by Calculated Risk on 5/08/2010 05:17:00 PM

Saturday, May 08, 2010

El-Erian: Europe's Critical Weekend

While we wait for the details ...

PIMCO's Mohamed El-Erian writes in the Financial Times: El-Erian on a critical weekend for Europe and the economy

[W]e have to wait for tomorrow’s operational details. ... [But] we should not under-estimate the historical relevance of what is happening this weekend; and the stakes for Europe and the global economy are huge.Tomorrow will be interesting!

If this rescue attempt does not work, there will be a material acceleration in the process of change to Europe’s economic, financial, and institutional landscape; and the reality of the debt explosion in industrial economies will become even more of a destabilizing factor for the world economy.

Duration of Unemployment

by Calculated Risk on 5/08/2010 01:14:00 PM

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

This really shows the change in turnover - there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

What really makes the current period stand out is the number of people (and percent) that have been unemployed for 27 weeks or more. In the early '80s, the 27 weeks or more unemployed peaked at 2.9 million or 2.6% of the civilian labor force.

In April 2010, there were 6.72 million people unemployed for 27 weeks or more, or 4.34% of the labor force. This is significantly higher than during earlier periods.

It is worth repeating some of the comments Atlanta Fed President Dennis Lockhart made in March:

There are two key types of match inefficiency. One is geographic mismatch. In 2008, the percentage of individuals living in a county or state different than the previous year was the lowest recorded in more than 50 years of data. People may be reluctant to relocate for a new job if the value of their house has declined. In addition, many who would like to move are under water in their mortgage or can't sell their homes.Both of these mismatches are contributing to the long term unemployment problem - and the housing bubble was a direct cause of both. Usually people can move freely in the U.S. to pursue employment (geographic mobility), but now many people are tied to an anchor (their home). And many workers went into the construction trades and acquired skills that are not easily transferable.

The second inefficiency is skills mismatch. In simple terms, the skills people have don't match the jobs available. Coming out of this recession there may be a more or less permanent change in the composition of jobs.

The good news is the economy is now adding jobs. But the lack of mobility and the skills mismatch make the long term unemployment problem a difficult challenge.

EU to Create Stabilization Fund, Details on Sunday

by Calculated Risk on 5/08/2010 08:30:00 AM

From Bloomberg: EU to Set Up Fund to Prevent Spread of Greek Crisis

European leaders agreed to set up an emergency fund ... European officials declined to disclose the size of the stabilization fund, to be made up of money borrowed by the European Union’s central authorities with guarantees by national governments. Finance ministers will meet at 3 p.m. tomorrow in Brussels to flesh out the details. A press briefing is scheduled for 6 p.m.Promises, promises ...

...

“When the markets re-open Monday, we will have in place a mechanism to defend the euro,” French President Nicolas Sarkozy said. “If you don’t think that’s significant, you haven’t been to many EU summits.”

Friday, May 07, 2010

Unofficial Problem Bank List May 7, 2010

by Calculated Risk on 5/07/2010 11:09:00 PM

Note: This earlier post has summaries of three major stories today: Europe, market glitch, and employment report.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 7, 2010.

Changes and comments from surferdude808:

This week the Unofficial Problem Bank List stands at 727 institutions with assets of $366.5 billion compared with 722 institutions with assets of $349.8 billion last week.Still on track for 1,000 banks by the end of the year ...

There are six removals including four failures -- 1st Pacific Bank of California (Ticker: FPBN), The Bank of Bonifay, Towne Bank of Arizona (Ticker: TWNE), and Access Bank. The other two removals were the terminations of Supervisory Agreements by the OCC against Mountain West Bank, National Association, (Ticker: MTWF), and Pikes Peak National Bank. However, it is likely these terminations will reappear when the OCC releases its actions for April as many times the OCC will replace a Supervisory Agreement with a Consent Order.

