by Calculated Risk on 2/26/2010 10:00:00 AM

Friday, February 26, 2010

Existing Home Sales Decline Sharply in January

The NAR reports: Existing-Home Sales Down in January

Existing-home sales – including single-family, townhomes, condominiums and co-ops – dropped 7.2 percent to a seasonally adjusted annual rate1 of 5.05 million units in January from a revised 5.44 million in December, but remain 11.5 percent above the 4.53 million-unit level in January 2009.

Total housing inventory at the end of January fell 0.5 percent to 3.27 million existing homes available for sale, which represents a 7.8-month supply at the current sales pace, up from a 7.2-month supply in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Jan 2010 (5.05 million SAAR) were 7.2% lower than last month, and were 11.5% higher than Jan 2009 (4.53 million SAAR).

This is a sharp drop from November when many of the transactions were due to first-time homebuyers rushing to beat the initial expiration of the tax credit (that has been extended). That pushed sales far above the historical normal level; based on normal turnover, existing home sales would be in the 4.5 to 5.0 million SAAR range.

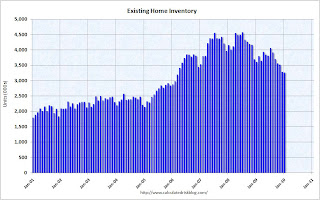

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.27 million in January from 3.29 million in December. The all time record high was 4.57 million homes for sale in July 2008.

The second graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.27 million in January from 3.29 million in December. The all time record high was 4.57 million homes for sale in July 2008. This is not seasonally adjusted and this decline is mostly seasonal - inventory should increase in the Spring.

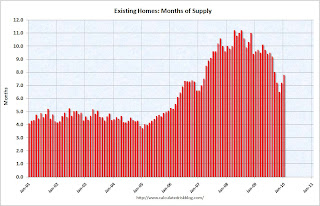

The third graph shows the 'months of supply' metric.

The third graph shows the 'months of supply' metric.Months of supply increased to 7.8 months in January.

A normal market has under 6 months of supply, so this is high - and probably excludes some substantial shadow inventory.

I'll have more later ...

Q4 GDP Revised to 5.9%

by Calculated Risk on 2/26/2010 08:30:00 AM

The headline GDP number was revised up to 5.9% annualized growth in Q4 (from 5.7%), however most of the improvement in the revision came from changes in private inventories. Excluding inventory changes, GDP would have been revised down to around 1.9% from 2.2%.

This table shows the changes from the "advance estimate" to the "second estimate" for several key categories:

| Advance | Second Estimate | |

|---|---|---|

| GDP | 5.7% | 5.9% |

| PCE | 2.0% | 1.7% |

| Residential Investment | 5.7% | 5.0% |

| Structures | -15.4% | -13.9% |

| Equipment & Software | 13.3% | 18.2% |

Changes in private inventories are transitory (only lasts a few quarters at the start of a recovery), and although the headline number was revised up, final demand was weaker than in the advance estimate.

FDIC to Test Principal Reduction

by Calculated Risk on 2/26/2010 12:47:00 AM

From Renae Merle at the WaPo: FDIC to test principal reduction for underwater borrowers

The Federal Deposit Insurance Corp. is developing a program to test whether cutting the mortgage balances of distressed borrowers who owe significantly more than their homes are worth is an effective method for saving homeowners from foreclosure.This is a pretty limited program. If principal reduction was offered on a widespread basis, millions of homeowners would probably immediately default.

...

Under the FDIC program, borrowers would be eligible for a reduction in their mortgage balances if they kept up their payments on the mortgage over a long period. ... "We're thinking about it in terms of earned principal forgiveness. If you stay current on your mortgage, you would earn a principal reduction. It would only be for loans significantly underwater," said FDIC Chairman Sheila C. Bair.

The program would ... apply only to loans acquired from a failed bank seized by the FDIC. That would be less than 1 percent of mortgages currently outstanding.

...

Lenders have been reluctant to cut the principal balance owed by distressed borrowers, arguing that it would encourage homeowners to become delinquent even if they can afford their mortgage.

