by Calculated Risk on 2/04/2010 12:25:00 PM

Thursday, February 04, 2010

Hotel Occupancy Up Slightly from Same Week in 2009

The good news for hotels is it appears the occupancy rate might be at or near the bottom. Of course - as I noted earlier - the bad news for hotels is the average daily rate (ADR) is still falling because the occupancy rate is so low. Therefore RevPAR (revenue per available room) is still falling.

From HotelNewsNow.com: Luxury leads chain scale segment increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy ended the week up 1.9 percent to 48.8 percent. Average daily rate dropped 5.6 percent to finish the week at US$94.92. Revenue per available room for the week fell 3.8 percent to finish at US$46.31.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the Year-over-year change in the occupancy rate using a 3 week average.

It is possible the occupancy rate has bottomed, but at a very low level.

The second graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Note: the scale doesn't start at zero to better show the change.

Note: the scale doesn't start at zero to better show the change.The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. Business travel will be the key over the next few months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

More European Sovereign Debt Woes

by Calculated Risk on 2/04/2010 10:03:00 AM

From the Financial Times: Sovereign debt fears rattle investors

“The latest catalyst was [Wednesday’s] bond auction in Portugal which was scaled back and which has re-ignited fears that the likes of Portugal and Greece will not be able to fund their deficits without a bail out,” said Gavan Nolan, credit analyst at Markit.From Bloomberg: Portugal, Spain Lead Worldwide Decline in Stocks; Dollar Gains

excerpted with permission

Stocks and bonds fell in Spain, Portugal and eastern Europe on concern governments will struggle to fund their budget deficits as spending cuts in Greece trigger labor strikes. ... “The focus is shifting toward Spain and Portugal, where the deficit-reduction plans have been far less ambitious than Greece,” said Kornelius Purps, a fixed-income strategist in Munich at UniCredit Markets & Investment Banking.And from the WSJ: Greece, Portugal Woes Intensify

Weekly Initial Unemployment Claims Increase to 480,000

by Calculated Risk on 2/04/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 30, the advance figure for seasonally adjusted initial claims was 480,000, an increase of 8,000 from the previous week's revised figure of 472,000. The 4-week moving average was 468,750, an increase of 11,750 from the previous week's revised average of 457,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 23 was 4,602,000, an increase of 2,000 from the preceding week's revised level of 4,600,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 11,750 to 468,750.

This is the third weekly increase in a row for the four week average, and the average is now 28,000 above the low in early January. Both the level of claims, and the recent increase in the 4-week average, are concerning and suggest continued job losses.

Daily Show: Toyotathon of Death

by Calculated Risk on 2/04/2010 12:23:00 AM

Jon Stewart on Toyota (link here):

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Toyotathon of Death | ||||

| www.thedailyshow.com | ||||

| ||||

Wednesday, February 03, 2010

Obama Vows to Address Yuan Exchange Rate Issue

by Calculated Risk on 2/03/2010 08:47:00 PM

Reuters is quoting President Obama:

"One of the challenges that we've got to address internationally is currency rates and how they match up to make sure that our goods are not artificially inflated in price and their goods are artificially deflated in price. That puts us at a huge competitive disadvantage."Pimco's Paul McCulley listed this as one of the key issues for 2010:

The first issue is the peg between the Chinese yuan and the U.S. dollar, which essentially gives us a one-size-fits-all monetary policy in a very differentiated world. ...And Professor Krugman wrote about this on Dec 31, 2009: Chinese New Year

China has become a major financial and trade power. But it doesn’t act like other big economies. Instead, it follows a mercantilist policy, keeping its trade surplus artificially high. And in today’s depressed world, that policy is, to put it bluntly, predatory.And Larry Summers mentioned this at Davos, see Gideon Rachman's piece in the Financial Times: How the bottom fell out of 'old' Davos

...

My back-of-the-envelope calculations suggest that for the next couple of years Chinese mercantilism may end up reducing U.S. employment by around 1.4 million jobs.

