by Calculated Risk on 6/16/2010 06:19:00 PM

Wednesday, June 16, 2010

Toll Brothers: Demand Choppy, Sales Down

Just a few weeks ago, new Toll CEO-designate Doug Yearley, Jr. noted:

"With demand increasing in many areas, we are very focused on growth."Uh, nevermind ...

From Toll today (ht Brian):

Joel H. Rassman, chief financial officer, stated: ... "While much of the attention surrounding the recent decline in housing indicators has focused on the expiration of the housing tax credit, we believe our customers' buying decisions have been driven more by consumer confidence than by the tax credit. As we noted in our second-quarter earnings press release of May 26, 2010, we believe the volatility in the financial markets and the high U.S. unemployment rate continue to weigh on the nation's psyche. Additionally, in the past several weeks, concerns about the financial crisis in Europe and escalating regional political tensions, coupled with worries about the oil spill in the Gulf of Mexico and its effects on the economy and the environment have negatively impacted the outlook of American consumers.Slightly ahead on a community bases - with 21% fewer communities. Do the math - they are running close to 20% below last year. And 40% below last year over the last three weeks (20% fewer deposits and 21% fewer communities).

"In the three weeks following our earnings conference call on May 26, 2010, our per-community deposits have been running about 20% behind the comparable period in last year's third quarter and our per-community traffic has been running about 3% behind. Thus, for the first six weeks of our FY 2010 third quarter beginning May 1, 2010, we are slightly ahead of last year's third-quarter pace of contracts signed on a per community basis. However, we have 21% fewer communities than one year ago.

"Although demand in recent weeks has been quite choppy, in general, we continue to believe that the housing market has emerged from its darkest period of late 2008 through early 2009. ... At the moment, consumers view the economic glass as half empty: volatile financial markets, global deficit concerns and the oil spill in the Gulf are all contributing to this gloom. We believe that once the employment picture begins to brighten and the economy stabilizes, consumer confidence will improve and the housing market should begin a steadier recovery."And there you have what might be the popular Q2 meme: blame the oil spill for poor results.

Iceland: Court rules Foreign currency indexed loans illegal

by Calculated Risk on 6/16/2010 04:44:00 PM

Here is a little different story ...

From The Iceland Weather Report: Foreign currency loans deemed illegal (ht Steinn)

The Icelandic supreme court ruled this afternoon that Icelandic loans indexed to a foreign currency are illegal.From The Reykjavík Grapevine: Supreme Court Rules Loans Pinned to Foreign Currency Illegal (ht Warlock)

This is hugely significant for thousands of people in this country.

Two cases were connected to the ruling involving car loans taken from the companies Lýsingu hf. and SP-fjármögnun that were pinned to foreign currency. With the collapse of the Icelandic crown in 2008, many people who took out such loans - at a time when the crown was strong - saw their debts double almost overnight.It was apparently pretty common in Iceland for car and some home loans to be indexed to a basket of foreign currencies. However when the Iceland Krona collapsed, the borrower was stuck with a much higher payment (and debt) than expected. Apparently many borrowers in eastern European countries also borrowed using these "basket of foreign currency" indexes.

Reader Warlock mentions that these loans appeared cheaper than other loans, and were frequently used to buy expensive foreign autos - and the financing was also from abroad. Just another risk for some banks, especially if this ruling spreads to other countries.

WaPo on Foreclosures and Deficiencies

by Calculated Risk on 6/16/2010 01:44:00 PM

From Dina ElBoghdady at the WaPo: Lenders go after money lost in foreclosures

Here is an excerpt:

Carlos Cortez and his wife['s] ... second lender came after them for $70,000 when their short sale was completed on his Manassas Park townhouse in 2008.Tanta (my former co-blogger an a mortgage banker) sent me an email about this in 2007:

Cortez knew that was a possibility, but he went through with the sale because his real estate agent said the lender was engaging in scare tactics.

James Scruggs, an attorney at Legal Services of Northern Virginia, said the lender appears to have backed off after Cortez argued that that the loan officer falsely qualified him and his wife for a home-equity line by fabricating key details about their finances.

