by Calculated Risk on 2/18/2010 04:58:00 PM

Thursday, February 18, 2010

Fed Raises Discount Rate to 0.75% from 0.50%

Note: Just to be clear, this is the discount rate (this is the rate the Fed charges banks that borrow reserves) and not the Fed Funds rate. This move was being discussed for some time although the timing is a surprise.

From the Fed:

The Federal Reserve Board on Thursday announced that in light of continued improvement in financial market conditions it had unanimously approved several modifications to the terms of its discount window lending programs.

Like the closure of a number of extraordinary credit programs earlier this month, these changes are intended as a further normalization of the Federal Reserve's lending facilities. The modifications are not expected to lead to tighter financial conditions for households and businesses and do not signal any change in the outlook for the economy or for monetary policy, which remains about as it was at the January meeting of the Federal Open Market Committee (FOMC). At that meeting, the Committee left its target range for the federal funds rate at 0 to 1/4 percent and said it anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The changes to the discount window facilities include Board approval of requests by the boards of directors of the 12 Federal Reserve Banks to increase the primary credit rate (generally referred to as the discount rate) from 1/2 percent to 3/4 percent. This action is effective on February 19.

...

The increase in the discount rate announced Thursday widens the spread between the primary credit rate and the top of the FOMC's 0 to 1/4 percent target range for the federal funds rate to 1/2 percentage point. The increase in the spread and reduction in maximum maturity will encourage depository institutions to rely on private funding markets for short-term credit and to use the Federal Reserve's primary credit facility only as a backup source of funds. The Federal Reserve will assess over time whether further increases in the spread are appropriate in view of experience with the 1/2 percentage point spread.

Short Sales Increasing

by Calculated Risk on 2/18/2010 03:59:00 PM

From Alejandro Lazo at the LA Times: Short sales grow as a cheaper alternative to foreclosure

In a short sale the lender lets a homeowner unload a house for less than what is owed on the mortgage. The transaction recognizes that the home isn't worth what the owner paid for it after more than two years of falling real estate values.There is much more in the article. As Lazo notes, many servicers haven't had adequate staff to handle all the short sale requests. And another reason lenders have been hesitant to approve short sales is because of potential fraud.

Such deals are appealing to struggling homeowners because they escape weighty house debts -- but they don't get away unscathed. Their credit scores will be damaged, perhaps less severely than in foreclosure, but still badly enough to limit for years their ability to borrow money. There may be tax consequences. And any money invested through down payments and renovations will be lost.

Lenders, which can withhold approval of a short sale if they don't like the price, have resisted such sales because they are difficult to execute, particularly when multiple creditors and other parties are involved. And short sales lock in losses that might be reduced if the sale is delayed until the market improves.

But that resistance is softening. With more Americans losing jobs and missing mortgage payments, banks and investors increasingly are agreeing to short sales as a less costly alternative to foreclosure.

Short sales approved by Fannie Mae and Freddie Mac, which own 57% of U.S. mortgages, nearly quadrupled in the first nine months of 2009 compared with the same period in 2008. At the nation's largest mortgage servicers, short sales soared 165% to 74,513 in the first nine months of 2009 from the year-earlier period.

Short sales are still few compared with foreclosures, but policymakers are looking at such sales to shrink the number of bank-owned homes on the market.

The Treasury's HAFA program will probably increase short sale activity significantly.

Under HAFA, the lender settles on an approved price in advance. From the directive a lender must provide "Either a list price approved by the servicer or the acceptable sale proceeds, expressed as a net amount after subtracting allowable costs that the servicer will accept from the transaction." This will help speed up the transaction and minimize short sale fraud.

Also under HAFA, the servicer must "allow a portion of gross sale proceeds to be paid to subordinate lien holders in exchange for release and full satisfaction of their liens." That helps with the 2nd lien problem and is great for the homeowner because there will be no deficiency judgment (also, upon closing, the first mortgage holder has to agree to release the borrower "from all liability for repayment of the first mortgage debt"). This is much better than "walking away"!

