by Calculated Risk on 10/19/2010 10:09:00 AM

Tuesday, October 19, 2010

Fed's Dudley: 3 million excess vacant housing units

From NY Fed President William Dudley: Regional Economy and Housing Update

[L]et's consider the slow housing recovery. Housing market activity—both new construction and sales—remains depressed. On the construction side, total housing starts are running at just 600,000 units per year (seasonally-adjusted) in recent months. This is up from 530,000 units at the trough in the first quarter of 2009 but it is still extremely low by the standards of the last 50 years. In fact, the rate of new construction is so low that there is barely any net growth in the U.S. housing stock these days.For those in the New York / New Jersey area, much of Dudley speech is on the regional economy and housing market.

One reason why so little housing is being built is that many existing homes stand vacant. We estimate that there are roughly 3 million vacant housing units more than usual. And more vacancies are added daily as the foreclosure process moves homes from families to mortgage lenders. This stock of vacant homes will shrink when fewer are foreclosed upon and more of these homes are sold or rented out.

On the sales side, even though low mortgage interest rates and falling home prices have together boosted housing affordability to its highest level in 40 years, the current pace of sales is quite sluggish. Impediments to home sales include tight lending standards, a weak job market and continued uncertainty regarding the future path of home prices. The large decline in home prices that occurred between 2006 and 2008 is also important. This decline reduced the amount of equity that owners have in their homes, making it difficult for people to come up with the funds needed to "trade-up" and move into better homes.

In addition, the steep decline in home prices put many families at risk of mortgage delinquency and, ultimately, losing their homes to foreclosure. With lower home prices, many families now owe more on their mortgage than their home is worth. This means that they cannot refinance or sell their homes easily if they experience a financial crisis, such as a job loss or a serious illness. Recent developments on foreclosures have been mixed. While RealtyTrac reports that foreclosure completions in the United States exceeded 100,000 for the first time in September, it is important to remember that foreclosure is a lengthy process in most states. Our data indicate that, in recent quarters, borrowers are becoming less likely to fall behind on their mortgages, so fewer households are now entering the foreclosure process. At the same time, though, major lenders have acknowledged serious problems in the processes they have used to repossess homes and announced moratoria on new foreclosures. Taken together, these developments suggest that the situation in housing remains uncertain for the foreseeable future.

The Federal Reserve actively encourages efforts to find viable alternatives to foreclosure, like loan modifications, or deeds in lieu. We also support due process and access to legal counsel for homeowners facing foreclosure, for instance through legal aid programs. At the same time, it is important that foreclosures that properly comply with state and federal law can ultimately take place, as this is a necessary part of the adjustment that will eventually return us to more normal conditions in the housing market.

At present, the extent of the documentation problem and its wider ramifications are still uncertain. In conjunction with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, the Federal Reserve is therefore seeking to establish the facts through a review of the foreclosure practices, governance and documentation at the major bank mortgage servicers. We want to ensure that the housing finance business is supported by robust back-office operations—for processing of new mortgages as well as foreclosures— so that buyers of homes and investors in mortgage securities have full confidence in the process. We are monitoring developments closely in order to evaluate any potential impact on the housing market, financial institutions and the overall economy.

Housing Starts increase in September

by Calculated Risk on 10/19/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 610 thousand (SAAR) in September, up 0.3% from the revised August rate of 608 thousand (revised up from 598 thousand), and up 28% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

There has been an increase in multi-family starts over the last two months, although single family starts are significantly below the levels of earlier this year.

Single-family starts increased 4.4% to 452 thousand in August. This is 25% above the record low in January 2009 (360 thousand).

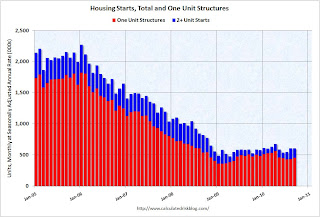

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 580 thousand starts, mostly because of the volatile multi-family starts. As I've mentioned many times - this low level of starts is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 610,000. This is 0.3 percent (±10.3%)* above the revised August estimate of 608,000 and is 4.1 percent (±12.0%)* above theSeptember 2009 rate of 586,000.

Single-family housing starts in September were at a rate of 452,000; this is 4.4 percent (±13.9%)* above the revised August figure of 433,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 539,000. This is 5.6 percent (±1.4%) below the revised August rate of 571,000 and is 10.9 percent (±2.3%) below the September 2009 estimate of 605,000.

Single-family authorizations in September were at a rate of 405,000; this is 0.5 percent (±1.3%)* above the revised August figure of 403,000.

Monday, October 18, 2010

Foreclosure-Gate: GMAC resumes some foreclosures

by Calculated Risk on 10/18/2010 09:48:00 PM

Statement from GMAC: GMAC Mortgage Statement on Independent Review and Foreclosure Sales

GMAC Mortgage ... has engaged several leading legal and accounting firms to conduct independent reviews of its foreclosure procedures in each of the 50 states.Earlier I posted the BofA and Citi comments (BofA is resuming foreclosures, Citi said their foreclosure process was "sound".) Several large banks report Q3 results over the next two days (BofA, Goldman Sachs, Wells Fargo and Morgan Stanley), and I expect more comments on foreclosure issues (and possibly more questions).

...

In addition to the nationwide measures, the review and remediation activities related to cases involving judicial affidavits in the 23 states continues and has been underway for approximately two months. As each of those files is reviewed, and remediated when needed, the foreclosure process resumes. GMAC Mortgage has found no evidence to date of any inappropriate foreclosures.

