by Calculated Risk on 11/08/2010 02:23:00 PM

Monday, November 08, 2010

Fed: Banks expect tight lending standards for foreseeable future

In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans).

From the Federal Reserve The October 2010 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October survey indicated that, on net, banks eased standards and terms over the previous three months on some categories of loans to households and businesses. ... However, substantial fractions of banks reported in response to a set of special questions that standards for many categories of loans would not return to their longer-run averages for the foreseeable future.Here is the full report.

...

Domestic survey respondents reported easing standards and most terms on [commercial and industrial] C&I loans to firms of all sizes. ... Demand declined, on net, for C&I loans ...

Most respondents reported no change in their bank's standards for approving [commercial real estate] CRE loans. ...

[A] special question asked banks whether their current level of lending standards remained tighter than the average level over the past decade and, if so, when they expected that standards would return to their long-run norms, assuming that economic activity progressed according to consensus forecasts. For all loan categories, substantial fractions of respondents thought that their bank's lending standards would not return to their long-run norms until after 2012 or would remain tighter than longer-run average levels for the foreseeable future.

NY Fed: Continued Decline in Consumer Debt

by Calculated Risk on 11/08/2010 11:14:00 AM

This is a new quarterly report from the NY Fed ... an interesting finding is that consumers are actively reducing their debt - the decline in debt isn't just because of defaults.

From the NY Fed: Q3 Report on Household Debt and Credit Shows Continued Decline in Consumer Debt

The Federal Reserve Bank of New York today released its Quarterly Report on Household Debt and Credit for the third quarter of 2010, which shows that consumer debt continues its downward trend of the previous seven quarters, though the pace of decline has slowed recently. Since its peak in the third quarter of 2008, nearly $1 trillion has been shaved from outstanding consumer debts.Here is the Q3 report: Quarterly Report on Household Debt and Credit

Additionally, this quarter’s supplemental report addresses for the first time the question of how this decline has been achieved and notes a sharp reversal in household cash flow from debt, indicating a decrease in available funds for consumption. According to newly available data through year end 2009, the payoff of debt by consumers reduced their cash flow by about $150 billion, whereas between 2000 and 2007, borrowing had contributed more than $300 billion annually to consumers’ cash flow.

Excluding the effects of defaults and charge-offs, available data show that non-mortgage debt fell for the first time since at least 2000. Also, net mortgage debt paydowns, which began in 2008, reached nearly $140 billion by year end 2009. These unique findings suggest that consumers have been actively reducing their debts, and not just by defaulting.

“Consumer debt is declining but only part of the reduction is attributable to defaults and charge-offs,” said Donghoon Lee, senior economist in the Research and Statistics Group at the New York Fed. “Americans are borrowing less and paying off more debt than in the recent past. This change, which we continue to study carefully, can be a result of both tightening credit standards and voluntary changes in saving behavior.”

And a supplemental report: Have Consumers Become More Frugal?

So are consumers becoming more frugal? Yes. Holding aside defaults, they are indeed reducing their debts at a pace not seen over the last ten years. A remaining issue is whether this frugality is a result of borrowers being forced to pay down debt as credit standards tightened, or a more voluntary change in saving behavior.And some data and graphs.

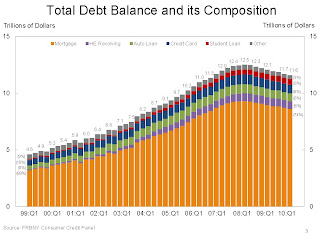

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the NY Fed:

Aggregate consumer debt continued to decline in the second quarter, continuing its trend of the previous six quarters. As of June 30, 2010, total consumer indebtedness was $11.7 trillion, a reduction of $812 billion (6.5%) from its peak level at the close of 2008Q3, and $178 billion (1.5%) below its March 31, 2010 level. Household mortgage indebtedness has declined 6.4%, and home equity lines of credit (HELOCs) have fallen 4.4% since their respective peaks in 2008Q3 and 2009Q1. Excluding mortgage and HELOC balances, consumer indebtedness fell 1.5% in the quarter and, after having fallen for six consecutive quarters, stands at $2.31 trillion, 8.4% below its 2008Q4 peak.There are a number of credit graphs at the NY Fed site.

Ireland Update: "Relying on the kindness of strangers"

by Calculated Risk on 11/08/2010 08:49:00 AM

The yield on the Ireland 10-year bond hit a record 7.75% this morning.

From Bloomberg: Irish Fight to End Bond `Buyers Strike' as EU Examines Budget

EU Economic and Monetary Affairs Commissioner Olli Rehn arrives in Dublin today for a two-day visit ... Ireland has the funds to avert the need for an immediate rescue, its cash may run out in the middle of next year unless it can raise money from the bond market in 2011.And a long piece from Professor Morgan Kelly (Ireland's "Doctor Doom"): If you thought the bank bailout was bad, wait until the mortgage defaults hit home. He is definitely pessimistic, and concludes:

...

