by Calculated Risk on 10/22/2010 10:00:00 AM

Friday, October 22, 2010

State Unemployment Rates in September: "Little changed" from August

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Eleven states now have double digit unemployment rates. A number of other states are close.

Nevada tied a series high at 14.4% and now has the highest state unemployment rate. Michigan held the top spot for over 4 years until May.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in September. Twenty-three states and the District of Columbia recorded unemployment rate decreases, 11 states registered rate increases, and 16 states had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

In September, Nevada’s unemployment rate held at 14.4 percent, again the highest among the states. The states with the next highest rates were Michigan, 13.0 percent, and California, 12.4 percent. North Dakota continued to register the lowest jobless rate, 3.7 percent, followed by South Dakota and Nebraska, at 4.4 and 4.6 percent, respectively.

Geithner calls for reducing trade imbalances

by Calculated Risk on 10/22/2010 08:37:00 AM

From a letter .S. Treasury Secretary Timothy Geithner sent to his G-20 counterparts:

“First, G-20 countries should commit to undertake policies consistent with reducing external imbalances below a specified share of GDP over the next few years, recognizing that some exceptions may be required for countries that are structurally large exporters of raw materials. This means that G-20 countries running persistent deficits should boost national savings by adopting credible medium-term fiscal targets consistent with sustainable debt levels and by strengthening export performance.And the proposal has plenty of opposition - no surprise - from the WSJ: G-20 Proposal on Curbing Trade Imbalances Faces Opposition

Conversely, G-20 countries with persistent surpluses should undertake structural, fiscal and exchange rate policies to boost domestic sources of growth and support global demand. Since our current account balances depend on our own policy choices as well as on the policies pursued by other G-20 countries, these commitments require a cooperative effort.

“Second, to facilitate the orderly rebalancing of global demand, G-20 countries should commit to refrain from exchange rate policies designed to achieve competitive advantage by either weakening their currency or preventing the appreciation of an undervalued currency.

G-20 emerging market countries with significantly undervalued currencies and adequate precautionary reserves need to allow their exchange rates to adjust fully over time to levels consistent with economic fundamentals. G-20 advanced countries will work to ensure against excessive volatility and disorderly movement in exchange rates.

Together these actions should reduce the risk of excessive volatility in capital flows for emerging economies that have flexible exchange rates.

Japan and Germany, whose export-led growth models have built up major trade surpluses, are opposing such a solution at the meeting of G-20 finance ministers and central bankers in Gyeongju.

"The idea of setting numerical targets is unrealistic," Japanese Finance Minister Yoshihiko Noda said Friday.

Thursday, October 21, 2010

Shanghai Composite Update

by Calculated Risk on 10/21/2010 10:38:00 PM

Just an update ... it seems like the Shanghai and the S&P 500 (and oil prices too - not shown) are all moving together.

This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite index is at 2,963.50, up about 14% since late August. The S&P 500 and oil are both up about 10% over the same period.

FOMC and QE2

by Calculated Risk on 10/21/2010 06:17:00 PM

A few people have asked me for a summary of the views of current FOMC members concerning QE2. Although no one has committed, here is my best guess based on recent speeches or other information ... there appears to be a majority of FOMC member who will vote "Yes", not counting the three labeled as "probably".

| Person, Position | FOMC Membership | QE2 Position |

|---|---|---|

| Ben S. Bernanke, Board of Governors, Chairman | FOMC | Yes |

| Janet L. Yellen, Fed Vice Chairman, Board of Governors | FOMC | Yes |

| William C. Dudley, New York, FOMC Vice Chairman | FOMC | Yes |

| James Bullard, St. Louis | FOMC | Yes |

| Elizabeth A. Duke, Board of Governors | FOMC | Yes (probably) |

| Thomas M. Hoenig, Kansas City | FOMC | No |

| Sandra Pianalto, Cleveland | FOMC | Yes |

| Sarah Bloom Raskin, Board of Governors | FOMC | Yes (probably) |

| Eric S. Rosengren, Boston | FOMC | Yes |

| Daniel K. Tarullo, Board of Governors | FOMC | Yes (probably) |

| Kevin M. Warsh, Board of Governors | FOMC | Undecided |

| Charles L. Evans, Chicago | Alternate | Yes |

| Richard W. Fisher, Dallas | Alternate | Undecided |

| Narayana Kocherlakota, Minneapolis | Alternate | Undecided |

| Charles I. Plosser, Philadelphia | Alternate | No |

| Christine M. Cumming, First Vice President, New York | Alternate | Unknown |

Hotel Performance: RevPAR up 9.4% compared to same week in 2009

by Calculated Risk on 10/21/2010 02:17:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a much more difficult year for the hotel industry than 2008. RevPAR (revenue per available room) is up 9.4% compared to 2009, but still down 7.8% compared to 2008 - and 2008 was a very difficult year for the hotel industry.

From HotelNewsNow.com: STR: Economy ADR performance falls short

Overall occupancy increased 8.3% to 63.8%, ADR was up 0.9% to US$100.40, and RevPAR ended the week up 9.4% to US$64.09.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.9% compared to last year (the worst year since the Great Depression) and 6.1% below the median for 2000 through 2007.

