by Calculated Risk on 11/28/2010 07:27:00 PM

Sunday, November 28, 2010

The recent improvement in economic news

Earlier:

• Schedule for Week of Nov 28th

• A Summary for Week ending November 27th

It is worth noting the recent improvement in economic news:

• The October employment report showed a gain of 151,000 nonfarm payroll jobs, the most since April ex-Census. Expectations are for a similar gain in November, although probably not enough jobs added to push down the unemployment rate.

• The BEA estimated real GDP grew at a 2.5% annual rate in Q3. This is still sluggish, but an improvement from the 1.7% growth rate in Q2.

• The Personal Income and Outlays report for October indicated incomes grew at a 0.5% rate (month-to-month), and it appears PCE has grown at about a 3% annualized rate over the last three months. The personal saving rate was 5.7% in October, and although I expect the rate to increase a little more - it appears a majority of the adjustment is behind us (a rising saving rate is a drag on personal consumption).

• The 4-week average of initial weekly unemployment claims has declined to 436,000 last week from over 480,000 at the end of August. The weekly reading was 407,000 last week; the lowest since July 2008.

• Most regional manufacturing surveys, with the exception of the NY Fed survey (empire state), has shown a pickup in manufacturing. This suggests the manufacturing sector is still improving (the ISM manufacturing index for November will be released on Wednesday).

• Trucking and rail traffic improved in October, although the Ceridian diesel fuel index was weak.

• The Architecture Billings Index (a leading indicator for commercial real estate) is near flat - suggesting investment in commercial structures such as hotels, offices and malls will stop contracting next year. (addition by subtraction!)

• Even small business optimism has improved slightly.

Most of the reasons for the recent slowdown are still with us - less stimulus spending, the end of the inventory adjustment, problems in Europe and a slowdown in China, and cutbacks at the state and local level - but it appears Residential investment (RI) has bottomed and will most likely add to GDP growth in 2011. I believe the RI drag is now behind us, and RI is usually the best leading indicator for the economy.

The data is still mixed and fits with my general view of a sluggish and choppy recovery (my view since the spring of 2009). Although I don't see a sharp increase in growth, I think the pace of recovery will probably pick up a little bit in 2011, and I'll take the over on the consensus view of 2.5% GDP growth in 2011. My guess is 3%+ GDP growth in 2011 - still not a strong recovery given the amount of slack in the economy, but an improvement over 2010.

Unfortunately there probably will not be enough growth to significantly reduce the unemployment rate in 2011.

Note: I'll add more before the end of the year, but I've been sharing my thoughts with a few analysts and economic commentators and I try to post my views whenever they change - even a little. Right now it looks like the "slowdown, but no double dip call" was correct (it is still early), and now I'm becoming a little more optimistic and taking the "over" on 2011 GDP growth (still no v-shape recovery though).

European Union approves €85 billion rescue of Ireland

by Calculated Risk on 11/28/2010 01:46:00 PM

Update: Here are the details: Announcement of joint EU - IMF Programme for Ireland

From the Irish Times: EU finance ministers agree deal on Irish rescue package

The Irish Times reports that the European Union has approved the €85 billion rescue package for Ireland with an estimated 5.8% average interest rate.

Also, the WSJ reports progress on the "permanent resolution mechanism" (aka default mechanism): EU Outlines Bond Restructuring Plan

Creditors of euro-zone countries that face insolvency after 2013 will see their bond holdings restructured ... [the proposal was] agreed earlier Sunday by German Chancellor Angela Merkel, French President Nicolas Sarkozy, EU President Herman Van Rompuy and European Central Bank chief Jean-Claude Trichet

A Summary for Week ending November 27th

by Calculated Risk on 11/28/2010 09:10:00 AM

Below is a summary of last week mostly in graphs.

Here is the economic schedule for the coming week.

Note: A key story has been the rescue of Ireland. The Irish Times reports that a deal is done, but the details haven't been released.

• New Home Sales declined in October

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 283 thousand. This is down from 308 thousand in September. "This is 8.1 percent below the revised September rate ... and is 28.5 percent below the October 2009 estimate of 396,000."

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply increased to 8.6 in October from 7.9 in September. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

The 283 thousand annual sales rate for October is just above the all time record low in August (275 thousand). This was the weakest October on record and well below the consensus forecast of 314 thousand.

• October Existing Home Sales: 4.43 million SAAR, 10.5 months of supply

The NAR reports: Existing-Home Sales Decline in October Following Two Monthly Gains

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2010 (4.43 million SAAR) were 2.2% lower than last month, and were 25.9% lower than October 2009.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

Although inventory decreased from September 2010 to October 2010, inventory increased 8.4% YoY in October. This is the largest YoY increase in inventory since early 2008.

