by Calculated Risk on 12/14/2009 06:19:00 PM

Monday, December 14, 2009

Report: Wells Fargo to repay TARP

From the WSJ: Wells Fargo to repay entire $25 billion in bailout aid, use proceeds from $10.4 billion stock sale.

The last of the big banks ...

Press Release from Wells Fargo: Wells Fargo to Repay Entire $25 Billion TARP Investment; Announces $10.4 Billion Common Stock Offering

Wells Fargo & Company announced today that, pursuant to terms approved by U.S. banking regulators and the U.S. Treasury, it will redeem the $25 billion of series D preferred stock issued to the U.S. Treasury in October 2008 under the government’s Troubled Asset Relief Program (TARP), upon successful completion of a $10.4 billion common stock offering.

“TARP stabilized our country’s financial system when confidence in financial markets around the world was being tested unlike any other period in our history. Its success also generated financial returns for taxpayers, including $1.4 billion in dividends paid to the U.S. Treasury by Wells Fargo,” said Wells Fargo President and CEO John Stumpf. “Now we’re ready to fully repay TARP in a way that serves the interests of the U.S. taxpayer, as well as our customers, team members and investors.”

Fed MBS Purchases: Over 85% Complete

by Calculated Risk on 12/14/2009 02:23:00 PM

Just an update on the status of the Fed's MBS purchase program.

From the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

The Fed purchased an additional $16 billion net in MBS over the last week.The Fed purchased a net total of $16 billion of agency-backed MBS in each of the last three weeks, with the last one through December 2. This purchase brings its total purchases up to $1.058 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 85% complete). In the last two months, the average weekly amount of MBS purchased has been smaller, averaging $17 billion over the last 10 weeks versus the average of $23.4 billion before that period.

And on the Fed balance sheet:

And on the Fed balance sheet: The balance sheet shrank slightly between November 26 and December 2 to $2.24 trillion.Note that the Fed balance sheet is mostly Agency & MBS and Tresuries now.

FDIC's Bair takes the "Over"

by Calculated Risk on 12/14/2009 12:03:00 PM

On Saturday I wrote that I'd take the "over" - more bank failures in 2010 than 2009. This is primarily because many FDIC insured banks are overly exposed to Construction & Development (C&D) and Commercial Real Estate (CRE) loans.

FDIC Chairwoman Sheila Bair is also taking the "over".

From CNBC: Worst of Bank Failures Isn't Over Yet: FDIC's Bair

Bank failures will continue to accelerate into next year despite "some encouraging signs" that things are turning around for the battered industry, FDIC Chair Sheila Bair told CNBC.A industry contact told me this weekend that they expect 400 bank failures in 2010.

... Bair did not quantify how bad the failures would get but said the worst isn't over yet for institutions that will suffer even as the economy improves.

"There's a lag generally with bank recovery from the overall economy," she said. "We do think bank failures will continue to go up next year but will peak. Even at higher levels than we have this year, it's still far below where we were during the S&L days."

...

"Even though the insured depository institutions are having their share of problems, it's really much lower than it was during the S&L days simply because most of this occurred outside the insured banks," Bair said.

Amid the problems for the industry, Bair said the Federal Deposit Insurance Corp's financial standing remains solid. She said the FDIC will head into 2010 with about $60 billion in cash reserves.

Refinance Activity and Interest Rates

by Calculated Risk on 12/14/2009 10:35:00 AM

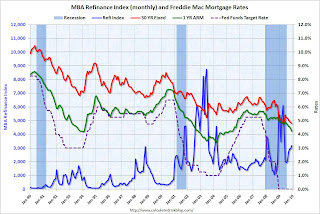

The Mortgage Bankers Association's (MBA) current forecast for refinance activity in 2010 is $693 billion, and falling further in 2011 to $591 billion. The MBA is currently estimating 2009 refinance originations will be $1,246 billion - so they expect activity to fall almost in half.

This gives me an excuse for a graph or two (as if I need one). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Refinance activity picks up when mortgage rates fall (for obvious reasons), and this graph shows the monthly refinance activity (MBA refinance index) and the Freddie Mac 30 year fixed mortgage rate and one year adjustable mortgage rate - and the Fed Funds target rate since Jan 1990.

Mortgage rates would have to fall further in 2010 to get another increase in refinance activity, and with the Fed MBS purchase program scheduled to end by the end of Q1, it seems unlike that rates will fall - unless the program is extended or the economy weakens significantly.

