sponsor is 3% or less of the total value of the securitization, these findings suggest that a 5% loss exposure requirement is likely to have a significant impact on loss rates.This appears to support the "skin in the game" requirement.

Two Updates: Tax Legislation and Europe

by Calculated Risk on 12/13/2010 03:39:00 PM

• Tax Legislation

If you are bored, here is the C-Span Link for the Senate vote.

From the Senate rules: "Under the cloture rule (Rule XXII), the Senate may limit consideration of a pending matter to 30 additional hours, but only by vote of three-fifths of the full Senate, normally 60 votes."

Most estimates are the cloture vote will receive close to 70 votes (the vote will stay open for some time because of bad weather). Then there will be 30 hours of additional "debate" (talking to an empty chamber) and then the final vote in the Senate will probably be on Wednesday.

Both Senators Reid and McConnell agreed to keep the Senate in session over the weekend and into next week, if needed, to make sure the bill passed. The only question is what will happen in the House?

• From Reuters: ECB eyes seeking capital hike - sources

The European Central Bank is considering requesting an increase in its capital from euro zone member states, euro zone central bank sources told Reuters, as a cushion against any potential losses from its bond buying.The ECB has been buying bonds of weaker euro zone countries (probably mostly Greece, Ireland, and Portugal).

Bond Girl: Default and bankruptcy in the municipal bond market

by Calculated Risk on 12/13/2010 12:36:00 PM

There have been quite a few bearish articles recently about the muni market. Not long ago there were even some "scary charts" showing a sharp sell off for the muni market, and at that time Bond Girl pointed out the correction was not because of imminent muni defaults, but because of the end of the Build America Bond (BAB) program.

For those who want to know more about munis, here is an ubernerd post from Bond Girl at Self-evident.org: Default and bankruptcy in the municipal bond market (part one)

I am just writing this post to demystify a process that evidently needs demystifying. ...There is much more on munis at the post.

One of the more frustrating aspects of muni market coverage in the news and blogosphere is the tendency to talk about municipal debt as if only one type of bond is issued and traded. There is actually considerable diversity among borrowers in the muni market (e.g., they are not all government entities), and by extension, the types of commitments that are made for the repayment of the debt. Although the relative health of the muni market has macroeconomic consequences, this is in many ways a market that defies generalization. (That’s one reason I find the muni market unusually interesting ...) The defaults that have taken place both before and during the economic downturn are what finance-types would refer to as storied credits. I often see people describing Jefferson County, Alabama, as the “canary in the coal mine” of muni defaults. Suggesting that Jefferson County, which was the center of a widely-publicized securities fraud case, is a typical muni credit is kind of like portraying Enron as a typical corporate credit. ... Another example would be Florida dirt bonds, which are backed by special assessments on property in a severely depressed market. These are not borrowers that were forced to establish their spending priorities or were muddling through difficult times; these are borrowers that experienced sudden and catastrophic losses and derived their revenues from limited sources.

Types of municipal bonds

The obvious starting place on this topic is to explain the types of muni bonds that are issued. Municipal bonds are broadly divided into two classes: general obligation (GO) and revenue bonds. The difference between GO and revenue bonds is the specific security that is pledged to repay the debt. (Bonds may also be issued with more than one kind of security and may involve a moral obligation pledge that implies contingent financial support from another entity with stronger credit.) GO bonds are secured by the full faith and credit of the issuer, meaning that the borrower is committing to raise taxes and other revenues sufficient to cover the amount owed.

Revenue bonds are secured by a defined stream of revenues. Whether the principal and interest on these bonds is paid in a timely manner depends upon: (1) the reliability of the specific revenues pledged; and (2) whether that revenue stream has been pledged toward other debt or is used for other purposes.

It is important that you understand what kind of bond you have. ...

CoreLogic: 10.8 Million U.S. Properties with Negative Equity in Q3

by Calculated Risk on 12/13/2010 09:00:00 AM

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q3 2010 negative equity report today.

CoreLogic reports that 10.8 million, or 22.5 percent, of all residential properties with mortgages were in negative equity at the end of the third quarter of 2010, down from 11.0 million and 23 percent in the second quarter. This is due primarily to foreclosures of severely negative equity properties rather than an increase in home values.Here are a couple of graphs from the report:

During this year the number of borrowers in negative equity has declined by over 500,000 borrowers. An additional 2.4 million borrowers had less than five percent equity in the third quarter. Together, negative equity and near-negative equity mortgages accounted for 27.5 percent of all residential properties with a mortgage nationwide.

