by Calculated Risk on 3/22/2010 02:06:00 PM

Monday, March 22, 2010

The Pressure on Malls: More Store Closings

Hang Nguyen at the O.C. Register has an interesting post from the Bank of America Merrill Lynch 2010 consumer conference:

Pat Connolly, executive vice president [Williams-Sonoma Inc., which also owns Pottery Barn]: "We are committed to restoring our retail channel profitability to historical levels ... We are working diligently to restructure our portfolio of stores and optimize our sales and costs per square foot. This will be accomplished by selective store closings and lease negotiations ... Over the next three fiscal years, 25 percent of our store leases will reach maturity ... E-commerce is 30 percent of our corporate revenue and it’s very profitable ... even in this environment. The Internet and e-commerce have become the focus on our capital investment."As the leases expire, Williams-Sonoma will be looking to cut the lease rates substantially, or close the stores. This is especially true in multi-store markets.

Sharon McCollam, chief operating officer and chief financial officer: "Every quarter last year, we increased the number of stores that we plan to close ... If we could get the deals (with landlords) done, we would not necessarily want to close stores if you could get to the profitability levels you were historically. ... However, we don’t believe that that is a strategy that can be executed. So there will be additional store closings ...

Other retailers probably have similar plans, and that means that malls will be facing rising vacancies and lower rents for some time.

For Q4 2009, real estate research firm Reis reported that the mall (and strip mall) vacancy rates were the highest since Reis began tracking the data. At the time, Reis economist Ryan Severino said:

"Our outlook for retail properties as a whole is bleak ... we do not foresee a recovery in the retail sector until late 2012 at the earliest."The comments from Williams-Sonoma executives fit with Severino's forecast.

Note: The Q1 mall vacancy rate be released in early April, and I expect more records.

Moody's: CRE Prices increase 1% in January 2010

by Calculated Risk on 3/22/2010 12:55:00 PM

From Bloomberg: U.S. Property Index Rises for Third Straight Month

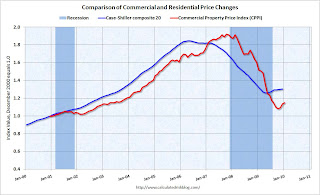

The Moody’s/REAL Commercial Property Price Index climbed 1 percent from December, Moody’s said today in a report. Values are 40 percent lower than the peak in October 2007. The index fell 24 percent from a year earlier.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

The number of transactions fell 8 percent to 376 in January from a year earlier and was lower than December, when buyers and sellers tried to complete deals before the year’s end, according to the report.

“A few months of price gains does not necessarily indicate a sustainable trend, particularly in these difficult times,” Moody’s said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.

DOT: Vehicle Miles Driven decline in January

by Calculated Risk on 3/22/2010 09:45:00 AM

Yesterday we discussed the impact of high oil prices on vehicle miles driven.

And today the Department of Transportation (DOT) reported that vehicle miles driven in January were down from January 2009:

Travel on all roads and streets changed by -1.6% (-3.7 billion vehicle miles) for January 2010 as compared with January 2009. Travel for the month is estimated to be 222.8 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent change from the same month of the previous year as reported by the DOT.

As the DOT noted, miles driven in January 2010 were down -1.6% compared to January 2009, and miles driven have declined 2.9% compared to January 2008, and are down 4.7% compared to January 2007. This is a multi-year decline, and miles driven appear to be falling again.

Chicago Fed: Economic Activity index decreased in February

by Calculated Risk on 3/22/2010 08:30:00 AM

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity slowed in February

Led by declines in production-related indicators, the Chicago Fed National Activity Index decreased to –0.64 in February, down from –0.04 in January. Three of the four broad categories of indicators that make up the index deteriorated, and only the sales, orders, and inventories category made a positive contribution.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.39 in February from –0.13 in January, but for the second consecutive month, it was higher than at any point since December 2007. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend.

...

Most of the weakness in the index continued to stem from the consumption and housing category. ... Employment-related indicators also made a negative contribution to the index, contributing –0.16 to the index in February compared with –0.02 in January.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A CFNAI-MA3 value below –0.70 following a period of economic expansion indicates an increasing likelihood that a recession has begun. A CFNAI-MA3 value above –0.70 following a period of economic contraction indicates an increasing likelihood that a recession has ended. A CFNAI-MA3 value above +0.20 following a period of economic contraction indicates a significant likelihood that a recession has ended.According to Chicago Fed, it is still too early to call the official recession over - but with the three month average CFNAI-MA3 above -0.70, the likelihood that a recession has ended is increasing.