Larry Summers ... pointed out that Paul Samuelson, a famous economist (and uncle of Mr Summers), had argued that the case for free trade might not apply when countries were trading with nations that were pursuing mercantilist policies. The reference to China did not need to be spelled out.Getting the Chinese to revalue (or float) their currency is probably critical to the U.S. achieving Obama's ambitious SOTU goal of doubling U.S. exports in the next five years.

excerpted with permission

LPS: Mortgage Delinquencies Reach 10%

by Calculated Risk on 2/03/2010 05:56:00 PM

From Jon Prior at HousingWire: Mortgage Delinquencies Pass 10%: LPS

Home-loan delinquency rates in the US reached 10% in December, up from the record-high 9.97% in November, according to Lender Processing Services ... which provides data on mortgage performance.More foreclosures and short sales coming!

Accounting for foreclosures in the pipeline, the total non-current rate stands at 13.3% .... When extrapolated for the entire mortgage industry, 7.2m mortgage loans are behind on their payments.

Note: the MBA reported the delinquency rate in Q3 was 9.64%; the MBA Q4 delinquency data will be released soon.

Housing Stock and Flow

by Calculated Risk on 2/03/2010 03:20:00 PM

Yesterday I posted some data from the Census Bureau that suggests there are about 1.8 million excess vacant housing units in the U.S. (above the normal levels).

IMPORTANT: The housing stock includes both owner occupied and rental units. I suspect many of the excess units absorbed will be by renters.

This raises a key question for the economy and jobs: How much longer until these excess housing units will be absorbed?

The answer depends on 1) how many net units are added to the housing stock, and 2) how many net households are formed. The table below shows about 650 thousand net housing units added to the stock in 2009.

Housing units include single family homes (included as 1 to 4 units), apartments (5+ units), and mobile homes. Demolitions are subtracted from the stock (note: demolitions are the hardest to estimate).

In 2009, because of the recession, fewer than normal net households were formed (probably around 650 thousand), so the excess inventory was not reduced.

NOTE: Table is based on Completions. Housing units added to stock:

| 2009 | 20101 | |

|---|---|---|

| 1 to 4 units | 535.4 | 500 |

| 5+ units | 260 | 125 |

| Mobile Homes2 | 53 | 60 |

| Sub-Total | 848.4 | 755.0 |

| Demolitions3 | 200 | 200 |

| Total | 648.4 | 485.0 |

1 Preliminary estimates for 2010.

2 Actual rate through November, December estimated.

3 estimated.

Notice for 2010 that the estimate is for 5+ unit completions to collapse. This is already in the works as shown in the following diagram:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is for multifamily starts and the red line is for multifamily completions. For the most part, all the multifamily units that will be delivered in 2010 have already been started since, according to the Census Bureau, it takes on average over 1 year to complete these projects.

Since multifamily starts collapsed in 2009, completions will collapse in 2010.

Similar logic applies to single family units, although these only take around 7 months to complete. Since there have been an average (SAAR) of 485 thousand units started over the last 6 months, completions will probably average under 500 thousand in the first half of the year. I was generous and added a little pickup later in the year, but it could easily be less. The D.R. Horton CEO said yesterday:

We expect our September quarter will be the most challenging as the tax credit for home sales will have expired. As we move past the selling season, we'll be able to get a better read on core demand and we'll adjust our business accordingly.The manufactured homes data is from the Census Bureau (and demolitions are estimated).

The good news is the population is growing at around 2.6 million people per year. And based on normal household formation to population ratios, this would usually mean 1.1 million or more net new households formed in 2010. Unfortunately job growth will probably be weak in 2010 and hold down household formation, but this suggests the number of excess units should finally start declining in 2010 - perhaps by more than 600 thousand units, perhaps even cut in half. (note: this doesn't include 2nd home buying that might also reduce the number of excess units).

Those expecting a sharp increase in residential construction this year will probably be disappointed since there are still a large number of excess vacant housng units - and, as I've noted many times, residential investment is usually one of the engines of recovery (both for GDP and jobs) - so I expect those looking for a "V-shaped" recovery will be disappointed too.

