by Calculated Risk on 12/11/2010 11:51:00 AM

Saturday, December 11, 2010

Several Stories: Apartment vacancy rates falling

The trend of falling vacancy rates continues ...

From Eric Wolff at the North County Times: Rental vacancy rates fall as people lose homes

Vacancy rates for North San Diego County apartments fell 1.2 percentage points to 4.3 percent in the fall, the fourth straight drop, according to the biannual survey conducted by the San Diego County Apartment Association.From Josh Brown at the Virginian-Pilot: Rents rise, vacancies drop for apartments in Hampton Roads

... and landlords took the opportunity to raise rents 0.8 percent ... The report attributed the drop in vacancy to the ongoing foreclosure crisis, as people evicted from homes need somewhere to live, and to a modest increase in employment.

Rough times in the housing market may be boosting demand for apartments in Hampton Roads, according to local experts and a new report.From the Aurora Sentinel: Denver metro vacancies for homes, condos to rent at lowest since 2001

... In the past year, the number of renters in the region has climbed by nearly 2,000, the largest uptick since 2005.

It’s slim pickings for those seeking a single-family home to rent.This fits with the Reis vacancy survey (showing apartment vacancy rates fell in Q3 to 7.2% from 7.8% in Q2), the NMHC apartment survey, and the Census Bureau's quarterly rental vacancy rate.

Vacancies in for-rent condos, single-family homes and other small properties across metro Denver fell to 2.9 percent during third quarter of this year - the lowest third-quarter rate since 2001.

Unofficial Problem Bank list at 919 Institutions

by Calculated Risk on 12/11/2010 08:30:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 10, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List declined by one to 919 this week after three additions and four removals. However, total assets increased by $1.1 billion to $411.4 billion.

The three additions include Intervest National Bank, New York, NY ($2.1 billion) and the two thrift subsidiaries of Great River Holding Company -- RiverWood Bank, Baxter, MN ($174 million) and RiverWood Bank, Bemidji, MN ($177 million).

The removals include the two failures this week -- Paramount Bank, Farmington, MI ($253 million) and Earthstar Bank, Southhampton, PA ($113 million). The other two removals are Millennium BCP Bank, National Association, Newark, NJ, which completed a voluntary liquidation on October 15, 2010; and Oceanside Bank, Jacksonville, FL, which was acquired by The Jacksonville Bank in an unassisted merger.

Next week, we anticipate the OCC will release its actions for November 2010.

Friday, December 10, 2010

An Economists' Hanukkah Song

by Calculated Risk on 12/10/2010 11:36:00 PM

Enjoy - a rearranged version of Adam Sandler's hit for the econ nerds out there. Jodi Beggs is an economist and Ph.D. candidate at Harvard University ... she has a website with a series of microeconomics lectures at Economists Do It With Models and she gave a talk at the AEA humor sesssion earlier this year.

Schedule for the Proposed Tax Legislation

by Calculated Risk on 12/10/2010 09:32:00 PM

The current plan is for the Senate to vote on the legislation on Monday at 3:00 pm. The House of Representatives is expected to vote later in the week, and then Congress plans to adjourn for the year on Friday.

From the LA Times: Sen. Bernie Sanders ends filibuster

Sen. Bernie Sanders (I-Vt.) has ended a marathon filibuster of the proposed tax compromise, ceding control of the Senate floor after more than 8 1/2 hours.I think so too, but it won't happen. This is basically a done deal.

"It has been a very long day," he said as he concluded his remarks, including a five-hour period in which he spoke without interruption. "... I think we can come up with a better proposal which better reflects the needs of the middle class."