The year-over-year increase in inventory is especially bad news because the reported inventory is very high (3.864 million), and the 10.5 months of supply in October is far above normal.

This graph shows existing home sales Not Seasonally Adjusted (NSA).

This graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010. Sales for the last four months are significantly below the previous years, and sales will probably be weak for the remainder of 2010.

Existing home sales were weak in October, and will continue to be weak for some time. Inventory is very high - and the significant year-over-year increase in inventory is very concerning. The high level of inventory and months-of-supply will put downward pressure on house prices.

• Moody's: Commercial Real Estate Prices increase in September

Moody's reported that the Moody’s/REAL All Property Type Aggregate Index increased 4.3% in September. This reverses the sharp decline in August. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

This graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

This graph is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

• CoreLogic: Total unsold housing inventory increases to 6.3 million units

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadown inventory" (by this method) at about 2.1 million units.

• Other Economic Stories ...

• Housing Supply: What do all the numbers mean?

• Galleries and more ...

• From the Chicago Fed: Index shows economic activity picked up in October

• From the BEA: Q3 real GDP growth revised up to 2.5% annualized rate

• From the BEA October report: Personal income increased $57.6 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $44.0 billion, or 0.4 percent.

• From the Fed FOMC Minutes: Forecasts revised down again, Disagreement on outlook.

• From LPS Applied Analytics Over 4.3 million loans 90+ days or in foreclosure

• From the American Trucking Association: ATA Truck Tonnage Index Rose 0.8 Percent in October

• Unofficial Problem Bank list increases to 919 Institutions

Best wishes to all!

Saturday, November 27, 2010

Saturday Night Reading

by Calculated Risk on 11/27/2010 11:08:00 PM

• From the NY Times: European Markets in Limbo as Irish Bailout Takes Shape

The package is certain to be complex because aid is expected to come from four sources — two separate European Union funds, the I.M.F. and most likely bilateral loans from Britain and Sweden.The announcement is expected Sunday night.

• From the NY Times: Demonstrators in Ireland Protest Austerity Plan

And a couple of posts from the holidays ...

• Housing Supply: What do all the numbers mean?

• Galleries and more ...

Schedule for Week of Nov 28th

by Calculated Risk on 11/27/2010 05:50:00 PM

The key report for the week will be the November employment report to be released on Friday, Dec 3rd. Other key reports include the Case-Shiller home price index on Tuesday, the ISM manufacturing index on Wednesday, and the ISM non-manufacturing (service) index on Friday.

10:30 AM: Dallas Fed Manufacturing Survey for November. The Texas survey showed a slight expansion last month (at 6.9), and is expected to show expansion again in November. This is the last of the regional surveys for November, and with the exception of the NY Fed (Empire State) survey, all showed improvement in November.

9:00 AM: S&P/Case-Shiller Home Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. The consensus is for prices to decline about 0.4% in September; the third straight month of price declines.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a decline to 60.0 from 60.6 in October.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 52.5 from 50.2 last month.

12:30 PM: Minneapolis Fed President Narayana Kocherlakota speaks on "Monetary Policy Actions and Fiscal Policy Substitutes"

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting reported home sales through the end of the year will be very weak.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for +68,000 payroll jobs in November, up from the +43,000 jobs reported in October.

8:30 AM: Productivity and Costs for Q3 (Final). The consensus is for a -0.2% decrease in unit labor costs.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a slight decrease to 56.5 from 56.9 in October.

10:00 AM: Construction Spending for October. The consensus is for a 0.4% decline in construction spending.

2:00 PM: The Fed’s Beige Book for November. This is anecdotal information on current economic conditions.

All day: Light vehicle sales for November. Light vehicle sales are expected to decrease slightly to 12.0 million (Seasonally Adjusted Annual Rate), from 12.3 million in October. Edmunds is forecasting:

Edmunds.com analysts predict that November's Seasonally Adjusted Annualized Rate (SAAR) will be 12.2 million, essentially flat from October 2010.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last several weeks. The consensus is for an increase to 424,000 from 407,000 last week (still high, but much lower than earlier this year).

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1% decrease in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in December.

12:20 PM: Philadelphia Fed President Charles Plosser speaks on the economic outlook

Expected: October Personal Bankruptcy Filings

8:30 AM: Employment Report for November. The consensus is for an increase of 145,000 non-farm payroll jobs in November, about the same as the 151,000 jobs added in October. The consensus is for the unemployment rate to stay steady at 9.6%.