HAFA starts on or before April 5, 2010. This is an excellent program, but like HAMP, is limited to homeowners with an unpaid principal balance less than or equal to $729,750.

Hotel RevPAR Off 6.9%

by Calculated Risk on 2/18/2010 01:53:00 PM

From HotelNewsNow.com: DC leads ADR, RevPAR decreases in weekly numbers

Overall, the U.S. hotel industry’s occupancy ended the week with a 2.3-percent decrease to 53.7 percent, ADR dropped 4.7 percent to US$97.12, and RevPAR fell 6.9 percent to US$52.19.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate. It is possible the occupancy rate is near the bottom, but at a very low level.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

Based on the normal seasonal pattern, the occupancy rate should have increased sharply last week since business travel usually increases in February. Smith Travel reports that the occupancy rate increased to 53.7% from 48.4% the previous week, but that the increase was less than normal. Occupancy was off 2.3% compared to the same week last year.

Perhaps weather was a factor last week, but business travel appears slightly softer this year than in the same period of 2009.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

First American CoreLogic: House Prices Decline in December

by Calculated Risk on 2/18/2010 11:43:00 AM

The Fed's favorite house price indicator from First American CoreLogic’s LoanPerformance ...

From LoanPerformance: Home Prices Exhibit “Improving Declines”

On a month-over-month basis the national average of home prices declined moderately, falling by 1.0 percent in December 2009 compared to November 2009, indicating seasonal slowing in a fledging housing recovery.

...

Including distressed transactions, the peak-to-current change in the national HPI (from April 2006 to December 2009) is -28.2 percent. Excluding distressed properties, the peak-to-current change in the HPI is -21.5 percent.

...

"The housing market, after experiencing stabilization in many, but not all, markets in the spring and summer of 2009 is going through the typical seasonal winter malaise," said Mark Fleming, chief economist for First American CoreLogic. "The big unknown for the 2010 spring selling season continues to be the future of the federal home buyer tax credit."

...

First American CoreLogic’s forecast continues to project declining house prices into the spring months. The national HPI is projected to fall an average of 4.4 percent through April 2010, as high levels of unemployment, housing inventories and foreclosures continue to exert downward pressure on prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the national LoanPerformance data since 1976. January 2000 = 100.

The index is off 3.7% over the last year, and off 28.2% from the peak.

The index has declined for four consecutive months.

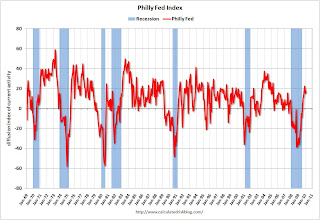

Philly Fed Index Shows Expansion in February

by Calculated Risk on 2/18/2010 10:00:00 AM

Two of the key numbers to watch are new orders and inventories. The new orders index increased sharply indicating more demand. However the inventory index turned positive, and rose to the highest level since September 2007, suggesting the positive contributions to inventory changes might be ending.

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 15.2 in January to 17.6 this month. The index has now remained positive for six consecutive months (see Chart). There was a notable increase in the current new orders index suggesting an improvement in demand for manufactured goods — the new orders index increased 20 points. The current shipments index increased 9 points. The current inventory index increased 5 points, to its first positive reading since September 2007.

Firms’ responses continued to suggest that labor market conditions have been stabilizing in recent months. For the third consecutive month, more firms reported an increase in employment than reported declines. The current employment index edged 1 point higher and remains at its highest reading since October 2007. The workweek index was 2 points lower but remained slightly positive for the fourth consecutive month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for six months now, after being negative or zero for 21 straight months.

Weekly Initial Unemployment Claims Increase to 473,000

by Calculated Risk on 2/18/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 13, the advance figure for seasonally adjusted initial claims was 473,000, an increase of 31,000 from the previous week's revised figure of 442,000. The 4-week moving average was 467,500, a decrease of 1,500 from the previous week's revised average of 469,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 6 was 4,563,000, unchanged from the preceding week's revised level of 4,563,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 1,500 to 467,500.

