by Calculated Risk on 11/14/2009 08:55:00 AM

Saturday, November 14, 2009

U.K. Mortgage Lenders: Don't Treat Us like "Drug Dealers"

This is amusing ...

From the Telegraph: FSA treats mortgage lenders like 'drug dealers', says CML chief

Hitting back at the idea that lenders are “evil” and reckless, [Council of Mortgage Lenders (CML) chief] Matthew Wyles said the industry should be allowed to treat its customers as adults, respecting their right to make their own decisions.There is nothing in the FSA proposals that would make borrowing "risk-free". That is absurd. And the consumers would still be responsible for all their own decisions.

He said: “I have a sneaking suspicion that it’s the way that regulators see consumers – as wanton children who have a tendency to want what isn’t necessarily good for them, and for whom Nanny knows best.

“Increasingly, I also have the feeling that regulators see lenders and intermediaries as the sweetshop owners – or worse, the drug-dealers at the school gates – of the mortgage market, enticing innocent consumers in and then getting them hooked, for their own evil profit-driven purposes.”

Speaking at the CML’s conference, he said the FSA was at risk of creating “the kind of moral hazard it wishes to avoid”, by making consumers feel they need to take no responsibility for their own decisions.

Mr Wyles added that the purpose of regulation should be to provide a sensible operating framework between businesses and their customers.

“It should not attempt to wrap consumers in cotton wool and make borrowing risk-free. That is not the nature of lending, and it is not the nature of borrowing,” he said.

The proposals are aimed at full disclosure, and to protect consumers from, uh, "drug dealers".

More Losses for TARP

by Calculated Risk on 11/14/2009 12:23:00 AM

When Pacific National Bank of San Clemente was closed by regulators Friday, the TARP lost $4.12 million (ht Matt Padilla). Last week the TARP lost $298.7 million when San Francisco-based United Commercial Bank (UCBH Holdings) failed.

It looks like TARP losses are becoming a trend ... and, oh, the cost to the FDIC Deposit Insurance Fund (DIF) for the three bank failures today is estimated to be almost $1 billion.

"I looked as hard as I could at how states could declare bankruptcy," said Michael Genest, director of the California Department of Finance who is stepping down at the end of the year. "I literally looked at the federal constitution to see if there was a way for states to return to territory status."

Friday, November 13, 2009

Unofficial Problem Bank List increases to 507

by Calculated Risk on 11/13/2009 09:30:00 PM

Note: This was before the three FDIC bank seizures today.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

The Unofficial Problem Bank List changed by a net two institutions this week to 507.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Seven institutions with assets of $1.6 billion were added to the list. The largest addition is First Federal Bank of North Florida, Palatka, FL ($444 million). The OCC did not release its actions for October today so we will look for those additions next week.

Assets on the list fell substantially from $330 billion to $304 billion as $13.2 billion of the decline came from the three failures last week -- United Commercial Bank ($12.8 billion), Prosperan Bank ($197 million), and Home Federal Savings Bank ($14 million) – and 2 banks that underwent unassisted mergers during July -- Discovery Bank ($151 million), and Southern Bank of Commerce ($30 million).

The list has been updated to include asset figures for the third quarter of 2009, which accounted for $14.5 billion of the decline in assets from last week. The largest decline in assets during the quarter occurred at AmTrust Bank (down $1.7 billion) and Woodlands Commercial Bank (down $1 billion). The average decline in assets during the quarter was $29 million but the median decline was only $4.5 million.

Positively, 368 institutions reduced their asset size during the quarter.

The only other changes to the list are the issuance of Prompt Corrective Action orders against three institutions that are already under a formal enforcement action. These PCA order were issued against Evergreen Bank, New South Federal Savings Bank, and Orion Bank (CR Note: Orion failed today!).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #123 in 2009: Pacific Coast National Bank, San Clemente, CA

by Calculated Risk on 11/13/2009 08:08:00 PM

Sun sets on Pacific Coast

A bank, drowned by debt

by Soylent Green is People

From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of Pacific Coast National Bank, San Clemente, California

Pacific Coast National Bank, San Clemente, California, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes three today ...

