by Calculated Risk on 2/25/2010 11:49:00 AM

Thursday, February 25, 2010

Hotel Occupancy Up Slightly Compared to Same Week 2009

From HotelNewsNow.com: Seattle tops US hotel weekly results

Overall, the industry’s occupancy ended the week with a 2.4-percent increase to 55.4 percent, ADR dropped 4.4 percent to US$95.81, and RevPAR fell 2.2 percent to US$53.04.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).This is a multi-year slump, and the YoY change suggests that occupancy rate may have bottomed, but at a very low level.

As Smith Travel noted, room rates are still falling (off 4.4%) because of the low occupancy rate. Business travel will be very important for the next few months, and right now it appears the weekday occupancy rate (mostly business travel) is at about the same levels as last year during the worst of the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Pianalto: "May take years to get back to 2007 level of output"

by Calculated Risk on 2/25/2010 09:15:00 AM

From Cleveland Fed President Sandra Pianalto: When the Small Stuff Is Anything But Small. A few excerpts:

You know we have been through one of the most severe and longest recessions in our nation’s history. The recovery from the recession may also end up being one of the longest in our history. In fact, it may take years just to get back to the level of output we enjoyed in 2007, just before the economic crisis began.Some of these

Some of you may think I am being too pessimistic. After all, we saw a strong GDP growth estimate for the fourth quarter of last year--nearly 6 percent at an annual rate. But I think that figure overstates the underlying strength of our economy right now.

This is a case where paying attention to the small stuff--the details beneath that impressive number--reveals a more complicated story of what is shaping up to be a gradual recovery. Most of the thrust behind that impressive fourth-quarter GDP growth figure owes to a rebuilding of inventory stocks, which had been cut to the bone and could no longer support even a mild economic recovery. Over the course of this year, I expect overall growth in employment and output to be on the weak side for the early stages of an economic recovery.

For many American households and businesses, this is a recovery that just does not feel much like a recovery. Let me point to two reasons why this is so. The first is due to the large amount of excess capacity that has accumulated. As spending declined in the recession, firms of all sizes cut back, drastically in many cases.

...

Excess capacity is a dilemma for businesses of all sizes. They can maintain capacity for only so long without an uptick in sales, and they’re confronting a market where demand is only gradually recovering after having fallen off a cliff. In fact, according to the most recent survey of the National Federation of Independent Business, or NFIB (January 2010), members cited poor sales as their single most important problem. The latest American Express Open Pulse Survey also expresses a similar perspective. A very slow recovery in demand, which translates into low sales for most firms, makes it far tougher to maintain idle capacity over time. ...

One of the forces holding back demand is the continuing high level of unemployment. Indeed, poor labor market conditions pose another large challenge to the recovery. ...

The duration of unemployment is also a big concern. According to the Bureau of Labor Statistics, the share of workers who have been without jobs for 27 weeks or longer now stands at 41 percent--the highest number since this series began in 1948.

Clearly, massive layoffs contributed to these large unemployment numbers, and fortunately, layoffs slowed months ago. Our current problem is a lack of job openings. In fact, the job-finding rate now stands at a historic low. Businesses are not creating new jobs very quickly, and where labor utilization is picking up, employers are simply restoring hours that had been previously cut.

...

So, to sum up, while we are likely now in a period of recovery, it doesn't really feel much like one. All types of businesses are continuing to see weak levels of demand – in other words, they don't expect to see a bounce-back in sales for quite a while yet. This in turn creates excess capacity, which leaves businesses having to decide whether to maintain or shut idle plants and offices. In such an environment, firms are being cautious about new hiring and so unemployment persists at a high level, which in turn restrains spending. From any perspective this is not a pretty picture, but it is especially challenging for small business ...