Sunday, March 21, 2010

Report: China Losing Support of American Business Community

by Calculated Risk on 3/21/2010 09:21:00 PM

From the Financial Times: China to lose ally against US trade hawks

Myron Brilliant, senior vice-president for international affairs, who has previously helped to protect Beijing from hawkish trade policies, told the Financial Times: “I don’t think the Chinese government can count on the American business community to be able to push back and block action [on Capitol Hill].”Mr Brilliant has long supported China, including lobbying for China to join the WTO.

...

Mr Brilliant said corporate America’s attitude had changed in response to a range of “industrial policies” pursued by Beijing, including the undervaluation of the renminbi, which made it harder for US companies to do business and compete with China.

excerpted with permission

And China keeps pushing back - from the WaPo: China's commerce minister: U.S. has the most to lose in a trade war

China's commerce minister warned the United States on Sunday that if it launches a "trade war" against China by levying punitive tariffs on Chinese imports, the United States will suffer the most.This is heating up prior to April 15th release of the Treasury report on worldwide currencies that might name China a "currency manipulator".

...

"You're not going to get 1.3 billion Chinese to change by insulting them," [Commerce Minister Chen Deming] said. "Could it be related to upcoming elections? I don't know. Because economically, it makes no sense."

...

"[Obama] wants exports to double in five years, but I don't know whom he is going to sell them to."

Oil Prices and Vehicle Miles

by Calculated Risk on 3/21/2010 05:03:00 PM

Something for a Sunday - in the weekly look ahead post I forgot to mention that the Department of Transportation (DOT) will release the vehicle miles driven report for January this week.

In early 2008 there was sharp drop in U.S. vehicle miles driven and that was one of the key signs of demand destruction for oil that led me to predict oil prices would decline sharply in the 2nd half of 2008.

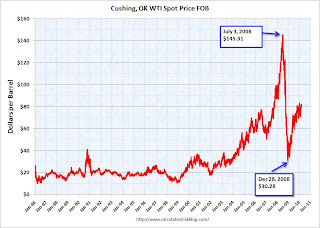

First a look at oil prices ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the daily Cushing, OK WTI Spot Price FOB from the Energy Information Administration (EIA).

With oil prices hoovering around $80 per barrel, I've started looking for possible signs of demand destruction again (see: Oil Prices Push Above $81 per Barrel). Of course there are other factors - like China - but vehicle miles is something to watch in the U.S. The second graph shows monthly oil prices and vehicle miles (month over the same month of the previous year with a 3 month centered average).

The second graph shows monthly oil prices and vehicle miles (month over the same month of the previous year with a 3 month centered average).

Although vehicle miles driven are noisy month to month, it appear that miles driven responds to spikes in oil prices.

For December 2009 - the last month of data - the DOT reported that miles driven were unchanged compared to December 2008 after increasing in 5 of the 6 pervious months. This slow down in miles driven could be because of the sluggish recovery, or it could be because oil prices are starting to impact miles driven.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/21/2010 12:30:00 PM

There will be two key housing reports released this week (existing home sales on Tuesday and new home sales on Wednesday) and plenty of Fed speeches ...

On Monday, the Chicago Fed will release the February Chicago Fed National Activity Index at 8:30 AM ET. Activity in February was probably sluggish. Also on Monday, Treasury Secretary Tim Geithner will speak at the American Enterprise Institute (4:30 PM ET), and Atlanta Fed President Dennis Lockhart will speak in the evening in Florida.

Probably early this week, the Moody's/REAL Commercial Property Price Indices (CPPI) for January will be released. This is a repeat sales price index for Commercial Real Estate (CRE).

On Tuesday, Existing Home sales for February will be released by the National Association of Realtors (NAR) at 10 AM ET. Expectations are for a slight decrease in sales to a 5 million Seasonally Adjusted Annual Rate (SAAR). I’ll take the under. The Census Bureau will also release the Mass Layoffs report for February on Tuesday.

Also on Tuesday the FHFA House Price Index for January will be released (this has been ignored recently), the Richmond Fed Survey (March) at 10 AM ET, and San Francisco Fed President Janet Yellen will speak at 3:35 PM ET. It is widely reported that Yellen will be nominated to be the next Fed Vice Chairman.

On Wednesday the American Institute of Architects’ February Architecture Billings Index will be released - a leading indicator for Commercial Real Estate (CRE). This has been showing significant weakness for some time.