The occupancy rate is about at the levels of 2008, but RevPAR is still down 7.8%.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

FHFA Projections for Fannie and Freddie draws, and House Price Assumptions

by Calculated Risk on 10/21/2010 11:35:00 AM

From the FHFA: FHFA Releases Projections Showing Range of Potential Draws for Fannie Mae and Freddie Mac

To date, the Enterprises have drawn $148 billion from the Treasury Department under the terms of the [Preferred Stock Purchase Agreements] PSPAs. Under the three scenarios used in the projections, cumulative Enterprise draws range from $221 billion to $363 billion through 2013.The key to the size of future draws is the trajectory of house prices. The following graph shows the three house projections used by the FHFA:

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the FHFA:

Stronger Near-term Recovery (FHFA Scenario 1) “Increased access to credit supports the above baseline growth. As a result, the recent increases in house prices are sustained, although additional increases are minimal in 2010 and 2011.” The peak to-trough decline is 31%. From the trough in 1Q09 to the end of the forecast period house prices increase by 5%.My current projection is for further house price declines of 5% to 10%, as measured by the Case-Shiller and Corelogic repeat sales indexes. That would put the peak-to-trough decline around 36% or so. So my guess is somewhere between scenarios 2 & 3.

Current Baseline (FHFA Scenario 2) "Small remaining home price declines" contribute to a 34% peak-to-trough decline. From the trough in 3Q11 to the end of the forecast period house prices increase by 8%.

Deeper Second Recession (FHFA Scenario 3) “As a result of restricted access to credit and continuing high unemployment, the moderate

rebound in housing construction that occurred over the first half of 2009 not only pauses but reverses course." The peak-to-trough decline is 45%. From the trough in 1Q12 to the end of the forecast period house prices increase by 11%.

And this graph shows the projected draws for each of the above scenarios.

And this graph shows the projected draws for each of the above scenarios.My guess is the draw will be somewhat over scenario 2, but well below the FHFA's scenario 3.

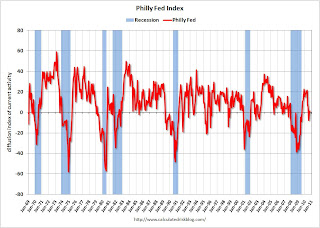

Philly Fed Index "steady" in October

by Calculated Risk on 10/21/2010 10:00:00 AM

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity was steady in October. Although the broad survey measures showed marginal improvement this month, the new orders index continued to suggest weak demand for manufactured goods.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of –0.7 in September to 1.0 in October. The index had been negative for two consecutive months (see Chart). Indexes for new orders and shipments continued to indicate weakness this month: The new orders index increased 3 points but remained negative for the fourth consecutive month.

...

Firms reported near steady employment again this month, but lower average work hours for existing employees. The percentage of firms reporting increases in employment (20 percent) narrowly edged out the percentage of firms reporting decreases (17 percent). The index for employment was slightly positive for the second consecutive month but increased just 1 point. Indicative of still weak activity, more firms reported declines in average work hours for existing employees (22 percent) than reported increases (16 percent).emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

This index turned down sharply in June and July and was negative in August and September (indicating contraction). The index was barely positive in October, and the internals (new orders, employment) are still weak.

These surveys are timely, but noisy. However this is further evidence of a slowdown in manufacturing. This was slightly worse than the consensus view of a reading of 1.8 (slight expansion).

Weekly Initial Unemployment Claims: Moving Sideways

by Calculated Risk on 10/21/2010 08:40:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 16, the advance figure for seasonally adjusted initial claims was 452,000, a decrease of 23,000 from the previous week's revised figure of 475,000 [revised up from 462,000]. The 4-week moving average was 458,000, a decrease of 4,250 from the previous week's revised average of 462,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,250 to 458,000.

The 4-week moving average has been moving sideways at an elevated level since last December - almost a year - and that suggests a weak job market.

Note: most revisions have been slightly up over the last year or so. The average revision has been up just over 2,000, but the revision last week was up 13,000.

Wednesday, October 20, 2010

WSJ: Here come the GSE Put-Backs

by Calculated Risk on 10/20/2010 10:56:00 PM

From Nick Timiraos at the WSJ: Regulator for Fannie Set to Get Litigious

[The FHFA] hired a law firm specializing in litigation as the agency considers how to move forward with efforts to recoup billions of dollars on soured mortgage-backed securities purchased from banks and Wall Street firms.Back in July, the Federal Housing Finance Agency announced: FHFA Issues Subpoenas for PLS Documents

...

In a statement, the FHFA said it is analyzing requested information and that "no decisions for future action have been made."