Weekly Initial Unemployment Claims Increase to 496,000

by Calculated Risk on 2/25/2010 08:42:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 20, the advance figure for seasonally adjusted initial claims was 496,000, an increase of 22,000 from the previous week's revised figure of 474,000. The 4-week moving average was 473,750, an increase of 6,000 from the previous week's revised average of 467,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 13 was 4,617,000, an increase of 6,000 from the preceding week's revised level of 4,611,000.

Click on graph for larger image in new window.

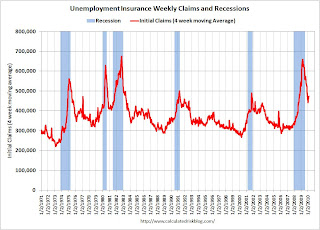

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 6,000 to 473,750.

The current level of 496,000 (and 4-week average of 473,750) are very high and suggest continuing job losses in February. This is the highest level since last November.

Wednesday, February 24, 2010

ATA Truck Tonnage Index increases in January

by Calculated Risk on 2/24/2010 11:59:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 3.1 Percent in January Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 3.1 percent in January, following a revised 1.3 percent increase in December 2009. The latest gain boosted the SA index from 107 (2000=100) in December to 110.4 in January, its highest level since September 2008.Trucking is a coincident indicator - and some of this increase is related to the inventory cycle - but this suggests growth in January.

...

For all of 2009, the tonnage index was down 8.7 percent (slightly larger than the previously reported 8.3 percent drop), which was the largest annual decrease since a 12.3 percent plunge in 1982.

...

ATA Chief Economist Bob Costello said that the latest tonnage reading, coupled with anecdotal reports from carriers, indicates that both the industry and the economy are clearly in a recovery mode. “While I don’t expect tonnage to continue growing as robustly as it did in January, the industry is finally moving in the right direction. Although there are still risks that could throw the rebound off track, the likelihood of that happening continues to diminish.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Weather and the February Employment Report

by Calculated Risk on 2/24/2010 07:49:00 PM

Note: I've added a list of "Posts Today" and "Posts Yesterday" on the right sidebar so everyone can find posts on recent economic releases (this has been a busy day and week)!

On Monday I linked to an article by Floyd Norris at the NY Times: Horrid Job Number Coming. Norris wrote:

"a lot of people who had jobs may report they did not work during the week, and companies may say they had fewer people on the payroll than they would have cited a week earlier or later. If so, we may get a truly horrid job number."Since then I've spoken to a BLS representative, and although they will not comment on upcoming releases, he told me the BLS would prominently disclose any possible impact of the recent snow storms on the employment report - similar to the disclosure after Hurricane Katrina. It is possible that the response rates will be lower than usual in certain areas (like Washington D.C.) - this will be disclosed and adjustments will be made.

Other contacts - with knowledge of how the BLS conducts the surveys - have told me the snow storms will have little or no impact on the employment report (other on data collection as will be disclosed by the BLS).

Heck, maybe the snow storm boosted employment because of all the people hired temporarily to shovel snow!

97,000 Homeowners in "Loan Mod Limbo"

by Calculated Risk on 2/24/2010 05:03:00 PM

Paul Kiel at ProPublica reports: Chase and Other Servicers Leave Many in Loan Mod Limbo; Treasury Threatens Penalties

About 97,000 homeowners in the government’s mortgage modification program have been stuck in a trial period for over six months. Most of them, about 60,000, have their mortgages with a single mortgage servicer, JPMorgan Chase.Paul Kiel has much more.

Trial periods are designed to last only three months, after which mortgage servicers are supposed to either give homeowners a permanent modification or drop them from the program. According to a ProPublica analysis, about 475,000 homeowners have been in a trial modification for longer than three months.

A couple of key points on HAMP I've mentioned before:

The January guidance from Treasury addressed both of the above points.

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests that there will be fewer trial modifications per month in the future (this is already happening, see graph below) and a surge of trial cancellations in February.