9:10 AM: Fed Vice Chair Janet Yellen speaks on "Fiscal Responsibility and Global Rebalancing"

10:00 AM: Manufacturers' Shipments, Inventories and Orders for October. The consensus is for a 0.7% decrease in orders.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a slight increase to 54.7 from 54.3 in October.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Ireland: €85 billion bailout expected Sunday

by Calculated Risk on 11/27/2010 01:31:00 PM

The timing is still not clear, but most people expect an announcment Sunday night.

From the Irish Times: Talks on Irish bailout to resume

Irish officials will today resume talks with a delegation from the EU and IMF on the terms of a €85 billion bailout for Ireland, ahead of the likely announcement of an agreement tomorrow.I'll post the details tomorrow night (if it is announced).

Unofficial Problem Bank list increases to 919 Institutions

by Calculated Risk on 11/27/2010 08:37:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 26, 2010.

Changes and comments from surferdude808:

The FDIC released its actions for October, which contributed to a notable increase in the Unofficial Problem Bank List. This week there were 17 additions and one removal leaving the list at 919 institutions with assets of $410.2 billion. Assets declined $9.4 billion during the week, but $11.6 billion, or more than 100 percent of the drop in assets, came from the release of 2010q3 financials. Thus, the net 16 additions this week added $2.2 billion of assets. For the month, a net 25 institutions were added and the list has 376 more institutions than it did a year ago.The Q3 FDIC Quarterly banking profile was released last week and showed 860 problem institutions at the end of Q3 with $379 billion in assets.

The sole removal this week is the termination of an action by the FDIC against Torrey Pines Bank, San Diego, CA ($1.2 billion Ticker: WAL).

Among the 17 additions this week are the Bank of the Orient, San Francisco, CA ($675 million); Town & Country Bank and Trust Company, Bardstown, KY ($454 million Ticker: FHDG); Border State Bank, Greenbush, MN ($347 million); McHenry Savings Bank, McHenry, IL ($271 million); and SouthBank, a Federal Savings Bank, Huntsville, AL ($265 million).

Friday, November 26, 2010

Fannie and Freddie on Foreclosed Homes: Resume all normal sales activity

by Calculated Risk on 11/26/2010 07:34:00 PM

From Kimberly Miller at the Palm Beach Post: Fannie Mae, Freddie Mac give the 'go-ahead' to resume sales of foreclosed homes

Fannie Mae and Freddie Mac gave the go-ahead this week to restart sales of their foreclosed properties ... Brokers received memos Wednesday from the government-sponsored enterprises saying that the homes could once again be marketed and sales finalized on properties already under contract.Fannie and Freddie halted some sales of already foreclosed properties (REO: Real Estate Owned), and they also halted some foreclosures in process. The above story was on sales of REOs.

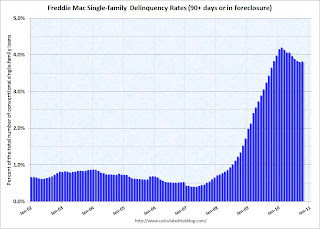

On a related point, Freddie Mac reported that the serious delinquency rate increased to 3.82% in October from 3.80% in September. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increase in October - the first increase since February - is probably related to the new foreclosure moratoriums.

Note: Fannie and Freddie report REO inventory quarterly, but the FHA reported that REO increased sharply in October to 54,609 from 51,487 at the end of September. So even though Fannie and Freddie halted many foreclosures in process, they also halted REO sales - so my guess is their REO inventory probably increased in October and November too (like for the FHA).

Accelerated Timetable for Ireland Bailout Details

by Calculated Risk on 11/26/2010 05:38:00 PM

From the NY Times: Europeans Striving to Calm Nerves in Markets

[T]he team of European Union and International Monetary Fund specialists in Ireland was racing to complete terms of its financing package before markets reopen on Monday.Looks like Sunday will be busy again.

And from the Irish Times: Reports that bailout will attract 6.7% rate rejected

The interest rate for a nine-year EU/IMF loan would be lower than the 6.7 per cent being quoted in some reports today, a source involved in the talks has indicated.University College Dublin professor Karl Whelan earlier estimated an EFSF borrowing rate close to 6%: Borrowing Rates from The EFSF

And more stress tests are coming in Spain (from NY Times article):

In Spain, the central bank ... said it would carry out further stress tests to show ... financial institutions ... could absorb a “problematic exposure” of 180 billion euros, or $238 billion, to the country’s collapsed construction and real estate sectors.

Housing Supply: What do all the numbers mean?

by Calculated Risk on 11/26/2010 01:42:00 PM

We are constantly bombarded with housing supply numbers: 3.86 million existing homes for sale, 10.5 month-of-supply, 2.1 million "pending sales", 7 million mortgages delinquent.