Also - the FDIC's previous modification efforts - after the seizure of IndyMac - were mostly unsuccessful. It is unlikely this one will do much better.

Thursday, February 25, 2010

The Year of the Short Sale and more Foreclosure Delays

by Calculated Risk on 2/25/2010 09:30:00 PM

Two informative articles ...

Diana Golobay at HousingWire reports on the Mortgage Bankers Association (MBA) National Mortgage Servicing Conference 2010 in San Diego: Mortgage Servicers Kick Around HAMP Mod Options

... a session called “Loss Mitigation – When HAMP is Not an Option” proved to be extremely popular.There is much more in Diana's article.

...

The shift away from the government plan marks a shift in the strategy of servicers as 2009 “was all about HAMP” in terms of allocating time and resources, according to Alanna Brown, director of government programs and new initiatives at Fannie Mae National Servicing Organization.

...

Rich Rollins, CEO of Infusion Technologies, said servicers are seeing increasing potential in short sales and leaseback options.

He agreed with a general mentality at the conference that 2010 — and even 2011 — looks to be the “year of the short sale,” which he said gives investors “immediate positive cash flow” as a non-retention strategy.

“HAFA gave [the short sale] credibility,” he told HousingWire.

Note: HAMP stands for the Treasury program: ""Home Affordable Modification Program", HAFA is part of HAMP and stands for "Home Affordable Foreclosure Alternatives" and is for short sales and deed-in-lieu (DIL) transactions.

And apparently the administration is considering more changes to HAMP, from Dawn Kopecki at Bloomberg: Obama May Prohibit Home-Loan Foreclosures Without HAMP Review

The Obama administration may expand efforts to ease the housing crisis by banning all foreclosures on home loans unless they have been screened and rejected by the government’s Home Affordable Modification Program.The only obvious solutions for when current modification efforts fail are: 1) private principal reduction (but not paid for by taxpayers since that would be very unpopular), 2) converting homeowners to renters for some period, and 3) short sales / DIL.

The proposal, reviewed by lenders last week on a White House conference call, “prohibits referral to foreclosure until borrower is evaluated and found ineligible for HAMP or reasonable contact efforts have failed,” according to a Treasury Department document outlining the plan.

Delaying tactics just drag out the problem ...

More on Mortgage Rates and Fed MBS Purchases

by Calculated Risk on 2/25/2010 07:48:00 PM

Earlier I discussed the possible impact of the end of the Fed's MBS (Mortgage Backed Securities) purchases on mortgage rates: Fed MBS Purchases and the Impact on Mortgage Rates. My estimate is that the spread between the Freddie Mac 30 year fixed mortgage rate and the Ten Year Treasury yield will increase by about 35 to 50 bps after March.

Analysts at Amherst Securities wrote today that they "don’t think there will be much of a widening", perhaps less than 25 bps, because some usual investors are under weighted in MBS. They also noted that "the widening may not happen for a number of months" as under weight investors add to their positions.

I also checked the recent residential MBS issuance and compared it to the same month Fed buying. The GSEs issued about $131 billion in residential MBS in December. And according to the NY Fed, net Fed agency MBS purchases were just over $62 billion in December. So the Fed bought about half of the new issuance; private buyers bought the other half.

Just two points to remember: there are private bidders (it is just a matter of price), and the increase to the normal spread might take a few months.

Reports on Possible Imminent Bank Failures

by Calculated Risk on 2/25/2010 04:26:00 PM

A couple of the largest banks on the Unofficial Problem Bank List - in terms of assets - are in Puerto Rico. We haven't seen any bank failures in Puerto Rico yet this cycle, but according to the following report that is about to change ...

From José Carmona and John Marino at caribbeanbusinesspr.com: Feds expected to take action against island banks next month

Federal regulators are likely to begin taking action against troubled island banks sometime next month, government and industry sources told CARIBBEAN BUSINESS.As of Q3 2009, Westernbank had $13.4 billion in assets, R-G Premier Bank had $6.4 billion and Eurobank had $2.8 billion in assets.