Erik Nielsen, chief European economist at Goldman Sachs Group Inc., said Ireland may need help from the European Stability Fund and the IMF in Washington in early 2011.

“This is starting to feel like a tsunami of new concerns,” Nielsen said “There is a considerable probability that the alphabet soup will get involved in financing Ireland and Portugal early next year.”

Ireland faced a painful choice between imposing a resolution on banks that were too big to save or becoming insolvent, and, for whatever reason, chose the latter. Sovereign nations get to make policy choices, and we are no longer a sovereign nation in any meaningful sense of that term.

From here on, for better or worse, we can only rely on the kindness of strangers.

Sunday, November 07, 2010

NY Times on Irish Bond Yields

by Calculated Risk on 11/07/2010 10:23:00 PM

From Landon Thomas at the NY Times: Irish Debt Woes Revive Concern About Europe

The yield on Ireland’s 10-year bond climbed to 7.6 percent on Friday ... Its debt woes have stoked fear that it might even need to follow Greece and request a bailout from the European Union and the International Monetary Fund.Ireland has until next June to make progress. If Ireland does need a bailout next year, it will probably come from the European Financial Stability Facility (EFSF) - and at rates of around 8%.

...

For the moment, at least, that outcome seems improbable. Unlike Greece earlier this year, Ireland has enough cash on hand to allow it to finance government operations through June 2011.

Earlier:

NFIB: Small Business hiring "improves slightly"

by Calculated Risk on 11/07/2010 06:28:00 PM

The National Federation of Independent Business (NFIB) will release their small business confidence survey on Tuesday. They pre-released the employment results: Job Creation Plans on Main Street Improve Slightly

“[A] seasonally adjusted net 1 percent of owners [plan] to create new jobs, 4 points better than September. Although expectations for business conditions and real sales trends improved in October, it wasn’t enough to produce a surge in job creation plans which remained mired at recession levels. The NFIB labor market indicators are underperforming all recovery periods since 1973.”Small business hiring has been weak in the current recovery, and any improvement is plus - however it is important to note that a large percentage of small businesses are real estate related (compared to all businesses).

Earlier:

Schedule for Week of Nov 7th

by Calculated Risk on 11/07/2010 01:30:00 PM

A light week for economic releases. The trade report on Wednesday is probably the key release and could lead to a revision in Q3 GDP.

Association of American Railroads rail traffic indicators for October. Trucking, rail traffic and the Ceridian diesel fuel index are all measures of transportation (a coincident indicator).

AM: New York Fed: U.S. Credit Conditions for Q3. This is a new quarterly report from the New York Fed.

7:30 AM: NFIB Small Business Optimism Index for October. This index has been showing small businesses remain pessimistic and the survey shows that the major concern is the lack of customers.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for October (a measure of transportation).

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is 0.6% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This report has been showing very little turnover in the labor market and few job openings.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last couple months - suggesting reported home sales through at least November will be very weak.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $45 billion (from $46.3 billion in August).

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for a decline to 450,000 from 457,000 last week. (released a day early).

Veteran's Day: Stock Market Open

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for November. The consensus is for a slight increase to 69.0 from 67.7 in October.

After 4:00 PM: Perhaps the FDIC will have another busy Friday afternoon ...

Summary for Week ending Nov 6th

by Calculated Risk on 11/07/2010 08:30:00 AM

A summary of last week - mostly in graphs. NOTE: The graphs in this summary post link to a new Gallery graphics tool (Thanks Ken!). This Gallery is a collection of current graphs from the blog. There are tabs for several categories: Employment, New home Sales, etc. Enjoy!

Statement from the Federal Reserve's Federal Open Market Committee

Details from the NY Fed: Statement Regarding Purchases of Treasury Securities

Fed Chairman Ben Bernanke in the WaPo: What the Fed did and why: supporting the recovery and sustaining price stability

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 24% at the end of Q3 2010 compared to Q2 2010. The REO inventory increased 92% compared to Q3 2009 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

This is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs. The REO inventory will probably increase sharply in Q4 too.

From the BLS:

Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today.Both August and September payroll employment were revised up.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).The dotted line shows payroll employment excluding temporary Census workers.

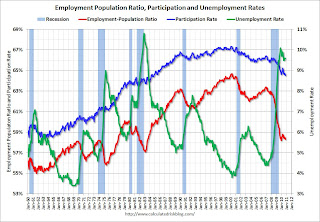

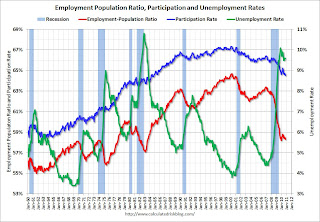

This graph shows the employment-population ratio, and the partcipation and unemployment rates. The unemployment rate has been stuck at 9.6% for three straight months.