Bank Failures #150 & 151: Michigan and Pennsylvania

by Calculated Risk on 12/10/2010 06:13:00 PM

Paramount's rising assets

Rolled over peak

Tremor in The Force

Earthstar has cleared the planet

Millions extinguished

by Soylent Green is People

From the FDIC: Level One Bank, Farmington Hills, Michigan, Assumes All of the Deposits of Paramount Bank, Farmington Hills, Michigan

As of September 30, 2010, Paramount Bank had approximately $252.7 million in total assets and $213.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $90.2 million. ... Paramount Bank is the 150th FDIC-insured institution to fail in the nation this year, and the fifth in Michigan.From the FDIC: Polonia Bank, Huntingdon Valley, Pennsylvania, Assumes All of the Deposits of Earthstar Bank, Southampton, Pennsylvania

As of September 30, 2010, Earthstar Bank had approximately $112.6 million in total assets and $104.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22.9 million. ... Earthstar Bank is the 151st FDIC-insured institution to fail in the nation this year, and the second in Pennsylvania.The FDIC is back in action!

Under 35: Living with Parents vs. Homeownership rate

by Calculated Risk on 12/10/2010 03:52:00 PM

This interesting graph is from economist Tom Lawler comparing the percent of 24-34 year olds living at home vs. the under 35 year old homeownership rate ...

There is a clear inverse relationship, and this suggests some pent up demand for housing units when the employment picture improves (although the demand could be for rental units).

The Pain in Spain

by Calculated Risk on 12/10/2010 01:13:00 PM

Just an update ... the yield on Spain's 10-year bond is rising again.

This graph from Bloomberg shows the yield for Spain's 10-year bond over the last year. The yield was up to 5.4% today, just below the peak of 5.5% in late November.

This graph from Bloomberg shows the yield for Spain's 10-year bond over the last year. The yield was up to 5.4% today, just below the peak of 5.5% in late November.

The bond yields declined in July following the European bank stress tests, but most investors have lost confidence in those tests - and another round will be conducted early next year. But will the bond markets wait?

The yield on Portugal's 10-year bond is up to 6.27%.

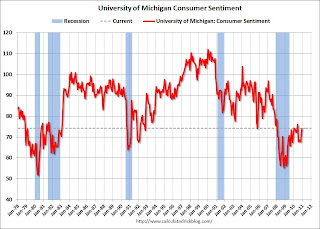

Consumer Sentiment increases in December

by Calculated Risk on 12/10/2010 09:55:00 AM

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.

This was above the consensus forecast of 72.5.

This is the highest level since June 2010, but sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator.

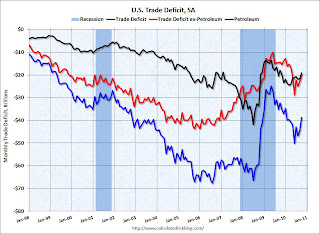

Trade Deficit decreases in October

by Calculated Risk on 12/10/2010 08:30:00 AM

The Census Bureau reports:

[T]otal October exports of $158.7 billion and imports of $197.4 billion resulted in a goods and services deficit of $38.7 billion, down from $44.6 billion in September, revised. October exports were $4.9 billion more than

September exports of $153.8 billion. October imports were $0.9 billion less than September imports of $198.4 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. October exports were $4.9 billion more than in September and are at the highest level since August 2008.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased slightly in September - even with higher prices - and the trade deficit with China decreased (NSA).

After stalling over the summer, it appears exports are growing again. I expect the dollar volume of oil imports to rise over the next couple of months since oil prices have increased sharply since October.

Thursday, December 09, 2010

Tax Bill to add $857 Billion to Debt

by Calculated Risk on 12/09/2010 11:10:00 PM

From Bloomberg: Senate Tax-Cut Extension Plan Would Add $857 Billion to Debt

The congressional Joint Committee on Taxation, which estimates the revenue effects of tax legislation, said the provisions would cost the government $801.3 billion in forgone revenue over 10 years. Extending unemployment benefits for 13 months, another feature of the package, would cost $56 billion, the Obama administration has said.It is important to remember the Joint Committee on Taxation assumed all the provisions will end as scheduled; the payroll tax cut after one year, and the other tax cuts after two years. That seems very unlikely, so the actual cost will be much much higher. As an example, if the tax cut for high income earners stays in place for the next decade that will add $700 billion alone to the debt!

Also, the vast majority of the impact is from extending the Bush tax cuts.