Since the beginning of the year, the Federal Deposit Insurance Corp. (FDIC) has been beefing up its local ranks, recruiting accountants and auditors, leading to speculation about imminent action during this year’s first quarter.

...

There are three local banks operating under FDIC cease & desist orders—R-G Premier Bank, Eurobank and Westernbank.

...

According to reliable industry sources, one of the three local institutions under cease & desist orders will most likely fall into receivership status under the FDIC due to its inability to raise capital, while the other two will probably survive through consolidation.

And from David Johnson at Contrarian Pundit: Tamalpais Bank Update

The bad news has continued for Tamalpais Bank since I broke the story last December that the institution had lent the equivalent of almost all its capital to the highly leveraged, publicly excoriated, and increasingly broke Lembi Group in the middle of the 2008 real estate crash. In January, the Federal Reserve took enforcement action against the parent company, following up on the bank’s cease and desist order from the FDIC last September. And on February 16, the bank announced total losses of $26.2 million for the last quarter and $37.6 million for 2009.And in an update, David points out the bank has just received a "Prompt Corrective Action" giving the bank a March 21st deadline. Tamalpais had about $700 million in assets as of Q3.

As grim as the news has been, the bank may be in even worse shape than acknowledged in media reports.

... the bank is currently in violation of the terms of the FDIC’s cease and desist order.

Fed MBS Purchases and the Impact on Mortgage Rates

by Calculated Risk on 2/25/2010 02:07:00 PM

First, the following graph is from the Atlanta Fed Financial Highlights, and shows the weekly Fed MBS purchases since January 2009: Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

Freddie Mac report that mortgage rates increased last week. From Freddie Mac: Long-Term Rates Rise to Over 5 Percent for the First Time in Three WeeksThe Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 17. This purchase brings its total purchases up to $1.199 trillion, and by the end of the first quarter of 2010 the Fed will have purchased $1.25 trillion (thus, it is 96% complete).

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.05 percent with an average 0.7 point for the week ending February 25, 2010, up from last week when it averaged 4.93 percent. Last year at this time, the 30-year FRM averaged 5.07 percent.

...

“Interest rates for 30-year fixed mortgages followed long-term bond yields higher and rose above 5 percent this week amid a mixed set of economic data reports” said Frank Nothaft, Freddie Mac vice president and chief economist.

And that brings us to this graph from Political Calculations based on some of my posts: Predicting Mortgage Rates and Treasury Yields

And that brings us to this graph from Political Calculations based on some of my posts: Predicting Mortgage Rates and Treasury YieldsUsing their calculator and a Ten Year Yield of 3.75%, we would expect the 30 year Freddie Mac fixed mortgage rate to be around 5.62%. Current mortgage rates are lower than expected - as they have been since early in 2009 - and some of the difference from the expected rate is probably due to the Fed's MBS purchases (also prepayment speed is a factor - and also just randomness).

The final graph shows the expected mortgage rates (UPDATE: based on formula in previous graph) with Ten Year Treasury yields on the x-axis, and actual mortgage rates from Freddie Mac (weekly) since the beginning of 2009 on the y-axis.

The final graph shows the expected mortgage rates (UPDATE: based on formula in previous graph) with Ten Year Treasury yields on the x-axis, and actual mortgage rates from Freddie Mac (weekly) since the beginning of 2009 on the y-axis.Note: Y-axis doesn't start at zero to better show the change.

There are many factors in determining the spread between the Ten Year Treasury yield and the 30 year mortgage rates (like the supply of new MBS) - but this graph suggests to me that mortgage rates will rise 35 to 50 bps relative to the Ten Year when the Fed stops buying agency MBS at the end of March.

Hotel Occupancy Up Slightly Compared to Same Week 2009

by Calculated Risk on 2/25/2010 11:49:00 AM

From HotelNewsNow.com: Seattle tops US hotel weekly results

Overall, the industry’s occupancy ended the week with a 2.4-percent increase to 55.4 percent, ADR dropped 4.4 percent to US$95.81, and RevPAR fell 2.2 percent to US$53.04.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).This is a multi-year slump, and the YoY change suggests that occupancy rate may have bottomed, but at a very low level.