Also on Wednesday, the New Home sales report from the Census Bureau will be released at 10 AM ET. The consensus is for some increase from the record low set in January (309 thousand SAAR), but the number will still be very low. Sales have averaged 370 thousand (SAAR) over the last 12 months, and February will be well below that level.

Also on Wednesday, the weekly MBA mortgage purchase applications index will be released (7 AM ET) and the Durable Goods report for February at 10 AM ET.

There will be more Fed speak on Wednesday: the FOMC’s lone dissenter, Kansas Fed President Thomas Hoenig, speaks at 10:45 AM ET, and outgoing Fed Vice Chairman Donald Kohn speaks at 8 PM ET.

On Thursday, the closely watched initial weekly unemployment claims will be released. Also the Census Bureau will released the Regional and State Employment and Unemployment for February at 10 AM ET.

Cleveland Fed President Sandra Pianalto speaks at 9 AM ET, and Fed Chairman Ben Bernanke testifies before the House Financial Services Committee at 10 AM ET.

On Friday the 3rd estimate of Q4 GDP released (any change will be minor), and the Reuter's/University of Michigan's Consumer sentiment index for March will be released at 9:55 AM ET (consensus is for a slight increase to 73 from 72.5).

Also on Friday the FDIC will probably close several more banks. I think this is the week for Puerto Rico!

And a summary of last week ...

Click on graph for larger image in new window.

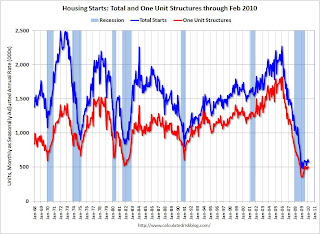

Click on graph for larger image in new window.Total housing starts were at 575 thousand (SAAR) in February, down 5.9% from the revised January rate, and up 20% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for nine months.

Single-family starts were at 499 thousand (SAAR) in February, down 0.6% from the revised January rate, and 40% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for nine months.

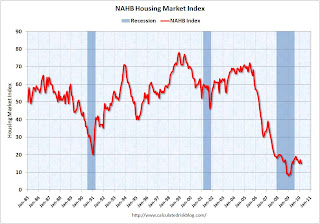

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 15 in March. This is a decrease from 17 in February.

The record low was 8 set in January 2009. This is very low - and this is what I've expected - a long period of builder depression.

From the Fed: "Industrial production edged up 0.1 percent in February following a gain of 0.9 percent in January. ... Capacity utilization for total industry moved up 0.2 percentage point to 72.7 percent, a rate 7.9 percentage points below its average from 1972 to 2009."

From the Fed: "Industrial production edged up 0.1 percent in February following a gain of 0.9 percent in January. ... Capacity utilization for total industry moved up 0.2 percentage point to 72.7 percent, a rate 7.9 percentage points below its average from 1972 to 2009."This graph shows Capacity Utilization. This series is up 6.5% from the record low set in June (the series starts in 1967).

Capacity utilization at 72.7% is still far below normal - and far below the the pre-recession levels of 80.5% in November 2007.

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: "On a month-over-month basis, the national average home price index decline accelerated, falling by 1.9 percent in January 2010 compared to 0.8 percent in December 2009, indicating the housing market still remains weak."

From LoanPerformance: "On a month-over-month basis, the national average home price index decline accelerated, falling by 1.9 percent in January 2010 compared to 0.8 percent in December 2009, indicating the housing market still remains weak."This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 0.7% over the last year, and off 29% from the peak.

The index has declined for five consecutive months.

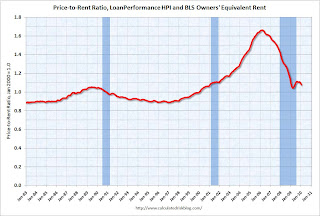

Here is an update on the price-to-rent ratio using the First Amercican CoreLogic house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

This graph shows the price to rent ratio (January 2000 = 1.0). This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined slightly again in February. The price index has declined 6 of the last 8 months, although most of the declines have been very small. With rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Best wishes to all.

I.M.F. Warns Wealthy Nations about Debt

by Calculated Risk on 3/21/2010 09:27:00 AM

From Sewell Chan and Keith Bradsher at the NY Times: I.M.F. Warns Wealthiest Nations About Their Debt

The global economic crisis has left “deep scars” in the fiscal balances of the world’s advanced economies, which should begin to rein in spending next year as the recovery continues, the No.2 official at the International Monetary Fund said Sunday.The U.S. deficit can be separated into 1) a cyclical deficit that will start to decline automatically when the economy begins to recover, and 2) a structural deficit that will be very difficult to resolve. But we need a recovery first, and then we can discuss deficit reduction.