Notice that following the '90/'91 and '01 recessions, the Fed kept lowering the Fed Funds rate because of high unemployment rates. This spurred refinance activity. The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen in 2010 and 2011 - there will only be a surge in refinance activity if rates fall below the rates of 2009.

Citi Reaches Agreement to Repay TARP

by Calculated Risk on 12/14/2009 08:13:00 AM

Press Release from Citigroup: Citigroup, U.S. Government and Regulators Agree to TARP Repayment

From the NY Times: Citigroup Says It Has Reached a Deal to Repay Bailout Funds

Misc: Dubai, Citi, CRE

by Calculated Risk on 12/14/2009 12:33:00 AM

From the WSJ: Abu Dhabi Supplies $10 Billion to Dubai

Dubai's government Monday said it received $10 billion in financing from Abu Dhabi, which will pay part of the debt held by conglomerate Dubai World and its property unit Nakheel.From the NY Times: Citigroup Nears Deal to Return Billions in Bailout Funds

Citigroup was close to a deal on Sunday night to be the last of the big Wall Street banks to exit the government’s bailout program, after trying to persuade regulators that it was sound enough to stand on its own.And on CRE:

Sunday, December 13, 2009

Housing Bust and Mobility

by Calculated Risk on 12/13/2009 10:06:00 PM

A couple more articles on the impact of the housing bust on mobility ...

From Patrick Coolican at the Las Vegas Sun: Mobility bust bad for Vegas

“Vegas is going to be disproportionately affected by the absolute crashing halt of interstate migration,” said Michael Hicks, director of the Center for Business and Economic Research at Ball State University.And a personal tale from Brian Fitzgerald at the WSJ: Confessions of an Underwater Homeowner

About 4.7 million Americans moved from one state to another in 2007 and 2008, according to the Census Bureau. That’s just 55 percent of the total in 1999 and 2000. Geographers and economists think the number will plummet further this year.

...

“People are underwater on their homes and that affects mobility,” said Isabel Sawhill, a Brookings Institution economist.

...

Geographic mobility is what economists call “countercyclical.” When a recession hits, people usually move to where the jobs are. Job-related stasis — staying put in one’s job versus hitting the road in search of a better one — is unique to this recession.

We never considered purposefully defaulting ... Although, if I were laid off and unemployed for more than a few months we might have to. ... if I was offered a job in another city, we wouldn't be able to sell.There is much more in Fitzgerald's story, but this bit on mobility is important - he can't sell, and he can't move to change jobs - and just like most Americans trapped underwater, he is trying to stick it out and hoping for the best.

Worker mobility has always been a significant positive for the U.S. economy, and this decline in mobility is one of the long lasting tragedies of the bubble. As I wrote almost two years ago:

Less worker mobility [due to negative equity] is kind of like arteriosclerosis of the economy. It lowers the overall growth potential.

Perhaps as many as 15 to 20 million households will be saddled with negative equity by 2009. Even if most of these homeowners don't "walk away", there might still be a negative impact on the economy due to less worker mobility.

Large Apartment Developer Files for Bankruptcy

by Calculated Risk on 12/13/2009 06:29:00 PM

From the WSJ: Fairfield Files for Chapter 11

Fairfield, which has built some 64,000 apartments, condominiums and off-campus student-housing units throughout the country, failed amid an inability to refinance debt or sell investment properties.Their main two lenders were Wachovia (now part of Wells Fargo) and Capmark Financial (now in bankruptcy). This is also another hit to a Morgan Stanley real estate fund and others:

The bankruptcy is also a blow to the California State Teacher's Retirement System and a subsidiary of Mitsubishi Corp., both of which invested in Fairfield over the years.

A Fairfield spokeswoman confirmed that investors including the Morgan Stanley fund and CalSTRS would be wiped out by the bankruptcy but said they would continue as joint-venture partners on Fairfield projects.

Summary and a Look Ahead

by Calculated Risk on 12/13/2009 02:36:00 PM

Some key real estate news will be released this week including the Housing Market Index on Tuesday, Housing Starts (November) and the Architecture Billings Index for CRE (both on Wednesday).

In other economic news, the Fed will release Industrial Production and Capacity Utilization (November) on Tuesday, and the FOMC meeting announcement on Wednesday (no change). CPI will be released on Wednesday and the Philly Fed Index on Thursday.

And a summary of last week ...

