by Calculated Risk on 1/31/2010 08:46:00 AM

Sunday, January 31, 2010

Volcker: "How to Reform Our Financial System"

Here is an OpEd in the NY Times from Paul Volcker: How to Reform Our Financial System

A few excerpts:

The further proposal set out by the president recently to limit the proprietary activities of banks approaches the problem from a complementary direction. The point of departure is that adding further layers of risk to the inherent risks of essential commercial bank functions doesn’t make sense, not when those risks arise from more speculative activities far better suited for other areas of the financial markets.And Volcker concludes:

The specific points at issue are ownership or sponsorship of hedge funds and private equity funds, and proprietary trading — that is, placing bank capital at risk in the search of speculative profit rather than in response to customer needs. Those activities are actively engaged in by only a handful of American mega-commercial banks, perhaps four or five. Only 25 or 30 may be significant internationally.

Apart from the risks inherent in these activities, they also present virtually insolvable conflicts of interest with customer relationships, conflicts that simply cannot be escaped by an elaboration of so-called Chinese walls between different divisions of an institution. The further point is that the three activities at issue — which in themselves are legitimate and useful parts of our capital markets — are in no way dependent on commercial banks’ ownership. These days there are literally thousands of independent hedge funds and equity funds of widely varying size perfectly capable of maintaining innovative competitive markets. Individually, such independent capital market institutions, typically financed privately, are heavily dependent like other businesses upon commercial bank services, including in their case prime brokerage. Commercial bank ownership only tilts a “level playing field” without clear value added.

emphasis added

I am well aware that there are interested parties that long to return to “business as usual,” even while retaining the comfort of remaining within the confines of the official safety net. They will argue that they themselves and intelligent regulators and supervisors, armed with recent experience, can maintain the needed surveillance, foresee the dangers and manage the risks.There is much more in the piece, but Volcker makes it clear:

In contrast, I tell you that is no substitute for structural change, the point the president himself has set out so strongly.

I’ve been there — as regulator, as central banker, as commercial bank official and director — for almost 60 years. I have observed how memories dim. Individuals change. Institutional and political pressures to “lay off” tough regulation will remain — most notably in the fair weather that inevitably precedes the storm.

The implication is clear. We need to face up to needed structural changes, and place them into law. To do less will simply mean ultimate failure — failure to accept responsibility for learning from the lessons of the past and anticipating the needs of the future.

1) There are huge competitive advantages of being "too big to fail", so naturally these banks want to continue with "business as usual".

2) Although improved regulation and capital requirements are important, structural changes are critical.

Saturday, January 30, 2010

Daily Show: CNBC Financial Advice

by Calculated Risk on 1/30/2010 10:31:00 PM

A little flashback from Jon Stewart: CNBC Financial Advice

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| CNBC Financial Advice | ||||

| www.thedailyshow.com | ||||

| ||||

FDIC Bank Failure Update

by Calculated Risk on 1/30/2010 05:44:00 PM

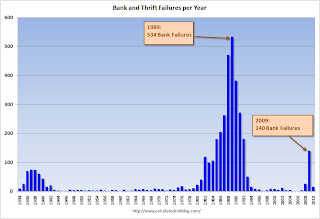

There have been 183 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | 2007 | 3 |

|---|---|

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 15 |

| Total | 183 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows bank failures by week in 2008, 2009 and 2010.

The FDIC is off to a fast start in 2010.

My prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 - peak of the S&L crisis (534 banks).

The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.The 140 bank failures last year was the highest total since 1992 (181 bank failures).

And since people always ask, the third graph is of bank failures by number of institutions and assets, from the December Congressional Oversight Panel’s Troubled Asset Relief Program report.

Note: This is through Nov 30th for 2009.

Note: This is through Nov 30th for 2009.From the report (page 45):

Figure 11 shows numbers of failed banks, and total assets of failed banks since 1970. It shows that, although the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion.167 Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.168Note: This is in 2005 dollars and this includes the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

I'll update the losses for the Deposit Insurance Fund (DIF) over the next few weeks.

Summers: "Statistical recovery and a human recession"

by Calculated Risk on 1/30/2010 02:16:00 PM

Quote of the day ...

""What we see in the United States and some other economies is a statistical recovery and a human recession."

Larry Summers, Davos, Jan 30, 2010 (via CNBC) Click on graph for larger image in new winder.

Click on graph for larger image in new winder.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The current employment recession is the worst since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

And the graph is before the annual benchmark revision that will be announced next Friday, and is expected to show the loss of an additional 824,000 jobs.

Investment Contributions to GDP: Leading and Lagging

by Calculated Risk on 1/30/2010 11:15:00 AM

By request, the following graph is an update to: The Investment Slump in Q2

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) has made a positive contribution to GDP the last two quarters, and the rolling four quarter change is moving up.

Equipment and software investment made a small positive contribution to GDP in Q3, and a larger contribution in Q4. The four quarter average is also moving up.

As expected, nonresidential investment in structures is now declining sharply as major projects are completed. The economy will recover long before nonresidential investment in structures recovers.

And as always, residential investment is the best leading indicator for the economy.

NPR: To Stay Or Walk Away

by Calculated Risk on 1/30/2010 08:53:00 AM

Here is an interesting podcast from NPR's Planet Money: To Stay Or Walk Away

NPR's Alex Blumberg and Chana Joffe-Walt interview Arizona attorney Mary Kinsley. She describes how a couple years ago homeowners would call her, in tears, trying desperately to save their homes from foreclosure.

Now homeowners call, their voices calm, and ask her the best way to strategically default - and in some cases how to get the banks to take back the houses they've been delinquent on for over a year. Pretty amazing. She thinks this is just the beginning of "walking away".

P.S. I appreciate the mention!

Friday, January 29, 2010

Unofficial Problem Bank List increases to 599

by Calculated Risk on 1/29/2010 10:29:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent significant changes since last as a net 15 institutions were added. Twenty-six institutions were added while 11 institutions were removed because of failure. Please note that the six failures were removed along with the five last Friday. Usually, failures are removed with a one-week lag.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

After these changes, the list stands at 599 institutions with aggregate assets of $322.5 billion, up from 584 institutions with assets of $305.3 billion last week.

Among the eleven failures are First Regional Bank ($2.2 billion); Charter Bank ($1.25 billion); Community Bank & Trust ($1.2 billion); Columbia River Bank ($1.1 billion); Florida Community Bank ($875 million); and First National Bank of Georgia ($833 million).

The 26 institutions added this week have aggregate assets of $25.9 billion. Notable among the additions are Flagstar Bank, FSB, Troy, MI ($14.8 billion); The Stillwater National Bank and Trust Company, Stillwater, OK ($2.7 billion); Guaranty Bank and Trust Company, Denver, CO ($2.1 billion); Fireside Bank, Pleasanton, CA ($1.0 billion); Darby Bank & Trust Co., Vidalia, GA ($909 million); and LibertyBank, Eugene, OR ($856 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #15: American Marine Bank, Bainbridge Island, Washington

by Calculated Risk on 1/29/2010 09:04:00 PM

The first month of twenty ten

Not a record....yet.

by Soylent Green is People

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of American Marine Bank, Bainbridge Island, Washington

American Marine Bank, Bainbridge Island, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes six.

As of September 30, 2009, American Marine Bank had approximately $373.2 million in total assets and $308.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $58.9 million. ... American Marine Bank is the 15th FDIC-insured institution to fail in the nation this year, and the third in Washington. The last FDIC-insured institution closed in the state was Evergreen Bank, Seattle, on January 22, 2010.

Bank Failure #14: First Regional Bank, Los Angeles, California

by Calculated Risk on 1/29/2010 07:51:00 PM

Gobbled up by East coast bank.

Zero near partners?

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of First Regional Bank, Los Angeles, California

First Regional Bank, Los Angeles, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Five down, at almost a $2 billion cost to DIF.

As of September 30, 2009, First Regional Bank had approximately $2.18 billion in total assets and $1.87 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $825.5 million. ... First Regional Bank is the 14th FDIC-insured institution to fail in the nation this year, and the first in California. The last FDIC-insured institution closed in the state was Imperial Capital Bank, La Jolla, on December 18, 2009.

Bank Failure #13 in 2010: Community Bank and Trust, Cornelia, Georgia

by Calculated Risk on 1/29/2010 07:03:00 PM

"Community" is spot on.

Loss, absorbed by all.

by Soylent Green is People

From the FDIC: SCBT, N.A., Orangeburg, South Carolina, Assumes All of the Deposits of Community Bank and Trust, Cornelia, Georgia

Community Bank and Trust, Cornelia, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Four down and about $1 billion in losses today ...

As of September 30, 2009, Community Bank and Trust had approximately $1.21 billion in total assets and $1.11 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $354.5 million. .... Community Bank and Trust is the 13th FDIC-insured institution to fail in the nation this year, and the second in Georgia. The last FDIC-insured institution closed in the state was First National Bank of Georgia, Carrollton, earlier today.