by Calculated Risk on 8/03/2010 10:02:00 AM

Tuesday, August 03, 2010

Pending Home fall to record series low in June

From the NAR: Pending Home Sales Ease in Post-Tax Credit Market

The Pending Home Sales Index, a forward-looking indicator, declined 2.6 percent to 75.7 based on contracts signed in June from an upwardly revised level of 77.7 in May [revised from 77.6], and is 18.6 percent below June 2009 when it was 93.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This decline was expected and suggests existing home sales - reported at closing - will fall sharply in July and probably a little further in August.

NAR chief economist Lawrence Yun says: “Over the short term, inventory will look high relative to home sales."

Yes, the months-of-supply will be in double digits, and that will put downward pressure on prices.

Note: This is a record low for this series that started in 2001.

Personal Income, Spending flat in June

by Calculated Risk on 8/03/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, June 2010

Personal income increased $3.0 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) decreased $2.9 billion, or less than 0.1 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in June, compared with an increase of 0.2 percent in May.

...

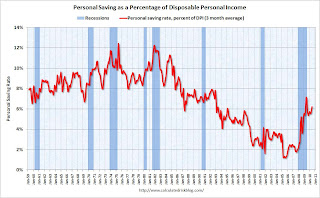

Personal saving as a percentage of disposable personal income was 6.4 percent in June

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report. The saving rate increased to 6.4% in June (increased to 6.2% using a three month average).

I expect the saving rate to rise some more over the next year, perhaps to 8% or so - keeping the pace of PCE growth below income growth. But the good news is the saving rate is much higher than orginally estimated, so much of the expected drag from an increase in the saving rate has already happened.

Monday, August 02, 2010

WSJ: FOMC considering reinvesting when MBS Matures

by Calculated Risk on 8/02/2010 11:59:00 PM

From Jon Hilsenrath at the WSJ: Fed Mulls Symbolic Shift

Federal Reserve officials will consider a modest but symbolically important change in the management of their massive securities portfolio ...This seems unlikely to happen at the Aug 10th meeting based on Chairman Bernanke's speech this morning, and his testimony to Congress less than two weeks ago.

The issue: Whether to use cash the Fed receives when its mortgage-bond holdings mature to buy new mortgage or Treasury bonds, instead of allowing its portfolio to shrink gradually, as it is expected to do in the months ahead. ...

Buying new bonds with this stream of cash from maturing bonds—projected at about $200 billion by 2011—would show the public and markets that the Fed is seeking ways to support economic growth.

Krugman: "Why Is Deflation Bad?"

by Calculated Risk on 8/02/2010 08:15:00 PM

A few excerpts from Professor Krugman: Why Is Deflation Bad?

There are actually three different reasons to worry about deflation, two on the demand side and one on the supply side.There are more details at Krugman's post.

So first of all: when people expect falling prices, they become less willing to spend, and in particular less willing to borrow. ....

A second effect: even aside from expectations of future deflation, falling prices worsen the position of debtors, by increasing the real burden of their debts. Now, you might think this is a zero-sum affair, since creditors experience a corresponding gain. But as Irving Fisher pointed out long ago (pdf), debtors are likely to be forced to cut their spending when their debt burden rises, while creditors aren’t likely to increase their spending by the same amount. ...

Finally, in a deflationary economy, wages as well as prices often have to fall – and it’s a fact of life that it’s very hard to cut nominal wages — there’s downward nominal wage rigidity. ...

Now, alert readers will have noticed that none of these arguments abruptly kicks in when the inflation rate goes from +0.1% to -0.1%. Even with low but positive inflation the zero lower bound may be binding; inflation that comes in lower than borrowers expected leaves them with a worse debt burden than they were counting on, even if the inflation is positive; and since relative wages are shifting around all the time, some nominal wages will have to fall even if the overall rate of inflation is a bit above zero.

The third point on sticky wages (and prices) is very important. Relative wages are being adjusted all the time in the economy. With some inflation, real wages can be cut (if needed) by keeping wage increases below the inflation rate. However, if inflation is near zero - or there is deflation - many companies that need to cut wages a little will have difficulty competing since it is difficult to cut nominal wages. This is a key reason why a little inflation is better than no inflation. Of course too much inflation is really bad too, but that isn't the problem right now.