As of August 31, 2009, Pacific Coast National Bank had total assets of $134.4 million and total deposits of approximately $130.9 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27.4 million. ... Pacific Coast National Bank is the 123rd FDIC-insured institution to fail in the nation this year, and the fifteenth in California. The last FDIC-insured institution closed in the state was United Commercial Bank, San Francisco, on November 6, 2009.

Bank Failures #121 & 122: Two more in Florida

by Calculated Risk on 11/13/2009 06:08:00 PM

Waiting for critical mass

Century flames out

What is that white light?

Orion Supernovas

Hot money burns bright

by Soylent Green is People

From the FDIC: IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of Century Bank, Federal Savings Bank, Sarasota, Florida

Century Bank, Federal Savings Bank, Sarasota, Florida, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of Orion Bank, Naples, Florida

As of October 31, 2009, Century Bank, FSB had total assets of $728 million and total deposits of approximately $631 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $344 million. ... Century Bank, FSB is the 121st FDIC-insured institution to fail in the nation this year, and the tenth in Florida. The last FDIC-insured institution closed in the state was Flagship National Bank, Bradenton, on November 6, 2009.

Orion Bank, Naples, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of October 31, 2009, Orion Bank had total assets of $2.7 billion and total deposits of approximately $2.1 billion. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $615 million. ... Orion Bank is the 122nd FDIC-insured institution to fail in the nation this year, and the eleventh in Florida. The last FDIC-insured institution closed in the state was Century Bank, Sarasota, FL, earlier today.

State Budget Quote of the Day, and more Bank Failure Preview

by Calculated Risk on 11/13/2009 05:07:00 PM

From the WSJ: State Finance Directors Warn of More Trouble Ahead

"I looked as hard as I could at how states could declare bankruptcy," said Michael Genest, director of the California Department of Finance who is stepping down at the end of the year. "I literally looked at the federal constitution to see if there was a way for states to return to territory status."And on banks:

From the Chicago Tribune: Amcore says regulators reject plan to raise capital (ht Doug)

Last month, Amcore ... disclosed it was "undercapitalized or significantly undercapitalized under some regulatory capital standards."Amcore has $4.9 billion in assets.

On Nov. 6, the Federal Reserve Bank of Chicago also notified Amcore that it found its capital plan unacceptable.

Amcore said it's continuing to work with its financial and professional advisors in seeking outside capital, and in complying with the regulators' orders, but "there can be no assurance that these actions will be successful."

It also conceded that it could get seized by regulators.

"Failure to submit an acceptable capital restoration plan or disposition plan or to restore capital levels may result in additional enforcement actions by the regulators, including the appointment of a receiver," it said.

And there is plenty of noise down in Florida tonight, from the Florida Business Journal BankUnited CEO: Big deal is coming

BankUnited CEO John Kanas told members of the Greater Miami Chamber of Commerce during a luncheon Tuesday that they should expect a big deal by his bank in the next week.And also: Texas billionaire Beal seeks failed Florida bank (ht Stephen)

Federal regulators have granted Texas billionaire and financial executive Andrew Beal approval to form a bank that could acquire a failed or failing Florida bank.

...

All of these players have plenty of problem banks from which to choose. On June 30, there were 15 undercapitalized banks in Florida, including Fort Pierce-based Riverside National Bank, Naples-based Orion Bank, Panama City-based Peoples First Community Bank, Immokalee-based Florida Community Bank and Sarasota-based Century Bank.

Bank Failure Preview

by Calculated Risk on 11/13/2009 03:32:00 PM

A couple of banks in trouble ...

From Reuters: US credit card issuer Advanta files for bankruptcy (ht jb)

The company also said its Advanta Bank's capital is below regulatory requirements and that the bank could turned over to a Federal Deposit Insurance Corp receivership.Advanta bank has just under $3 billion in assets.

Advanta said it decided not to fund the bank's capital shortfall to preserve value for other stakeholders.

emphasis added

And from SignonSanDiego: Imperial Capital hits deadline to raise capital

The regulator-imposed deadline has passed for La Jolla's Imperial Capital Bank to raise additional capital, putting into question the future of the long-struggling institution.Inperial has about $4.2 billion in assets, and has also received a Prompt Corrective Action from the FDIC:

...

