by Calculated Risk on 6/08/2010 08:34:00 AM

Tuesday, June 08, 2010

Small Business Optimism improves slightly in May

From NFIB: Small Business Optimism Increases But Not Enough to Spur Hiring, Capital Spending

The National Federation of Independent Business Index of Small Business Optimism gained 1.6 points in May with a reading of 92.2. Although not a strong sign of recovery, it is headed in the right direction. It is the best reading since September 2008’s 92.9 index that occurred just before the five-point decline in October that started the rapid deterioration in the fourth quarter of 2008. In May, seven of the 10 index components rose, but job creation and capital expenditure plans barely gained and remained at recession levels.The outlook has improved, but the recovery is sluggish and hiring is "bleak".

“The performance of the economy is mediocre at best,” said William C. Dunkelberg, NFIB’s chief economist.

...

In May, firms still shed workers ... The small business sector is not contributing to private sector employment growth.

“"The recovery in optimism we are currently experiencing is very weak compared to recoveries after 1982 or 1975."Note: although the press release doesn't mention it, there is a heavy concentration of construction related businesses in the small business sector - and obviously that is one of the weakest sectors.

Monday, June 07, 2010

Bernanke: Economy "won't feel terrific"

by Calculated Risk on 6/07/2010 11:30:00 PM

From Sewell Chan at the NY Times: Bernanke Forecasts a Fitful Recovery

“My best guess is that we’ll have a continued recovery, but it won’t feel terrific,” Mr. Bernanke told the broadcast journalist Sam Donaldson in a question-and-answer session at the Woodrow Wilson International Center for Scholars.The Asian markets are up somewhat tonight.

...

“Even though technically we’ll be in recovery and the economy will be growing, unemployment will still be high for a while and that means that a lot of people will be under financial stress,” he said.

The CNBC Pre-Market Data shows the S&P 500 up about 5 points and the Dow futures are up about 40 points.

The Euro is up slightly at 1.196 dollars

Best to all.

Distressed Sales: Sacramento as an Example, May 2010

by Calculated Risk on 6/07/2010 06:42:00 PM

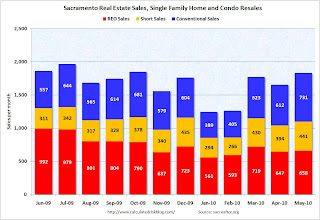

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the May data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009 - so we now have one year of data.

In May, 60.1% of all resales (single family homes and condos) were distressed sales. This is the lowest level over the last year.

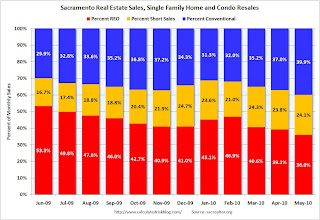

Note: This data is not seasonally adjusted. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter). Also there appears to be a higher percentage of conventional sales associated with the tax credit.

Also total sales in May were off 1.8% compared to May 2009; the 12th month in a row with declining YoY sales - even with the tax credit buying this year!

On financing, 57 percent were either all cash (23.3%) or FHA loans (33.6%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

Starting in June we can do some year-over-year comparisons. It appears short sales will be up substantially YoY and REOs down, and it will be interesting to see the level of total distressed sales once the tax credit buying is behind us (July).

Rail Traffic Softens in May

by Calculated Risk on 6/07/2010 03:49:00 PM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in May 2010 was up 15.8% compared to May 2009 - and traffic was still 11.8% lower than in May 2008.

This graph shows U.S. average weekly rail carloads. Traffic increased in 18 of 19 major commodity categories YoY.

From AAR:

• U.S. freight railroads originated 1,153,675 carloads in May 2010, an average of 288,419 carloads per week. That’s up 15.8% from May 2009 (which is the second highest percentage gain ever, behind April 2010 — see chart ...) but down 11.8% from May 2008.As the graph above shows, rail traffic collapsed in November 2008, and now eleven months into the recovery, traffic has only recovered about half way. This is more evidence of a sluggish recovery ... and the decline in May is concerning, although one month does not make a trend (and May was "a bit overstated" due to the timing of Memorial Day).

• U.S. railroads averaged 294,758 carloads per week in April 2010 and 288,793 in March 2010. Thus, May 2010’s average was actually down slightly from those months ... One month does not a trend make, but it would obviously be worrisome if the decline continued.

• As was the case in April 2010, the big year-over-year percentage gains in May 2010 U.S. rail traffic were partly a function of easy comparisons (May 2009 was a miserable month for rail traffic) and partly a function of real traffic growth.

