by Calculated Risk on 10/03/2009 05:00:00 PM

Saturday, October 03, 2009

The Impact of the Declining Homeownership Rate

This is an update to a 2007 post: Home Builders and Homeownership Rates1

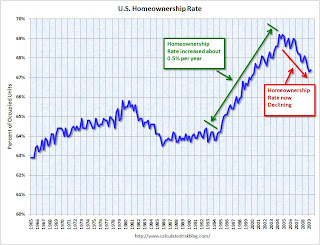

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The reasons for the change in homeownership rate are discussed in the 2007 post ( a combination of demographics and changes in mortgage "innovation"), but here are two key points: 1) During the boom, the change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the homeownership rate (red arrow is trend) is now declining.

The U.S. population has been growing at close to 3 million people per year on average, and there are about 2.4 people per household. Assuming no change in these rates, there would be close to 1.25 million new households formed per year in the U.S. (The are just estimates, and fewer households are formed during a recession - a key problem right now).

Since about 2/3s of all households are owner occupied, an increase of 1.25 million households per year would imply an increase in homes owned of about 800K+ per year. If an additional 500K per year moved to homeownership - as indicated by the increase in the homeownership rate from 1995 to 2005 - then the U.S. would have needed 1.3 million additional owner occupied homes per year.

Important note: these number can't be compared directly to the Census Bureau housing starts and new home sales. There are many other factors that must be accounted for to compare the numbers.

During that same period, since about 1/3 of all households rent, the U.S. would have needed about 400K+ new rental units per year, minus the 500K per year of renters moving to homeownership. So the U.S. needed fewer rental units per year from 1995 to 2005. The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The second graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

Sure enough, the number of rental units in the U.S. peaked in early 1995 and declined slowly until 2005. The builders didn't stop building apartment units in 1995, instead the decline in the total units came from condo conversions and units being demolished (a fairly large number of rental and owner owned units are demolished every year).

Even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

Since 2004 there has been a surge in rental units. Most of this increase is not new apartment buildings, rather a combination of investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes or 2nd homes instead of selling. This increase in rental units is more than offsetting the decline in the homeowership rate, and the rental vacancy rate was at a record 10.6% in Q2. (and will probably be over 11% soon because of the "first-time" homebuyer tax credit).

This increase in the homeownership rate, from 1995 through 2005, meant the homebuilders had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units, but the builders definitely benefited from the increase in homeownership rate.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.5% per year. This means the net demand for owner occupied units would be 833K minus about 500K per year or about 333K per year - about 25% of the net demand for owner occupied units for the period 1995 to 2005. (Not including replacing demolished units and 2nd home buying).

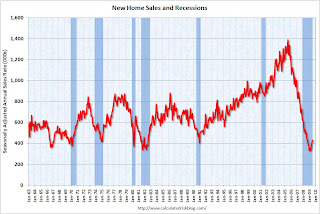

Although we can't compare this number directly to new home sales (because of 2nd home buying, replacement of demolished units, and other factors) this does suggest new home sales will probably remain at a low level until the homeownership rate stops declining. The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

The third graph shows New Home Sales for the last 45 years. the Census Bureau reported: "Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000."

Once the homeownership rate stops declining - probably at about the same time the excess existing home units are mostly absorbed - new home sales will probably increase to a steady state rate based on population growth. However this level will be substantially below the average for the period from 1995 to 2005 when the homebuilders benefited from the increasing homeownership rate.

The "first-time" homebuyer tax credit (and new homebuyer tax credit in California) probably boosted new home sales a little this year, so the homeownership rate might increase in the 2nd half of 2009. However that increase will probably be temporary, and the homeownership rate will probably start declining again.

Key points:

1 A special thanks to Jan Hatzius. Several of the ideas for this post are from his piece: "Housing (Still) Holds the Key to Fed Policy", Nov 27, 2007

NY Times: Retailers Expect No Growth in Holiday Spending

by Calculated Risk on 10/03/2009 01:43:00 PM

From the NY Times: Retailers Expect Flat Christmas Sales This Year

[A] lot of people are thinking about it, and taking surveys to test the mood of the American consumer, and deciding that this Christmas will be as bad as last — which is to say, one of the worst on record.And that suggests that seasonal retail hiring will be weak too. Here is a repeat of a graph from a post a couple weeks ago: Seasonal Retail Hiring

Retailers are relieved to hear that prediction. Flat sales this holiday season would at least mean that things had stopped getting worse ... several reports published in the last few days, including surveys by Nielsen and Deloitte, forecast no change in holiday sales from last year to this year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This really shows the collapse in retail hiring in 2008. This also shows how the season has changed over time - back in the '80s, retailers hired mostly in December. Now the peak month is November, and many retailers start hiring seasonal workers in October.