Back in my day working for a servicer ... the absolute all time last possible thing you could get me to do is send an attorney barging into court demanding a deficiency judgment if I had any reason whatsoever to fear that my own effing loan officer was implicated in fraud on the original loan application. Any borrower with half a brain will raise that as a defense, and any judge even slightly awake will not only deny the deficiency but probably make the lender pay all costs, or worse. And I'd call that justice.It is unclear how often lenders are pursuing borrowers for deficiencies - but it is clearly happening more often now. This is one reason why people involved in short sales or considering "walking away" should consult an attorney. I suspect this is part of the reason for the recent surge in personal bankruptcy filings.

Spain, Germany agree to release bank "stress test" results

by Calculated Risk on 6/16/2010 12:41:00 PM

From the Financial Times: Spain to reveal bank ‘stress tests’ results

“The Bank intends to make public the results of these stress tests, showing estimated loan losses, the consequent capital requirements and the contribution of promised balance sheet reinforcements, so that the markets have a perfect understanding of the circumstances of the Spanish banking system,” [Miguel Angel Fernández Ordóñez, governor of the Bank of Spain, said on Wednesday].And from the Financial Times: Berlin agrees to release stress test results

excerpt with permission

The German government has dropped its resistance to publishing the results of bank stress tests ... A spokeswoman for the finance ministry said on Wednesday that Berlin was currently “co-ordinating” with its EU partners about how the results of existing annual stress tests could best be presented ...Transparency is helpful - although this might show a number of banks require additional capital. In the U.S., the government provided capital from TARP until the banks could raise private capital.

Note that the EU and the UK conduct annual stress tests - this is just an issue of making the results public. I think the U.S. should conduct annual stress tests of all the largest financial institutions, and make the economic scenarios and results public every year.

Industrial Production, Capacity Utilization increase in May

by Calculated Risk on 6/16/2010 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

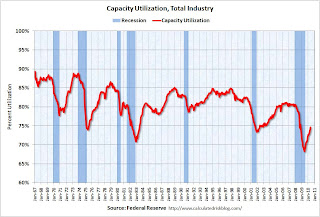

Industrial production advanced 1.2 percent in May after having risen 0.7 percent in April. Manufacturing output climbed 0.9 percent last month, its third consecutive monthly gain of about 1 percent, and was 7.9 percent above its year-earlier level. Outside of manufacturing, the output of mines edged down 0.2 percent, and the output of utilities increased 4.8 percent. The jump in utilities reflected unseasonably warm temperatures that boosted air conditioning usage in May after uncharacteristically temperate weather in April reduced heating demand. ... The capacity utilization rate for total industry rose 1.0 percentage point to 74.7 percent, a rate 6.2 percentage points above the rate from a year earlier but 5.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.4% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 73.7% is still far below normal - and 7.2% below the the pre-recession levels of 80.5% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.This is the highest level for industrial production since Nov 2008, but production is still 7.9% below the pre-recession levels at the end of 2007.

Still a long way to go.

Housing Starts plummet in May

by Calculated Risk on 6/16/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 593 thousand (SAAR) in May, down 10% from the revised April rate of 659,000 (revised down from 672 thousand), and up 24% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts collapsed 17.2% to 468,000 in May. This is 30% above the record low in January 2009 (360 thousand).  The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:Note that permits fell sharply, suggesting another significant decline in housing starts next month. This is way below expectations (I took the under!), and is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 593,000. This is 10.0 percent (±10.3%)* below the revised April estimate of 659,000, but is 7.8 percent (±9.7%)* above the May 2009 rate of 550,000.

Single-family housing starts in May were at a rate of 468,000; this is 17.2 percent (±7.9%) below the revised April figure of 565,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 574,000. This is 5.9 percent (±2.2%) below the revised April rate of 610,000, but is 4.4 percent (±2.6%) above the May 2009 estimate of 550,000.

Single-family authorizations in May were at a rate of 438,000; this is 9.9 percent (±2.1%) below the revised April figure of 486,000. Authorizations of units in buildings with five units or more were at a rate of 117,000 in May.