Federal regulators first placed Imperial Capital under a cease-and-desist order in February. As part of that, the bank was required to submit a plan to raise additional capital.

The bank submitted its plan in August, but regulators rejected it and set yesterday as a deadline for the bank to sell stock to raise money or find a buyer.

On October 15, 2009, Imperial Capital Bank (the "Bank"), a wholly owned subsidiary of Imperial Capital Bancorp, Inc. (the "Company"), received a Supervisory Prompt Corrective Action Directive (the "Directive") from the Federal Deposit Insurance Corporation (the "FDIC").A Prompt Corrective Action Directive is basically a "Hail Mary pass" and frequently means failure is imminent (though not always).

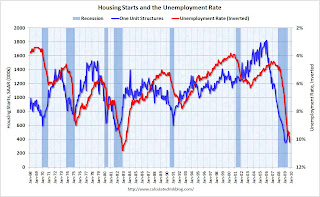

Housing Starts and the Unemployment Rate

by Calculated Risk on 11/13/2009 12:54:00 PM

This is an update to an earlier post. As I've noted for some time, housing leads the economy and is the best leading indicator for the economy - both into and out of recessions.

Update: Employment tends to be a coincident indicator into recessions, and used to be coincident coming out of recessions. Employment has lagged the economy after the previous two recessions (and appears to be lagging again).

Employment lags housing, and the following graph shows the relationship between starts and unemployment.

The graph is based on a talk by Jon Fisher, a professor at the University of San Francisco School of Business.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Professor Fisher argued that unemployment will rise to about 10.4% and then fall rapidly. He is now projecting unemployment will decline to 8% by the end of 2010.

He is basing the rapid decline in unemployment on a "V shaped" housing recovery similar to previous recessions. I disagree with that point.

In most earlier recessions, the slumps were caused by the Fed raising interest rates to fight inflation. When the Fed cut rates, housing bounced back sharply (V shaped).

Although this recession was led by a housing bust - and that makes it look similar to some previous periods - this recession was not engineered by the Fed raising rates, rather it was the busting of the credit and housing bubbles, and all the related problems that led the economy into recession. Since there is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think Fisher's forecast for a rapid decline in unemployment is also unlikely.

Euro Zone GDP Grows in Q3

by Calculated Risk on 11/13/2009 11:19:00 AM

From the NY Times: Euro Zone Officially Out of Recession

... [T]he euro area emerged from recession during the third quarter, helped largely by export growth and improved industrial production in its largest economy, Germany.Note: the 0.4% is the quarterly rate (1.6% annualized when comparing to reporting in the U.S.).

The European Union’s statistics agency, Eurostat, reported Friday that gross domestic product for the 16 countries using the single currency expanded by 0.4 percent from the second quarter, following five quarters of contraction. Against a year earlier, G.D.P. was still 4.1 percent lower.

Analysts said the outlook remained patchy, particularly because unemployment is still climbing, wages are stagnant and consumption and lending are being propped up by government programs that will not be renewed indefinitely.

Here is the Eurostat report: Euro area GDP up by 0.4% and EU27 GDP up by 0.2% with a breakdown by country.

Trade Deficit Increases in September

by Calculated Risk on 11/13/2009 08:37:00 AM

The Census Bureau reports:

The ... total September exports of $132.0 billion and imports of $168.4 billion resulted in a goods and services deficit of $36.5 billion, up from $30.8 billion in August, revised. September exports were $3.7 billion more than August exports of $128.3 billion. September imports were $9.3 billion more than August imports of $159.1 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through September 2009.

Imports and exports increased in September. On a year-over-year basis, exports are off 13% and imports are off 21%.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $68.17 in September - up more than 50% from the prices in February (at $39.22) - and the seventh monthly increase in a row. Import oil prices will probably rise further in October.

The major contributors to the increase in the trade deficit were the increase in oil prices, and more imports from China. Also - the deficit is higher than expected, suggesting a downward revision to Q3 GDP.