...

"Negative equity is a primary factor holding back the housing market and broader economy. The good news is that negative equity is slowly declining, but the bad news is that price declines are accelerating, which may put a stop to or reverse the recent improvement in negative equity," said Mark Fleming, chief economist with CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

About 10% of homeowners with mortgages have more than 25% negative equity - although the percent of homeowners with severe negative equity has been declining over the last few quarters mostly because of homes lost to foreclosure.

The second graph shows the break down of equity by state.

The second graph shows the break down of equity by state.In Nevada very few homeowners with mortgages have any equity, whereas in New York almost half have over 50%.

As Mark Fleming noted, the number of homeowners with negative might increase over the next few quarters with declining home prices.

Sunday, December 12, 2010

Tax Proposal: Update on Senate Vote

by Calculated Risk on 12/12/2010 11:35:00 PM

From the WSJ: Tax Deal Set to Pass Senate

Three Senate aides said the tax package appeared likely to attract at least 65 to 70 supporters Monday in a procedural vote in the Senate to test whether there is support to block a potential filibuster. Sixty votes are needed for the bill to cross that hurdle. A vote on final passage is expected a day or two later.The key is the House. The plan was to adjourn by Friday, but the session could be extended to the following week.

Earlier:

• Here is the busy economic schedule for the coming week.

• Here is the Summary of last week

FOMC Preview: No Change

by Calculated Risk on 12/12/2010 05:35:00 PM

The FOMC meets on Tuesday, and this will probably be a boring statement - and therefore this is a boring preview!

Perhaps the FOMC will use the statement to defend their decision to launch "QE2" in November. But it is very unlikely there will be any change to FOMC policy, and there will probably be no material change to the statement.

I expect:

• The target range for the federal funds rate to remain at 0 to 1/4 percent

• The policy of reinvestment of principal payments to remain

• and for no change to the plan to purchase an additional $600 billion of longer-term Treasury securities by the end of June 2011.

For the FOMC statement, I expect the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" to remain, and even though there has been some improvement in the recent economics news, the first paragraph will probably be about the same. The following is from the Nov 3rd statement:

Information received since the Federal Open Market Committee met in September confirms that the pace of recovery in output and employment continues to be slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. Housing starts continue to be depressed. Longer-term inflation expectations have remained stable, but measures of underlying inflation have trended lower in recent quarters.Change "September" to "November" and nothing has changed.

• Kansas City Fed President Thomas Hoenig will cast his last no vote. The regional Fed presidents rotate on the FOMC, and Hoenig will not be a voting member of the FOMC next year (edit: he will be an alternate member).

Earlier:

• Here is the busy economic schedule for the coming week.

• Here is the Summary of last week

Here come the '99ers

by Calculated Risk on 12/12/2010 01:30:00 PM

"This is just as scary as people lobbing mortars over your head at 2 o'clock in the morning."

James Mitchell, a 64-year-old Vietnam veteran who lost his job in early 2009 and is about to exhaust his unemployment benefits.

As I mentioned last week, the proposed tax legislation provides no additional help for the so-called "99ers". The "extension of the unemployment benefits" is an extension of the qualifying dates for the various tiers of benefits, and not additional weeks of benefits.

The above quote is from an article by Richard Read in the Oregonian: Oregon aid agencies brace for tens of thousands losing unemployment benefits

Each week, about 600 Oregonians exhaust jobless benefits. In January, about 4,000 a week will lose coverage. And state officials expect those numbers to spike in April when more than 35,000 people will exhaust benefits in a single week.

...

If Congress acts within days to extend emergency unemployment compensation nationally, 14,000 fewer Oregonians will lose benefits in April. But President Barack Obama's proposed extensions ... won't do anything for those who exhaust the maximum 99 weeks of jobless benefits.

...

The mass exhaustion of benefits, an echo effect of the great recession, is unprecedented ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the change in payroll jobs each month. The peak job losses were in early 2009 - and 99 weeks is just under two years - so many of those people will be exhausting their benefits over the next few months.

There is much more in Richard Read's article - he discusses how the local aid agencies in Oregon are preparing to help, but there is only so much they can do.

Summary for Week ending December 11th

by Calculated Risk on 12/12/2010 08:54:00 AM

Note: here is the busy economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs. Also the proposed tax legislation and the rise in mortgage rates (impacting refinance activity) were important stories last week.