As Smith Travel noted, room rates are still falling (off 4.4%) because of the low occupancy rate. Business travel will be very important for the next few months, and right now it appears the weekday occupancy rate (mostly business travel) is at about the same levels as last year during the worst of the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Pianalto: "May take years to get back to 2007 level of output"

by Calculated Risk on 2/25/2010 09:15:00 AM

From Cleveland Fed President Sandra Pianalto: When the Small Stuff Is Anything But Small. A few excerpts:

You know we have been through one of the most severe and longest recessions in our nation’s history. The recovery from the recession may also end up being one of the longest in our history. In fact, it may take years just to get back to the level of output we enjoyed in 2007, just before the economic crisis began.Some of these

Some of you may think I am being too pessimistic. After all, we saw a strong GDP growth estimate for the fourth quarter of last year--nearly 6 percent at an annual rate. But I think that figure overstates the underlying strength of our economy right now.

This is a case where paying attention to the small stuff--the details beneath that impressive number--reveals a more complicated story of what is shaping up to be a gradual recovery. Most of the thrust behind that impressive fourth-quarter GDP growth figure owes to a rebuilding of inventory stocks, which had been cut to the bone and could no longer support even a mild economic recovery. Over the course of this year, I expect overall growth in employment and output to be on the weak side for the early stages of an economic recovery.

For many American households and businesses, this is a recovery that just does not feel much like a recovery. Let me point to two reasons why this is so. The first is due to the large amount of excess capacity that has accumulated. As spending declined in the recession, firms of all sizes cut back, drastically in many cases.

...

Excess capacity is a dilemma for businesses of all sizes. They can maintain capacity for only so long without an uptick in sales, and they’re confronting a market where demand is only gradually recovering after having fallen off a cliff. In fact, according to the most recent survey of the National Federation of Independent Business, or NFIB (January 2010), members cited poor sales as their single most important problem. The latest American Express Open Pulse Survey also expresses a similar perspective. A very slow recovery in demand, which translates into low sales for most firms, makes it far tougher to maintain idle capacity over time. ...

One of the forces holding back demand is the continuing high level of unemployment. Indeed, poor labor market conditions pose another large challenge to the recovery. ...

The duration of unemployment is also a big concern. According to the Bureau of Labor Statistics, the share of workers who have been without jobs for 27 weeks or longer now stands at 41 percent--the highest number since this series began in 1948.

Clearly, massive layoffs contributed to these large unemployment numbers, and fortunately, layoffs slowed months ago. Our current problem is a lack of job openings. In fact, the job-finding rate now stands at a historic low. Businesses are not creating new jobs very quickly, and where labor utilization is picking up, employers are simply restoring hours that had been previously cut.

...

So, to sum up, while we are likely now in a period of recovery, it doesn't really feel much like one. All types of businesses are continuing to see weak levels of demand – in other words, they don't expect to see a bounce-back in sales for quite a while yet. This in turn creates excess capacity, which leaves businesses having to decide whether to maintain or shut idle plants and offices. In such an environment, firms are being cautious about new hiring and so unemployment persists at a high level, which in turn restrains spending. From any perspective this is not a pretty picture, but it is especially challenging for small business ...

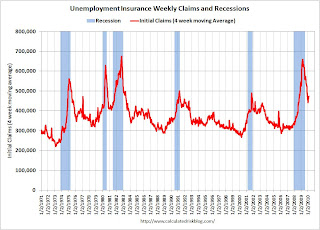

Weekly Initial Unemployment Claims Increase to 496,000

by Calculated Risk on 2/25/2010 08:42:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 20, the advance figure for seasonally adjusted initial claims was 496,000, an increase of 22,000 from the previous week's revised figure of 474,000. The 4-week moving average was 473,750, an increase of 6,000 from the previous week's revised average of 467,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 13 was 4,617,000, an increase of 6,000 from the preceding week's revised level of 4,611,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 6,000 to 473,750.

The current level of 496,000 (and 4-week average of 473,750) are very high and suggest continuing job losses in February. This is the highest level since last November.