• For the purposes of AAR rail traffic data, May 2010 consists of the four weeks ending May 29 — i.e., it does not include Memorial Day, which was May 31 this year. However, the May 2009 and May 2008 comparison months do include Memorial Day. The net result is that May 2010 data is a bit overstated relative to the two previous years, and June 2010 will be a bit understated relative to the two previous years. It is impossible to know exactly how much rail traffic is affected.

excerpts with permission

Consumer Credit increases slightly in April

by Calculated Risk on 6/07/2010 03:00:00 PM

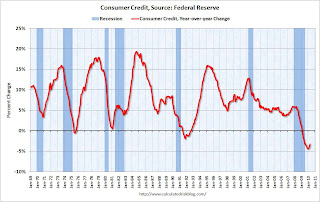

The Federal Reserve reports:

Consumer credit increased at an annual rate of 1/2 percent in April 2010. Revolving credit decreased at an annual rate of 12 percent, and nonrevolving credit increased at an annual rate of 7 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 3.2% over the last 12 months.

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Usually there is a fairly sharp increase in consumer credit during a robust recovery - but that isn't happening this time because household balance sheets are still a mess. Just another reminder that the recovery will be sluggish and choppy ...

Impact of Decennial Census on Unemployment Rate

by Calculated Risk on 6/07/2010 12:00:00 PM

Last week I posted the Impact of Census 2010 on Payroll Report

My estimate was that the 2010 Census would add 417,000 payroll jobs in May; the actual was 411,000 payroll jobs.

My preliminary estimate is the Census will subtract 200,000 payroll jobs in June - and most of the remaining temporary Census jobs (564,000 total in May) will be unwound by September.

I've been puzzling over how much (if any) these temporary jobs lowered the unemployment rate in May. I think these workers come from three groups:

1) already employed workers taking a part time job,

2) people not in the workforce picking up a little temporary income (like retirees or students who would otherwise not be in the workforce), and

3) the unemployed taking a part time job.

Sure enough there was an increase in people working multiple jobs in May. The number of multiple jobholders jumped by 210,000 in May (seasonally adjusted). There can be other reasons for this increase, but if we assume these are mostly Census workers, then about half the 411,000 additional Census workers already have other jobs - so for these workers, the temporary Census jobs has no impact on the unemployment rate.

The other half are probably otherwise unemployed workers, or people not in the workforce (although the participation rate declined in May). If we assume that this is mostly unemployed workers, these temporary hires lowered the unemployment rate by around 0.1% (from 9.8% to 9.7%).

Tim Duy: Lost Chance for Global Rebalancing

by Calculated Risk on 6/07/2010 08:35:00 AM

Professor Duy is not happy: A Good Crisis, Wasted

It is official. The rest of the world assumes the economy can pick up were we left off in 2006, with the US as the driver of global demand. And it is apparent there is little US policymakers can or will do to counter the trend. Once again, crisis - and along with it the opportunity to rebalance global growth - is wasted.Not only are we headed back to the pre-crisis imbalances, this suggests that unemployment in the U.S. will stay elevated for some time.

...

Don Geithner [is] tilting at windmills. His battles are futile. Financial markets know it, sensing that the global growth cannot be sustained on the back of the US alone. Of course, this was always the case; demand in the US alone was never sufficient to recreate the fabled "V" recovery of the 1980s. Market participants also know that US policymakers have their finger in the dam of a tidal wave of competitive devaluations. The Dollar, for all its warts, remains the big dog of reserve currencies, and Geithner fears the global pandemonium that would result from an actual US response to the currency manipulation of others. Thus the postponed report on currency manipulators becomes another case of "extend and pretend."

In the end, why continue to hold the Euro on what is increasingly the myth of global rebalancing? It is clear European policymakers want a weaker Euro, and US policymakers are powerless to prevent a stronger dollar. At least we are getting cheaper oil as a result.

When it all shakes out, the US will actually be asked to do more, not less.

...

Where does this all leave us? The rest of the world is intent on pursuing a begger thy neighbor strategy, with the US being the neighbor. I suspect US policymakers will eventually relent; it will be the only choice left. All we can do now is sit back and wait for the inevitable explosion in the US trade deficit, waiting idly by for the next crisis and the "chance" to bring some sanity to the global financial architecture.

Sunday, June 06, 2010

Sunday Night Futures

by Calculated Risk on 6/06/2010 10:55:00 PM

Note: Here is the weekly summary and a look ahead (with plenty of interesting graphs).

The Asian markets are red tonight with the Nikkei off 4%.

From CNBC: Pre-Market Data shows the S&P 500 off about 8 or less than 1%. Dow futures are off about 70 points.

The Euro is down against at 1.19 dollars

Best to all.

Hungary: Never mind

by Calculated Risk on 6/06/2010 06:20:00 PM

Here is the weekly summary and look ahead.

The furious backpedaling continues ...

From the WSJ: Hungary Seeks to Reassure Lenders and Investors

Hungary's new cabinet huddled in an emergency session over the weekend to devise an economic plan aimed at restoring confidence in the nation's creditworthiness, as the government backtracked on officials' earlier comments that the country could default on its debts.