...

For the United States, “a higher public savings rate will be required to ensure long-term fiscal sustainability,” Mr. Lipsky said.

...

“Addressing this fiscal challenge is a key near-term priority, as concerns about fiscal sustainability could undermine confidence in the economic recovery,” Mr. Lipsky said. ... While it makes sense for the world’s largest economies to continue stimulus spending through the end of this year, “fiscal consolidation should begin in 2011, if the recovery occurs at the projected pace,” Mr. Lipsky said.

Mr. Lipsky also discussed the need for rebalancing the world economy, although he didn't criticize China's currency manipulation (he was speaking in China).

Phoenix Housing Market: The Rise of the Investor

by Calculated Risk on 3/21/2010 01:09:00 AM

This is an article describing the changing dynamics in the Phoenix housing market ...

From Craig Anderson at the Arizona Republic: Real-estate investors, who once fueled a run-up in home values, now helping stabilize market (ht JG)

For decades to come, participants in the Valley's housing economy are sure to remember 2009 as the Year of the Investor. ... Investors and bank foreclosures helped boost Maricopa County home sales up to 78,899 in 2009, up from 58,454 the previous year, according to The Arizona Republic's analysis of 2009 Valley home-values data from the Information Market, based in Phoenix.These investors are very different from the "investors" (really speculators) in the 2003 - 2006 period. The current investors are paying all cash - and planning on renting the homes until prices increase. Of course this is supply that will come back on the market eventually ...

... [Alan] Langston, executive director of the Arizona Real Estate Investors Association, based in Tempe, said a number of recent developments have slowed the rate of lender foreclosure in recent months ...

One factor is the rise in short sales, which have replaced about 25 percent of the foreclosures banks were initiating a year ago, he said. ...

Another recent change is the decision by some lenders to use "drop bids" to sell more properties in default to third-party investors before they become bank-owned, he said.

Before the first half of 2009, it was rare for private parties to buy homes at a trustee's deed sale, a cash-only auction for pre-foreclosed properties that takes place daily at the Maricopa County courthouse.

Drop bids changed all that, Langston said. They are a last-minute decision by the lender to slash a property's auction price. Langston said drop bidding has helped lenders avoid taking possession of even more homes while providing new opportunities for buyers.

Saturday, March 20, 2010

Federal Home Loan Bank sues Wall Street Banks for Billions

by Calculated Risk on 3/20/2010 09:33:00 PM

This was lawsuit was filed on March 15th. Here are some details from the bank and see Morgenson's story in the NY Times for more ...

From the Federal Home Loan Bank of San Francisco: Statement Regarding PLRMBS Litigation

Today the Federal Home Loan Bank of San Francisco (Bank) filed complaints in the Superior Court of California, County of San Francisco, against nine securities dealers in relation to certain of the Bank’s investments in private-label residential mortgage-backed securities (PLRMBS). The Bank is seeking to rescind its purchases of 134 securities in 113 securitization trusts, for which the Bank originally paid more than $19.1 billion. The Bank’s complaints allege that the dealers made untrue or misleading statements about the characteristics of the mortgage loans underlying the securities.From Grechen Morgenson at the NY Times: Pools That Need Some Sun

All of the PLRMBS in the Bank’s mortgage portfolio, including those identified in the complaints filed today, were rated AAA when purchased, based on the information provided by the securities dealers.

The suit, filed March 15 in state court in California, seeks the return of the $5.4 billion as well as broader financial damages.All the private mortgage insurers are working hard to rescind as many insurance policies as possible based on fraud and misrepresentation . As are Fannie and Freddie.

...

The defendants in the Federal Home Loan Bank case were among the biggest sellers of mortgage-backed securities back in the day; among those named are Deutsche Bank; Bear Stearns; Countrywide Securities, a division of Countrywide Financial; Credit Suisse Securities; and Merrill Lynch. The securities at the heart of the lawsuit were sold from mid-2004 into 2008 ...

In the complaint, the Federal Home Loan Bank recites a list of what it calls untrue or misleading statements .... The alleged inaccuracies involve disclosures of the mortgages’ loan-to-value ratios ... as well as the occupancy status of the properties securing the loans. ...

Finally, the complaint said, the sellers of the securities made inaccurate claims about how closely the loan originators adhered to their underwriting guidelines.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.It makes sense that the Federal Home Loan Banks get more aggressive too.