The current level of 473,000 (and 4-week average of 467,500) are very high and suggest continuing job losses in February.

Wednesday, February 17, 2010

Report: Treasury Secretary to Chair Systemic Risk Council

by Calculated Risk on 2/17/2010 09:41:00 PM

From Sewell Chan at the NY Times: Agreement Near on New Overseer of Banking Risks

The Senate and the Obama administration are nearing agreement on forming a council of regulators, led by the Treasury secretary, to identify systemic risk to the nation’s financial system, officials said Wednesday.I can just imagine a council in 2004 and 2005 led by ex-Treasury Secretary John Snow with Alan Greenspan as Vice Chair. Yeah, that would have worked well ...

...

The effect would be to diminish the authority of the Federal Reserve ... Ben S. Bernanke, is willing to go along with a Treasury-led council.

James Bullard, president of the St. Louis Fed, thinks this will fail:

“If [Bernanke]’s giving up, it’s because he’s somehow making some calculations about what the realities are,” Mr. Bullard said.

“But I’m telling you, this business of how we’re going to give this to a committee and we’re going to have an effective response to the next crisis. That is a joke.”

Q4: Quarterly Housing Starts and New Home Sales

by Calculated Risk on 2/17/2010 06:45:00 PM

This morning the Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q4 2009.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 71,000 single family starts, built for sale, in Q4 2009, and that is less than the 82,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA).

This is the 9th consecutive quarter with homebuilders selling more homes than they start.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders do build spec homes and many builders were stuck with some “unintentional spec homes” because of cancellations during the bust. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts (blue) were higher than sales (red), and inventories of new homes increased. For the last 9 quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q4 were at an all time record low of 3,000 condos built for sale. This breaks the record set in Q1, Q2 and Q3 of 2009 of 5,000 condos per quarter. The previous record was 8,000 set in Q1 1991 (data started in 1975). Only 18,000 condos were started in 2009, far below the previous low of 41,000 in 1991.

Units built for rent set an all time record low in Q4 (19,000 units in Q4 2009 compared to the previous record low of 21,000 units in Q1 1993). With the vacancy rate at a record high, the demand for new rental units will stay low for some time.

Owner built units are above the record low set in Q1 2009 (31,000 units compared to 24,000 units in Q1 2009), however the pickup in owner built starts was probably mostly seasonal (this is NSA data).

And the largest category - starts of single family units, built for sale - was very low at 71,000 units in Q4.

With starts so low in every category, the number of units added to the housing stock in 2010 will be at a record low - and that will help reduce the significant excess inventory of housing units.

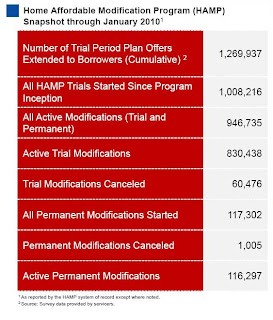

HAMP: 116,000 Permanent Mods, Over 1,000 Permanent Mods Cancelled

by Calculated Risk on 2/17/2010 04:11:00 PM

From Treasury: Administration Releases January Loan Modification Report

Click on graph for larger image  in new window.

in new window.

Just over 116,000 modifications are now permanent.

Here is the link at Treasury. See here for a list of reports.

If there were 416,471 cumulative HAMP trial modifications in August - how come there were only 116,297 permanent mods and 60,476 disqualified modifications by the end of January? The numbers don't add up.

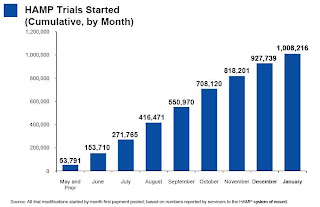

What happened to the other 240,000 modifications? I guess they we will find out in the February report when the servicers start removing delinquent borrowers from the trial modification program. The second graph shows the cumulative HAMP trial programs started.

