by Calculated Risk on 3/19/2010 08:28:00 AM

Friday, March 19, 2010

Rents Expected to decline through 2011 in Seattle

From Vanessa Ho at Seattlepi.com: Renters, rejoice: Apartments are cheap and the iPod is free (ht Patrick)

"We've done holiday specials -- a one-night stay in a downtown hotel - or an iPod nano," said [Craig Dwyer, vice-president of Seattle-based Pinnacle Family of Companies] residential division. "We've done a microwave. We even did a 32-inch flat panel TV."I'm starting to hear stories about vacancy rates stabilizing in some markets, although rents are probably still falling in most areas. This will keep pressure on CPI and house prices.

After peaking in 2006 and 2007, rents in King, Snohomish and Pierce counties tanked over the course of last year by nearly 4 percent, according to [Mike Scott, whose firm, Dupre + Scott, researches the Puget Sound apartment market]. He expects rents will continue to plummet this year by 5 percent, and again in 2011, but less dramatically.

In Seattle, property managers say that trend has been more pronounced, with some rents dropping as much as 15 to 20 percent last year. ... Bart Flora, co-owner of Cornell & Associates, which manages 6,500 properties in the city, said some, in-city, one-bedroom apartment now rent for $800 to $850, instead of roughly $1,000 two years ago.

"It's the steepest drop I've ever encountered in 25 years, certainly in my career," said Flora. He added that he believed the market - at least in Seattle - appears to have hit bottom and is stabilizing.

Thursday, March 18, 2010

WSJ: Supply of Foreclosed Homes Increases

by Calculated Risk on 3/18/2010 10:32:00 PM

From James Hagerty at the WSJ writes about a Barclays Capital report: Supply of Foreclosed Homes on the Rise Again

Hagerty notes that the analysts at Barclays Capital estimate that various lenders held 645,800 REO (Real Estate Owned) in January, up 4.6% from 617,286 in December.

Also Barclays estimated the peak supply was in November 2008 at 845,000, and then declined through 2009. Barclays is projecting the supply will increase to 733,000 in April 2010, and then gradually decline.

The current supply is similar to the analysis from Tom Lawler that I posted yesterday. These number from Barclays are a little higher (Lawler noted he wasn't including everything, but the pattern is the same).

As an aside, here is a video from Steven Russolillo at Dow Jones (posted at the WSJ): Financial Blogs Grow Up

Thanks!

C.A.R. Outlines Possible Criminal Penalties for Undisclosed 2nd Lien Payments

by Calculated Risk on 3/18/2010 07:59:00 PM

In a recent email to agents on March 16th, the California Association of Realtors (C.A.R.) points out that making undisclosed 2nd lien payments in a short sale transaction could be a crime and punishable by up to 30 years in prison.

The email points out that undisclosed payments might violate HUD's RESPA (Real Estate Settlement Procedures Act) and laws against loan fraud.

In addition any agent participating in the scheme might be subject to disciplinary action and could have their license revoked.

Apparently the requests by 2nd lien holders are common. The C.A.R. reported: "Short sale agents have increasingly reported to C.A.R. about requests for agents and their clients to pay junior lienholders and others, often times outside of escrow."

Although the email doesn't address possible criminal activity of 2nd lienholders, it would appear the junior lienholders are soliciting a crime if they ask for a payments and suggest that the payment not be disclosed on the settlement documents. Properly disclosed payments to junior lienholders are perfectly fine and legal.

I doubt law enforcement will pursue individual homeowners, so probably the best way to end this practice is to report the requests for payments outside of escrow by 2nd lien holders (name of person and company holding the junior lien) to either HUD or the FBI.

This possible fraud was first reported by Eric Wolff at the North County Times: Wrinkle raises questions in home short sales, and by Diana Olick at CNBC: Big Banks Accused of Short Sale Fraud

Perhaps this version of short sale fraud is finally getting the attention it deserves ...

Countdown: Fed MBS Purchase Program 99.2% Complete

by Calculated Risk on 3/18/2010 05:34:00 PM

Almost finished ...

For a discussion on how trades settle, and the coming associated expansion of the Fed's balance sheet over the next few months, please see my post last week.

From the Atlanta Fed weekly Financial Highlights released today (as of last week): Click on graph for larger image in new window.

Click on graph for larger image in new window.

Graph Source: Altanta Fed.