This graph shows the employment-population ratio, and the partcipation and unemployment rates. The unemployment rate has been stuck at 9.6% for three straight months.The Employment-Population ratio declined to 58.3% in October from 58.5% in September. This is disappointing news.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate also declined to 64.5% in October from 64.7% in September. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 9.154 million in October, from the record 9.472 million in September. This is still very high.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 9.154 million in October, from the record 9.472 million in September. This is still very high.These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 17.0% in October from 17.1% in September. The high for U-6 was 17.4% in October 2009. Still grim.

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.206 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.123 million in September. It appears the number of long term unemployed has peaked ... although this may be because people are giving up.

The underlying details of the employment report were mixed. The positive included the 151,000 payroll jobs added, the upward revisions to August and September, a slight uptick in hours worked and average hourly earnings, and a slight decline in part time workers (and slight decline in U-6 unemployment).

The negatives include the declines in the employment-population ratio and the participation rate, the increase in workers unemployed for over 26 weeks, and the unemployment rate still flat at a very high level. This report was a clear improvement from the previous four months, but this was still a fairly soft report.

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in October. That is up 17.9% from October 2009, and up 4.7% from the September 2010 sales rate.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

This was above most forecasts of around 12.0 million SAAR.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.The October ISM Non-manufacturing index was at 54.3%, up from 53.2% in September - and above expectations of 54.0%. The employment index showed expansion in October at 50.9%, up from 50.2% in September. Note: Above 50 indicates expansion, below 50 contraction.

The Census Bureau reported the homeownership and vacancy rates for Q3 2010 this week.

The Census Bureau reported the homeownership and vacancy rates for Q3 2010 this week. The homeownership rate was at 66.9%, the same level as in Q2. This is at about the level of early 1999.

Note: graph starts at 60% to better show the change.

The homeowner vacancy rate was at 2.5% in Q3 2010. This is the same level as in Q2, and below the of 2.9% in 2008. The rental vacancy rate declined to 10.3% in Q3 2010 from 10.6% in Q2.

Best wishes to all.

Saturday, November 06, 2010

Ireland Update

by Calculated Risk on 11/06/2010 09:19:00 PM

Just an update from the Irish Times: Interest rate on bonds falls slightly

IRELAND MANAGED to break an eight-day losing streak on international bond markets yesterday ... Sovereign bond yields ... remained near record highs for much of the day but finished a little lower at 7.623 per cent.The Greece 10 year yield was up to 11.46%, and the Portugal 10 year yield fell slightly to 6.51%.

...

However, the spread ... on 10-year money reached 5.34 per cent yesterday, the most since Bloomberg began collecting the data in 1991, before narrowing to 5.2 per cent.

Just something to watch ... best wishes to all

Employment: Participation Rate

by Calculated Risk on 11/06/2010 02:15:00 PM

The following graph shows the employment population ratio, the participation rate, and the unemployment rate (ht Dirk).

Click on graph for larger image.

Click on graph for larger image.

Most of the increase in the participation rate in the '60 and '70s was from women joining the labor force. However one of the key features of the current employment recession is the decline in the participation rate.

The sharplest declines in the participation rate are for the "16 to 19" and the "20 to 24" age groups.

The partcipation rate for the "16 to 19" group has fallen from 41.4% in Dec 2007 to 35.2% in Oct 2010.

The participation rate for the "20 to 24" group has fallen from 74.0% to 71.4% in the same period.

The participation rate for the "55 and over" group has increased from 38.9% to 40.0% since December 2007. Of course the size of the "55 and over" group is increasing, and that might be pushing down the overall participation rate. I'll have more on this later this week.

And a repeat of a popular graph ...

And a repeat of a popular graph ...

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is over.

Best to all

Live Webcast 10:45 AM ET: Bernanke at Jekyll Island

by Calculated Risk on 11/06/2010 10:30:00 AM

From the Atlanta Fed, here is a live webcast from Jekyll Island (Saturday 10:45AM ET).

Panelists will share personal insights and perspectives on the purpose, structure, and functions of the Federal Reserve System.

Panelist: Ben Bernanke, Chairman, Board of Governors of the Federal Reserve System

Panelist: Alan Greenspan, Former Chairman, Board of Governors of the Federal Reserve System

Panelist: Gerald Corrigan, Managing Director, Goldman Sachs, and Former President, Federal Reserve Bank of New York

Moderator: Raghuram Rajan, Professor of Finance, University of Chicago

Posts yesterday (Graphics Gallery, Employment report, Record Fannie, Freddie, FHA REO):