Preview: Auto Sales, Pending Home Sales, Aug 10th FOMC Meeting

by Calculated Risk on 8/02/2010 05:04:00 PM

1) July Auto Sales. Light vehicle sales will be reported tomorrow by the automakers. In the weekly schedule, I noted that "expectations are for about a 11.6 million SAAR for light vehicles in July – up from the 11.1 million sales rate in June." There is a pretty wide range in forecasts:

From Bloomberg: Auto Sales May Rise to Highest of Year on U.S. Closeout Deals

Industrywide deliveries ... may reach an annualized rate of 11.9 million vehicles in July, the average of eight analysts’ estimates compiled by Bloomberg. That would be 5.3 percent higher than last year’s 11.3 million pace and the best month since August 2009 ...And from Reuters: Auto Sales in US Expected to Rise Slightly in July

Analysts surveyed by Reuters expected an average annualized sales rate of 11.4 million vehicles in July, up slightly from 11.1 million in June and 11.2 million a year earlier. Forecasts for July range from 11.1 million to 12.1 million vehicles.2) Pending Home Sales: The consensus is for a slight decline in the pending homes sales index for June, after the 30% drop decline in May. Lawler expects about a 3% decline (based on limited data).

3) FOMC meeting on August 10th: There has been some speculation that the FOMC would ease monetary policy next week. As an example from CNBC: Fed Will Ease Monetary Policy on Aug. 10: Economist

Japan's Nomura has become the first investment bank to predict the Federal Reserve will begin to ease monetary policy following the recent slowdown in growth in the world's biggest economy.Given Chairman Bernanke's comments this morning, this seems very unlikely. Bernanke's speech was fairly positive, and I think the FOMC statement might note that growth has slowed, but the "extended period" wording will probably remain the same - and there will probably be no mention of further easing. The following was the key sentence in Bernanke's speech:

The deterioration in expectations for growth and inflation argues for an easing of monetary policy, Paul Sheard, the global chief economist at Nomura, wrote in his latest report.

"In particular, in the household sector, growth in real consumer spending seems likely to pick up in coming quarters from its recent modest pace, supported by gains in income and improving credit conditions."Unless there is a huge downside surprise this week, I think the FOMC statement will basically remain the same.

Foreclosure Auction Investing Gone Wrong

by Calculated Risk on 8/02/2010 02:54:00 PM

Usually when auction buyers lose money it is because they either overvalue the home, or the home was seriously damaged. However this is an unusual story from Carolyn Said at the San Francisco Chronicle: Winning bid on mortgage buys family heartache (ht Jesse)

Roberta and Randall Strand took $97,606 out of their paid-off house to buy a foreclosed home at a courthouse auction. Five months later, they found out they actually bought the second mortgage, and that the bank planned to foreclose on the first mortgage, leaving them out in the cold.This is pretty easy to check. In this case the lender (Wachovia, now Wells Fargo) held both the 1st and 2nd and foreclosed on both. Because of timing issues, the 2nd went to the court house steps first - and the buyers are now out around $100,000. Well, probably less ...

Wells and the family negotiated a confidential settlement and were finalizing details late last week.

Private Construction Spending declines in June

by Calculated Risk on 8/02/2010 12:06:00 PM

Overall construction spending increased slightly in June, and private construction spending, both residential and non-residential, decreased in June. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is now 62% below the peak of early 2006.

Private non-residential construction was revised down for both April and May, and spending is now 35% below the peak of late 2008.

From the Census Bureau: June 2010 Construction at $836.0 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2010 was estimated at a seasonally adjusted annual rate of $836.0 billion, 0.1 percent (±1.6%)* above the revised May estimate of $834.8 billion.I expect:

...

Spending on private construction was at a seasonally adjusted annual rate of $527.6 billion, 0.6 percent (±1.3%)* below the revised May estimate of $530.9 billion. Residential construction was at a seasonally adjusted annual rate of $258.3 billion in June, 0.8 percent (±1.3%)* below the revised May estimate of $260.3 billion. Nonresidential construction was at a seasonally adjusted annual rate of $269.3 billion in June, 0.5 percent (±1.3%)* below the revised May estimate of $270.6 billion.

Residential spending will probably exceed non-residential later this year (or early 2011), but that will be mostly because of weakness in non-residential construction, as opposed to any significant increases in residential spending.