On the Citi conference call this morning there were no questions on foreclosure-gate and only one on securitization issues - and that didn't provide any new information.

2010 Census: Final Weekly Payroll Update

by Calculated Risk on 10/18/2010 06:59:00 PM

The Census Bureau has released the final weekly payroll report for the 2010 Census. The report shows only 2,766 temporary workers were on the payroll for the week ending Oct 2nd.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

I'm providing this update because every month there is some confusion over how to report the payroll numbers in the employment report. Starting with the October employment report (to be released on November 5th), we can go back to reporting the headline number (not ex-Census), and we can ignore the impact of the temporary Census hiring on the monthly payroll numbers - well, until the next decennial Census!

Citigroup: Foreclosure Process is 'Sound', BofA expects to submit new affidavits next week

by Calculated Risk on 10/18/2010 03:38:00 PM

From Dow Jones: Citigroup Says Its Foreclosure Processing Is 'Sound' Dow Jones is reporting that the Citigroup CFO John Gerspach said they have found no issues with the foreclosure process, and they see no reason to halt foreclosures.

"While we use external attorneys to prepare [foreclosure] documents, each package is reviewed by a Citi employee, who verifies the information and signs the foreclosure affidavit in the presence of a notary," Gerspach said ...And from the WSJ: BofA Sets Timetable for Foreclosure Review. The WSJ is reporting that BofA will resubmit new affidavits for 102,000 pending foreclosures, and that they expect to resubmit the affidavits, with the proper reviews and new signatures, by October 25th.

Fed's Lockhart: QE2 is an "insurance policy" against further disinflation

by Calculated Risk on 10/18/2010 01:03:00 PM

From Atlanta Fed President Dennis Lockhart: The Challenges of Monetary Policy in Today's Economy

To opt for more quantitative easing at this juncture is a big decision. Today I will walk you through the thicket of considerations that lead me, at this moment, to be sympathetic to more monetary stimulus in the near future.Lockhart is not currently on the FOMC.

...

With current inflation running at about 1 percent or a little higher and with official unemployment measured at 9.6 percent, it's clear that the economy is not where we want it to be. In my mind, the question is whether this situation is a call to immediate action.

...

As a starting point, I expect final measures of third quarter GDP growth to be close to that in the second quarter which came in at 1.6 percent. My current forecast sees a modest increase in the rate of growth in the fourth quarter and further, but still modest, improvement in 2011. In this forecast, inflation remains low but with no further disinflation, and unemployment comes down very gradually.

In my thinking, the range of plausible divergence from this forecast is quite wide, and the risks are more to the downside.

...

In my view, the decision is not clear cut. We policymakers have to weigh these arguments pro and con, potential costs versus benefits, and competing risks. As I said earlier, I am leaning in favor of additional monetary stimulus while acknowledging the longer-term risks the policy may present. At this juncture, and given the circumstances of sluggish growth and measured inflation that is too low, I give greater weight to the risk of further disinflation leading to deflation. In my mind, QE2 is a form of risk management—an insurance policy that is prudent to put in place at this time.

Note: Lockhart see modest improvment in both GDP growth and unemployment, but I think we will see a little more weakness in GDP growth and the unemployment rate will even tick up a little from 9.6%.

NAHB Builder Confidence increases in October

by Calculated Risk on 10/18/2010 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in October. This is a 3 point increase from 13 in September, and is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Improves in October

Builder confidence in the market for newly built, single-family homes rose three points to 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for October, released today. This was the first improvement registered by the HMI in five months, and returns the index to a level last seen in June of this year.

...

All three of the HMI's component indexes registered gains in October. The index gauging current sales conditions rose three points to16, while the index gauging sales expectations in the next six months rose five points to 23 and the index gauging traffic of prospective buyers rose two points to 11.

Industrial Production, Capacity Utilization decreased in September

by Calculated Risk on 10/18/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in September after having increased 0.2 percent in August. ... The capacity utilization rate for total industry edged down to 74.7 percent, a rate 4.2 percentage points above the rate from a year earlier but 5.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.5% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.7% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined slightly in September, and production is still 7.5% below the pre-recession levels at the end of 2007.

This is below consensus expectations of a 0.2% increase in Industrial Production, and an increase to 74.8% (from 74.7% before revision) for Capacity Utilization.

Sunday, October 17, 2010

Schedule additions: Large Bank Financial Results

by Calculated Risk on 10/17/2010 09:53:00 PM

Here is the Schedule for Week of Oct 17th

Here is the Summary for Week ending Oct 16th (with plenty of graphs).

I've updated the schedule to include financial results for several large banks (ht Tony). Usually I wouldn't include an earnings calendar, but I'll be looking for comments on Foreclosure-Gate (and other comments).

The additions are:

HUD Secretary on Foreclosure-Gate: "Will respond with full force of the law"

by Calculated Risk on 10/17/2010 07:49:00 PM

From the HuffPo: How We Can Really Help Families

The recent revelations about foreclosure processing -- that some banks may be repossessing the homes of families improperly -- has rightly outraged the American people. The notion that many of the very same institutions that helped cause this housing crisis may well be making it worse is not only frustrating -- it's shameful.I hope actions follow words.

...

[T]he Obama Administration has a comprehensive review of the situation underway and will respond with the full force of the law where problems are found. The Financial Fraud Enforcement Task Force that President Obama established last November has made this issue priority number one.