Given the expectation of no growth in holiday spending, retailers will probably be very cautious hiring again this year.

Comparing Employment Recessions including Revision

by Calculated Risk on 10/03/2009 08:56:00 AM

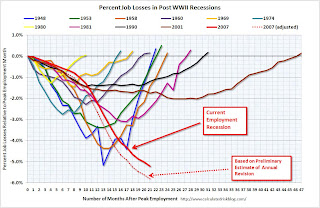

Here is a graph with an estimate of the impact of the preliminary estimate of the annual benchmark revision. (ht John) Click on graph for larger image.

Click on graph for larger image.

The dashed line is an estimate of the impact of the large benchmark revision (824 thousand more jobs lost).

The graph compares the job losses from the start of the employment recession in percentage terms (as opposed to the number of jobs lost).

Instead of 7.2 million net jobs lost since December 2007, the preliminary benchmark estimate suggests the U.S. has lost over 8.0 million net jobs during that period.

Even before the annual revision, the current employment recession was already the worst recession since WWII in terms of percent of job losses. The benchmark revision shows this recession was even deeper. The revision will be reported in February ... just something to remember over the next few months.

Friday, October 02, 2009

Problem Bank List (Unofficial) Oct 2, 2009

by Calculated Risk on 10/02/2009 09:15:00 PM

This is an unofficial list of Problem Banks. All three banks failures today were on this list (Warren Bank, Warren, Michigan; Jennings State Bank, Spring Grove, Minnesota; Southern Colorado National Bank, Pueblo, Colorado)

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net four institutions during the week to 463. Aggregate assets increased by $1.5 billion to $298.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions include three Illinois-based institutions -- Valley Bank, Moline ($691m); Highland Community Bank, Chicago ($120m); and Freedom Bank, Sterling ($86m) - and First Utah Bank, Salt Lake City ($358m) and Coastal Community Bank, Everett, WA ($262m).

The state banking department of Illinois may be the only state department that publicly releases its enforcement actions. We wish other state banking departments would follow Illinois’ lead by providing transparency around their actions.

There is one deletion from last week’s list -- Waterford Village Bank, Williamsville, NY, which we inadvertently missed removing from the list when it failed on July 24th. We greatly appreciate all feedback received in making this list as accurate as possible.

The only other notable change to the list is the addition of a Prompt Corrective Action order against Partners Bank, Naples, FL issued on September 18th. The OTS had previously placed Partners Bank under a Cease & Desist Order on August 21st.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #98: Southern Colorado National Bank, Pueblo, Colorado

by Calculated Risk on 10/02/2009 08:20:00 PM

Rarified Air, Rarer cash.

Where did it all go?

by Soylent Green is People

Form the FDIC: Legacy Bank, Wiley, Colorado, Assumes All of the Deposits of Southern Colorado National Bank, Pueblo, Colorado

Southern Colorado National Bank, Pueblo, Colorado, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Three down. Closing in on 100.

As of September 4, 2009, Southern Colorado National Bank had total assets of $39.5 million and total deposits of approximately $31.9 million. ....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.6 million.... Southern Colorado National Bank is the 98th FDIC-insured institution to fail in the nation this year, and the third in Colorado. The last FDIC-insured institution closed in the state was New Frontier Bank, Greeley, on April 10, 2009.

Bank Failure #97: Jennings State Bank, Spring Grove, Minnesota

by Calculated Risk on 10/02/2009 07:08:00 PM

Recovery is forestalled

More bankers jobless

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Jennings State Bank, Spring Grove, Minnesota

Jennings State Bank, Spring Grove, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Hey, less than $12 million! Still counts ...