Bernanke: Challenges for the Economy and State Governments

by Calculated Risk on 8/02/2010 10:18:00 AM

From Fed Chairman Ben Bernanke: Challenges for the Economy and State Governments

On the economy:

While the support to economic activity from stimulative fiscal policies and firms' restocking of their inventories will diminish over time, rising demand from households and businesses should help sustain growth. In particular, in the household sector, growth in real consumer spending seems likely to pick up in coming quarters from its recent modest pace, supported by gains in income and improving credit conditions. In the business sector, investment in equipment and software has been increasing rapidly, in part as a result of the deferral of capital outlays during the downturn and the need of many businesses to replace aging equipment. At the same time, rising U.S. exports, reflecting the expansion of the global economy and the recovery of world trade, have helped foster growth in the U.S. manufacturing sector.On state and local governments:

To be sure, notable restraints on the recovery persist. The housing market has remained weak, with the overhang of vacant or foreclosed houses weighing on home prices and new construction. Similarly, poor economic fundamentals and tight credit are holding back investment in nonresidential structures, such as office buildings, hotels, and shopping malls.

Importantly, the slow recovery in the labor market and the attendant uncertainty about job prospects are weighing on household confidence and spending. After two years of job losses, private payrolls expanded at an average of about 100,000 per month during the first half of this year, an improvement but still a pace insufficient to reduce the unemployment rate materially. In all likelihood, significant time will be required to restore the nearly 8-1/2 million jobs that were lost over 2008 and 2009. Moreover, nearly half of the unemployed have been out of work for longer than six months.

Cuts in state and local programs and employment are also weighing on economic activity. These cuts principally reflect the historically large decreases in state tax revenues during the recession. Sales tax revenues have declined with household and business spending, and income tax revenues have been hit by drops in wages and salaries, capital gains, and corporate profits. In contrast, property tax revenues collected by local governments generally held up well through the beginning of this year, although reappraisals of the values of homes and commercial properties may affect those collections in the future.This is a fairly positive outlook for the overall economy, but less so for local governments.

...

With revenues down and Medicaid spending up, other categories of spending by state governments have been tightly squeezed. Over the past year, numerous state governments have laid off or furloughed employees, decreased capital spending, and reduced aid to local governments. Indeed, state and local payrolls have fallen by more than 200,000 jobs from their peak near the end of 2008. Some states have also raised taxes, but the weak economy has made it difficult to find significant new revenues.

Assistance from the federal government, especially through the fiscal stimulus package, has eased, but certainly not eliminated, the budget difficulties faced by states. Although states and localities will continue to receive significant aid this year, that source of help will be winding down next year.

On a more positive note, state and local tax revenues seem set to increase as economic activity expands.

ISM Manufacturing Index declines in July

by Calculated Risk on 8/02/2010 10:00:00 AM

PMI at 55.5% in July down from 56.2% in June.

From the Institute for Supply Management: July 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in July for the 12th consecutive month, and the overall economy grew for the 15th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "Manufacturing continued to grow during July, but at a slightly slower rate than in June. Employment, supplier deliveries and inventories improved during the month and reduced the impact of a month-over-month deceleration in new orders and production. July marks 12 consecutive months of growth in manufacturing, and indications are that demand is still quite strong in 10 of 18 industries. The prices that manufacturers paid for their inputs were slightly higher but stable, with only a few items on the short supply list."

...

ISM's New Orders Index registered 53.5 percent in July, which is a decrease of 5 percentage points when compared to the 58.5 percent reported in June.

...

ISM's Employment Index registered 58.6 percent in July, which is 0.8 percentage point higher than the 57.8 percent reported in June. This is the eighth consecutive month of growth in manufacturing employment.

emphasis added

Sunday, August 01, 2010

NY Times: China State-owned companies move into real estate development

by Calculated Risk on 8/01/2010 08:52:00 PM

From David Barboza at the NY Times: State-Owned Groups Fuel China’s Real Estate Boom

All around the nation, giant state-owned oil, chemical, military, telecom and highway groups are bidding up prices on sprawling plots of land for big real estate projects unrelated to their core businesses.The story mentions a salt company building luxury high rises ... that seems very speculative!

...

By driving up property prices, the state-owned companies, which are ultimately controlled by the national government, are working at cross-purposes with the central government’s effort to keep China’s real estate boom from becoming a debt-driven speculative bubble ...

A repeat: Early this morning Part 5C of the Sovereign Default series: Some Policy Options, Good and Bad

Yesterday: Negative Equity Breakdown. The authors estimate there are 4.1 million homeowners with more than 50% negative equity, and another 5 million with 20% to 50% negative equity.

And How do you put recession bars on graphs using Excel?