This graph shows the cumulative MBS purchases by week. From the Atlanta Fed:

The NY Fed purchased an additional net $10 billion in MBS for the week ending March 17th. This puts the total purchases at $1.240 trillion or 99.2% complete. Just $10 billion and two more weeks to go - and I don't expect any fireworks ...The Fed purchased a net total of $10 billion of agency-backed MBS through the week of March 10. This purchase brings its total purchases up to $1.23 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 98% complete).

Note: The Fed's balance sheet released today shows "only" $1.066 trillion in MBS on March 17th. As mentioned above, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles.

DataQuick: California Bay Area Sales decline Slightly

by Calculated Risk on 3/18/2010 03:28:00 PM

Note: since the mix is changing, the median price is not useful. The repeat sales indexes - like FirstAmerican CoreLogic and Case-Shiller - have problems too, but they probably are better for actual price changes.

From DataQuick: Bay Area home sales down slightly from last year, median sale price rises

Bay Area home sales were subpar again in February, dipping below the year-ago level for the second straight month as some potential buyers worried about job security, some couldn’t get financing and others found a thin inventory of homes for sale. ...This is definitely a market "off kilter". Almost 27% of the buyers used FHA insured loans, and another 27% paid cash (mostly investors). This is a long way from normal ...

Last month’s sales fell 22.2 percent short of the February average of 6,413 sales since 1988, when DataQuick’s statistics begin.

February’s sales were the second-lowest for that month since 1995, behind the record-low 3,989 homes sold in February 2008. January and February this year are the only two months since August 2008 in which sales have fallen year-over-year.

“The sales and price data remain choppy, with more ups and downs and inconsistencies than we’d typically see. It’s partly the season – January and February are often atypical and don’t serve as good barometers. But it’s more than that. The market remains fundamentally off kilter. There’s still relatively little lending going on in the upper price ranges, and little adjustable-rate financing, which had been vital to the Bay Area. Investor and cash-only deals remain well above normal, as does the level of sales involving distressed property,” said John Walsh, MDA DataQuick president.

“Despite the widening stability seen in the housing market in recent months, the outlook remains murky,” he said. “Whether prices will firm, or remain firm, will depend largely on three factors: The market’s response as the government reduces its housing stimulus, the economy’s ability to gain traction, and the decisions that lenders and borrowers will make in countless distress cases. The key question is how much more distressed inventory is coming, and when.”

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – rose to 36.6 percent of all homes resold last month, marking the fourth consecutive month in which foreclosure resales edged higher. Foreclosure resales peaked at 52 percent of resales in February 2009, then gradually fell and, in the fall, leveled off near 32 percent before starting to rise modestly.

... Federally-insured, low-down-payment FHA loans, a popular choice among first-time buyers, made up 26.9 percent of Bay Area purchase loans last month. That was up from 23.3 percent a year ago and 1.4 percent two years ago.

Last month absentee buyers – mostly investors – purchased 19.4 percent of all Bay Area homes sold, the same as in January and up from 18.4 percent a year ago. The monthly absentee buyer average over the past decade is 13.0 percent. Buyers who appeared to have paid all cash – meaning there was no corresponding purchase loan found in the public record – accounted for a record 27.1 percent of sales in February, up from 25.7 percent in January and 24.4 percent a year ago.

Hotel Occupancy increases compared to same week in 2009

by Calculated Risk on 3/18/2010 12:51:00 PM

From HotelNewsNow.com: STR: New Orleans tops weekly numbers

Overall the industry’s occupancy ended the week with a 4.6-percent increase to 57.7 percent, ADR dropped 1.9 percent to US$97.80, and RevPAR was up 2.6 percent to US$56.44.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

It appears that occupancy rates have bottomed and even started to increase, but the level is still well below normal - the average occupancy rate for this week is close to 62%, well above the current 57.7%. This low occupancy rate is still pushing down room rates (on a YoY basis) although revenue per available room (RevPAR) increased.

