by Calculated Risk on 11/05/2010 12:01:00 AM

Friday, November 05, 2010

Clearing House warns of higher Irish debt margin requirements

A late night update ... from the Financial Times: Clearing house warning to Irish bond traders

Fears over the health of the eurozone bond market intensified after one of Europe’s biggest clearing houses warned investors they could be compelled to stump up substantially more money to trade in Ireland’s debt.And from the Irish Times: Government to postpone publication of four-year plan

...

Such a curb would be a blow to the Irish debt market and comes amid growing concerns over the fragility of the eurozone’s peripheral economies.

excerpt with permission

A detailed four-year budget had been scheduled for publication in the next week or so but it emerged yesterday that the plan will not be disclosed until closer to the December budget.

Thursday, November 04, 2010

Employment Report Preview

by Calculated Risk on 11/04/2010 06:14:00 PM

The BLS will release the October Employment Report at 8:30 AM tomorrow. The consensus is for an increase of 60,000 payroll jobs in October, and for the unemployment rate to stay steady at 9.6%.

Most of the reports this week have been slightly above expectations:

I don't expect a strong report, but perhaps slightly better than expectations (I have no strong view this month).

European Bond Spreads

by Calculated Risk on 11/04/2010 02:29:00 PM

As followup to the previous post, here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Nov 2nd):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Some peripheral European bond spreads (over German bonds) continue to be elevated, particularly those of Greece, Ireland, and Portugal.The Atlanta Fed data is a couple days old. Nemo has links to the current data on the sidebar of his site.

Since the September FOMC meeting, the 10-year Greece-to-German bond spread has narrowed by 45 basis points (bps), from 8.62% to 8.17%, through November 2, though the spread has risen by 110 bps in the past two weeks.

Similarly, with other European peripherals’ spreads, Portugal’s is essentially unchanged over the intermeeting period but is 56 bps higher than two weeks prior, and Ireland’s spread is actually 70 bps higher since the last FOMC meeting and 100 bps higher since October 19.

As of today, the Ireland-to-German spread has increased to a record 525 bps, and the Portugal-to-German spread has increased to 417 bps - just below the record set in late September. The Greece-to-German spread is at 892 bps.

Will Ireland need to use the EFSF?

by Calculated Risk on 11/04/2010 12:24:00 PM

The yield on the Ireland 10-year bond surged again today to 7.68%. The Portugal 10-year yield is near a record at 6.57%.

At what point does it make sense for Ireland to use the European Financial Stability Facility (EFSF)?

Wolfgang Münchau at the Financial Times worked through the details in September and estimated the EFSF borrowing costs would be around 8%: Could any country risk a eurozone bail-out?

It is not all that hard to conceive of a situation in which the borrower would end up paying a total interest rate of 8 per cent ... Three issues arise from this set-up. The first is that no country would ever want to borrow from the EFSF, unless it was absolutely unavoidable. The typical situation where an EFSF loan would be useful would be a case of egregious market failure. If the borrower is insolvent, the EFSF cannot help.So probably at around 8%. Ireland apparently will not need to borrow until sometime in 2011 - and they will do everything possible to avoid the EFSF, still the yields are getting close for the EFSF to make sense ...

excerpt with permission

And it appears Russia has stopped investing in bonds of Ireland and Portugal - via Tracy Alloway at the Financial Times Alphaville: The world backs away from Ireland, Spain, Portugal

There’s something missing from the Russian Finance Ministry’s website.No mention of Ireland, Portugal or even Spain.

Hotels: RevPAR up 12.5% compared to same week in 2009

by Calculated Risk on 11/04/2010 11:38:00 AM

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a more difficult year for the hotel industry than 2008. RevPAR (revenue per available room) is up 12.5% compared to the same week in 2009, but still down 3% compared to the same week in 2008 - and 2008 was a very difficult year for the hotel industry.

From HotelNewsNow.com: STR: Upper-upscale reports softer week

Overall the industry’s occupancy increased 11.7% to 57.9%, ADR was up 0.7% to US$99.84, and RevPAR ended the week up 12.5% to US$57.76.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 8.5% compared to last year (the worst year since the Great Depression) and 5.8% below the median for 2000 through 2007.

The occupancy rate is slightly above the levels of 2008, but RevPAR is still down 3% compared to the same week in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims increase to 457,000

by Calculated Risk on 11/04/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 30, the advance figure for seasonally adjusted initial claims was 457,000, an increase of 20,000 from the previous week's revised figure of 437,000. The 4-week moving average was 456,000, an increase of 2,000 from the previous week's revised average of 454,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 2,000 to 456,000.

The 4-week moving average has been moving sideways at an elevated level for almost a year - a sign of a weak job market.

Wednesday, November 03, 2010

Bernanke: "What the Fed did and why"

by Calculated Risk on 11/03/2010 11:59:00 PM

Fed Chairman Ben Bernanke explains what the Fed is trying to accomplish in the WaPo: What the Fed did and why: supporting the recovery and sustaining price stability

[W]hen the Fed's monetary policymaking committee - the Federal Open Market Committee (FOMC) - met this week to review the economic situation, we could hardly be satisfied. The Federal Reserve's objectives - its dual mandate, set by Congress - are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent ...

Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. ... [L]ow and falling inflation indicate that the economy has considerable spare capacity, implying that there is scope for monetary policy to support further gains in employment without risking economic overheating. The FOMC decided this week that ... further support to the economy is needed. With short-term interest rates already about as low as they can go, the FOMC agreed to deliver that support by purchasing additional longer-term securities, as it did in 2008 and 2009. ...

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

Misc: Bankruptcy Filings increase, Freddie Mac reports loss, and more

by Calculated Risk on 11/03/2010 09:46:00 PM

Foreclosure activity for non-performing loans also continued to increase during the third quarter as many of those loans transitioned to REO. The timing and volume of the company's future REO activities could be adversely affected by deficiencies in the foreclosure practices of the company's mortgage servicers, as well as related delays in the foreclosure process.And the costs for the REOs are increasing too:

included in non-interest expense for the third quarter of 2010 was REO operations expense of $337 million, compared to REO operations income of $40 million in the second quarter of 2010, reflecting higher property write-downs due to lower estimated REO fair values as well as higher expenses driven by increased REO inventory.Earlier stories today:

Comments on FOMC statement

by Calculated Risk on 11/03/2010 05:40:00 PM

A few comments ...

U.S. Light Vehicle Sales 12.26 million SAAR in October

by Calculated Risk on 11/03/2010 03:29:00 PM

Note: I'll posts some comments on the FOMC statement later today.

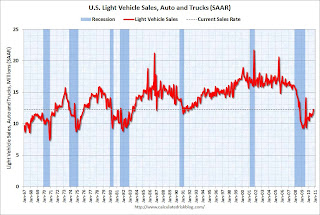

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in October. That is up 17.9% from October 2009, and up 4.7% from the September 2010 sales rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.0 million SAAR.