As of July 31, 2009, Jennings State Bank had total assets of $56.3 million and total deposits of approximately $52.4 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.7 million. ... Jennings State Bank is the 97th FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota. The last FDIC-insured institution closed in the state was Brickwell Community Bank, Woodbury, on September 11, 2009.

Bank Failure #96: Warren Bank, Warren, Michigan

by Calculated Risk on 10/02/2009 06:11:00 PM

Bank: GL GBTW

Bair: BCNU

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Warren Bank, Warren, Michigan

Warren Bank, Warren, Michigan, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of July 31, 2009, Warren Bank had total assets of $538 million and total deposits of approximately $501 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $275 million. ... Warren Bank is the 96th FDIC-insured institution to fail in the nation this year, and the second in Michigan. The last FDIC-insured institution closed in the state was Michigan Heritage Bank, Farmington Hills, on April 24, 2009.

Report: Starwood "Winner" of Corus "Assets", and more Walking Away from Hotels

by Calculated Risk on 10/02/2009 03:56:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From the WSJ: Starwood-Led Group Likely Winner of Corus Assets

... a group of investors led by ... Starwood Capital Group is emerging as the likely winner ... of the failed Corus Bank's condominium loans and other property ...And more hotels going down ... from a Lodgian press release: (ht Zach)

The assets have a face value of about $5 billion but the winning bid is expected to be far less than that ... To minimize the losses to taxpayers from the failure of Corus, the FDIC will take a 60% equity stake in the partnership that ends up owning the Corus assets ...The FDIC also will provide financing to the partnership.

The Merrill Lynch Fixed Rate Pool 3, secured by six hotels, is in default. The loan matured on October 1, 2009. The company has engaged in negotiations with the lender regarding extension and modification of the loan, with no resolution to date. Unless some agreement is reached in the near-term, the company intends to return the hotels to the lender in full satisfaction of the debt; The company has stopped servicing the debt secured by the Crowne Plaza in Worcester, Mass., and intends to return the hotel to the lender in full satisfaction of the debt;

Bloomberg: Banks With 20% Unpaid Loans

by Calculated Risk on 10/02/2009 03:09:00 PM

Since it is Friday ...

From Bloomberg: Banks With 20% Unpaid Loans at 18-Year High Amid Recovery Doubt

The number of U.S. lenders that can’t collect on at least 20 percent of their loans hit an 18-year high, signaling that more bank failures and losses could slow an economic recovery.And here is a classic quote:

[There are] 26 firms with more than one-fifth of their loans 90 days overdue or not accruing interest as of June 30 -- a level of distress almost five times the national average ...

For banks with 20 percent of loans overdue, “either they’ve got a massive amount of capital, or the FDIC just hasn’t gotten around to them,” said Jeff Davis, an analyst with FTN Equity Capital Markets in Nashville.

“Everything was so positive for so long in this area, it came as a surprise when it stopped,” said John Medernach, Benchmark’s CEO ...Hey, Hoocoodanode? (Who could have known?)

“I stop and think of all the rich farmland that has been developed into subdivisions during the boom years,” Medernach said. “It makes you wonder what we’ve been doing.”

The article includes a table with all 62 banks. Here are the "leaders" according to Bloomberg:

| Company | Location | Nonaccrual Loans as % of Total |

|---|---|---|

| Community Bank of Lemont | Lemont, IL | 49.45 |

| Eastern Savings Bank FSB | Hunt Valley, MD | 48.01 |

| City Bank | Lynnwood, WA | 43.95 |

ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

by Calculated Risk on 10/02/2009 12:41:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Surge Past One Million During First Nine Months of 2009

Consumer bankruptcies totaled 1,046,449 filings through the first nine months of 2009 (Jan. 1-Sept. 30), the first time since the 2005 bankruptcy overhaul that filings have surged past the 1 million mark during the first three calendar quarters of a year, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The filings for the first three-quarters of 2009 were the highest total since the 1,350,360 consumer filings through the first nine months of 2005.

"Bankruptcy filings continue to climb as consumers look to shelter themselves from the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "The consumer filing total through the first nine months is consistent with our expectation that consumer bankruptcies will top 1.4 million in 2009."

The September 2009 consumer filing total reached 124,790, a 41 percent increase from the 88,663 consumer filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!