As mentioned last week, the other good news for the industry (although bad news for construction employment) is that the pipeline of new hotel projects has slowed sharply, see: STR: US pipeline for February 2010

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

First American CoreLogic: House Prices Decline 1.9% in January

by Calculated Risk on 3/18/2010 10:46:00 AM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: January Home Price Index Shows Narrowing Annual Decline

National home prices, including distressed sales, declined by 0.7 percent in January 2010 compared to January 2009, according to First American CoreLogic and its LoanPerformance Home Price Index (HPI). This was a significant improvement over December’s year-over-year price decline of 3.4 percent. Excluding distressed sales, year-over-year prices declined in January by 0.4 percent; while in December the non-distressed HPI fell by 3.3 percent year-over-year. Compared to a year ago, the month-to-month rate of decline is lessening – in January 2009, the HPI showed the largest one month decline in its more than 30-year history. On a month-over-month basis, the national average home price index decline accelerated, falling by 1.9 percent in January 2010 compared to 0.8 percent in December 2009, indicating the housing market still remains weak.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 0.7% over the last year, and off 29% from the peak.

The index has declined for five consecutive months.

Banks failing to pay TARP dividends increases to 82

by Calculated Risk on 3/18/2010 09:24:00 AM

From Binyamin Appelbaum and David Cho at the WaPo: Small banks lag in repaying Treasury for bailout funds

[H]undreds of community banks have yet to return their bailouts. More than 10 percent of the 700 banks that got federal bailouts and are still holding the money even failed to pay the government a quarterly dividend in February. The list of 82 delinquent banks is significantly longer than the 55 banks that failed to make payments in November, according to an analysis by Linus Wilson, a finance professor at the University of Louisiana at Lafayette.Here is the report from the Treasury.

Wilson calculated that the missed payments totaled $78.1 million in February and that banks now have missed a total of $205 million in dividend payments to the government.

Many of the community banks still holding aid from the Troubled Assets Relief Program are struggling with losses on real estate development loans.

And in excel format under Dividend and Interest Reports.

There are three permanent deadbeats on the list: CIT Group (filed bankruptcy and wiped out its $2.3 billion in TARP debt), UCBH Holdings Inc. was seized by the FDIC (TARP lost $298.7 million), and Pacific Coast National Bank was also seized by the FDIC (TARP lost $4.1 million).

Weekly Initial Unemployment Claims Decline Slightly

by Calculated Risk on 3/18/2010 08:26:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 13, the advance figure for seasonally adjusted initial claims was 457,000, a decrease of 5,000 from the previous week's unrevised figure of 462,000. The 4-week moving average was 471,250, a decrease of 4,250 from the previous week's unrevised average of 475,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 6 was 4,579,000, an increase of 12,000 from the preceding week's revised level of 4,567,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,250 to 471,250.

The dashed line on the graph is the current 4-week average. The current level of 457,000 (and 4-week average of 471,250) is still very high, and suggests continuing job losses through the middle of March. Note: There is no way to compare directly between weekly claims, and net payrolls jobs.

Wednesday, March 17, 2010

Previous Business Cycle: "Bad by any measure"

by Calculated Risk on 3/17/2010 11:59:00 PM

We've seen all the statistics from the aughts - declining employment, declining stock prices, and weak income.

Andrew Flowers, economic research analyst at the Atlanta Fed, points out that decades are arbitrary, and that the previous decade started with a recession and ended with the great recession. He suggests looking at periods as trough-to-trough: Bad by any measure

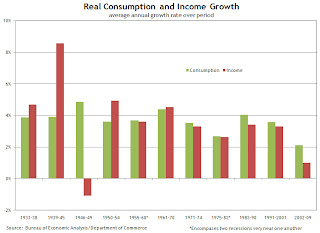

Flowers provides graphs of GDP, personal income and consumption, and payrolls for each trough-to-trough period. As an example, on income and consumption: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Flowers writes:

[F]or real consumption and income growth, the 2002–09 period is also bleak. Average annual consumption and income growth had averaged 3.81 percent and 3.79 percent, respectively, going into 2002. But during this recent trough-to-trough period, income growth was very weak at 1 percent, with only the 1946–49 period doing worse (–1.09 percent). But consumption growth in 2002–09 was the lowest on record, averaging only 2.12 percent growth annually.The 1946-49 period isn't surprising since there was a flood of workers from the military (keeping income down), but people had significant savings from WWII when income far outpaced consumption. Of course, in the recent period, consumption was higher than income primarily because of mortgage equity extraction (The Home ATM).

Another interesting observation is the spread between average annual consumption and income growth. The 1946–49 and 2002–09 periods are where it's the largest, at 5.9 percent and 1.1 percent, respectively. These large imbalances could possibly reflect growth in household debt and/or lower saving rates, as consumption growth far outstrips income growth. Indeed, debt grew and savings declined notably during 2002–09.

The previous business cycle was "bad by any measure".