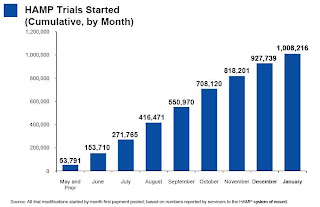

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Housing: The Best Leading Indicator for the Economy

by Calculated Risk on 2/24/2010 02:24:00 PM

Historically the best leading indicator for the economy (and employment) has been housing. I've been writing about this for years. For a great summary paper, see Professor Leamer's presentation from the 2007 Jackson Hole Symposium: Housing and the Business Cycle

For housing as a leading indicator, I use Residential Investment (quarterly from the BEA's GDP report), and monthly data on Housing Starts and New Home sales from the Census Bureau, and builder confidence from the NAHB.

Two key points:

So here is a review of the three monthly leading indicators:

Housing Starts

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Total starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

Housing starts are moving sideways ...

Builder Confidence

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May 2009.

More moving sideways ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

New Home Sales

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the 348 thousand rate in December.

And it would be generous to even call this "moving sideways".

So these leading indicators suggest any growth will be sluggish and choppy.

Now some people might argue that housing starts and new home sales are about to increase sharply. Based on what? That seems unlikely with the large number of excess housing units (new and existing homes and rental units). See: Housing Stock and Flow

As I noted above, it might be different this time with exports and technology leading the way, but I'll stick with housing as a business cycle indicator.

Freddie Mac: "Potential Large Wave of Foreclosures"

by Calculated Risk on 2/24/2010 11:55:00 AM

"We start 2010 with some early signs of stabilization in the housing market, with house prices and home sales likely nearing the bottom sometime in 2010. We expect that low mortgage rates, relatively high affordability and the homebuyer tax credit will help continue to fuel the recovery. Still, the housing recovery remains fragile, with significant downside risk posed by high unemployment and a potential large wave of foreclosures."The quote is from the Freddie Mac Q4 earnings release:

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Freddie Mac Releases Fourth Quarter and Full-Year 2009 Financial Results Fourth quarter 2009 net loss was $6.5 billion. After the dividend payment of $1.3 billion to the U.S. Department of the Treasury (Treasury) on the senior preferred stock, net loss attributable to common stockholders was $7.8 billion ... for the fourth quarter of 2009.Another $7.8 billion in losses ...

...

Full-year 2009 net loss was $21.6 billion. After dividend payments of $4.1 billion during the year to Treasury on the senior preferred stock, net loss attributable to common stockholders was $25.7 billion ... for the full-year 2009.

New Home Sales fall to Record Low in January

by Calculated Risk on 2/24/2010 10:15:00 AM

Note: See previous post for video and discussion of Bernanke's testimony.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the revised rate of 348 thousand in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2010. In January 2010, 21 thousand new homes were sold (NSA).

This is below the previous record low of 24 thousand in January 2009. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

Sales of new single-family houses in January 2010 were at a seasonally adjusted annual rate of 309,000 ... This is 11.2 percent (±14.0%)* below the revised December rate of 348,000 and is 6.1 percent (±15.1%)* below the January 2009 estimate of 329,000.And another long term graph - this one for New Home Months of Supply.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.The seasonally adjusted estimate of new houses for sale at the end of January was 234,000. This represents a supply of 9.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, but sales have set a new record low. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another extremely weak report.

Bernanke Humphrey-Hawkins Testimony at 10 AM ET

by Calculated Risk on 2/24/2010 09:50:00 AM

Federal Reserve Chairman Ben Bernanke is scheduled to provide the Semiannual Monetary Policy Report to the Congress before the House Committee on Financial Services at 10 AM ET.

I'll add a link to the prepared testimony, and I'll be posting the New Home sales numbers shortly after 10 AM. Commenters: Hopefully we can discuss Bernanke's testimony (especially the Q&A) on this thread, and New Home sales on the following thread).

Here is the CNBC feed.

Here is the C-Span Link

Prepared Testimony: Semiannual Monetary Policy Report to the Congress