FHFA, as Conservator of Fannie Mae and Freddie Mac (the Enterprises), has issued 64 subpoenas to various entities, seeking documents related to private-label mortgage-backed securities (PLS) in which the two Enterprises invested. The documents will enable the FHFA to determine whether PLS issuers and others are liable to the Enterprises for certain losses they have suffered on PLS.The GSEs have a huge advantage over other investors because the FHFA can issue subpoenas. The article mentions estimates that the banks could face put-backs ranging from $24 billion to as high as $179 billion. Quite a range and the actual amount will probably be towards the lower end of the range, and this will play out over a long period (unless there is a settlement).

Note: It is difficult for private investors to obtain the actual loan documents - and that is one of the hurdles the investors asking BofA to repurchase loans need to overcome. Yves Smith at Naked Capitalism points out some of the difficulties: More on Why the PIMCO, BlackRock, Freddie, NY Fed Letter to Countrywide on Putbacks Is Way Overhyped. However the private investors can obtain the required voting rights (usually 25% to 50% depending on the deal), and essentially force the trustee to make the servicer turnover the loan documentation. As I mentioned last night, put-backs could be a big issue for the banks, although I think it will play out over several years and not be a serious issue for the economy.

Comerica and Wells Fargo: Some color on C&I borrowing

by Calculated Risk on 10/20/2010 07:03:00 PM

Just a little color ... this sounds like a sluggish recovery with little new investment. The following comments from Comerica and Wells Fargo on Commercial & Industrial (C&I) lending this morning are mixed. Perhaps a little improvement, but not much. Here are the excerpts from the transcripts (ht Brian).

From Comerica Incorporated conference call:

Analyst: Can you talk about what you saw from your more traditional borrowers during the quarter? Any signs of lines being drawn down or increased optimism?And from Wells Fargo:

Dale Green, EVP, Comerica: Yeah, this is Dale. Number one, as we indicated, the usage was up a bit from about 45% to about 46%, it’s good to see that. We haven’t seen that in a while. If you look at the backlogs and you look at the growth from new customers, and increases to existing customers, it’s kind of spread across most of our businesses. Currently the dealer business is showing growth. The energy business has indicated they are showing growth, those backlogs continue to look good, and what we call the commitments to commit, or the approved deals that we’re waiting to close are up rather substantially this quarter over last quarter, and again, that’s generally across most of the segments. Middle market, technology and life sciences, and so forth. So the quality of the backlog, if you will, is good in the sense that there are more deals that have been approved that are waiting to close, and the level of activity is generally a little better than it’s been. So I would say that we are cautiously optimistic, but you know, this is an uncertain time. So while we’re seeing some improvements, and we’re happy to see it, we’re happy to see better usage, there’s still an economy here that most business people will tell you is concerning, troubling, uncertain.

...

Analyst: I know you talked about utilization rate and everything in terms of demand firming up on commercial lending, but just trying to get an idea of how soon we can see growth commercial offset so CRE roll off in terms of loan growth.

Dale Greene: I hope soon, but the reality is that number one, in terms of new CRE types of opportunities, there are very few new opportunities, so we’ll continue to see the run off of the commercial real estate book as part of a design, if you will. Clearly, as we talked about before, is I had one against growth. While we are seeing some positive trends in the non-CRE, the rest of the C & I book – it’s still very difficult to predict, because there’s just that uncertainty, and so I wouldn’t sit here and tell you exactly when you might see it. It might be a while. I mean, John talked about unemployment rates, and the growth and the economy still being on very muted labels. I don’t know that that’s going to change anytime in the near term, therefore, what we’re doing is the things we’ve done for years. We’re calling on customers, we’re calling on prospects, we’re looking for the core middle market opportunities, particularly in Texas and California. We have loads of good opportunities, we have a better quality backlog, but it will take some time, I think, to see any significant growth, if you will, in the C & I book. It’s just going to be sort of ongoing, quarter to quarter, a block and a tackle kind of an effort.

Ralph Babb, CEO: As Dale was mentioning, we’re staying very close to our customers, and what we’re hearing from our customers, and we have a lot of customers who are doing very well. They are not, because of the uncertainty in the economy, and other things that affect their particular business, investing for the future. They’re really taking care of what’s happening today, and until there is a confidence factor build out there along with the economy showing a steady improvement, I don’t think you’re going to see loans consistently pick up in the industry. You monitor the numbers, I’m sure, just like we do, as to how the industry in total is working. We saw a little bit of that in Q1 and Q2, where things began to pick up, and then all of a sudden the economy slowed back down again, and the estimates that I’ve heard and look at, over the next couple of quarters and into next year, are not significant in pickup. I hope that that’s not correct.

Analyst: So what is the percentage of the C&I loan utilization? I will use that as a measure for how much loan demand there is. What is your feeling about loan demand?

WFC CFO: Roughly in the low 30s on commercial line utilization, and that has been relatively consistent for a couple of quarters now. Again as we say, we are seeing somewhat increased activity, but it is not as robust as we would like to see it be. As I said we think we are picking up market share because we have got so many relationships and all the other cross-sell. So we'll just have to see when demand comes back.

WFC CEO: One of the keys, is our increase in commitments is much greater than what is happening in the portfolio, the outstandings. So we are making investments today, spending money today, to win new clients, service existing clients, that we're not seeing the benefit of yet.