There were 11 additions this week including Carolina First Bank, Greenville, SC ($11.9 billion Ticker: TSFG); Metro Bank, Lemoyne, PA ($2.1 billion Ticker: METR); North American Savings Bank, F.S.B., Grandview, MO ($1.5 billion Ticker: NASB); and Tower Bank & Trust Company, Fort Wayne, IN ($681 million Ticker: TOFC).

Bank Failures #67 & 68: Arizona and California

by Calculated Risk on 5/07/2010 08:09:00 PM

Stopping and starting Friday's

A long road ahead.

Like hollowed pumpkins

Scooped out, carved up, value-less

Fearful faces left.

by Soylent Green is People

From the FDIC: Commerce Bank of Arizona, Tucson, Arizona, Assumes All of the Deposits of Towne Bank of Arizona, Mesa, Arizona

Towne Bank of Arizona, Mesa, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: City National Bank, Los Angeles, California, Assumes All of the Deposits of 1st Pacific Bank of California, San Diego, California

As of March 31, 2010, Towne Bank of Arizona had approximately $120.2 million in total assets and $113.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $41.8 million. Towne Bank of Arizona is the 67th FDIC-insured institution to fail in the nation this year ...

1st Pacific Bank of California, San Diego, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....That makes four today.

As of March 31, 2010, 1st Pacific Bank of California had approximately $335.8 million in total assets and $291.2 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $87.7 million. .... 1st Pacific Bank of California is the 68th FDIC-insured institution to fail in the nation this year, and the fifth in California.

Three Major Stories

by Calculated Risk on 5/07/2010 07:56:00 PM

A break from our usual Friday afternoon custom ... there were three major stories today.

1) On Europe: there is a reasonable chance of a major announcement this weekend. Earlier today there were rumors of a €600 billion loan facility for European banks. One key analyst thinks the Fed might re-open the dollar swap lines for Europe - one, or both, or something else could be announced on Sunday.

Tonight, Bloomberg is reporting: EU to Craft Financial Backstop to Prevent Spread of Crisis

Leaders of the 16 countries sharing the currency said finance ministers will meet tomorrow to hash out the details of a “stabilization mechanism to preserve the financial stability in Europe.”Krugman has the best line: O Nao!

I really really hope the ECB staff are huddling right now ... Otherwise Anno Domini 2010 is shaping up to be Anno Domino instead.2) On the Stock Market: From the SEC: Statement of the Securities and Exchange Commission and the Commodity Futures Trading Commission

“We are continuing to review the unusual trading activity that took place briefly yesterday afternoon to pinpoint its cause and contributing factors.The causes of the weird price changes still haven't been determined.

...

“Our market oversight units are reviewing trading and market data from the exchanges, self regulatory organizations and market participants to examine yesterday's unusual trading activity. We are scrutinizing the extent to which disparate trading conventions and rules across various markets may have contributed to the spike in volatility.

“We are devoting significant resources and expertise to this effort.

“As we determine the cause and contributing factors, we will make our findings and any recommendations public. ...

3) Employment Report: Usually the big story of the day would be the 290K (224K ex-Census) increase in payroll employment. Here were my earlier posts:

Bank Failures #65 & 66: Florida and Minnesota

by Calculated Risk on 5/07/2010 06:37:00 PM

Injections of capital

Could not save this bank

One thousand point drop

Ten thousand banks may yet fail

Is it time for gold?

by Soylent Green is People

From the FDIC: First Federal Bank of Florida, Lake City, Florida, Assumes All of the Deposits of The Bank of Bonifay, Bonifay, Florida

Bank of Bonifay, Bonifay, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Prinsbank, Prinsburg, Minnesota, Assumes All of the Deposits of Access Bank, Champlin, Minnesota

As of March 31, 2010, The Bank of Bonifay had approximately $242.9 million in total assets and $230.2 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $78.7 million. ... The Bank of Bonifay is the 65th FDIC-insured institution to fail in the nation this year, and the tenth in Florida. The last FDIC-insured institution closed in the state was Riverside National Bank of Florida, Fort Pierce, on April 16, 2010.