We are still a long way from significant job growth in residential construction, but we might actually see progress in reducing the excess inventory this year.

Special thanks to housing economist Tom Lawler who shared with me some of his thoughts on completions.

MBA: Mortgage Applications Increase to mid-December Levels

by Calculated Risk on 2/03/2010 12:15:00 PM

From earlier this morning ... the MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased of 21.0 percent on a seasonally adjusted basis from one week earlier. ...

"Mortgage application volume rebounded last week, returning the purchase and refinance indexes to levels from mid-December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Rates continue to hover around 5 percent, quite low by historical standards, but are well above the record lows seen in 2009, and hence are not generating substantial refi volume. We expect that rates will rise over the next few months as the Federal Reserve winds down its MBS purchase program, and this will likely lead to a decline in refinance volume."

The Refinance Index increased 26.3 percent from the previous week and the seasonally adjusted Purchase Index increased 10.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.01 percent from 5.02 percent, with points increasing to 1.04 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

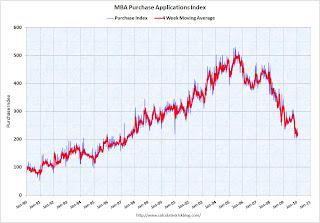

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four week moving average has declined sharply since October, and is at about the same level as November 1997. The increase this week was just a rebound from the decline last week.

The decline in mortgage applications since October appears significant, and even with the increase in refinance applications last week, it also appears the refinance boom is ending.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen this year and next - there will only be a surge in refinance activity if rates fall below the rates of 2009.

ISM Non-Manufacturing Shows Slight Expansion in January

by Calculated Risk on 2/03/2010 10:00:00 AM

This is another weak service report. According to this survey, the service sector barely expanded in January, and employment also contracted in the non-manufacturing sector "for the 25th consecutive month".

From the Institute for Supply Management: January 2010 Non-Manufacturing ISM Report On Business®

In January, the NMI registered 50.5 percent, indicating growth in the non-manufacturing sector after two months of contraction. A reading above 50 percent indicates the non-manufacturing sector economy is generally expanding; below 50 percent indicates the non-manufacturing sector is generally contracting.

...

"The NMI (Non-Manufacturing Index) registered 50.5 percent in January, 0.7 percentage point higher than the seasonally adjusted 49.8 percent registered in December, indicating growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased 1 percentage point to 52.2 percent, reflecting growth for the second consecutive month. The New Orders Index increased 2.7 percentage points to 54.7 percent, and the Employment Index increased 1 percentage point to 44.6 percent.

...

Employment activity in the non-manufacturing sector contracted in January for the 25th consecutive month. ISM's Non-Manufacturing Employment Index for January registered 44.6 percent.

emphasis added

ADP: Private Employment Decreased 22,000 in January

by Calculated Risk on 2/03/2010 08:32:00 AM

ADP reports:

Nonfarm private employment decreased 22,000 from December 2009 to January 2010 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from November to December 2009 was revised by 23,000, from a decline of 84,000 to a decline of 61,000.Note: ADP is private nonfarm employment only (no government jobs).

The January employment decline was the smallest since employment began falling in February of 2008.

On the Challenger job-cut report from MarketWatch: Planned layoffs rise for first time since July: Challenger Gray

Planned layoff announcements at major U.S. corporations increased 59% in January, reaching 71,482 from a nine-year low of 45,094 seen in December, according to the latest job-cut tally by Challenger Gray & Christmas.The BLS reports on Friday, and the consensus is for a small net gain in payroll jobs in January, on a seasonally adjusted (SA) basis, and the unemployment rate flat at 10.0%.

It was the first month-to-month increase since July, the outplacement firm reported Wednesday.

Layoff plans ran 70% lower than the 241,749 announced in January 2009, which was a seven-year high..

The relatively strong ISM manufacturing and ADP reports suggest a positive BLS number on Friday.