• Trade Deficit decreased in October

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The first graph shows the monthly U.S. exports and imports in dollars through October 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. However imports have slowed over the last few months. October exports were $4.9 billion more than in September and are at the highest level since August 2008.

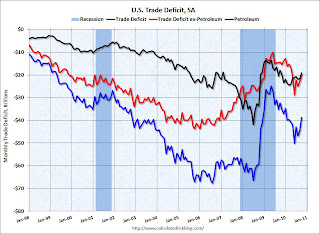

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The trade deficit decreased in October to $38.7 billion, down from $44.6 billion in September.

• BLS: Job Openings increased sharply in October, low Labor Turnover

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In October, about 4.047 million people lost (or left) their jobs, and 4.196 million were hired (this is the labor turnover in the economy) adding 149 thousand total jobs.

The good news was job openings increased from 3.0 million in September to 3.4 million in October, however overall labor turnover was still low.

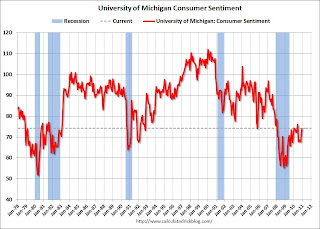

• Consumer Sentiment increased in December

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November. This was above the consensus forecast of 72.5.

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November. This was above the consensus forecast of 72.5.

This is the highest level since June 2010, but sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator.

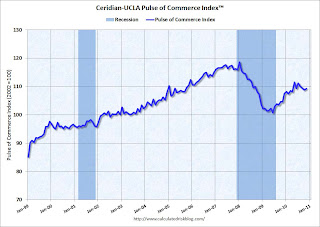

• Ceridian-UCLA: Diesel Fuel index increases slightly in November

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM. The data suggests the recovery has "stalled" since May.

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM. The data suggests the recovery has "stalled" since May.

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, grew 0.4 percent in November following three consecutive months of decline. The growth, while positive, is not enough to offset the 0.6 percent decline that the PCI saw the previous month, nor the 2.1 percent decline experienced in the PCI since July. Though on a year-over-year basis the PCI is up, the three month moving average has been declining for four months, suggesting relative weakness within the goods producing segments of the economy."

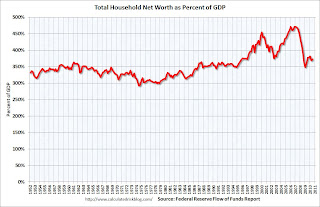

• Q3 Flow of Funds Report

The Federal Reserve released the Q3 2010 Flow of Funds report this week: Flow of Funds.

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

The Fed estimated that the value of household real estate fell $684 billion to $16.55 trillion in Q3 2010, from $17.2 trillion in Q2 2010. Mortgage debt declined by $65 billion in Q3. Mortgage debt has now declined by $488 billion from the peak.

Assets prices, as a percent of GDP, have fallen significantly and are not far above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Other Economic Stories ...

• From the Association of American Railroads: AAR Reports November 2010 Rail Traffic Continues Mixed Progress

• From David Leonhardt at the NY Times: For Obama, Tax Deal Is a Back-Door Stimulus Plan

• From CoStar: Commercial Real Estate prices declined in October

• From Bloomberg: Mortgage Rates for U.S. Loans Jump to Five-Month High

• Unofficial Problem Bank list at 919 Institutions

Best wishes to all!

Saturday, December 11, 2010

Recovery and Recession at the same time

by Calculated Risk on 12/11/2010 10:13:00 PM

Note: here is the economic Schedule for Week of December 12th

Ylan Mui at the WaPo captures the economic bifurcation of America: Economic recovery leaving some behind this Christmas

At Tiffany's, executives report that sales of their most expensive merchandise have grown by double digits. At Wal-Mart, executives point to shoppers flooding the stores at midnight every two weeks to buy baby formula the minute their unemployment checks hit their accounts. Neiman Marcus brought back $1.5 million fantasy gifts in its annual Christmas Wish Book. Family Dollar is making more room on its shelves for staples like groceries, the one category its customers reliably shop.Some people are doing fine. Others are barely getting by and still trapped in a deep recession. A 9.8% unemployment rate is unacceptable ... something to remember this time of year. Best to all.

"When you start to line up all the pieces, you see a story that starts to emerge," said James Russo, vice president of global consumer insights for The Nielsen Co. "You kind of see this polarized Christmas."