Access Bank, Champlin, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of March 31, 2010, Access Bank had approximately $32.0 million in total assets and $32.0 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.5 million..... Access Bank is the 66th FDIC-insured institution to fail in the nation this year, and the fifth in Minnesota. The last FDIC-insured institution closed in the state was State Bank of Aurora, Aurora, on March 19, 2010.

NMHC Quarterly Survey: Apartment Market Conditions Tighten

by Calculated Risk on 5/07/2010 04:00:00 PM

From the National Multi Housing Council (NMHC): Apartment Industry Shows Widespread Improvement According to NMHC Quarterly Survey of Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose sharply from 38 to 81. This was the highest figure in nearly four years. Fully 64 percent of respondents said markets were tighter (meaning lower vacancies and/or higher rents). Only two percent reported looser markets. This is the sixth straight increase for this measure.

...

“We saw a sharp increase in the Market Tightness Index, which fits with the surprisingly strong (for a seasonally weak period) effective rent growth. ... Even so, a sustained recovery in the apartment market needs a firm economic and demographic foundation ... in the near-term the industry’s prospects still depend upon a stronger rebound in both the job market and household formation.” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year. Right now I expect BLS reported rents to continue to decline through most of 2010.

This data is a survey of large apartment owners. The data released last week from the Census Bureau showed a 10.6% rental vacancy rate for all rental units.

A final note: at some point the apartment market would start to tighten from the very high vacancy rates (record levels according to the Census Bureau and Reis).

The question asked was:

Q: [O]n balance, apartment market conditions in your markets today are:

Of those surveyed, 64% answered: "Tighter than three months ago" and 34% answered "About unchanged from three months ago". So it appears the bottom in vacancy rates was reached in Q4 2009.

The improvement in the labor market is probably leading to more household formation - and combined with a record low number of new apartment units being completed this year - the apartment market is now starting to tighten. It will take some time for the overall vacancy rate to fall to normal levels, but the excess housing units are now being absorbed. (See Housing Stock and Flow for an analysis of the absorption of excess housing units).

European Liquidity Issues

by Calculated Risk on 5/07/2010 01:29:00 PM

There is a rumor circulating that the ECB is prepared to announce a €600 billion loan facility for European banks over the next few days. One key analyst has suggested that the FOMC might re-open the dollar swap lines for Europe. Update: I don't usually post rumors during the day, but this is being widely circulated as a possibility.

Note that the Bank of Japan moved last night, from the Financial Times: Bank of Japan pumps funds into market

The Bank of Japan offered Y2,000bn ($21.6bn) in overnight liquidity on Friday to “increase markets’ sense of security” because of turmoil resulting from the debt crisis in Greece. ... the bank’s action reflects global demand for dollar liquidity as investors move out of the euro.And from the WSJ: European Banks Head Toward New Funding Crunch

excerpt with permission

Europe's sovereign debt crisis is making it harder for European banks to get their hands on dollars and may require their central banks to step in with short-term liquidity ...The Libor rate has increased, but it is still at a very low level. This could be something to watch.

Temporary Help and Diffusion Index

by Calculated Risk on 5/07/2010 12:51:00 PM

Here are a couple more graphs based on data in the employment report ...

Temporary Help

From the BLS report:

Temporary help services continued to add jobs (26,000); employment in this industry has increased by 330,000 since September 2009.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

This graph is a little complicated. The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees (hours worked increased slightly in April) and also hire temporary employees. Since the number of temporary workers increased sharply over the last seven months, some people think this might be signaling the beginning of a strong employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Note that the temporary hiring for the Census is excluded from this graph.

Diffusion Index

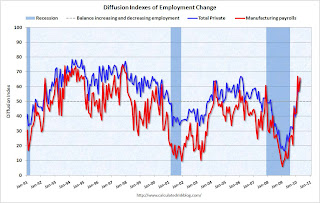

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.

The BLS diffusion index for total private employment increased to 64.3 from 57.8 in March. This is the highest level since 2006. For manufacturing, the diffusion index is at 65.9; the highest since 1998.Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This fits with the headline payroll report and is a positive.

Earlier employment posts today: