by Calculated Risk on 1/12/2010 10:41:00 PM

Tuesday, January 12, 2010

Financial Crisis Inquiry Commission Hearings Start Tomorrow

From Dow Jones: Financial-Crisis Panel Set To Grill Wall Street Executives

Wednesday's hearing marks the first of two days of testimony before the financial-crisis commission.The purpose of this commission is to determine the causes of the crisis, and I hope they don't spend the entire day on pay. I think they should spend a significant amount of time discussing the entire chain of the originate-to-distribute model and other financial innovations (such as automated underwriting), the interaction with the credit agencies, and what regulators were asking and being told.

...

Top executives from Goldman Sachs Group Inc. (GS), Morgan Stanley (MS), Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) are likely to come under stiff questioning from members of the bipartisan Financial Crisis Inquiry Commission.

...

Top policymakers, including Securities and Exchange Commission Chairman Mary Schapiro and Attorney General Eric Holder, are scheduled to appear on Thursday.

The tendency will be to focus on pay and gotcha type questions (and that makes good theater), but asking question about the process would be far more helpful.

Here is the FCIC website.

More on Option ARMs

by Calculated Risk on 1/12/2010 07:24:00 PM

From Mark Koba at CNBC: More Homeowners Struggling As Option ARMs Reset Higher

From Diana Olick at CNBC: Walkaways, Pay Option ARMS Hit Banks Bad

And from my earlier post: Option ARM Recast Update

This impact is still being debated, but the Option ARM fallout will hit the mid-to-high end bubble areas because it was used as an affordability product.

UPDATE: As Laurie Goodman at Amherst Securities noted yesterday, Option ARM borrowers were a self selecting group (people stretching to buy homes) and most have negative equity in their homes. The "payment shock" is unclear because of low interest rates and because of modifications. Many lenders will be willing to extend the term, and some lenders like Wells Fargo has reduced principal on a case-by-case basis.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

On negative equity, this graph from Amherst shows the CLTV for various mortgage products. Note that subprime and Alt-A had a somewhat higher percent of borrowers with negative equity than prime - but Option ARMs (red) borrowers are mostly in negative equity!

HUD Probes FHA Lenders

by Calculated Risk on 1/12/2010 04:14:00 PM

From HUD: HUD Inspector General Probes Morgage Companies with Significant Claim Rates

U.S. Department of Housing and Urban Development (HUD) Inspector General Kenneth M. Donohue and Federal Housing Administration (FHA) Commissioner David H. Stevens announced today an initiative focusing on mortgage companies with significant claim rates against the Federal Housing Administration mortgage insurance program.HUD has a great tool to track FHA lender performance: Neighborhood Watch Early Warning System

HUD Office of Inspector General (OIG) subpoenas were served to the corporate offices of 15 mortgage companies across the country demanding documents and data related to failed loans which resulted in claims paid out by the FHA mortgage insurance fund.

Inspector General Donohue said, “The goal of this initiative is to determine why there is such a high rate of defaults and claims with these companies and whether there is wrongdoing involved. We aren’t making any accusations at this time, we have no evidence of wrongdoing, but we will aggressively pursue indicators of fraud. We are members of the President's Financial Fraud Enforcement Task Force and today’s activities reflect our commitment to seeking information on red flags that may arise from data analysis.

...

“The FHA market share has skyrocketed,” Inspector General Donohue further said. “Our job is oversight. We work for the American taxpayer. Each loan on this list will be thoroughly examined and we will track down the reasons why it failed. Once we determine the causes, we will look to see whether there is a need for further review or remedial action. We want to send a message to the industry that as the mortgage landscape has shifted we are watching very carefully and that we are poised to take action against bad performers."

The default rates shown are for loans made during the last two years. As an example, according to the FHA, 15.97% of the loans originated by Pine State Mortgage Corporation of Atlanta, GA are in default or were claim terminated. The rate is 14.4% for Alacrity Financial Services, LLC of Southlake, TX, and 11.23% for Assurity Financial Services, LLC of Englewood, CO. All three have default rates well above the national average for loans originated during the last two years (5.05%), and all received subpoenas today.

Option ARM Recast Update

by Calculated Risk on 1/12/2010 01:58:00 PM

Laurie Goodman and others at Amherst Securities released a new research note yesterday: Option ARMs - Performance and Pricing

They make several important points (quoted section are from Amherst):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This chart shows the expected payment shock coming in 2010 and 2011 from Option ARMs. This chart includes projected increases in LIBOR (if LIBOR stays low, the shock will not be as high), and the recast due to reamortizing the loan over the remaining period.

Update: There is question on the size of the payment "shock". The report suggests many payments will double, but other estimate are much lower.

China Increases Bank Reserve Requirements

by Calculated Risk on 1/12/2010 12:39:00 PM

From the Financial Times: China raises bank reserve requirements (ht James)

China on Tuesday increased the required amount of deposits banks must keep as reserves in the clearest signal yet that the central bank was trying to tighten monetary conditions amid mounting concerns of overheating and inflation as a result of the ongoing credit boom.More from the WSJ: China Cuts Amount Banks Can Lend, in Sign of Inflation Worries

excerpted with permission

As it orders banks to lock up more cash, Beijing is demonstrating it is on guard against asset bubbles that can accompany inflation. The initial impact may be to knock back China's stock market, which gained 80% last year according to the Shanghai Composite Index. ...That calls for a graph ...