MBA: Mortgage Purchase Applications increase slightly, near 13 Year Low

by Calculated Risk on 6/16/2010 07:11:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 21.1 percent from the previous week. This is the highest Refinance Index recorded in the survey since May 2009. The seasonally adjusted Purchase Index increased 7.3 percent from one week earlier, which is the first increase in six weeks.

...

“Mortgage applications for home purchases increased last week, the first increase in over a month. Refinance applications also picked up significantly over the week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “While it is clear that purchase applications in May dropped sharply as a result of the tax credit induced increase in applications in April, it is unclear whether we are seeing the beginnings of a rebound now.”

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.82 percent from 4.81 percent, with points decreasing to 0.89 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has collapsed following the expiration of the tax credit suggesting home sales will fall sharply too. This is the lowest level for 4-week average of the purchase index since February 1997.

Tuesday, June 15, 2010

Falling Euro impacts New York Real Estate market

by Calculated Risk on 6/15/2010 11:59:00 PM

From the WSJ: Currency Fall Curbs Europe's Taste for New York Property

Although there are no hard figures, the article mentions ab estimate of 15% to 20% of Manhattan condo buyers are Europeans. Apparently demand from European buyers has declined sharply.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Foreign buying - especially from Europeans because of the strong euro - was one of the reasons NY house prices had only fallen 21.1% from the peak.

With the weaker euro, and a substantial number of condos coming on the market later this year, prices will probably fall further in New York.

Short Sale: Agent "takes advantage" of Bank of America?

by Calculated Risk on 6/15/2010 09:28:00 PM

Jim the Realtor thinks Bank of America was taken on this deal. This 4,374 sq ft house, on two acres, is in a great location in Rancho Santa Fe (upscale San Diego). The loan was $3.2 million, and the short sale was for $1.575 million.

This was another "5 second" listing. Some agents list short sales for less than a minute to show the bank the listing ... and then keep the entire process secret. I've heard stories of sales to relatives, friends, or the listing agent just wanting both sides of the deal. If this was listed on the open market, Jim thinks it would have sold for substantially more.

SoCal Home sales at 4 Year High

by Calculated Risk on 6/15/2010 05:55:00 PM

From DataQuick: Southland sales at 4-year high

Note: as always I ignore the median price and use the repeat sales indexes from Case-Shiller and CoreLogic.

Southern California home sales rose last month in all but the lowest price categories as buyers took advantage of tax credits and low mortgage rates. ... A total of 22,270 new and resale houses and condos closed escrow in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 9.7 percent from 20,299 in April, and up 7.2 percent from 20,775 in May 2009, according to MDA DataQuick of San Diego.And here is the dumb headline of the day: Southern California median home price surges 22.5% (ht JBR). So what? That just says the mix changed ... and that is because the distressed sales are moving on up to higher priced neighborhood.

May sales were the highest for that month since May 2006, but they still fell 15.0 percent short of the average number sold in May since 1988, when DataQuick’s statistics begin. The 9.7 percent increase in sales between April and May compares with an average change of 6 percent since 1988.

...

“The important thing to remember, though, is that what we saw in May was partly driven by government stimulus,” he continued. “In the second half of the year the market will have to stand on its own again, barring new forms of government involvement. Prices will be tested if there’s any sudden move by lenders to release a flood of distressed properties.”

Foreclosure resales accounted for 33.9 percent of the resale market last month, down from 36.4 percent in April and 49.8 percent a year earlier. The all-time high for foreclosure resales – homes that had been foreclosed on in the prior 12 months – was 56.7 percent in February 2009. Foreclosure resales have waned over the last year as lenders have channeled more distress into loan modifications and short sales.

...

Foreclosure activity remains high by historical standards but is lower than peak levels reached over the last two years.

What matter is this is probably the high point for sales this year. This report includes both new and existing home sales, and new home sales are counted when the contract is signed (peaked in April) and existing home sales are counted when the transaction closes (will peak in May or June).