The second graph shows the cumulative HAMP trial programs started.

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in Septmenber to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Edit: Also - 1,005 permanent modifications have already failed. At first that seemed high considering those borrowers made all the trial modification payments ... but I suppose that is about the expected re-default rate.

FOMC Minutes: Expect "slow improvement in the labor market"

by Calculated Risk on 2/17/2010 02:00:00 PM

In the most recent FOMC statement, the Fed removed all references to residential housing. This was in recognition that the housing sector is not as strong as it appeared in November or December. This makes the FOMC Minutes a little more interesting this month ... first, as a review, here are the housing comments from the last three FOMC statements:

Nov, 2009: "Activity in the housing sector has increased over recent months"

Dec, 2009: "The housing sector has shown some signs of improvement over recent months."

Jan, 2010: No comment.

And here are the January FOMC minutes on residential real estate:

The recovery in the housing market slowed in the second half of 2009, even though a number of factors supported housing demand. Interest rates for conforming 30-year fixed-rate mortgages remained historically low. ... Sales of new homes also turned down in November and December, retracing part of their recovery earlier in the year. Similarly, starts of single-family homes retreated a little from June to December after advancing briskly last spring. ...And the economic outlook:

By and large, participants judged that residential investment had stabilized but did not expect housing construction to make a sizable contribution to economic growth during the next year or two.

In their discussion of the economic situation and outlook, participants agreed that the incoming data and information received from business contacts, though mixed, indicated that economic growth had strengthened in the fourth quarter, that firms were reducing payrolls at a less rapid pace, and that downside risks to the outlook for economic growth had diminished a bit further. Participants saw the economic news as broadly in line with the expectations for moderate growth and subdued inflation in 2010 that they held when the Committee met in mid-December; moreover, financial conditions were much the same, on balance, as when the FOMC last met. Accordingly, participants' views about the economic outlook had not changed appreciably. Many noted the evidence that the pace of inventory decumulation slowed quite substantially in the fourth quarter of 2009 as firms increased output to bring production into closer alignment with sales. Participants saw the slower pace of inventory reductions as a welcome indication that, in general, firms no longer had large inventory overhangs. But they observed that business contacts continued to report great reluctance to build inventories, increase payrolls, and expand capacity. Participants expected the economic recovery to continue, but most anticipated that the pickup in output and employment growth would be rather slow relative to past recoveries from deep recessions. A moderate pace of expansion would imply slow improvement in the labor market this year, with unemployment declining only gradually. Most participants again projected that the economy would grow somewhat more rapidly in 2011 and 2012, generating a more pronounced decline in the unemployment rate, as financial conditions and the availability of credit continue to improve. In general, participants saw the upside and downside risks to the outlook for economic growth as roughly balanced. Participants agreed that underlying inflation currently was subdued and was likely to remain so for some time. Some noted the risk that, with output well below potential over the next couple of years, inflation could edge further below the rates they judged most consistent with the Federal Reserve's dual mandate for maximum employment and price stability; others, focusing on risks to inflation expectations and the challenge of removing monetary accommodation in a timely manner, saw inflation risks as tilted toward the upside, especially in the medium term.

The weakness in labor markets continued to be an important concern for the FOMC; moreover, the prospects for job growth remained an important source of uncertainty in the economic outlook, particularly in the outlook for consumer spending. While the average pace of layoffs diminished substantially in recent months, few firms were hiring. The unusually large fraction of individuals who were working part time for economic reasons, as well as the uncommonly low level of the average workweek, pointed to a gradual increase in payrolls for some time even if hours worked were to increase substantially as the economic recovery proceeded. Indeed, many business contacts again reported that they would be cautious in hiring, saying they expected to meet any near-term increase in demand by raising existing employees' hours and boosting productivity, thus delaying the need to add employees.

emphasis added