A sharp spike in bank lending starting in late 2008 was the central element to Beijing's effort to escape the global financial crisis. The forceful policy may have worked too well, allowing companies to gorge on easy credit and speculate on properties and stocks.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite Index closed at 3,273.97, up about 90% from the low in 2008.

BLS: Near Record Low Job Openings in November

by Calculated Risk on 1/12/2010 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.4 million job openings on the last business day of November 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 1.8 percent. The openings rate has held relatively steady since March 2009. The hires rate (3.2 percent) and the separations rate (3.3 percent) were essentially unchanged in November.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple line) and separations (red and light blue together) are pretty close each month. When the purple line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.176 million hires in November, and 4.340 million separations, or 164 thousand net jobs lost. The comparable CES report showed a gain of 4 thousand jobs in November (after revisions).

Openings near a series low can't be a positive sign. Separations have declined sharply, but hiring has not picked up. This also suggests that eventually (possibly when the March 2010 benchmark revision is announced in Feb 2011), the November net change in employment will be revised down.

Trade Deficit Increases in November

by Calculated Risk on 1/12/2010 08:31:00 AM

The Census Bureau reports:

The ... total November exports of $138.2 billion and imports of $174.6 billion resulted in a goods and services deficit of $36.4 billion, up from $33.2 billion in October, revised. November exports were $1.2 billion more than October exports of $137.0 billion. November imports were $4.4 billion more than October imports of $170.2 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through November 2009.

Both imports and exports increased in November. On a year-over-year basis, exports are off 2.3% and imports are off 5.5%.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $72.54 in November - up 85% from the low in February (at $39.22).

Oil import volumes are off 8% from last November.

Overall trade continues to increase, although both imports and exports are still off significantly from the pre-financial crisis levels. Net export growth had been one of the positives for the U.S. economy - but now imports are growing faster than exports.

Monday, January 11, 2010

The Depression of 1948?

by Calculated Risk on 1/11/2010 10:55:00 PM

It is always nice to be mentioned. Henry Blodget called the graph comparing the percent job losses in post WWII recessions "The Scariest Jobs Chart Ever"1. And then Glenn Beck mentioned the graph too, but ... uh, the Depression wasn't in 1948!

If we had the data, the percent job losses during the Great Depression (in the '30s) would probably have been 20% or more - far worse than the current employment recession. It was the Great Depression that led to the expansion of the BLS program to track employment. From the BLS:

With the deepening economic crisis in 1930, President Herbert C. Hoover appointed an Advisory Committee on Employment Statistics, which recommended extension of the BLS program to include the development of hours and earnings series. In 1932, the U.S. Congress granted an increase in the BLS appropriation for the survey. In 1933, average hourly earnings and average weekly hours were published for the first time for total manufacturing, for 90 manufacturing industries, and for 14 nonmanufacturing categories.

During the Great Depression, there was controversy concerning the actual number of unemployed people; no reliable measures of employment or unemployment existed. This confusion stimulated efforts to develop comprehensive estimates of total wage and salary employment in nonfarm industries, and BLS survey data produced such a figure for the first time in 1936.

Click on graph for larger image in new window.

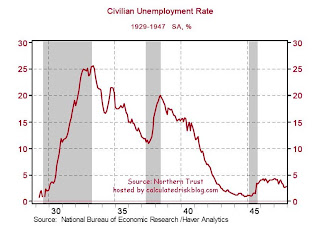

Click on graph for larger image in new window.Although there is some data on unemployment during the Great Depression, it is based on very rough estimates.

As an example, this graph from Northern Trust shows an estimate of the unemployment rate from 1929 through 1947.

And here is a repeat of the "scariest chart ever".

And here is a repeat of the "scariest chart ever".Even after the benchmark revision is added next month, the job losses for the current recession as a percent of peak employment are only about one fourth of the losses in the Great Depression.

1Note: The total jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the final benchmark revision that will be announced on February 5, 2010).

CRE: "Almost FREE"

by Calculated Risk on 1/11/2010 07:56:00 PM

Talk about falling rents ... Doug in Chicago sends along this photo "a storefront in a normally bustling neighborhood retail district on North Clark St in Chicago, about a mile south of Wrigley Field". (telephone number blacked out)

Distressed Sales: Sacramento as an Example

by Calculated Risk on 1/11/2010 04:56:00 PM

NOTE: I expect the use of short sales to increase nationwide in 2010. Since the Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the December data.

They started breaking out REO sales in 2008, but they have only broken out short sales since June 2009. About 66 percent of all resales (single family homes and condos) were distressed sales in December. The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

The second graph shows the percent of REO and short sales (and total distressed sales). The percent of REOs has been declining, but the percent of short sales has been steadily increasing, from 16.7% in June to 24.7% in December.

When the trial modification period ends, the REO sales will probably increase. Also, I expect short sales to be higher in 2010 than in 2009 (there is more emphasis on short sales and deed-in-lieu of foreclosure now).

Total sales in December were off 14.3% compared to December 2008; the seventh month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (27.5%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.