From the BLS: Job Openings and Labor Turnover Summary The following graph shows job openings (yellow line), hires (blue Line), Quits (green bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and green added together equals total separations.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue line) and separations (red and green together) are pretty close each month. When the blue line is above total separations, the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 3.966 million hires in October, and 4.203 million separations, or 237 thousand net jobs lost. With job openings and hires near record lows, this suggests the current labor problem is mostly a lack of new jobs although layoffs and discharges were still elevated in October.

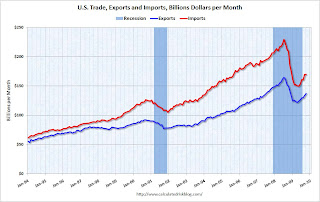

The Census Bureau reported: "The ... total October exports of $136.8 billion and imports of $169.8 billion resulted in a goods and services deficit of $32.9 billion, down from $35.7 billion in September, revised."

This graph shows the monthly U.S. exports and imports in dollars through October 2009.

This graph shows the monthly U.S. exports and imports in dollars through October 2009.Imports and exports both increased in October. On a year-over-year basis, exports are off 9% and imports are off 19%.

Import oil prices decreased slightly to $67.39 in October - and oil import volumes dropped sharply in October. The decline in oil imports was the major contributor to decrease in the trade deficit.

The Treasury reported 31,382 HAMP permanent modifications as of the end November.

The Treasury reported 31,382 HAMP permanent modifications as of the end November. Here is the link at Treasury. See here for a list of reports.

The rules to include a borrower in a trial modification program vary by servicer - and that makes that number essentially meaningless. The number that matters is the permanent mods, and although early, it appears the program will fall short of the original goal.

The Fed released the Q3 2009 Flow of Funds report this week: Flow of Funds.

According to the Fed, household net worth is now off $11.9 Trillion from the peak in 2007, but up $4.9 trillion from the trough earlier this year.

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This really shows the recent stock and real estate bubbles.

Also, the following Mortgage Equity Withdrawal estimate is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. (See: Q3 2009: Mortgage Equity Extraction Strongly Negative)

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method. For Q3 2009, the Net Equity Extraction was minus $91 billion, or negative 3.3% of Disposable Personal Income (DPI). This is not seasonally adjusted.

On a monthly basis, retail sales increased 1.3% from October to November (seasonally adjusted), and sales are up 1.9% from November 2008.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

The red line is for retail sales ex-gasoline and this shows there might be a little pickup in final demand.

"In summary, it is encouraging to find that, despite the rapid growth of mortgage debt, only a small fraction of households across the country have loan-to-value ratios greater than 90 percent. Thus, the vast majority of homeowners have a sizable equity cushion with which to absorb a potential decline in house prices."

Alan Greenspan, Sept, 2005

Best wishes to all.

Volcker Cautions on Complacency

by Calculated Risk on 12/13/2009 11:39:00 AM

From Der Spiegel: Interview with US Economic Recovery Advisory Board Chair Paul Volcker (ht jb)

Volcker: ... We had a quarter of increased growth but I don't think we are out of the woods.And on the banks:

SPIEGEL: You expect a backlash?

Volcker: The recovery is quite slow and I expect it to continue to be pretty slow and restrained for a variety of reasons and the possibility of a relapse can't be entirely discounted. I'm not predicting it but I think we have to be careful.

SPIEGEL: What is the difference between this deep recession and all the other recessions we have seen since World War II?

Volcker: What complicates this situation, as compared to the ordinary garden variety recession, is that we have this financial collapse on top of an economic disequilibrium. Too much consumption and too little investment, too many imports and too few exports. We have not been on a sustainable economic track and that has to be changed. But those changes don't come overnight, they don't come in a quarter, they don't come in a year. You can begin them but that is a process that takes time. If we don't make that adjustment and if we again pump up consumption, we will just walk into another crisis.

...

Volcker: ... We have not yet achieved self-reinforcing recovery. We are heavily dependent upon government support so far. We are on a government support system, both in the financial markets and in the economy.

emphasis added

Volcker: It's amazing how quickly some people want to forget about the trouble and go back to business as usual. We face a real challenge in dealing with that feeling that the crisis is over. ...There is much more in the interview.

SPIEGEL: You have been clear about your ideas. Do you really believe we have to break up the big banks in order to create a more sustainable financial system?

Volcker: Well, breaking them up is difficult. I would prefer to say, let's just slice them up. I don't want them to get heavily involved in capital market activities so my view is: Hedge funds, no. Equity funds, no. Proprietary trading, no. Trading in commodities, no. And that in itself would reduce the size of the big banks. So you get some reduction in size. Equally important, you make them more manageable and easier to deal with if they do get in trouble.