Recently NY Fed president William Dudley said "We estimate that there are roughly 3 million vacant housing units more than usual", and other sources have mentioned there are close to 19 million vacant housing units in the U.S.!

What does it all mean?

The number to start with is the "visible supply" reported monthly from the National Association of Realtors (NAR). At the end of October, the NAR reported there were 3.86 million homes for sale.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows nationwide inventory for existing homes.

Notice that inventory started to increase in the 2nd half of 2005. That was one of the indicators I used to call the top of the housing bubble.

Also notice the seasonal pattern for inventory - inventory increases in the spring, and usually peaks during the summer months, and then falls off sharply in December as homeowners take their homes off the market for the holidays. I expect NAR reported inventory to fall to around 3.5 million of so in December (down from 3.86 million in October, but up from 3.283 in December 2009).

This brings up an interesting point about how the NAR calculates "months-of-supply". The simple formula is months-of-supply = inventory divided by sales. The NAR uses the Seasonally Adjusted Annual Rate (SAAR) of sales, but the Not Seasonally Adjusted (NSA) inventory - even though there is a clear seasonal pattern for inventory.

The NAR formula is: months-of-supply = (inventory (NSA) /sales (SAAR)) * 12 months. (edit: oops, inverted initially, correct above) For October, the NAR reported 4.43 million sales (SAAR), and 3.86 million units of inventory, so that equals 10.5 months of supply.

If inventory drops to 3.5 million in December (normal seasonal decline), but the sales rate stay at 4.43 million, the months-of-supply metric will decline to 9.5 months. Some analysts might report that decline as "good news" even though it is just because of the normal seasonal change in inventory.

A couple more points:

• Historically year end inventory is around 3% to 3.5% of the total number of owner occupied units. Currently there are about 75 million owner occupied units, so a normal level of year end inventory would be around 2.3 to 2.6 million units. So the visible inventory at around 3.5 million would be significantly above the normal level.

• It is the visible inventory that impacts prices. Also important is the level of distressed sales (short sales and foreclosures).

This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006. From CoreLogic:

Distressed sales fell 10 percent in August to 68,700, the lowest level since May 2008. Although the level of distressed sales declined, it simply reflects the weak demand in the market overall because total sales also declined and the distressed sale share remained stable at 28 percent.So both the level of visible inventory and the percentage of distressed sales is elevated - and that puts downward pressure on house prices.

The next number is the "pending sales" of 2.1 million units. This was reported by CoreLogic this week:

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.CoreLogic estimates the "pending sale" (by this method) at about 2.1 million units. This number is useful - especially the trend - because it suggests that the visible inventory will stay elevated for some time. And also that the number of distressed sales will stay elevated.

Some analyst have called the number of REOs and total delinquent loans as the "shadow inventory". This is incorrect for two reasons: 1) some homes are listed for sale and are visible (CoreLogic removed these homes from their pending sales metric), and 2) some loans will cure from the borrower catching up, the sale of the home, or with a loan modification.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.A fairly large number of 90+ day and in-foreclosure loans are curing too. This is probably because of modifications - and there will probably be a high percentage of redefaults - but this shows why you can't include all delinquent loans as part of the "shadow inventory".

And that brings us to the 7 million delinquent loans. There are two sources for the number of delinquent loans: the Mortgage Bankers Association (MBA) quarterly National Delinquency Survey, and a monthly report from Lender Processing Services (LPS).

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

And from LPS Applied Analytics October Mortgage Performance data:

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

And finally, what about those "3 million excess vacant housing units"?

This number comes from the Census Bureau's quarterly Housing Vacancies and Homeownership. This report shows almost 19 million total vacant housing units, but that number is pretty meaningless and includes 2nd homes, partially constructed new homes, and much more.

The 3 million number is calculated using the homeowner and rental vacancy rates, and estimating the number of excess units above the normal frictional level. There is always some number of vacant homeowner and rental units as people move and for other reasons. So the excess is the number above this frictional level. The NY Fed also added in a part of the increase in "Vacant, held off market, other" to obtain the 3 million estimate.

I think this last portion of the "excess vacant inventory" is less reliable, and I just use the homeowner and rental vacancy rates. My current estimate is about 1.55 million excess vacant units. This is a key number because once the excess is absorbed in an area as new households are formed, then new construction will begin - and that will mean a pickup in economic activity and employment.

The key numbers to follow for the housing market are 1) existing home inventory, 2) number of delinquent loans, and 3) the excess vacant inventory.