From Reuters: Analysis: Hungary faces struggle to regain trust of markets

Hungary is likely to take months to regain the trust of financial markets after politicians in its new government made controversial comments ...The euro is down to 1.1956 dollars.

This makes me think of Gilda Radner: "Never mind".

Weekly Summary and a Look Ahead

by Calculated Risk on 6/06/2010 11:59:00 AM

The key economic report this week will be April retail sales to be released on Friday.

On Monday, the Fed will release Consumer Credit for April at 3 PM ET. Consumer credit has declined sharply since mid-2008, especially revolving debt (credit cards). Also this week, the May rail traffic report from the Association of American Railroads (AAR) and May LA port traffic will probably be released.

On Tuesday, the National Association of Independent Business (NFIB) will release the small business optimism survey for May. The NFIB pre-released the employment survey on Friday and the employment outlook was described as “bleak”. Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for April will be released at 10 AM by the BLS. This report has been showing very little turnover in the labor market and few job openings.

On Wednesday, the MBA will release the mortgage purchase applications index. This has been falling sharply suggesting a sharp decline in home sales after the expiration of the tax credit. Also on Wednesday, Wholesale Inventories and the Fed’s Beige Book will be released. Fed Chairman Ben Bernanke will testify at 10 AM before the house budget committee (the hearing is about the State of the Economy: View from the Federal Reserve), and the NY Fed’s Brian Sack will speak at noon at the New York Association of Business Economics.

On Thursday the April Trade Balance report will be released at 8:30 AM by the Census Bureau. The consensus is for a further increase in the U.S. trade deficit to around $41 billion (from $40.4 billion). Also on Thursday, the closely watched initial weekly unemployment claims will be released. Consensus is for a decline to 448K from 453K last week.

Also on Thursday, the Fed will release the Q1 Flow of Funds report, and the May Ceridian-UCLA Pulse of Commerce Index (based on diesel fuel consumption) will be released. Last month this was the one of the first indicators that showed the economy slowed in April.

On Friday May retail sales will be released at 8:30 AM. The consensus is for an increase of 0.3% from the April rate, and 0.1% increase ex-autos. Also the May Reuter's/University of Michigan's Consumer sentiment index will be released at 9:55 AM, and April Business inventories will be released at 10 AM.

And of course the FDIC will probably have another busy Friday afternoon ...

And a summary of last week:

From the BLS:

Total nonfarm payroll employment grew by 431,000 in May, reflecting the hiring of 411,000 temporary employees to work on Census 2010, the U.S. Bureau of Labor Statistics reported today. ... The unemployment rate edged down to 9.7 percent.

Click on graphs for a larger image.

Click on graphs for a larger image.This graph shows the job losses from the start of the employment recession, in percentage terms. This really shows how stunning the job losses were during the great recession.

The dotted line is the job losses ex-Census. Census 2010 hiring was 411,000 in May.

The recession that started in 2007 was by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

This graph shows the same data, but this time aligned at the bottom of the recession.

This graph shows the same data, but this time aligned at the bottom of the recession.Notice that the 1990 and 2001 recessions were followed by jobless recoveries - and the eventual job recovery was gradual. In earlier recessions the recovery was somewhat similar and a little faster than the decline (somewhat symmetrical).

This graph shows the Employment-Population ratio. The ratio decreased to 58.7% in May (from 58.8% in April). This had been increasing after plunging since the start of the recession.

This graph shows the Employment-Population ratio. The ratio decreased to 58.7% in May (from 58.8% in April). This had been increasing after plunging since the start of the recession.Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate decreased to 65.0% from 65.2% in April. This is the percentage of the working age population in the labor force. This decline is disappointing. The decline in participation was a key reason the unemployment rate declined.

This graph shows the long term unemployed. The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

This graph shows the long term unemployed. The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there were a record 6.72 million workers who had been unemployed for more than 26 weeks (and still want a job). This was a record 4.34% of the civilian workforce. (note: records started in 1948)

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.63 million SAAR in May. This is up 18.1% from May 2009 (when sales were very low), and up 3.9% from the April sales rate.

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.63 million SAAR in May. This is up 18.1% from May 2009 (when sales were very low), and up 3.9% from the April sales rate.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for May (red, light vehicle sales of 11.63 million SAAR from Autodata Corp).

The 136,142 consumer bankruptcies filed in May represented a 9 percent increase from May 2009 total.

The 136,142 consumer bankruptcies filed in May represented a 9 percent increase from May 2009 total. This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

The American Bankruptcy Institute (ABI) has increased their forecast to over 1.6 million filings this year .

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Private residential construction spending appears to have bottomed in early 2009, but has been mostly moving sideways since then. Residential spending is now 61% below the peak of early 2006.

Private non-residential construction spending is now 29% below the peak of late 2008.

Best wishes to all.